Uncovering a reality: China is currently dominating the USDT market

This week, the recognised crypto research institute Diar and the Investigation Center Chainalysis released a special report about the status quo of the Chinese crypto market. For the surprise of many, the discoveries showed that the demand for Tether (USDT) is significantly high, exceeding $10 billion this year. The main reason? China.

Chainalysis software has been monitoring USDT flow of funds during the last couple of months and the investigation concludes that Tether market capitalisation is at record highs, as well as the number of tokens in circulation and on-chain trading volume.

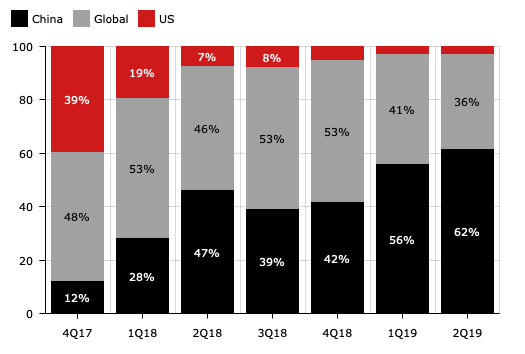

The most recent report issued by Diar described the variations in the number of USDT received since 2017. During Q4 2017 US On-chain trading volume was 39% compared with 12% in China. In 2018, that percentage started to shift considerably, with US markets losing the first place and China representing 39% of the transactions during the bear market. Remarkably, in 2Q 2019 China exchanges represent 62% of all Tether transactions.

Source: China Special Report. Volume 3, Issue 17. June 3, 2019

Tether percentage change across regional exchanges is questioning the belief of USDT major demand coming for the United States, as many traders are still betting on China still has an insignificant role in today’s crypto space. In 2017, The People’s Bank of China (PBOC) declared that holding and trading cryptocurrencies were prohibited as well as ordering financial firms to close all the trading accounts in less than a month. At that moment, China was one of the biggest markets in the world. In addition, 173 crypto platforms and several Bitcoin mines were closed during the months following the announcement.

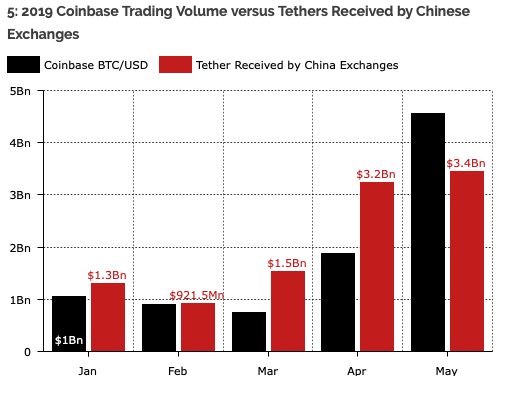

Volume 3 of Diar’s China Special Report also stated that Tether volume was bigger than BTC trading volume in the last month, with figures continuously increasing. China’s OTC desks have had a recognisable role to play in the recent bull run. Those Over-the-Counter firms have received more than $3.4B Tether just in May 2019, therefore, they are taking the credit of the rise on the demand of stable coins.

Source: China Special Report. Volume 3, Issue 17. June 3, 2019

In conclusion, at this current the moment, USDT 24h volume is $20.1B, and it ranks ninth by market cap. If monthly figures are compared, the outcome is quite interesting. In January 2019, 24H Vol was $3.3B while currently, 24H Vol is oscillating around $20.3B with market capitalisation increasing from $1.9B to $3.2B. The figures also show that on-chain trading volume is bigger than the corresponding BTC volume.

Image licensed via Shutterstock

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms