So, what’s happening this week?

A minor banking crisis hit traditional finance. Circle was an unfortunate victim, and its $USDC briefly de-pegged. $USDC restored its $1 peg, and the market made a full recovery - all in the space of a weekend!

As a result, decentralised stablecoins have an even stronger bull case now.

And, as we approach Ethereum’s Shanghai upgrade (set for April), liquid staking (LS) protocols have been scrambling to increase the attractiveness of their projects.

Let’s dive in…

TLDR

- $3.3B of reserves backing the $USDC stablecoin were locked after Silicon Valley Bank (SVB) collapsed.

- USDC briefly de-pegged and fears of a total loss of the peg spread.

- The $USDC de-peg situation highlights the importance of decentralised stablecoins.

- Despite the crisis, platforms like Curve and Uniswap saw record-breaking volumes.

- RocketPool has been lowering the barrier for entry to Ethereum staking to attract both existing and prospective stakers. From 32 $ETH down to 8 $ETH, this represents a huge decrease.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

DeFi Overview

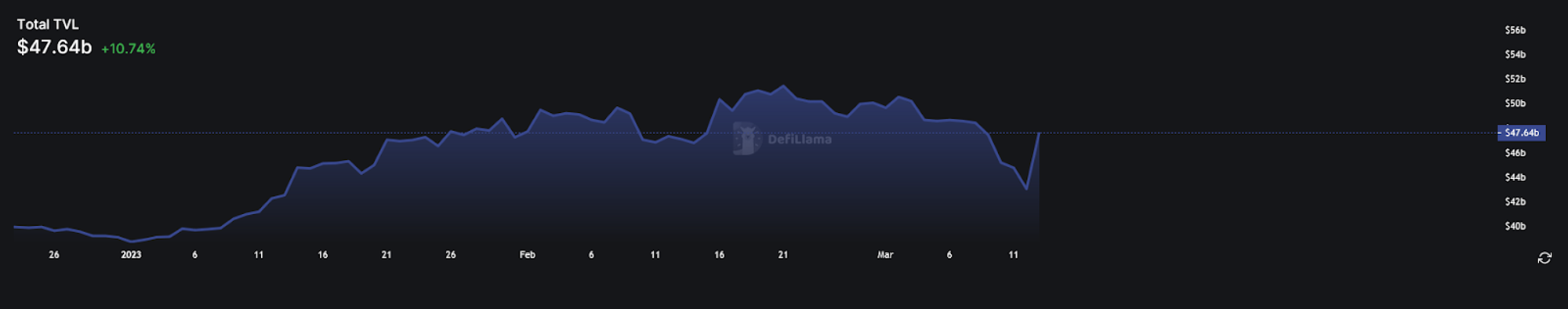

This week, the total DeFi TVL (Total Value Locked) expanded from $42Bto $47.6B- a more than 10% increase.

As the market recovers from the Circle/$USDC scare, and a minor banking crisis, DeFi has proven resilient.

Let’s dive into the news!

Key Developments

- $ETH labelled a security in KuCoin lawsuit. According to New York's Attorney General Letitia James, investment in Ethereum is similar to participating in a common enterprise with the expectation of profit from the efforts of others – so by definition, according to her, it’s a security as opposed to a commodity. However, simply saying this does not turn $ETH into a security. $ETH’s classification can only be definitively resolved through a court decision.

- Uniswap and Curve hit all-time high trading volumes as traders flocked to stablecoin swaps. Traders exchanged USD Coin ($USDC) following its de-peg from the U.S. dollar after the SVB collapse. Curve recorded over $7B in trading volume while Uniswap processed almost $12B in 24 hours.

- Euler Finance lost $190M in DeFi lending exploit. Smart contract auditor BlockSec reported that the exploit resulted in losses from four transactions in Dai ($DAI), Wrapped Bitcoin ($WBTC), Staked Ether (sETH), and $USDC.

- Synthetix V3 “complete overhaul” details released. With V3, Synthetix will become a plug-and-play liquidity layer. Any derivative project can build on it, and instantly access deep liquidity. The need for token emissions to bootstrap initial liquidity has been removed. If successful, this will be a massive step forward for both Synthetix and the DeFi ecosystem as a whole.

Hot Narratives

Banking Meltdown Hits DeFi

First, here’s some background, in case you live under a rock…Over the last few days, the second-largest bank collapse in US history occurred.

Silicon Valley Bank (SVB), the eighteenth largest bank in the US by asset size (with $212B on its balance sheet), melted down following a run on the bank (when a large number of people withdraw their money at the same time).

Without going into too much detail (this is a DeFi digest, after all), SVB had assets to cover its liabilities. The issue is that those assets couldn’t be sold instantly without suffering losses. They are what is known as ‘hold to maturity assets, and with interest rates so high, the value on the open market (if they need to be sold before maturity) is lower.

