With over 2,400 deadcoins on Coinopsy (a website that tracks defunct projects), it's crucial to learn how to spot red flags and avoid scams.

Today, we dissect four cautionary crypto tales and the key lessons that will safeguard your investments!

Read this article; your portfolio will thank you!

TLDR

- If something sounds too good to be true, it probably is. If a project promises massive interest rates or overblown promises of riches, exercise caution!

- Ambition is good, but make sure it’s realistic. Consider whether the project addresses a problem or need actually faced by crypto. Or whether it has simply created one and is offering a solution. A great example is Dragon Coins and its (supposedly) real-world floating casino.

- FOMO is lethal. It provokes emotion, makes you think you don’t have time to research and leads to unnecessary risk-taking and mistakes. $SQUID, to name but one, was a FOMO generator that backfired on investors.

- Doing your own research is the most important thing in crypto. Consider who the project’s founders are, what its goal is, and how realistic the chances of success are. OneCoin had a team of founders with questionable backgrounds, which would’ve raised red flags for anyone that researched them properly.

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Today, we’re going to break down the vital lessons that can be learned from four dead crypto projects: BitConnect ($BCC), Dragon Coins ($DRG), Squid Game ($SQUID) and OneCoin.To start off, let’s look at the straight-up scam that was BitConnect (BCC).

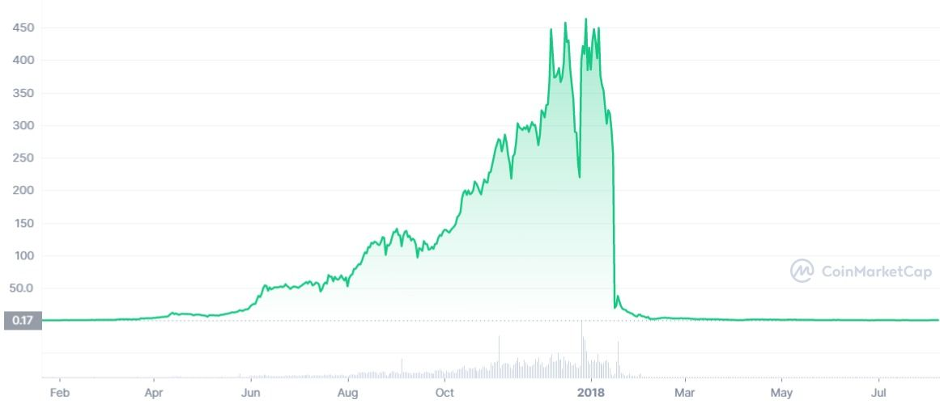

BitConnect | $BCC: $463 -> $0.17

Rug Date (the date the project failed or was exposed): January 17, 2018.

If you’ve been in crypto for a while, you’ve definitely heard of this one.

Launched in 2016, BitConnect claimed to offer “proprietary technology” in its “BitConnect Trading Bot” and “Volatility Software.” The project promised to generate huge, guaranteed returns.

In reality, BitConnect was the largest Ponzi scheme in crypto history.

It hit an all-time high in December 2017, and ranked in CoinMarketCap’s best-performing coins with a $2.5B market cap.

The Problem?

Promising returns of 40% a month, the token was operating as a clear-cut Ponzi scheme, paying interest with new users' deposits.Eventually, the bubble had to pop.

The Lesson

If it sounds too good to be true, it probably is.High interest rates should raise red flags.

It’s absolutely vital to know where the money paying the interest is coming from!

Any project that advertises over 10-20% APY should raise concerns. That’s not to say it can’t be legit, but you need to be damn sure it’s sustainable. Dig as deep as possible into a project’s documentation to determine these sources. If you come up empty, it’s probably a good idea to bail.

If you know a project isn’t sustainable but hope to capitalise on the hype, be careful. Make sure you have a clear exit plan to get out before the music stops!

Dragon Coins | $DRG: $2.22 -> $0.00

Rug Date: March 20, 2018.

Dragon Coins was an extremely ambitious project.

Launching mid-ICO (Initial Coin Offering) boom (when projects were launching with only a whitepaper and raising obscene amounts of money), its founders raised $380M to fund the construction of a floating casino and hotel.

The casino was to be based in Macau but could relocate anywhere in the world.

But after its ICO, $DRG’s price just wouldn’t stop falling.

The Problem?

Not only is a floating casino completely unnecessary, it’s also a logistical nightmare.Following the 2018 ICO, it was revealed that the Norwegian construction firm Brova Idea had abandoned the project in November 2017. Despite being without a contractor for this material maritime asset, the ICO went ahead.

As a result, the price went straight down, as people realised the project was a pipe dream, never to become a reality.

The Lesson

Ambition is good, but it needs to be realistic.Dragon Coins is a perfect example of a project that was too ambitious (or just greedy).

Even if we pretend a floating casino was feasible, or even possible, and one was built, what possible reason could there be for a related crypto token? There isn’t any we can think of.

Dragon Coins’ founders had simply found a way to easily raise huge amounts of money, and capitalised on this.

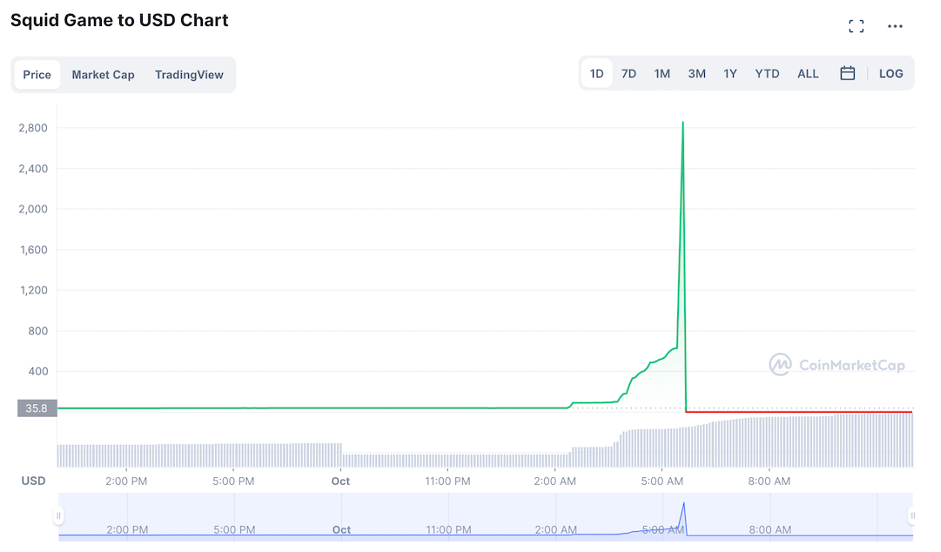

Squid Game | $SQUID: $2,862 -> $0.01

Rug date: November 1, 2022.

$SQUID, inspired by the nightmarish Netflix show, launched in October 2022, and was initially valued at $0.01.

Within a week it rocketed up a whopping 28,620,000%, reaching a peak of $2,862.

Then, this happened…

The team rugged. All liquidity was removed. Tokens were dumped.

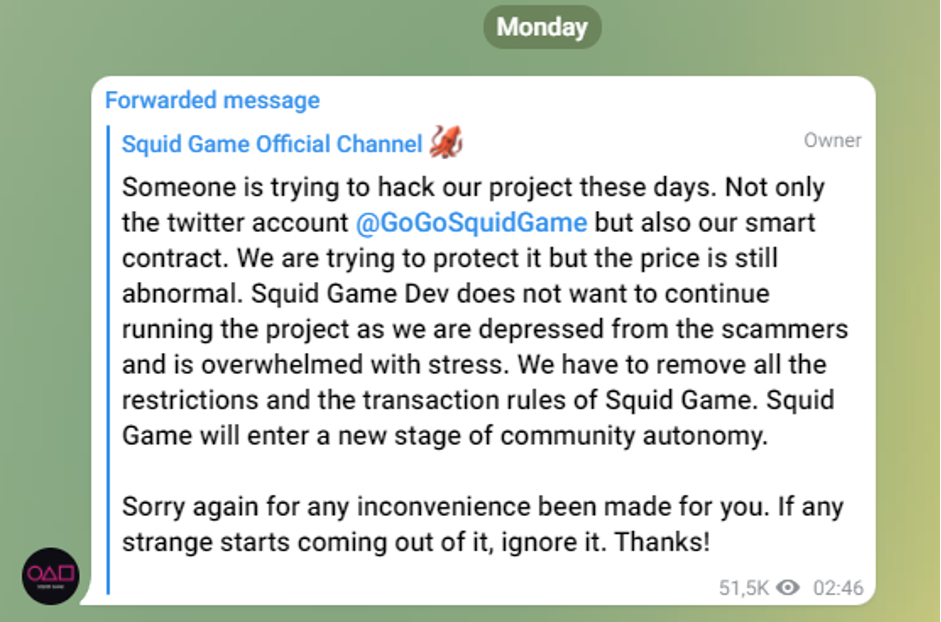

They then posted this incredibly brazen message on Telegram:

Despite the astronomical numbers, due to the lack of liquidity on the token, scammers were only able to get away with $3.38M.

For our on-chain sleuths, you can see the rug pull wallets on BSC scan (1 and 2).

The Problem?

Because there was so much hype behind $SQUID, with people seemingly making over 28,000,000%, retail traders FOMO’d in hard.They didn’t have time to research the project, they needed to get in straight away before they missed another move up. Anyone that did research would have noticed that $SQUID had an anonymous team, spelling mistakes on the website, a suspiciously new Twitter profile, and massive red flags in its whitepaper.

The Lesson

Don’t FOMO!100X projects come very rarely (let alone 28,000Xs!).

When they do, there’s usually immense risk.

$SQUID was simply too good to be true.

Getting caught up in the emotion of, “OMG I can’t believe I missed that pump, I need to get in before it goes higher,” clouds your judgement and causes bad decisions.

Nine times out of ten, this ends badly. Take a breath and collect your emotions.

OneCoin: $4,000,000,000 -> $0 (total scheme value)

Rug date: Unclear.

OneCoin launched in 2014, and was heralded as a Bitcoin killer.

The data for OneCoin is hard to find, because there was never a real blockchain.

The scheme brought in a massive $4B despite never touching a smart contract.

Its founder, Ruja Ignatova, ran global events and built a cult-like following.

Check out this example from an event at Wembley Stadium:

[video width="1280" height="720" mp4="https://cryptonary.s3.eu-west-2.amazonaws.com/wp-content/uploads/2023/03/zZgWJGjnOSQkq9yA.mp4"][/video]

Of course, it came crashing down hard.

Several warnings were issued by government agencies (such as Norway, Sweden, Bulgaria, Finland, and many more) from 2015 to 2017.

In April 2017 Indian police arrested 18 people for organising a OneCoin recruitment event. In total, over 98 individuals were arrested.

Ruja was never caught and is now among the FBI’s top 10 most wanted fugitives.

The Problem?

OneCoin’s cult-like following led to investors blindly following the crowd.Research into the project would have revealed that Sebastian Greenwood, a co-founder, had previously been involved in Unaico, another pyramid scheme.

The project’s ex-president Nigel Allan had also been involved in several suspected pyramid schemes, including Crypto 888 and Brilliant Carbon.

The Lesson

Do your research!Clear red flags were overlooked as investors simply didn’t dig deep enough.

Researching a project’s founders is essential. They steer the ship. If they have sketchy pasts, don’t even consider investing.

When it comes to cults, or aggressively passionate communities, steer clear. Unless you’re aware of this red flag and have an exit plan, it’s never worth it.

Cryptonary’s Take

Rug pulls and scams are common in crypto, as in an unregulated industry (for the time being) that nevertheless holds vast potential, bad actors come with the territory.There is a huge number of incredible, innovative, and legitimate projects. But for each genuine game changer, there are numerous scams and overly ambitious projects.

Being hyper-aware when researching projects will help prevent you from getting rekt.

Let’s sum up the vital lessons:

- If it sounds too good to be true, it probably is.

- Ambition is good, but make sure the goals are realistic.

- Don’t FOMO.

- Do your research!

Take these lessons forward with you on your investing journey.

Action Points

- Consider your portfolio and holdings, use these lessons to make sure you’re not making any potentially fatal errors.

- Read our Ultimate guide for building a crypto portfolio, which gives some invaluable insights into how to judge risks/reward of investments.

- Read our Fundamental analysis and Tokenomics series to learn how to DYOR (Do Your Own Research).

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms