Dogecoin (DOGE) price prediction

Dogecoin price prediction remains as volatile as ever, with its all-time high of $0.6878 driven by celebrity endorsements and viral trends pushing its value in unexpected directions. As one of the most recognised meme coins, Doge’s price continues to present opportunities for both high rewards and risks.

We at Cryptonary provide you with the most accurate price prediction for all sorts of coins. You can also request an on-demand Doge price prediction by joining our Discord Community.

Our Price Prediction Model

DOGE Targets $0.43 Resistance Next

11 December 2024Price action

In this analysis, we're zooming in on DOGE's price action, as we've already covered the market context extensively in the previous update. We marked a potential pullback into the $0.35 level, and it now looks like this might play out following the market-wide flush-out.The steady grind upward that followed DOGE's huge move has transitioned into a consolidation phase with a clear battle between buyers and sellers. In this situation, decision-making becomes straightforward: what's more likely based on the context of the asset? Further immediate expansion seems unlikely, given the magnitude of DOGE's recent growth.

A slight pullback, which we projected, makes much more sense. After the flush out, DOGE has re-entered its range cleanly, showing resilience in the face of broader market weakness. Now, the $0.35 level comes into play, and we'll place a buy box there. It's worth noting DOGE's ability to hold up well through this pullback, reinforcing the volume and density of interest in the asset.

Market mechanics

DOGE's funding rate hit a wild 0.0980% on December 5th, which was always going to lead to some form of correction. Funding rates that high show extreme long-side exposure, and corrections become inevitable. Now that we've returned to healthier levels, DOGE remains in a strong position, holding at the top of its range.The high funding rates also reinforce the meme coin sentiment, highlighting the market's willingness to maintain outsized exposure to DOGE, a testament to its dominance in this narrative.

Playbook

Buy box

- Place the buy box at $0.35, as this level has held historically and aligns with the current pullback dynamics. It's the key accumulation zone we're watching closely.

Upside levels

$0.43: Still the next resistance level to reclaim. A breakout above this would signal a renewed push higher. $0.63: The mid-term target remains intact and aligns with DOGE's overall momentum-driven narrative.Key takeaways

DOGE's ability to hold up during the market flush-out speaks volumes about its volume density and the strength of demand. Stay patient and wait for confirmation of levels before adding leverage or trading exposure.Cryptonary's take

DOGE's resilience through the recent correction is impressive. The $0.35 level now becomes the most important focus for accumulation. What stands out here is DOGE's ability to consolidate at the top of its range, even after a significant market-wide flush.The extreme funding rates seen earlier this month highlight the speculative appetite for DOGE, reinforcing its position as the king of the meme coin narrative. This willingness to maintain long exposure, even during corrections, speaks to the broader sentiment surrounding DOGE.

For now, the buy box at $0.35 is the play, and we'll monitor how price action develops at this level. If DOGE can reclaim $0.43, the next leg up to $0.63 remains firmly in sight. As always, stick to the levels, manage risk, and don't chase trades unnecessarily.

DOGE momentum slows; key levels hold

02 December 2024Market context

Since our last analysis, DOGE has experienced a slowdown in momentum, which is something we expected after its stellar performance in recent weeks. Let's not downplay that run: it was a significant statement for meme coins and a massive testament to DOGE's standing as a titan in the entire crypto space, not just among memes.The market's willingness to inject such capital into a non-utility token, especially off the back of Trump's win, shows how open-minded participants are toward speculative assets in this cycle. The broader meme narrative seems alive and well, and DOGE continues to lead the charge, reinforcing its position as a benchmark asset for the sector.

DOGE price action

Looking at the technicals, we've seen a slight upward grind in price action, marked by diagonal resistance levels. This structure reflects typical accumulation behaviour by early participants combined with some opportunistic bidding from buyers riding the momentum. It's not flashy, but it's functional, hinting at sustained interest in DOGE despite the stall.

Playbook

Key levels to watch:Buy zone

$0.35 remains the key support and accumulation level. This area has proven its strength historically and continues to show buyers stepping in during dips. We'll look to this level as the most probable reset zone before DOGE attempts another leg higher.Upside targets

- $0.43: The next significant resistance where we'll likely see price pause or consolidation.

- $0.63: A mid-term target if $0.43 is cleared with strong conviction.

Cryptonary's take

DOGE's performance has been brilliant, and even this recent stall in momentum doesn't change the bigger picture. It's still the leading meme coin, with massive speculative demand driving its cycles. The price action now reflects a healthy reset, with accumulation clearly visible. The $0.35 level remains the key area to focus on. If the price returns there, it offers a strong opportunity for entries or repositioning.However, we'll continue to monitor how DOGE interacts with the $0.43 resistance, as a breakout there could reignite the trend and open the door to $0.63. For now, DOGE remains a top-tier setup in the meme coin narrative and a good indicator for retail participation in this cycle. Stay focused, stick to the levels, and adjust as new data unfolds.

DOGE targets $0.43 breakout next

27 November 2024Market context

In our previous analysis, we highlighted the $0.35 bid box as a key support zone for Dogecoin, and this level has continued to hold strong. Price remains within our expected range, showing consistent demand at $0.35.From a broader perspective, Doge is still positioned roughly 100% off its all-time high, but the consolidation above $0.35 suggests steady accumulation and growing interest, which may act as a foundation for the next move.

DOGE price action

The $0.35 level continues to act as a reliable support zone. Price has shown respect for this level multiple times, reinforcing its validity as a strong bid area. For this follow-up, we're maintaining $0.35 as the key buy zone while also watching for any movements toward our upside targets at $0.43 and $0.63.There hasn't been a significant shift in market dynamics or mechanics since the last update, so this analysis will focus solely on price action and levels.

Playbook

Buy zone: $0.35 remains our primary accumulation zone for spot positions.Upside targets: $0.43: The next significant level to watch for bullish continuation. $0.63: A medium-term target if $0.43 is cleared with strength.

Strategy: Look to accumulate within the $0.35 zone during pullbacks. Monitor price action closely at $0.43 for a potential breakout confirmation toward $0.63.

Cryptonary's take

The $0.35 level has continued to hold strong as a key buy zone for Dogecoin, with no major changes in market mechanics to note since our last analysis. While the price remains within our expected range, the consolidation and accumulation at these levels indicate the potential for further upside.As we approach $0.43, keep an eye on how the price reacts- a breakout above this resistance could trigger a move toward $0.63. For now, stick to the plan, focus on $0.35 for entries, and watch for confirmations before positioning for the next leg up.

Doge: Critical levels for upside moves

19 November 2024Market context

In our last analysis, we correctly identified the $0.35 bid box as a key support level for Dogecoin, and the price has respected this level beautifully. Since Sunday, $0.35 has acted as a key zone, holding firm despite increased activity in the market. This shows our accuracy in identifying actionable levels and highlights the strength of this support.From a higher-level perspective, Doge is still about 100% off its all-time high, but the current price action suggests that it's building momentum for another potential leg up. With growing open interest and strong buyer interest, Doge remains well-positioned in this cycle.

Market mechanics: Open interest and funding rate

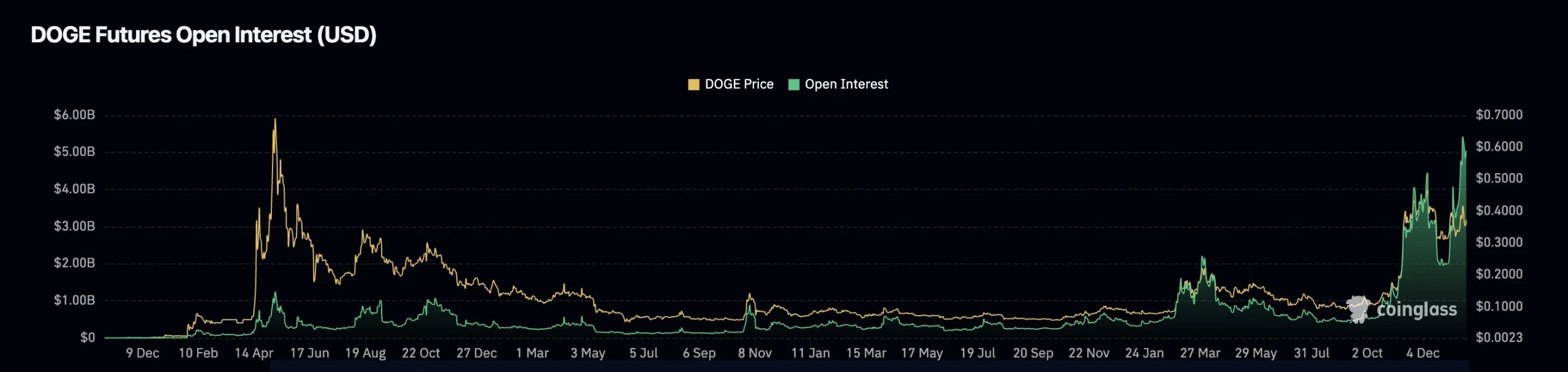

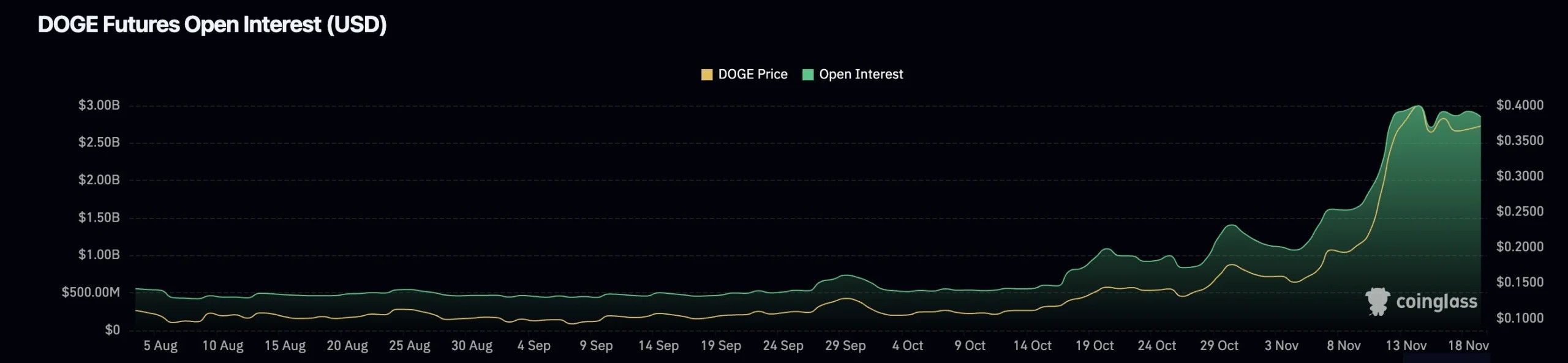

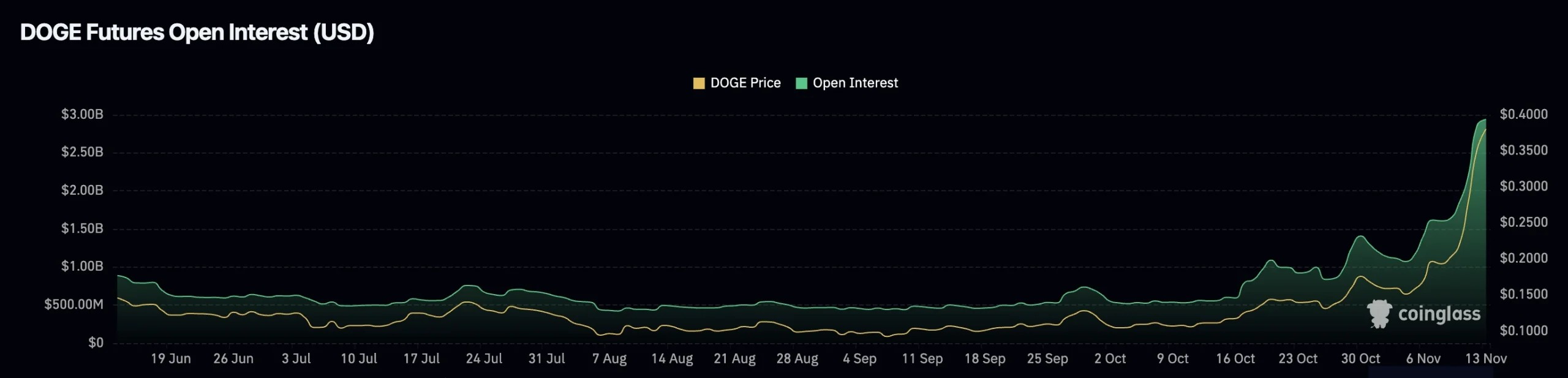

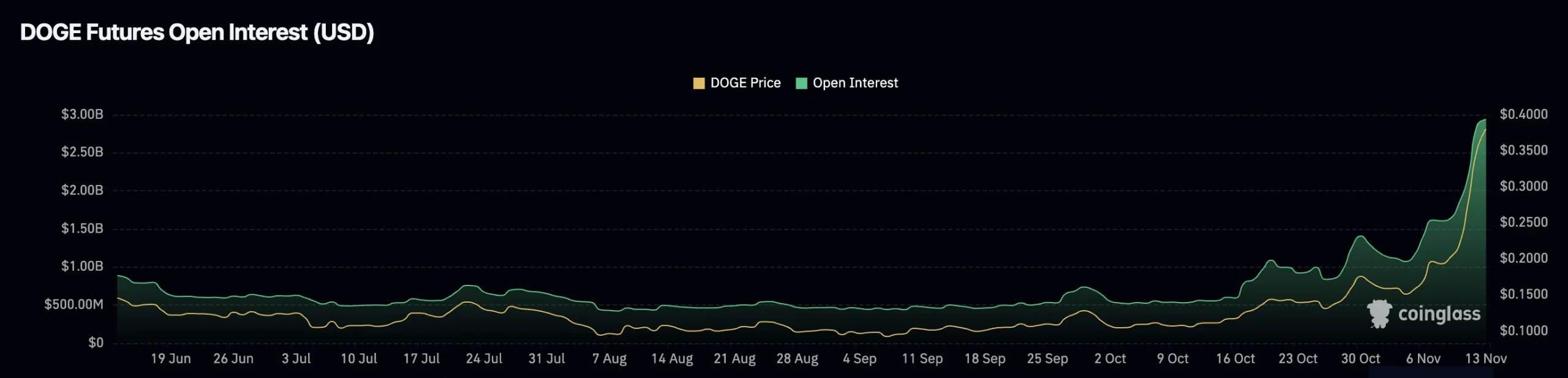

Open interest

Open interest in Dogecoin has now reached its highest level ever, a major milestone that reflects significant leverage participation on both the buy and sell sides. The market is clearly heating up, with traders positioning heavily in anticipation of major moves. This heightened activity shows Doge's relevance and its ability to attract capital.

Funding rate

Funding ramped up significantly earlier today, on the 19th, peaking at 0.0546 before cooling to 0.02. While traders are slightly biased toward the long side, funding hasn't hit extreme levels of concern yet. However, elevated funding combined with all-time-high open interest signals a potentially volatile market. A short squeeze or liquidity flush could occur if momentum shifts too aggressively in either direction.![]()

Playbook

Our playbook focuses on the $0.35 support zone, which has proven to be a solid area of demand. Price has retested this level early today and held well, reinforcing it as a reliable region for accumulation. This creates a strong foundation for potential upside, but we're also prepared for a deeper pullback if broader market conditions shift.- Buy box: Between $0.30 and $0.35, this remains an ideal accumulation zone for spot positions.

- Upside targets: The next area of interest is $0.43, and a move above this level could pave the way toward $0.63, aligning with Doge's recent momentum.

Key levels

- $0.30-$0.35: Spot accumulation zone.

- $0.43: A significant level to watch for further upside as it's the recent high swing.

- $0.63: The next potential target if Doge clears $0.43 with strength.

Risk management

With Doge's momentum increasing, it's important to manage risk appropriately:- Spot Positions: Focus on building at $0.30-$0.35. This range has shown consistent demand and offers a solid entry.

- Leverage Trades: Be cautious with high open interest and funding levels. If you're considering leverage, wait for A+ level setups

- Keep an eye on Bitcoin's price action, as broader market moves could influence Doge.

Cryptonary's take

We've been spot on with Doge from the $0.35 level to tracking its growing momentum. The increase in open interest and strong market participation shows that Doge is attracting attention this cycle. While it's not part of our holdings or CPRO picks, it's a key asset to monitor for market sentiment and broader implications. If the $0.35 level holds, Doge is well-positioned to push toward $0.43 and beyond.For now, spot accumulation in the buy box looks like the best strategy, with leverage trades requiring extra caution due to market conditions. Stay sharp, stick to the plan, and let the levels guide you.

The memecoin supercycle is rewriting the rules, offering opportunities that could redefine your investment strategy. Discover why this moment is a game-changer for crypto enthusiasts.

DOGE: Critical levels for upside moves

14 November 2024Market context

In our last analysis, we correctly identified Dogecoin's potential for a major upside move. We had pinpointed $0.13 as a critical breakout level, and that level has played out perfectly. Doge faced resistance at $0.13 back on September 28th and again on October 16th and 17th. When it finally broke out on October 26th, it came back to retest $0.13, signalling a major shift in market sentiment.Sellers who previously kept pushing Doge down from this level seem to be out of the picture, paving the way for a more bullish stance. Fast forward, Doge has since captured a massive move, adding tens of billions to its market cap in the wake of this breakout. It's now the sixth-largest crypto asset by market cap, with nearly $30 billion in daily trading volume, showing how significant the interest and momentum behind Doge are.

Since November 8th, Doge's market cap surged from $28 billion to a high of $63 billion, an impressive $30+ billion gain. This indicates a powerful sentiment shift that's driving the asset forward in this cycle.

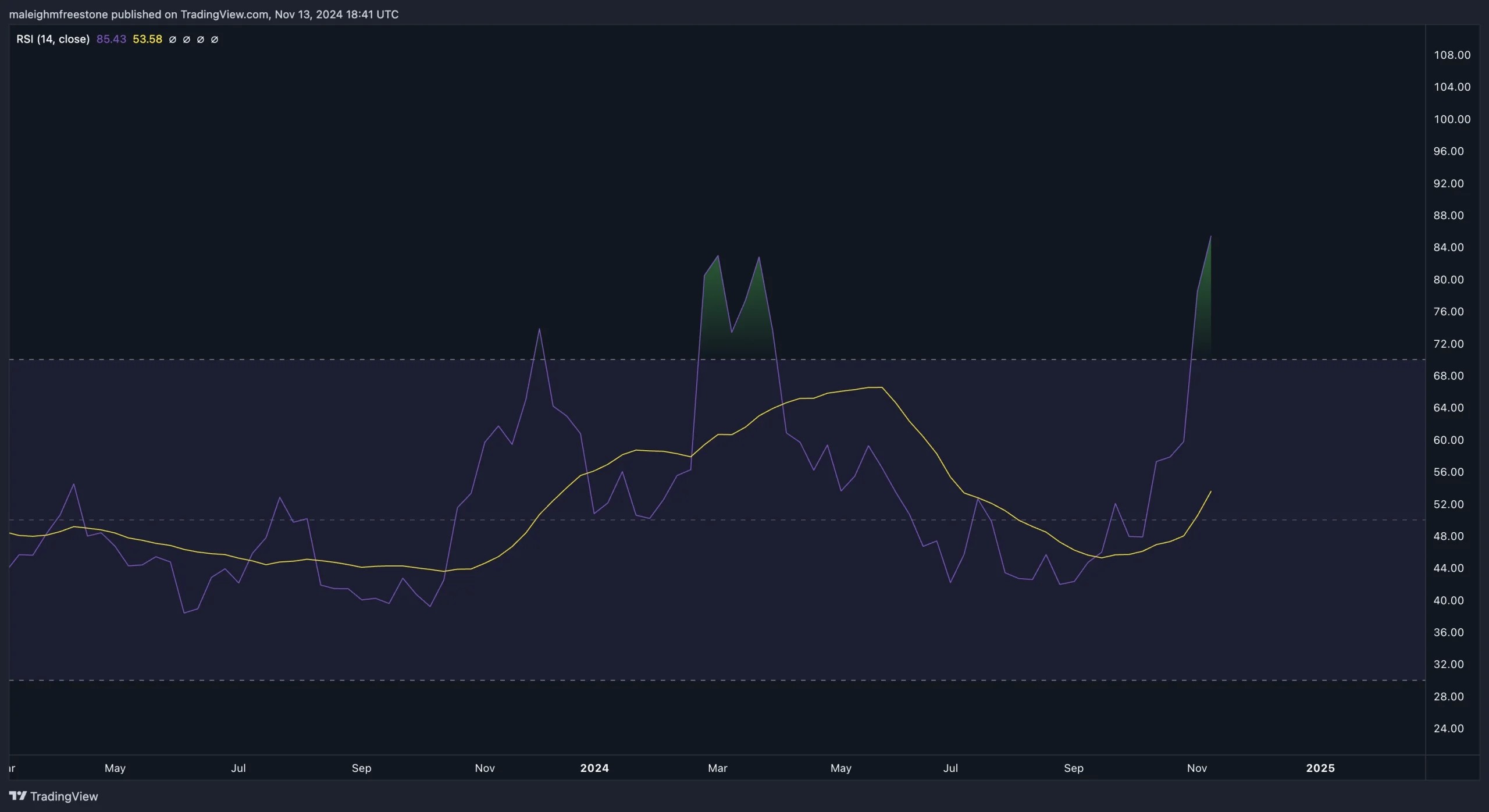

Currently, we're seeing Doge slightly overheated on the RSI, with readings around 90 on the daily timeframe, indicating the potential for a pullback. We're still significantly below the all-time high, with the price currently around 80% off that mark. But the momentum and sentiment indicate that reclaiming all-time highs is a real possibility this cycle.

Market mechanics: Open interest and funding rate

- Open interest: Doge's open interest has spiked significantly. On October 7th, open interest sat around $554 million, but as of today, it's risen to $2.94 billion. This uptick indicates strong interest in Doge from leverage traders and suggests that the market is increasingly viewing Doge as a high-stakes asset.

- Funding rate: On November 12th, Doge's funding rate hit 0.05, signalling high demand for leveraged longs. While it corrected to around 0.01, it has since inched back up to 0.02, showing a gradual buildup of bullish positioning. This isn't yet at unhealthy levels, but it's something to monitor closely, as it could indicate potential volatility or a short squeeze if bullish momentum continues.

With elevated open interest and increasing funding rates, we're seeing clear signs that the market is heating up for Doge. This positioning underscores the potential for strong moves, but it also suggests that we should be cautious of pullbacks, especially if funding rates continue to climb.

Playbook

Our playbook now revolves around support at $0.35, recently reclaimed by Doge. This level has acted as a strong demand. Following the breakout on Saturday, Doge came down to retest $0.35 as support early this morning, showing a solid bullish reaction. We're establishing a "buy box" between $0.3 and $0.35 as an accumulation zone, providing an ideal entry region.Given the overheated RSI and high open interest, we might see a pullback as some traders take profits. Our strategy is to watch for a retest of $0.35 or potentially down to $0.3 for a spot accumulation. If Doge holds these levels, we'll target the $0.43 level next. A clean break above $0.43 could pave the way for further upside, potentially pushing Doge toward $0.63.

Key levels

- $0.3 - $0.35: Accumulation zone or "buy box"

- $0.43: Key breakout level for additional upside

- $0.65: Target level upon successful breakout of $0.43

Risk management

With Doge's recent surge in demand and bullish momentum, you have to be smart here. Spot positions are recommended around the $0.3 - $0.25 region, given this zone's historical strength as support. Due to elevated open interest and funding rates, caution with leverage is advised. Additionally, keeping an eye on Bitcoin's price action and following the market directions as BTC's momentum could influence Doge's next move.Cryptonary's take

We've been spot-on with Doge, from calling the $0.13 breakout to tracking its insane surge in demand. Doge has stepped up this cycle, pulling in massive trading volume and becoming a highlight asset in the market. While Doge isn't part of our holdings or in our CPRO picks, it's one we're watching closely because of its market influence. If Bitcoin keeps pushing, Doge could follow suit and make a serious run toward $0.63.For now, spot accumulation between $0.3 and $0.35 looks solid, but if you're considering leverage, wait for clean retests or breaks to avoid getting caught in any shakeouts.

DOGE show strength amid bullish momentum

8 November 2o24Market context

Following up on our previous Doge analysis, we've seen a strong price action sequence unfold. Initially, we highlighted $0.13 as a critical breakout and retest zone, which has played out as expected. Doge initially faced resistance at $0.13 in late September and mid-October, but the breakout on October 26th turned this level into solid support. This shift shows that sellers previously active around $0.13 have exited, allowing buyers to take control. The breakout has already delivered a 40% move, reaching $0.175.We're seeing signs of profit-taking and minor exhaustion, but if Doge manages to establish $0.175 as new support, it sets the stage to target the next key level of $0.229. Doge is one of the few assets from the last cycle that has surpassed its March-April 2022 sell-off zone, showing its strength. This price action marks a higher high and higher low structure that suggests a sustained bullish shift as we approach $0.229.

Playbook

Monitor Doge around the $0.175 level. A retest here could confirm support, offering a strong entry signal for targeting the $0.229 level.- Spot accumulation: Accumulate spot positions if Doge confirms $0.175 as support. Waiting for the retest at $0.13 could also offer a lower entry for a longer-term position.

- Positioning strategy: Avoid adding positions around $0.15 without a confirmed breakout at $0.175, as there's potential for a retrace. If $0.175 holds, targeting $0.229 with additional spot accumulation makes sense.

- Profit-taking: If Doge approaches $0.229, assess for profit-taking opportunities, as this is a significant resistance level.

Key levels

- $0.175 - Established support and potential re-entry level.

- $0.229 - Short-term target; a breakout level that could signal sustained bullish momentum.

Risk management

Doge has shown solid demand, but careful positioning is still critical. Bitcoin's price action above the $70k range may influence Doge's next moves, so it's essential to monitor BTC. For now, spot positions are favoured, as Doge is showing strength.Cryptonary's take

Doge's performance has been strong, confirming our analysis around the $0.13 breakout. While Doge isn't part of our core holdings, it's shaping up to be a strong contender this cycle with the Trum & Elon duo narrative and Elons past support of Doge. naturally, people will look to bid on this narrative.If momentum holds, particularly with BTC's influence, Doge could revisit levels like $0.175 and potentially hit $0.229. Spot accumulation at support levels is sensible, while patience with leverage is key to avoiding premature entries in volatile conditions. Remember what we taught about overheated mechanics in our live video a few weeks back? We must be cautious about increasing exposure when things get hot.

Dogecoin (DOGE) price prediction today: Can DOGE hold $0.13 support

29 October 2024DOGE has bounced from $0.13 support with impressive momentum, nearing the $0.175 resistance. A break above could open a path to $0.229. This analysis reviews Dogecoin’s key levels and setup for potential upside as bullish sentiment remains strong.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Market context

In our recent analysis, we pinpointed the $0.13 level as a crucial breakout and retest zone for Doge, and it's playing out perfectly. We saw resistance at $0.13 on both September 28th and again on October 16th and 17th before Doge finally broke out, then came back and retested this level on October 26th.This price action signals a clear shift-sellers who previously pushed down from $0.13 are now out of the market, leaving room for a more bullish stance from buyers at this key level.

Now that the breakout is in motion, Doge has already captured a nearly 34% upside move, bringing it close to our $0.175 target. We may see a brief stall or even a pullback at this level, but if Doge breaks $0.175, it opens up the potential to target $0.229.

It's important to note that Doge is one of the few assets from the last cycle that has now breached the March-April 2022 sell-off zone, a major inflexion point in the market. The breakout above the corrective flag pattern, first tested on September 26th, shows strong demand, with a clear higher high and higher low structure forming as we move closer to reclaiming $0.229.

Playbook

We're keeping an eye on the 0.13 level as a foundation for continued upside. Spot accumulation was advised between $0.084 and $0.1, with a strategy to capitalize on the breakout and retest of $0.13. With momentum carrying Doge towards the next resistance at $0.175, we would wait for either a break and retest at $0.175 or a potential pullback to $0.13 to evaluate further positioning.If Doge breaks $0.175 cleanly, we're looking to target $0.229. However, entering around $0.15 isn't ideal without seeing further confirmation of the breakout at $0.175, as we could experience a retrace. With seller pressure noted from May 23rd around the $0.15 level, it's best to wait for a solid break and retest this zone to confirm a shift in sentiment.

Key levels

- $0.13 - Key support level

- $0.175 - Immediate target and resistance

- $0.229 - Longer-term target on a clean break of $0.175

Risk management

Doge has shown strong demand, but given the current levels and recent breakouts, patience with spot accumulation is advised. Bitcoin's momentum around $70k could influence Doge's next leg, so watching BTC action will be key here. For Doge, spot positions make sense; however, leverage isn't recommended until we see a clear retest or break of higher resistance levels, as market volatility could shift.Cryptonary's take

Doge has shown impressive demand, capturing a strong upside since our call on the $0.13 breakout. While we're not invested in Doge, it's proving to be a strong performer this cycle. If momentum holds, especially with BTC's influence, Doge could replicate its past moves, potentially heading towards $0.175 and even $0.229. Spot accumulation at support levels appears wise, but staying patient with leverage is key here to avoid premature entries.Can momentum push DOGE from $0.13 to $0.175?

16 October 2024After breaking out above $0.13, DOGE is gaining momentum. Can it reach $0.175? Here’s what the charts are showing us about the next potential move.

Market context

We've seen significant pressure building around the $0.13 level for Doge. On 23rd September, we observed a breakout, which indicates a potential shift in momentum. Breaking through this level is a critical point for Doge as we've also broken out of a downtrend line. The breakout on 23rd September held above the key level of $0.13, which has been an important support and resistance area in the past.Looking back at previous price action, we can see how Doge had to push through this level during prior moves, particularly back in March and before that. This gives us a strong indication that this breakout will be a bullish development, signalling potential further upside if we can sustain above this level.

Playbook

- If we maintain above $0.13, we could see further upside action. Bitcoin's momentum around the $68,000-$69,000 price point will be key in determining whether Doge and other similar assets break through their respective levels.

- Doge has a history of strong moves, such as the 175% move we saw earlier this year in Feb after breaking out. This makes Doge an asset worth watching closely in the current market conditions.

Key levels

- $0.13 (current critical level)

- $0.175 (next target if momentum continues)

Risk management

Given the strong historical price action around the $0.13 level, it's essential to remain cautious with leverage positions. Patience and a spot accumulation strategy could be a wise approach if you're looking to build exposure to Doge. Keep a close eye on Bitcoin's price action around the $68,000-$69,000 level, as it could drive Doge's next leg up.

Cryptonary's take

Doge is in a pivotal moment. The breakout above $0.13 suggests potential for further gains, but it will largely depend on Bitcoin's ability to maintain momentum above its key levels. Doge has been a strong player before, and we may see it replicate its previous performance.Watch for continued strength above $0.13, with a potential move towards $0.175 in the near future. Stay patient and manage risk carefully, as this could be an opportunity for spot accumulation rather than leveraging too early.

Can DOGE break $0.13 for a 70% rally?

7 October 2024Market context

DOGE has been in a key breakout phase following a prolonged consolidation in a channel formation. On the weekly timeframe, we anticipated a breakout from the resistance trendline, which materialized during the week of September 23rd. This breakout was driven by a strong bullish push, largely off the back of the interest rate decision, aligning with broader market sentiment.The price action has been impressive, wicking into the 0.13 level, which now stands as key resistance moving forward. This zone has historically played an important role, with Price consistently reacting to it across multiple tests.

The range bottom has now formed around 0.104, a significant support going forward. This level has held strong in recent weeks, showing the potential for DOGE to build off this structure. Given that Bitcoin held above 60K during the same period and showed a similar bullish reaction, DOGE is aligning with the broader crypto market sentiment, indicating strength at these levels.

During the daily timeframe, DOGE confirmed a breakout and retest of the trend pattern, with the price holding well above 0.104. This retest of the 0.104 level has historically been a solid indication of future upside, reinforcing the significance of this zone. What stands out is how DOGE has maintained strength post-breakout.

Multiple tests of this 0.104 support, combined with its strong reaction, give a solid case for potential continuation to the upside. We want to see a clean breakout of 0.13 resistance to confirm continued bullish momentum. Historically, this level has been tested several times, including key moments in mid-July and early March. A breakout above 0.13 would clear the path for further upside toward 0.175, aligning with broader bullish market movements.

Playbook

Key Levels:- Support: 0.104

- Resistance: 0.13 (short-term), 0.175 (medium-term target)

- Long-term resistance: 0.22

Trading setup

The current range sits between 0.104 (support) and 0.13 (resistance), creating a solid trading zone. From a spot position, playing the bounce off 0.104 is a strong opportunity. The initial upside target sits at 0.175, which would represent a 70% gain. If the bullish momentum holds, the next significant level is at 0.22, offering a potential 120% return from the current range.Risk management

The main confirmation we're looking for is a breakout above the 0.13 resistance level. Historically, this zone has been a significant point of resistance, with multiple tests in March, June, and July. A successful breakout beyond 0.13 would open up more upside potential, targeting 0.175 initially.Market sentiment

DOGE remains one of the most popular meme coins, and while current market attention has shifted to other meme assets, its ability to hold structure here makes it a contender. What's particularly impressive is that DOGE has already broken the April 2022 sell-off, which is something very few assets have managed to do. The asset has performed well in comparison to other coins, maintaining strength in the current market environment.Cryptonary's take

DOGE is holding up well, and while it's not currently in the Cryptonary portfolio, it shows promise. Its ability to break through significant levels and maintain momentum is solid. With a potential upside of 70% to 120% in the mid to short term, this is an asset worth monitoring closely. A breakout above 0.13 would give a clear path to the 0.175 target, and how DOGE handles this level will determine its next major move.Will $0.23 be the next target for DOGE

27 September 2024Overview

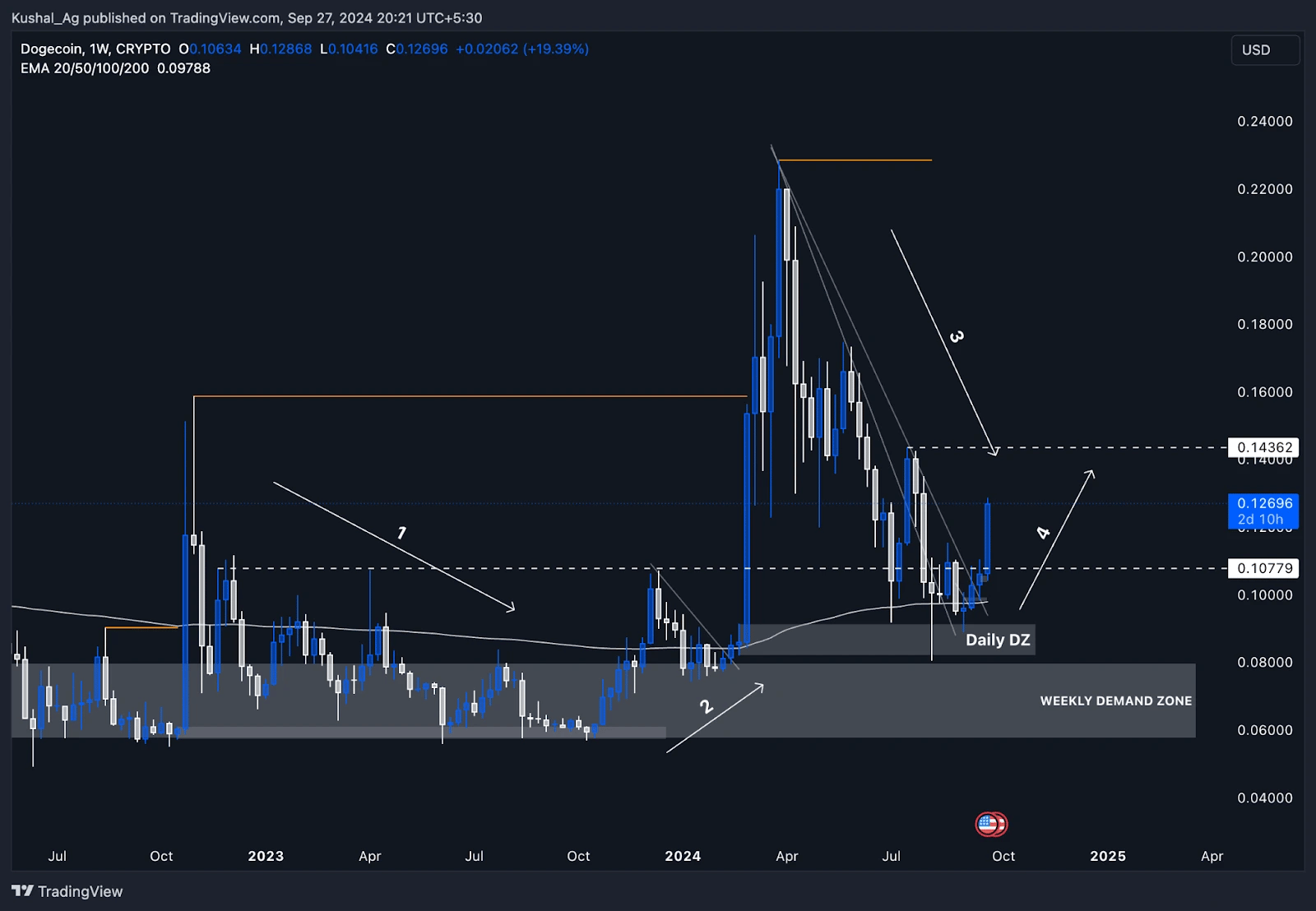

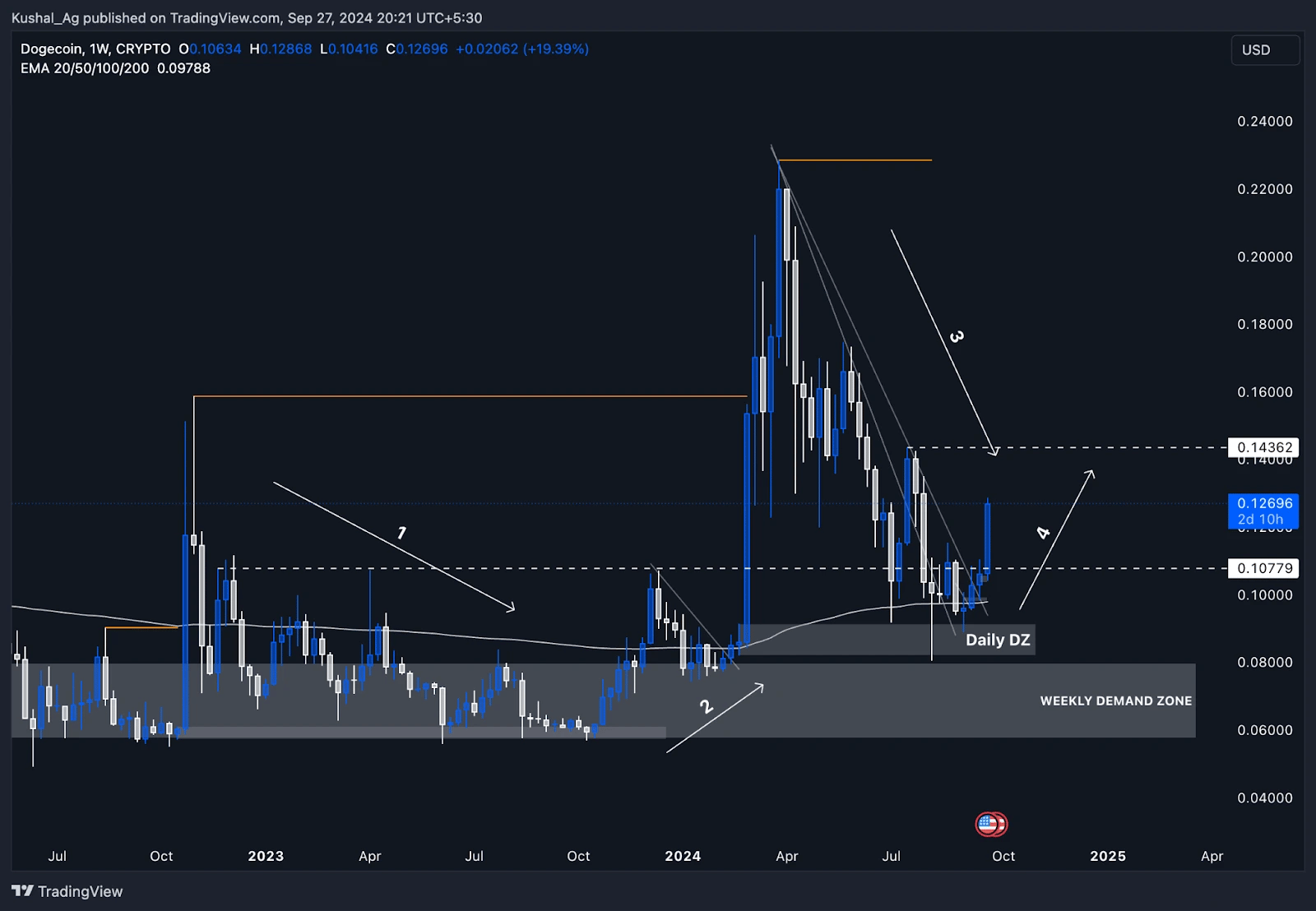

DOGE has proven its staying power by becoming a favourite for many investors and traders. As of today, DOGE is showing clear signs of bullish momentum. After a period of consolidation and a brief retracement, it's now on the move, trading at approximately $0.127 with an 8% gain just today.DOGE's higher timeframe price action, specifically on the weekly chart, indicates that it has taken key support from the 200 EMA. Furthermore, DOGE's daily chart shows that it has been respecting its demand zones and breaking out of critical downtrend trendlines. This combination of bullish developments places DOGE in a favourable position as we analyse its potential move higher, especially given that Bitcoin (BTC) has been breaking through its own key resistances.

With this backdrop, let's dive into DOGE's weekly and daily charts and analyse its performance against Bitcoin (DOGE/BTC pair).

Weekly timeframe analysis (DOGE/USD)

DOGE has held up well on the weekly timeframe, using the 200 EMA as a crucial support level. After multiple tests, the price dipped below momentarily, leading to long liquidations, but this ultimately proved to be a liquidity grab before a reset and bounce back to higher levels.- 200 EMA support: DOGE's ability to consistently hold the 200 EMA suggests that this is a strong level of support, signalling the long-term health of the asset. Buyers have continued to step in at this level, pushing prices back up.

- Bullish trendline break: DOGE has been consolidating for several weeks and has now broken out of a downtrend trendline, marked by the orange line on the chart. This breakout indicates that momentum is beginning to shift in DOGE's favour.

- Key resistance levels: The first major resistance is at $0.1436, and breaking this would potentially trigger a much stronger rally. The next resistance is at $0.23, followed by the ATH zone. If these levels are flipped into support, DOGE could see a more significant move upward in the coming weeks and months.

Daily timeframe analysis (DOGE/USD)

On the daily timeframe, DOGE continues to show a strong bullish trend. The coin has respected the $0.10078 level as a significant support zone, which led to a major breakout after several days of consolidation. DOGE also took support from the daily demand zone, marked by the grey box on the chart, which is key to its recent price action.- Breakout from downtrend: DOGE has broken out of a downtrend trendline, resulting in a strong rally of 25%, moving from $0.10078 to $0.125.

- Potential accumulation zone: The $0.10078 level, now flipped into support, offers a potential accumulation zone for investors looking for solid entries. Layering orders in this region provides a good risk-to-reward ratio, given DOGE's bullish momentum. Additionally, the $0.1436 resistance could act as a new support if flipped, offering another area for accumulation.

- Next resistance levels: As DOGE pushes higher, the next key resistance zones to watch are $0.1436, followed by $0.23. Once $0.1436 is flipped, DOGE could move swiftly toward higher levels, including the ATH target.

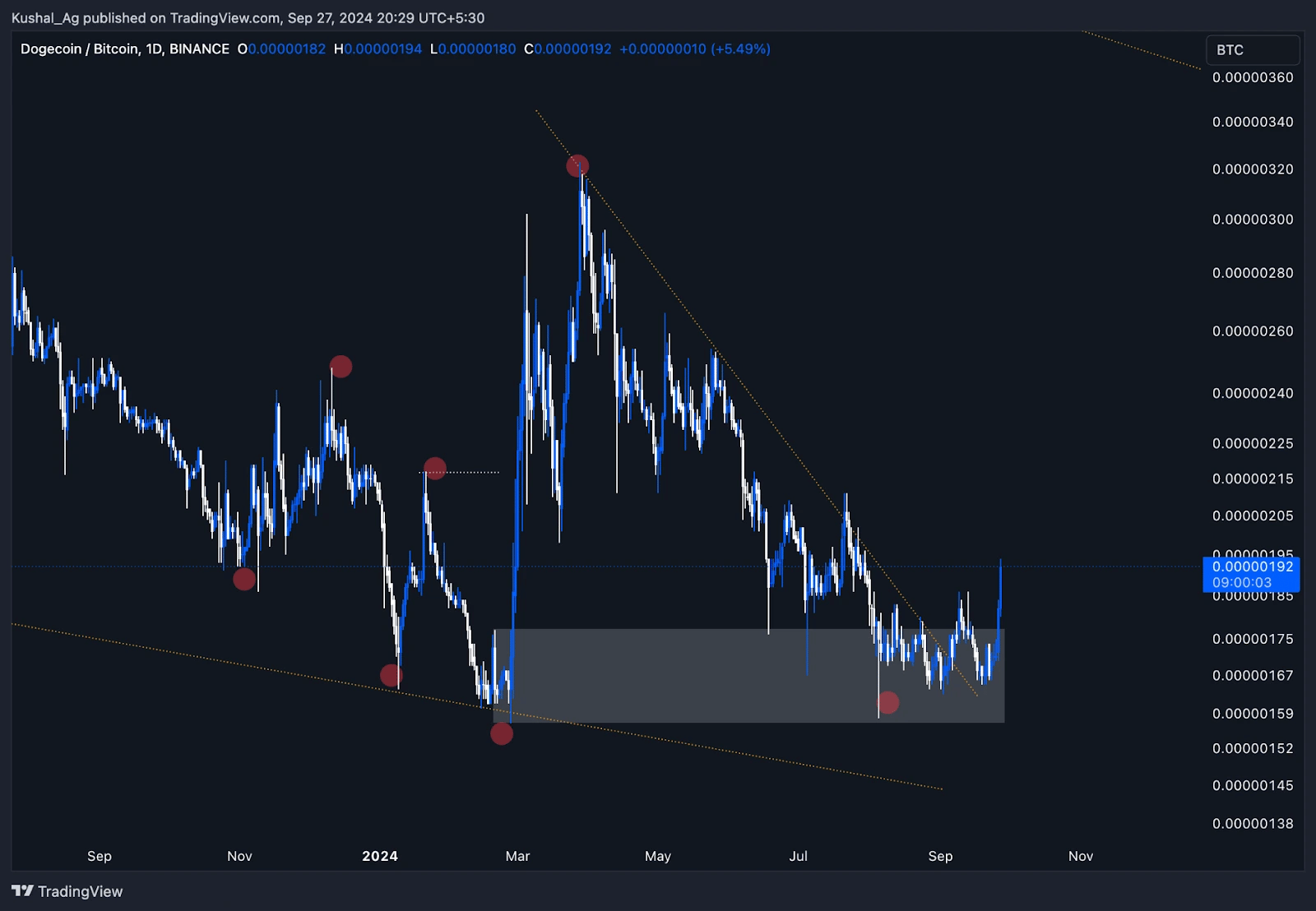

DOGE/BTC pair analysis

The DOGE/BTC pair is crucial in analyzing DOGE's relative strength against Bitcoin (BTC). After a long downtrend, DOGE/BTC has recently broken out of a daily downtrend trendline. This breakout signals that DOGE is poised to outperform BTC, especially if Bitcoin continues its bullish run.- Higher highs and higher lows: The structure on the DOGE/BTC pair shows that DOGE has been forming consistent higher highs and higher lows, marked by the red dots on the chart. This indicates strength in DOGE's price action relative to BTC.

- Demand zone bounce: DOGE/BTC found strong support in a daily demand zone, represented by the grey box on the chart. This zone acted as a springboard for the price to break out of its downtrend and move higher.

- Potential outperformance: With both DOGE/USD and DOGE/BTC breaking key resistances, DOGE seems poised for outperformance against BTC. This is especially relevant as Bitcoin continues breaking key levels, further fueling DOGE's momentum.

Cryptonary's take

DOGE appears to be gearing up for a notable bullish move, supported by strong technical signals on both the weekly and daily timeframes. The breakout from key downtrend lines, combined with the strength shown in the DOGE/BTC pair, underscores the potential for significant outperformance in the near future. If DOGE can flip the critical $0.1436 resistance into support, it could rally toward $0.23 and beyond, aligning with the broader market's bullish momentum.That said, meme coins like DOGE come with inherent volatility and heightened risk. While technical indicators are signaling a potential breakout, it's essential to be cautious as DOGE remains susceptible to sharp corrections. Investors should closely monitor Bitcoin's performance, as its movement will heavily influence DOGE's trajectory. For those looking to accumulate, the current setup presents opportunities, but strategic risk management remains crucial in this high-risk asset class.

Will Dogecoin surpass $0.104 resistance?

29 August 2024- Firstly, we're looking at DOGE on the 3D timeframe in the chart, so please be aware of this.

- DOGE has been in a general downtrend since mid-March and has now fallen into a zone of support between $0.093 and $0.10.

- Alongside this, price is now also squeezing into the downtrend lines.

- If price can form a base between $0.09 and $0.10 and push into the downtrend lines, then we may see a breakout.

- For our theory to stand/hold up, we'd need to see price hold above $0.09. A breakdown of this level would see price fall into a lower range, which wouldn't support a significant move up.

Cryptonary's take

As a pure trade goes, DOGE looks attractive here. However, it depends on whether DOGE can break out from the downtrend lines. To do that, it'll need to hold above $0.09 in the coming week and also reclaim back above $0.104. Overall, we see this as a positive setup, though. A breakout of the downtrend lines could see price run to $0.137 in the coming month or so.Will $0.13 trigger a reversal?

12 August 2024Dogecoin has been trending downward, forming a well-defined descending channel.

Please note: The video above is set to start at the 21-minute 50-second mark, featuring an in-depth technical analysis of Dogecoin (DOGE).

However, the correction has been orderly, indicating that the market might be setting up for a potential reversal. We identified key levels at $0.084 and $0.13 as critical areas to watch. A break above $0.13 could signal the beginning of a bullish reversal, while a dip to $0.084 might present a more attractive entry point for accumulation.

We believe that Dogecoin's long-term potential remains positive, especially if it can hold above these key levels and break out of its current downtrend. Before entering new positions, traders should watch for signs of a reversal, such as a breakout above resistance or a strong bullish candlestick pattern.

Can $0.1 resistance hold?

8 August 2024This article provides a comprehensive technical analysis of the current Dogecoin (DOGE) market trends.

Please note: The video above is set to start at the 10:04 minute mark, featuring an in-depth technical analysis of Dogecoin (DOGE).

Dogecoin is currently navigating a short-term bearish trend, exhibiting clear resistance around the $0.1 mark. This trendline has been well-respected, indicating a potential continuation of the current downward movement. However, the accumulation zone between $0.08 and $0.1 offers an attractive entry point for long-term investors.

Given Dogecoin's historical volatility, we anticipate significant price swings. However, maintaining positions within this accumulation region could provide substantial upside potential as market sentiment improves. Monitoring price action and key resistance levels will be crucial in managing this trade.

Educational insight: Trendline are powerful tools in technical analysis, helping to identify the direction and strength of price movements. By drawing trendlines, traders can visualise support and resistance levels and make informed decisions about potential entry and exit points. In Dogecoin's case, understanding these trends helps us navigate its inherent volatility effectively.

Dogecoin (DOGE) price prediction today: Will $0.10 break soon?

7 August 2024Discover why Dogecoin traders should monitor the $0.10 level closely.

Please note: The video above is set to start at the 11:19 mark, featuring an in-depth technical analysis of Dogecoin.

Dogecoin (DOGE)

Dogecoin has been consolidating within a defined range after initial expansions, indicating a period of stability following significant price movements. This consolidation suggests that strong catalysts are required to drive future price movements. Monitoring this range closely can provide opportunities for accumulation as Dogecoin's price stabilises before the next potential surge. The asset's historical performance indicates that these periods of consolidation often precede significant upward movements.Dogecoin's current trading range presents a strategic accumulation zone for investors. The defined range between key support and resistance levels offers a clear framework for making entry and exit decisions. By accumulating within this range, traders can position themselves to benefit from any future positive catalysts. The asset's tendency to experience sharp price movements following periods of consolidation underscores the potential for substantial returns.

Educational breakdown

Consolidation phases often precede significant price movements. By identifying these ranges and waiting for the right catalysts, traders can position themselves advantageously. Dogecoin's current state underscores the importance of patience and strategic accumulation in trading. Recognising consolidation patterns can help traders anticipate future trends and optimise their investment strategies.

What is Doge? Dogecoin (DOGE) is a cryptocurrency that started as a joke but quickly gained a large following due to its friendly and approachable nature. Now, it is the King of memes. Inspired by the popular Doge meme, Dogecoin is known for its strong community and widespread use in tipping and charitable donations.

How to Buy: Via Centralized Exchange (CEX):

- Choose a CEX like Binance, Coinbase, or Kraken.

- Create and verify your account.

- Deposit funds.

- Navigate to the DOGE trading section and complete your purchase.