The bank run made SVB insolvent. The Federal Deposit Insurance Corporation (FDIC) stepped in, freezing the bank’s assets.

$USDC reserves stuck

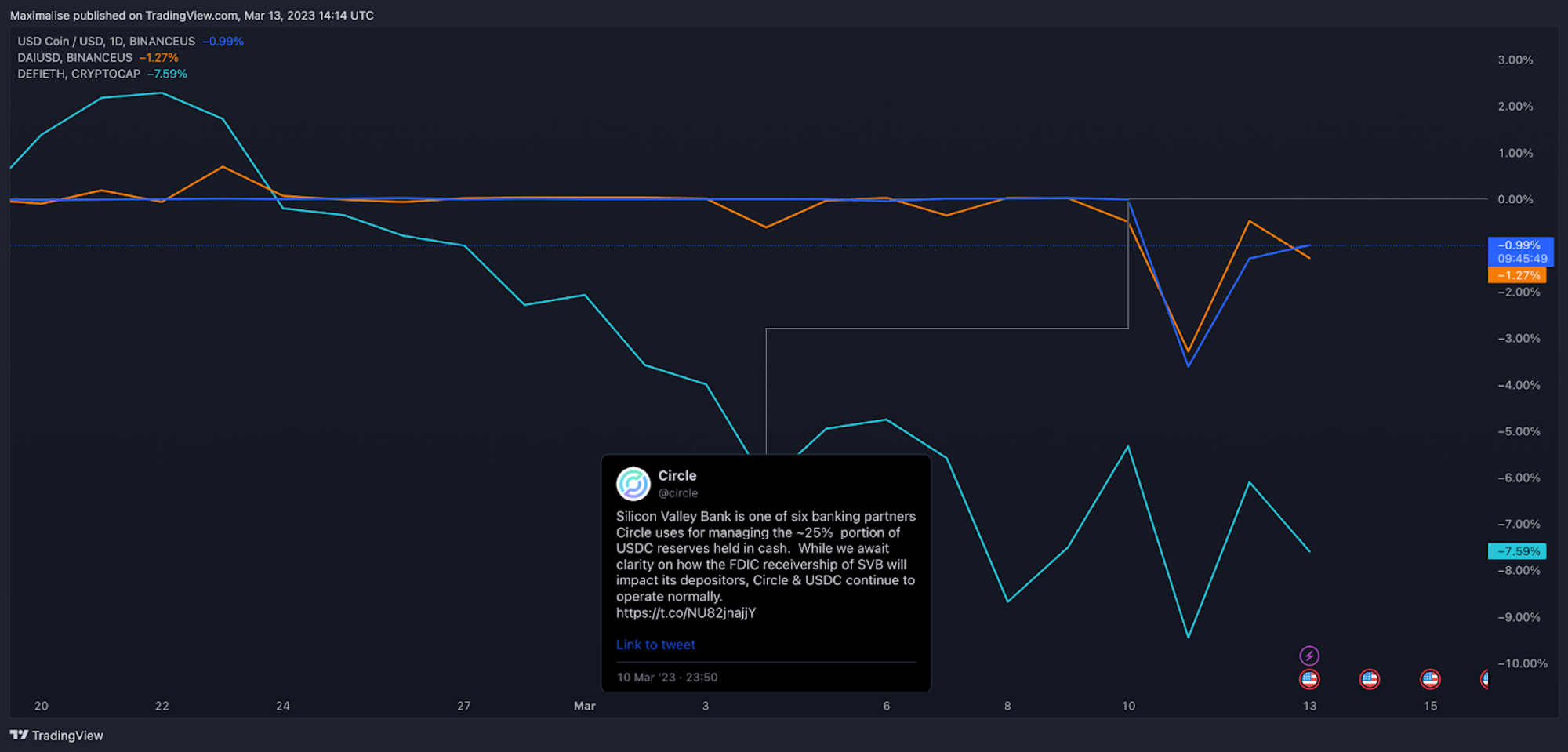

$USDC, a systemically (meaning it is a key pillar, and its failure would be catastrophic) important stablecoin, had $3.3B tied up in SVB.The effects of this are clear to see, on USDC and DAI, who had a large number of reserves in USDC (blue and orange in the chart below), and the total DeFi market cap (light blue).

Impacts on DeFi

DeFi relies heavily on $USDC. It’s insane when you think about it - DeFi is extremely dependent on a centralised stablecoin! But here we are.When $USDC de-pegged, hitting lows of $0.88 on the major trading platforms, the impact was seen throughout DeFi.

GMX saw “protocol spreads” activated. One result of this was short profits being paid out assuming 1 $USDC = $1. There are wider impacts as well, on the $GLP liquidity token (which can only be redeemed at the reduced $USDC price, no matter what asset was deposited), as well as on trading.

dYdX denominates everything in $USDC, meaning all positions, deposits, insurance funds, and other assets are vulnerable to devaluing in the event of a $USDC de-peg.

MakerDAO holds around 50% of collateral for their $DAI stablecoin in $USDC, resulting in a similar de-peg for $DAI (which is often considered a safe, decentralised stablecoin…).

The situation is similar for Frax, which is largely backed by $USDC.

And many, many more supposedly decentralised protocols rely mostly or entirely on $USDC.

Had Circle been unable to cover assets, and the Federal Reserve not guaranteed SVB deposits, deposits into a huge portion of DeFi protocols would have suffered losses - simply by backing the wrong stablecoin.

This situation shows DeFi’s immaturity. We clearly need less reliance on CeFi to operate successfully.

But guess what? If you get involved when all the problems have been solved, you’re too late.

There’s also one big positive from all this - Binance is buying $BTC and $ETH. Lots of $BTC and $ETH…

This is due to the fact they hold almost $1bn in BUSD, which is being removed from circulation after regulatory action. With issues surrounding other stablecoins, it was a necessary move for Binance.

The good part? It will cause some serious buying pressure on the market.

Decentralised stablecoins

In our previous DeFi Digest, we explored the growing narrative around decentralised stablecoins.$USDC’s de-peg has brought renewed attention to the segment.

TrueUSD

TrueUSD has emerged as the clear winner of this saga. Since we wrote about $TUSD last week, its market cap has climbed by 76% to $2B, solidly retaining its #5 spot and outperforming other stablecoins with similar market caps.

Despite gaining market share, however, it was not unscathed. Techteryx, which issues TrueUSD ($TRUSD), announced Monday morning that minting and redemption was suspended for its users with Signature Bank but would continue undisturbed across the rest of its banking network.

It will be interesting to see if $TRUSD can maintain its position as a top stablecoin, and how its exposure to Signature Bank will affect its reputation.

Liquitity protocol

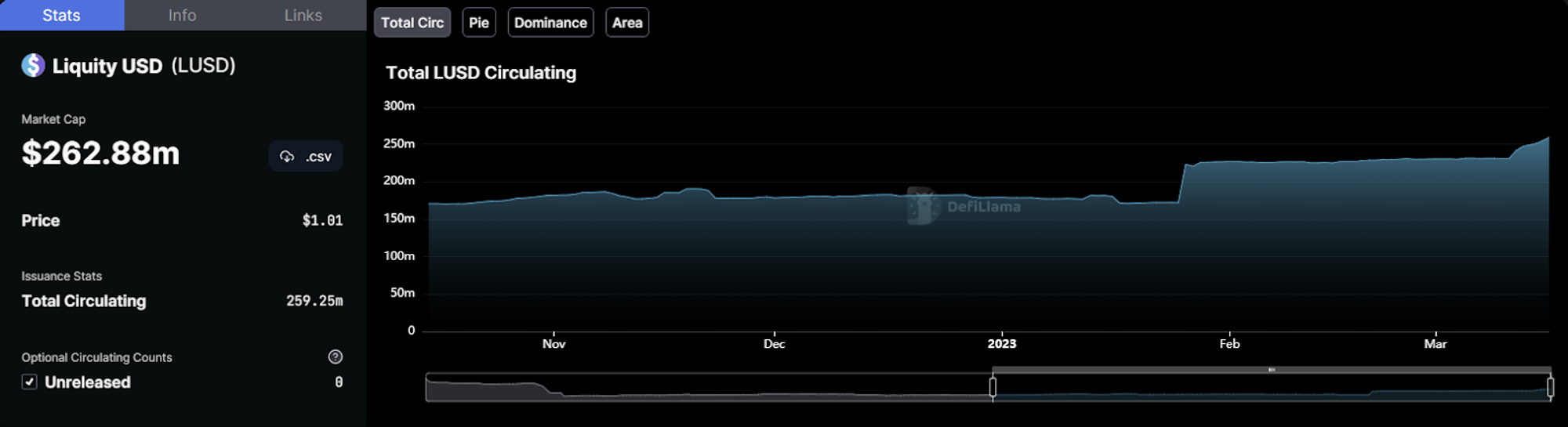

Last week, we covered Liquitity Protocol's $LUSD, which has emerged as one of the most decentralised stablecoins on the market. Unlike $TRUSD, which has faced issues with banking relationships due to its off-chain collateral, $LUSD's entire collateral is on-chain, making it more reliable and secure.

Recent uncertainty surrounding centralised stablecoins has led to increased interest in decentralised alternatives like $LUSD. Even stablecoins that were backed by $USDC, such as $DAI and $FRAX, have faced scrutiny and volatility. As a result of this flight to safety, $LUSD has experienced a significant increase in market share, growing by an impressive 13%.

Since our coverage of the project, the price of $LQTY, Liqutity Protocol's utility token, has risen by 38%.

Projects to keep an eye on

There are a number of other interesting projects that have either already launched, or are currently developing, an alternative stablecoin.

- Vesta Finance: A stablecoin, denominated as $VST, that’s created on the Arbitrum network. It requires users to deposit supported cryptocurrencies as collateral to mint and borrow against them.

- Yama Finance: A platform that allows users to earn interest on stablecoins and offers up to 100x leverage on investments in yield-bearing assets.

- Curve Finance: While Curve does not offer native stablecoins yet, its upcoming curve USD (crvUSD) token is much anticipated.

- Reflexer Finance: A platform where investors can use their crypto collateral to mint $RAI, a non-pegged stablecoin backed by $ETH.

Liquid Staking

With the delay of Ethereum’s Shanghai upgrade, LS protocols have continued to accrue $ETH. With ETH withdrawals enabled, there will be a fundamental change in the LS market. LS protocol TVL has risen consistently for months and appears to be accelerating as we get closer to $ETH withdrawals.

RocketPool ($RPL) - lowering barriers

The RocketPool Atlas upgrade will ensure the protocol’s compatibility with the Ethereum Shanghai upgrade:

- Withdrawals - users can withdraw their staked $ETH from RocketPool (once Shanghai has enabled withdrawals).

- Solo Staker Migration - a method for individual node operators/validators to migrate to RocketPool, without validators having to stop validating.

- Minipools - this is the key upgrade that will significantly reduce the barrier for entry to Ethereum staking, from 32 $ETH to 8 $ETH.

Minipools LEB8’s

By far the most important Atlas update, mini pools reduce the lower $ETH barrier (LEB) for staking to 8 $ETH. This is huge - a 75% reduction. It’s expected that the staking capacity for RocketPool will expand 3X. Additionally, current node operators can split their $ETH and run more nodes. More nodes mean a higher chance for yield.RocketPool follows the trend of LS protocols improving its design ahead of Shanghai. Once $ETH can be unstaked, competition will be fierce. By implementing upgrades like this, LS protocols hope to attract as much $ETH to their platforms as possible.

$RPL performed well this week, in line with other LS protocol tokens.

Crypto Investment Corner

Framework funds Prover (a proof-of-solvency start up), in a $15.8M round.

The protocol will offer zero-knowledge proof of solvency solutions. These allow protocols or exchanges to show they’re solvent, taking into account both assets and liabilities, without making any of the data public.Coinbase venture backs Mauve, a DEX (decentralised exchange) whose main focus is regulatory compliance, in a $15M round.

With the gap between DeFi and CeFi slowly being bridged through Coinbase’s base layer 2 and regulation, this type of protocol is one we’re likely to see more of in the future.Gyroscope raises $4.5M in seed funding

Crypto startup Gyroscope has raised $4.5M in a seed funding round to build a new stablecoin called gyro dollar ($GYD). It will have a novel all-weather reserve design, aiming to solve the issues surrounding current stablecoins.To maintain its price stability, the stablecoin uses a mechanism known as a "yield reserve," which dynamically adjusts its supply based on demand while also earning yield on its underlying assets, whereas other stablecoins typically rely on fiat currency reserves or collateralized assets.

Placeholder VC and Galaxy Ventures co-led the round, with Maven 11, Archetype, Robot Ventures, Balancer Labs co-founder and CEO Fernando Martinelli and others participating,

Other News

- Kwenta launched options markets using Lyra as the back-end. This pilot program could see Lyra become the back-end (tech stack) for other protocols, massively increasing their addressable market (and revenues).

- Trader Joe is live on BNB (Trade Joe is an exchange, similar to Uniswap, that originally started on Avalanche).

- DeFi Llama launched a browser extension designed to enhance Etherscan (and other blockchain explorers) and protect from scams. Get it here.

- Gitcoin launched a staked $ETH index allowing users to easily diversify staked $ETH holdings.

- Frax Finance published an update on the $USDC situation.

- Privacy-focused blockchain network Aztec closes Aztec Connect tool.

Cryptonary’s take

It was another interesting week in DeFi. There may be more after-effects from the banking crisis, but for now, the situation appears stable. The huge overreaction by the market to the $USDC de-peg shows the fear the market has when it comes to stablecoins (thank you, Terra!) Yet, as the recovery has shown, Circle is not Terra, and $USDC is not $UST.As the SVB situation develops, stay tuned for next week’s update!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms