Last week was a masterclass on what not to do, especially when it seemed that nothing could go wrong.

Bitcoiners lost more than half a billion dollars — and the culprit? Leverage!

Leverage demands that you sacrifice control of your coins, and if the market takes an unexpected turn, it leads to the liquidation of leveraged positions.

So, BTC traders lost upwards of $500 million to forced liquidations; the situation couldn’t be sweeter for institutions.

But there’s a lesson here for all of us.

TLDR 📃

- Half a billion in BTC positions liquidated in the largest liquidation event since the collapse of FTX.

- Over $822 million had been in long BTC positions leading up to the crash.

- The liquidation was triggered by a perfect storm of factors, such as SpaceX’s BTC investments, soaring US bond yields, and leverage.

- But it’s not all gloomy. Coinbase receives approval to offer BTC futures, and the first spot BTC ETF in the EU gets approval.

The audio version of this weekly analysis is available here.👆

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

$500 million in BTC lost over 6 hours - leverage is risky

Last week, we reported on the massive amounts of open interest in long BTC positions in the market. At the peak of the bullish sentiment, there was a whopping $822 million in long positions in BTC.The thing is, all market participants can see this data. And at some point, some big players realised that a price below a certain amount would liquidate many leverage positions to trigger a snowball effect.

And true to form, all that leverage came crashing down. This was the worst BTC price drop since the collapse of FTX, with upwards of $500 million liquidated – a trader on Binance lost $10 million in one go.

And this, here, is the warning against leverage. Yes, there are positive catalysts on the horizon. But don’t count your chicks until they are hatched.

Who is to be blamed for Bitcoin’s crash?

So, who is to be blamed for last week’s BTC price drop?While too much leverage brought the liquidation ball into play, there was also a perfect storm of other factors at work.

For instance, some people blamed Elon Musk for writing down the value of SpaceX’s BTC by $373 million.

However, while it is easy to point fingers, the BTC market has grown beyond where one person’s decision could easily move it.

But beyond that, the SpaceX angle is mostly a moot point. Writing down an asset’s value doesn’t mean they sold that much asset. It only means the investment is worth that much less.

An analyst at the CME offered another factor: the skyrocketing yields on US bonds.

Since those yields have been soaring, they soak liquidity out of every other market, being too good an investment to pass up. But before you sell your BTC to buy bonds, read our recent report on the topic.

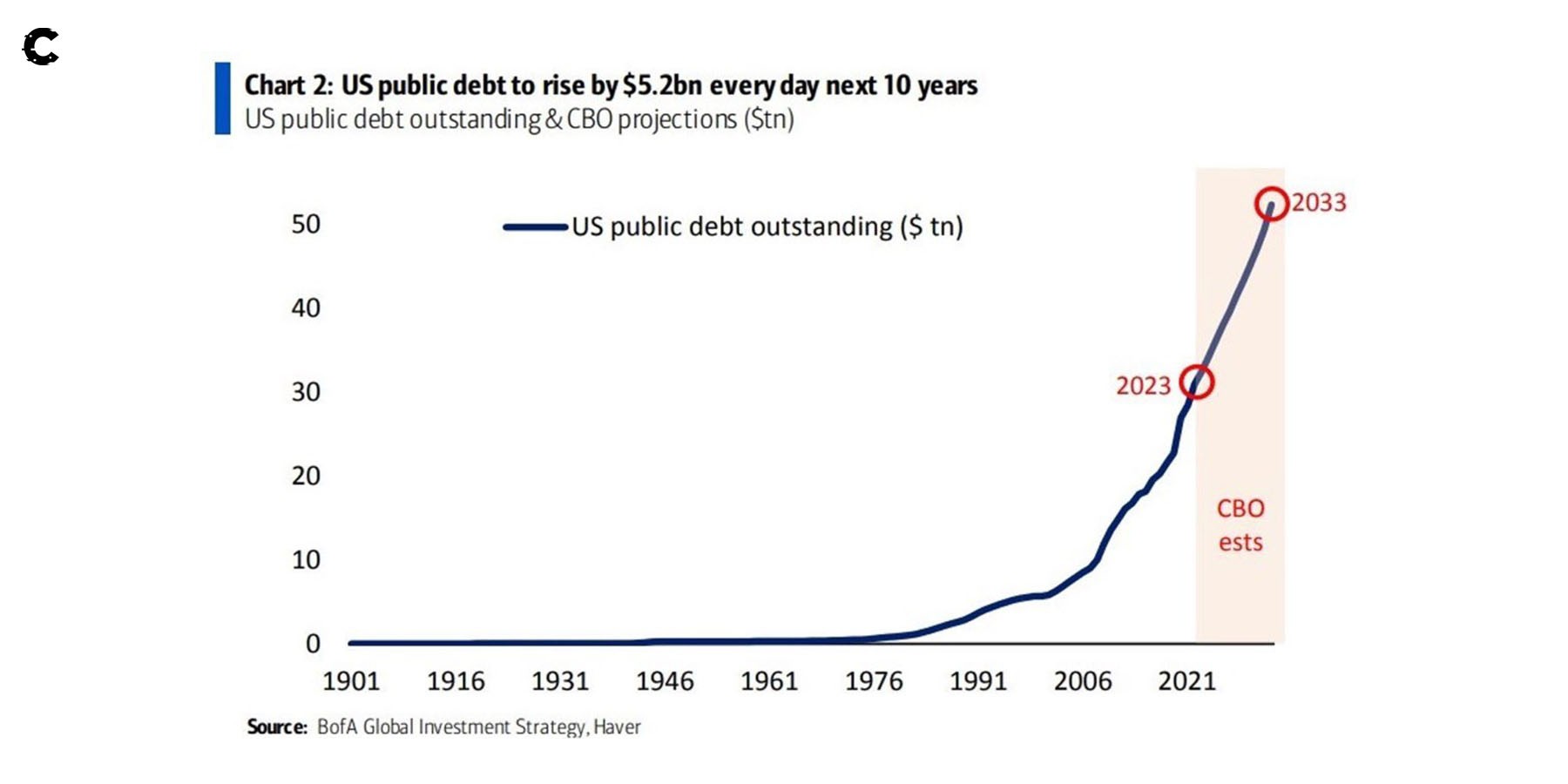

New forecasts show that US public debt is set to increase by $5.2 billion daily for the next ten years.

Of course, many people also think some powerful players triggered BTC’s collapse to allow institutions to acquire BTC ahead of upcoming ETF approvals. Again, this is conjecture. While all the bigwigs entering Bitcoin have some sway, it’s not as much as the media would have you believe.

The price drop wasn’t caused by a single factor but by a bunch of events aligning at just the right time – and that’s why risk is what you don’t see.

Institutions are here; what does that mean for you?

Last week we talked about how absurdly high open interest has become; well, the chickens have come home to roost.Institutions have certainly arrived at the BTC scene and will try their best to play 3D chess with crypto.

A significant development was Coinbase receiving the coveted approval to offer BTC futures, making it a completely regulated exchange. This creates an attractive avenue for those institutions to build exposure and massively boosts the chances of a spot BTC ETF being approved.

Investors in Europe are already blazing ahead with the first spot BTC ETF being approved in the EU. While a relatively small ETF with initial exposure of $1 million, its approval bodes well for more spot ETFs to launch in the region. Of course, this opens up BTC to every institutional investor in the EU, the second-biggest capital market after the US.

Institutional participation is rising, and we welcome what they bring; the good and the bad. What this means, though, is that BTC is becoming more sophisticated as an asset class.

To swim with the sharks, you need to upgrade your toolset and skillset and revamp your mindset - Cryptonary Pro helps you do that and more.

Price analysis 📊

Some might think Bitcoin left the market in the rumble, but we argue otherwise. Last week’s performance only provided new and better opportunities for us to capitalise on. Lower prices, high rewards, and we’re all here for it.

The price of BTC found a lot of demand after testing $25,150 last week. Although this hints at another pump, the opposite may happen. Usually, prices tend to range and drop following a significant descent in the market.

For a while (1-2 weeks, could be more), we expect the market to remain stagnant and on its way to testing previous lows. In this case, BTC will slowly head back to $25,150 for a second retest as support – that’s when you should start filling up your carts.

The price of BTC found a lot of demand after testing $25,150 last week. Although this hints at another pump, the opposite may happen. Usually, prices tend to range and drop following a significant descent in the market.

For a while (1-2 weeks, could be more), we expect the market to remain stagnant and on its way to testing previous lows. In this case, BTC will slowly head back to $25,150 for a second retest as support – that’s when you should start filling up your carts.

Cryptonary’s take 🧠

We expect institutions to seize the opportunity BTC now presents, acquiring BTC quietly over the next few months to avoid increasing prices.Their enthusiasm is no less than when BTC was more expensive, and it’s an opportunity they’ll be taking full advantage of.

At Cryptonary, we’ll also enjoy accumulating BTC at the current discount. We also intend to take the lesson from this week close to heart, avoiding reckless leverage to maintain complete control over our investments.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms