We need to learn to understand what this means for us as traders and investors. This is not the time to panic; it's a time to look to take full advantage of this market because soon, these prices will be behind us. You need to be in the fight to have a shot at winning; decide which side you want to be on.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Bitcoin (BTC) price analysis

Bitcoin is currently experiencing a sell-off, influenced by short-term bearish reactions to recent data and geopolitical conflicts. However, we view this as an opportunity to accumulate spot positions at more attractive prices. The larger catalysts that have driven previous bullish movements still outweigh the current downside price movement. It's crucial to zoom out and look at higher timeframes, where Bitcoin is forming a bull flag on the monthly chart. While we may see some lower swings, they are minor in the grand scheme of things.To navigate these times, our focus should be on protecting capital. Next week, we will reduce our leverage exposure and look for opportunities to accumulate spot positions at lower prices. We trust in Fibonacci retracements and expect Bitcoin to find support around $60,000. This level aligns with the April-March sell-off, which could also lead to attractive buying opportunities in other assets. It's essential to view support levels as floors—if a floor is broken, we adjust our strategies and prepare to take advantage of the next level down.

Ethereum (ETH) price analysis

Ethereum is another asset we're closely monitoring. We anticipate the $2,900 level could come into play again, forming a potential double bottom. This level has previously seen significant moves, and we believe it could be a strong support. The excitement lies in the potential for deeper price corrections, which can lead to significant rebounds in a bullish market. The larger the pullback, the stronger the subsequent price pop could be.We suggest accumulating spot positions around the $2,900 level on Ethereum. Historical data shows that Ethereum has seen a 35% increase from this level just off the ETF news. This price point offers a strong foundation to capitalize on future bullish movements. It's crucial to maintain a balanced perspective and not panic during these corrections, as they provide valuable opportunities to strengthen our positions.

Solana (SOL) price analysis

Solana is currently facing a potential drop to its April-March sell-off levels, around $130. This area has substantial liquidity and demand, making it a prime spot for accumulation. We had projected a high move for Solana, and despite it surpassing expectations, we are ready to take advantage of lower prices. Our strategy involves allocating $10,000 for this challenge, with a focus on spot and leverage trades to grow the bag aggressively.If Solana reaches the $130 level, we plan to allocate $7,500 to spot positions and reserve the remaining $2,500 for further dips. This approach allows us to maximize gains while maintaining a high conviction in Solana's long-term potential. By not setting a stop loss, we demonstrate our confidence in the asset and our readiness to adapt our strategy as needed. This mixture of spot accumulation and strategic leverage positions aims to capitalize on Solana's volatility.

Injective (INJ) price analysis

Injective is another asset of interest, though we are approaching it more defensively this week. We recently took a minor loss, prompting us to be cautious and focus on better opportunities. The current price point remains attractive, but our strategy involves a mental reset and reducing leverage positions. This conservative approach prepares us for numerous trading opportunities in the coming months.By being patient and waiting for the right conditions, we can avoid unnecessary risks and better position ourselves for future gains. The market offers continuous opportunities, and it's essential to maintain a disciplined approach, especially after a loss. Our focus on high-quality setups and solid risk management will help us navigate the market effectively.

Pendle (PENDLE) price analysis

Pendle has broken down beyond our initial levels, prompting us to advise holding off for now. However, we are approaching a critical support level at $2.566, which we call the "scene of the crime" price point. This level has previously shown strong support, and we have a conviction in its potential to hold.We will monitor this level closely over the weekend and update our watchlist accordingly. It's crucial to recognize that unexpected scenarios can occur, and adapting our strategies based on new data is part of effective trading. By staying informed and flexible, we can make well-timed decisions that align with our risk management principles.

Dogecoin (DOGE) price analysis

Dogecoin has reached a beautiful price point, making it an attractive spot for accumulation. Given the numerous opportunities the market presents, our current focus is on spot trading. By accumulating at these lower levels, we position ourselves for exponential returns as the market recovers.The key to successful spot trading is recognizing high-probability setups and maintaining a disciplined approach. Dogecoin's current price offers a prime opportunity to build a solid position with the potential for significant upside. Patience and strategic accumulation are crucial during these times.

Kaspa (KAS) price analysis

KAS has broken out and retested its levels, requiring us to be patient. We advise waiting for a few days above the breakout point to confirm the move before taking action. This cautious approach helps avoid fake-outs and ensures we capitalize on more stable opportunities.Understanding market sentiment and timing is essential in trading. Waiting for confirmation reduces the risk of premature entries and enhances our chances of success. Monitoring KAS closely will allow us to identify the right moment to act.

AVAX price analysis

AVAX has traded down a bit lower, and we want to wait until it breaks out above $31 before we look to capitalize on it. Until then, it is best to be patient and avoid making premature moves. The $21 level doesn't have enough support to justify taking action yet.Waiting for clear breakout signals ensures that we are entering positions with higher probability setups. It's crucial to avoid the temptation to jump in too early, which can lead to unnecessary losses. Patience is key when navigating volatile markets like AVAX.

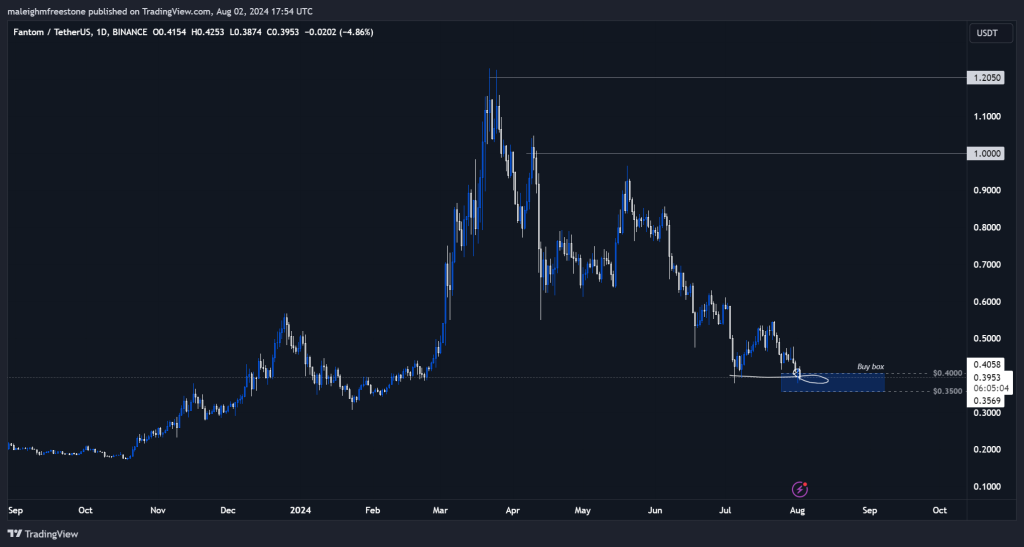

Fantom (FTM) price analysis

FTM is holding up nicely within our designated buy box between $0.35 and $0.40. This is a solid range for accumulation, and we suggest focusing on building spot positions here. Avoid applying leverage and concentrate on strengthening your spot holdings.Accumulating within defined price ranges helps manage risk and allows for better entry points. By sticking to our buy-box strategy, we can build a strong position in FTM, ready to capitalize on future bullish movements.

Pepe (PEPE) price analysis

Pepe has shown precise movements around our identified "scene of the crime" price point. This accuracy makes it a great candidate for accumulation. Shiba Inu, Dogecoin, and Pepe have all displayed strong chart patterns this cycle compared to the broader market.These assets present unique opportunities due to their chart patterns and relative strength. Understanding the technical aspects of these patterns can help us make informed decisions and take advantage of high-probability setups.

Shiba Inu (SHIB) price analysis

Shiba Inu's chart is forming a big wedge pattern, suggesting a positive outlook. This corrective move, following its surge in February, is healthy for the asset. The wedge pattern indicates potential for future bullish movements, making it an attractive candidate for accumulation.Recognizing chart patterns like wedges can provide valuable insights into future price movements. Shiba Inu's current setup offers a promising opportunity to build a position with the potential for significant upside.

Toncoin (TON) price analysis

Ton was expected to struggle to break out of its all-time highs. We now focus on accumulating around the $6.227 to $6.2 level. This is a time to accumulate rather than timing the market. We aim to build a strong position, preparing for a turnaround and more positive sentiment in the coming months.Accumulation at strong support levels allows for better entry points and positions us well for future gains. By focusing on building our spot positions, we can take advantage of positive market cycles when they occur.

DogWifHat (WIF) price analysis

WIF has come down to an attractive level of around $1.85, presenting a valuable opportunity. We view this as a gift and encourage accumulation at these levels. WIF's stability and potential for future gains make it a prime candidate for building a solid position.Taking advantage of opportunities during market downturns can lead to substantial rewards. WIF's current price offers a chance to accumulate at a discount, preparing us for future bullish moves.

Popcat (POPCAT) price analysis

Popcat has experienced significant corrections, which we anticipated. These pullbacks present opportunities to accumulate at lower prices. By understanding Popcat's characteristics and preparing for these corrections, we can position ourselves for future gains.History often repeats itself in markets. Popcat's past behaviour suggests that significant pullbacks can lead to substantial rebounds, making it an attractive candidate for accumulation during downturns.

Jupiter (JUP) price analysis

Jupiter correlates well with Solana and has been following similar market movements. We anticipate that Jupiter might come into play around the same levels as Solana's April-March 2022 sell-off. This presents an opportunity to accumulate at lower prices and capitalize on future bullish movements.Recognizing correlations between assets can provide valuable insights into potential price movements. By monitoring both Jupiter and Solana, we can make informed decisions and take advantage of key support levels.

Tremp (TREMP) price analysis

Tremp is holding around its lower range of $0.4 to $0.25, presenting a valuable accumulation opportunity. Similar to Popcat, Trempe has experienced significant corrections and recoveries. We expect this pattern to continue, making it an attractive candidate for accumulation during downturns.Patience and strategic accumulation are essential in trading. Trempe's current price offers a chance to build a solid position with the potential for significant upside. Monitoring its performance closely will help us make informed decisions