Tokenomics 4: Inflationary or Deflationary?

As part of this series, we’ve already looked at what Tokenomics is, how to evaluate a crypto’s supply, and the things to look out for when it comes to token distribution/allocation.

Now, it's time to look at the differences between inflationary and deflationary tokens.

Let's dive in...

Inflation v deflation

A crypto is either inflationary or deflationary. If 5,000 tokens out of 10,000 have already been created, the supply will inflate by 100%.Consider:

- What is the inflation rate, and where are the emissions (new tokens) going?

- Are there plans for it to be deflationary? If so, what are they, and how will it work (what is the mechanism for burning tokens)?

Deflation can increase the value of tokens over time. As there are fewer tokens, each one is worth more. This is why deflationary tokens can be so valuable. However, we must consider how those tokens are being burnt. For example, some protocols charge a high tax on sales (50%, for example), of which 60% goes to the protocol, and 40% is burned. This doesn’t add value to the protocol at all, in fact, it is a clear sign of ponzinomics, which we’ll cover in more detail in another article!

Often you can stake your tokens to avoid dilution through inflation. If you do so, you’re receiving tokens in line with the rate of inflation (not including private sale, team unlocks, or incentives outside of staking).

Inflation is used by many projects to incentivise participation. However, the sort of aggressive inflation used to pay liquidity providers in many DeFi protocols can overwhelm your investment and erode value drastically.

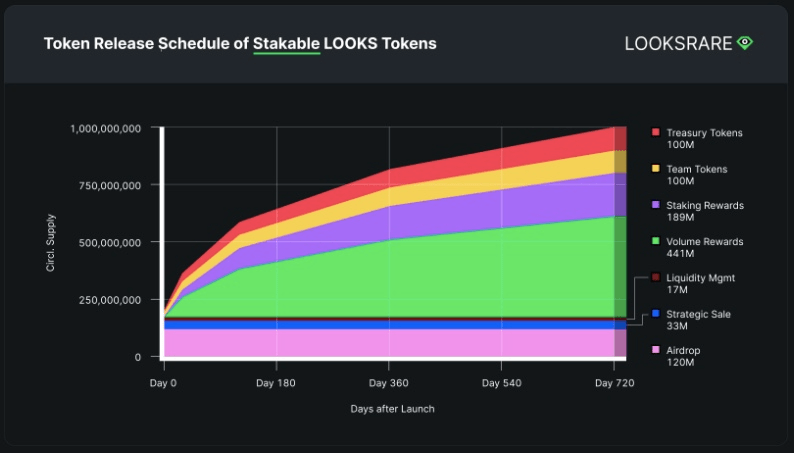

An example of this is LOOKS (LooksRare’s token), where 50% of tokens were distributed in the first 90 days. If you had bought in at launch, this inflation would have drastically eroded the value of your tokens, with the amount of tokens over doubling from launch in only 90 days.

When looking at a project, consider whether there are plans to stop emissions at a set point. What will happen after that? Will there be incentives for people to continue using the platform? This is a vital point to consider. What happens when emissions stop? Will the project continue to attract users and liquidity, or will the token be dumped?

Let’s take a look at some popular cryptos in terms of supply and inflation/deflation.

Bitcoin

Bitcoin’s creator, Satoshi Nakamoto decided that only 21 million bitcoins would ever exist. When the last BTC is released, 21 million coins will circulate in the market, and this number will never increase. Verifiable scarcity is essential to Bitcoin’s value proposition.New bitcoins are issued as part of a block reward process. Every time a Bitcoin miner “discovers” a block, they receive new coins as compensation. When Bitcoin first launched, the reward stood at 50 BTC per block. According to Bitcoin’s rules, this reward is cut by 50% every 4 years. This process is known as halving. This contrasts with fiat currencies, where governments and central banks can print more money at their discretion.

As there will only ever be 21 million Bitcoin, there will only ever be 32 halving events. Once the 32nd halving event is complete, Bitcoin’s maximum supply of 21 million coins will have been reached.

At the next halving, in 2024, the number of bitcoins released per block will drop to around 3.125.

Halving & price

After every halving, it is likely that the value of mined coins will rise (if fewer BTC are released and the demand remains the same, the price will rise). Understanding the concept of halving is useful for crypto traders as there is typically a positive correlation between halving events and price, especially with BTC.So, it’s likely that we won’t see any significant inflationary pressure that could decrease the value of Bitcoin as it’s fixed and inflation decreases every 4 years through halving. This means there won’t be any surprises.

However, most other cryptocurrencies aren’t as simple as Bitcoin.

Let's look at Ethereum as another example.

Ethereum

As of April 2022, Ethereum has a circulating supply of around 120,600,000. But, unlike Bitcoin, there is no limit on how many Ether (ETH) can exist.According to Ethereum’s official website, the annual inflation rate of ether is about 4.5%. After The Merge, Ethereum’s inflation rate is scheduled to drop from approximately 4.5% to 0.43%. This value-adding event has been referred to as the “triple halvening” and will see emissions fall from 12,000 ETH a day to 1,280 ETH a day.

Block rewards have been reduced twice since the first Ethereum block (genesis) was mined. Block reductions are programmed into Ethereum’s code as Bitcoin’s halving events are. However, members of Ethereum’s community offer “Ethereum Improvement Proposals” or EIPs, and the rest of the community votes on whether to update Ethereum’s code to reflect the proposals.

Ethereum’s EIP1559 update introduced a burn of a portion of gas fees. This means that if the Ethereum network is used heavily, it becomes deflationary.

In the next Guide in this series, we'll dive into token utility.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms