Will DeFi break out? Find answers in the capital flow

The SEC's recent actions brought a bit of uncertainty in the market, but guess what? BTC went on a quick-paced rally this week—all thanks to renewed interest in a Bitcoin ETF from major players like BlackRock and Citadel.

Even Fed Chair Powell couldn't help but acknowledge that "crypto appears to have some staying power in the US economy."

Isn't it fascinating how the narrative can shift instantly when these big players jump into the game?

The burning question on everyone's mind is this: "Will DeFi break out in response to Bitcoin's rally?" Well, let’s find out.

TLDR 📃

- Bitcoin rallies, leading to speculation on DeFi's potential surge.

- However, the SEC’s attack on altcoins continues to incubate uncertainty.

- If BTC breaks out, a capital flow from BTC to ETH, and then to DeFi is expected.

- A few DeFi projects are showing a readiness to capitalize on BTC's rally.

- The Decentralized securities sector (DeSec) is also poised for growth.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Bitcoin rallies; will DeFi break out? 🛣

Bitcoin’s dominance has smashed through its usual range and is now at 53%. Meanwhile, altcoins are far behind in BTC’s rearview mirror.

Now, to the big elephant in the room: the SEC. The uncertainty surrounding altcoins and their regulatory status in the US has thrown a lot of tokens into a state of limbo.

Okay, okay, maybe we're getting a bit dramatic here. After all, BTC only started rallying this week. But guess what? The SEC hasn't won, and it's not likely to win anytime soon.

That means there's some wiggle room for manoeuvring. And hey, based on previous BTC moves, we have every reason to believe this one won't be all that different: Fiat > BTC > Alts. That's the usual dance.

Now, hold on one sec. We're not declaring the start of a new bull market just yet. But what's likely to happen if Bitcoin can keep up these prices? Yep, you got it—altcoins will catch up and join the party too.

Where will the capital go? 📍

Remember previous digests, where we outlined catalysts that suggest DeFi is ready to pop?

Let’s refresh our memory:

- First, many protocols like MakerDAO take advantage of high US treasury bill yields and distribute that cash to DeFi.

- Then, this long-standing interest in Ether staking is leading to the creation of a new sector - LSD-Fi.

These key areas showed us that DeFi wasn't just doggy paddling in the bear market. It was doing more than just surviving. So, if the capital flow returns to BTC, it's only logical that some of it will make its way to DeFi sooner or later.

But where in DeFi exactly?

You don't need to dig too deep for this one. Ethereum is where it's at. If you want the scoop on the most important points for Ethereum this week, check out our latest digest.

But wait, there's more! We need to highlight two emerging DeFi scenes: LSDs and LSD-Fi.

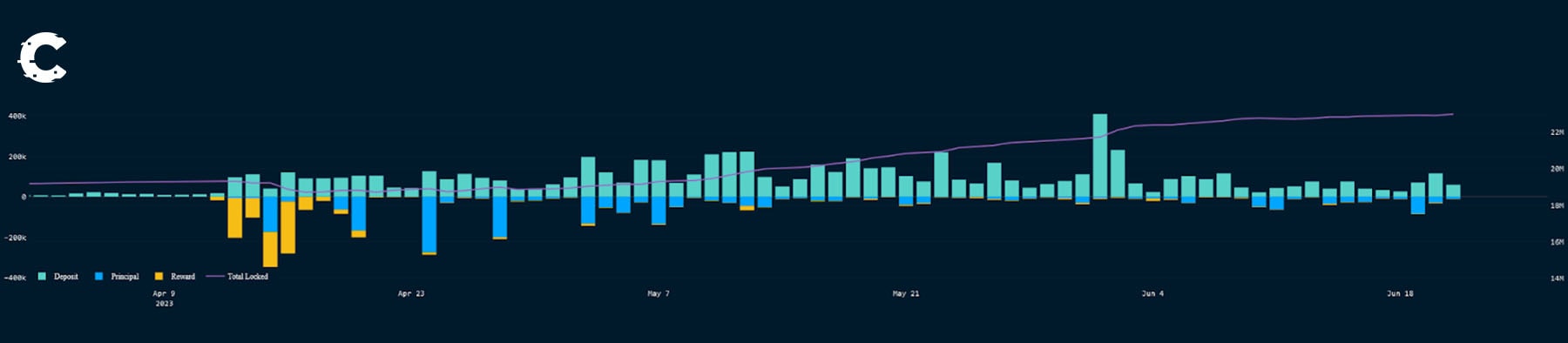

Here's the scoop: ETH staking inflows are looking pretty positive, crossing that impressive 23 million ETH mark. It's like fuel for the engine, generating yield for those who dare to venture in.

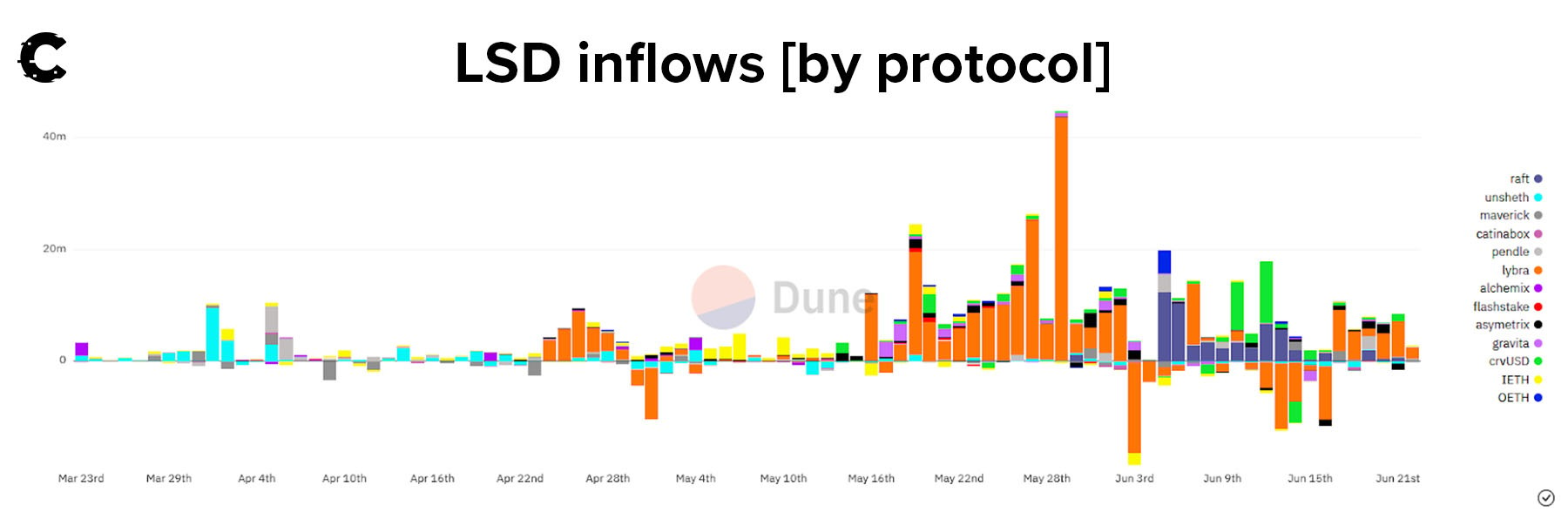

And guess what? Inflows to LSD-Fi protocols are net positive after some outflows last week. It's like the tide has turned in their favour.

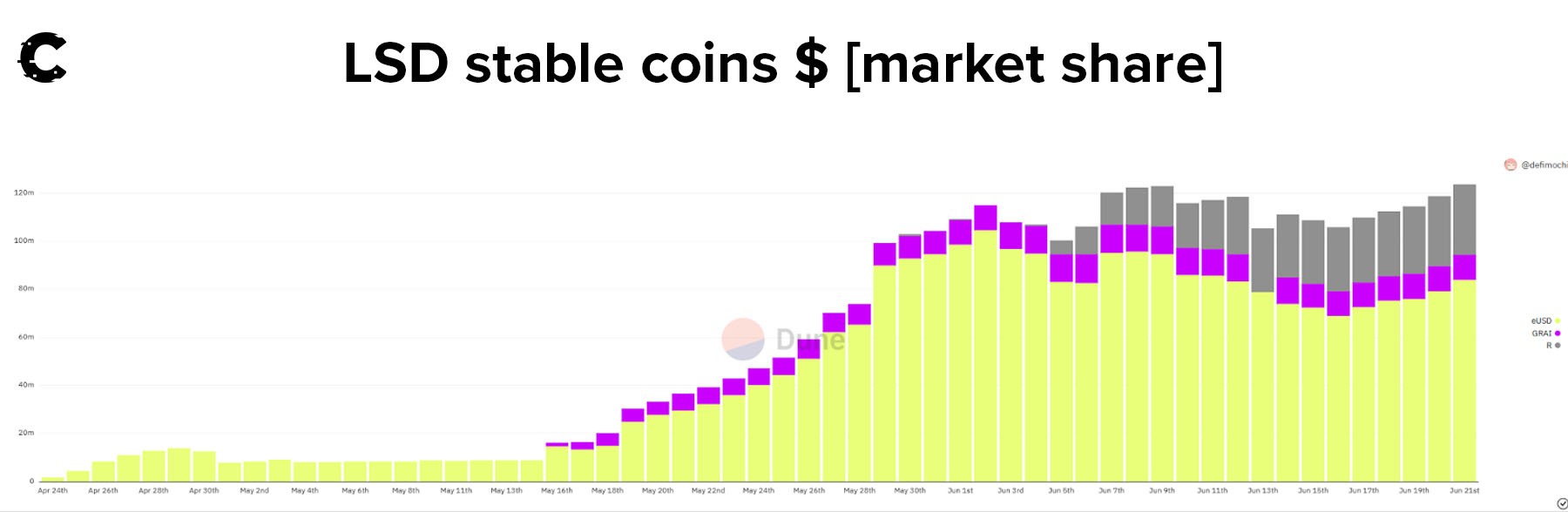

Now, don’t act surprised when we tell you that Lybra is leading the charge here. As the price of ETH rises, so does the capacity to mint eUSD. And guess what? It's happening right before our eyes.

In just six days, traders minted another ~$15 million worth of eUSD on Lybra. That's a whopping 20% increase!

1 ETH = 1 ETH, and Ethereum staking yield is denominated in ETH. A higher USD value of ETH means that, in real terms, more capital is available to DeFi protocols leveraging that yield. This is the DeFi sector that is likely to pop first.

Tokens to watch in this sector include:

- LDO

- RPL

- FXS

- LBR

There is more to say, but that’d be too much alpha for a free digest…

Can we poach some yield from TradFi? 🤑

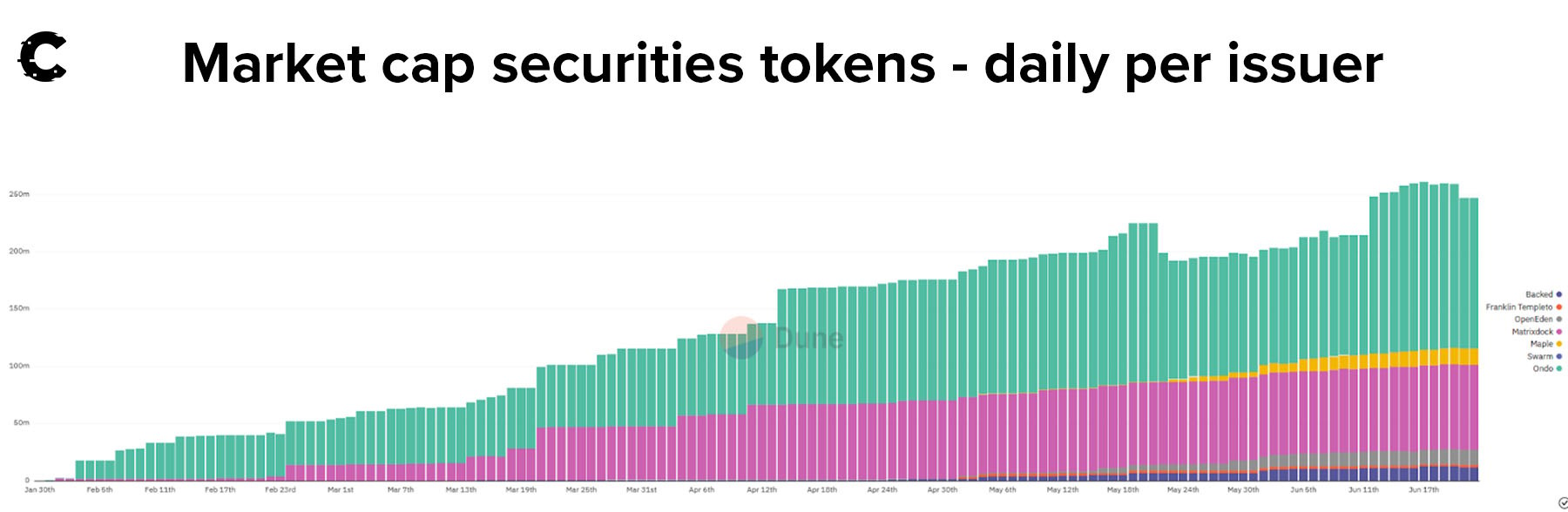

Another sector that's been experiencing some impressive growth is the decentralised securities sector. Last week, it briefly crossed the $250 million Total Value Locked (TVL) mark. Impressive, right? For now, we'll call it DeSec to spice things up a bit.

We've touched on this topic before, but now the pieces are starting to fall into place.

Capital parked in crypto is useless unless it’s doing something. If, as we expect, capital starts flowing from BTC to other areas of the market, DeSec is likely to witness a surge in participation. It's like a party you don't want to miss!

And mark our words, if a Bitcoin ETF gets the green light, you can bet your bottom dollar that it will become available as a DeSec product.

In case you're curious, Maple Finance recently made some waves by launching an update to its T-Bill product. It added Open-Term loans to their arsenal, making capital management through Maple even more efficient.

Now, we won't bore you with all the nitty-gritty details. Let's just say it's a game-changer in terms of capital management.

And in true Cryptonary style, we won’t leave you hanging without a token to keep an eye on. Drumroll, please! MPL is the token to watch in this space.

Cryptonary’s take 🧠

It is still a little too early to call where DeFi goes in any definitive direction, but BTC’s rally has historically shown the capacity to lift all the boats in the water. If BTC sustains the rally and breaks out, it could signal a return to good times for a DeFi breakout.

The flow of capital is usually Fiat > BTC > ETH > Alts, and there’s no reason to believe that will change. This makes ETH the prime candidate for capital inflows after BTC. Let's not forget that Ethereum staking, in its "final form," has only been around since March. That's like the new kid on the block, ready to shine.

We believe that the rise of LSD-Fi will be supercharged by capital flowing towards Ethereum staking.

The key indicator here would be what ETH does in response to BTC. We will be watching capital flows, and you should too.

As always, thanks for reading. 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms