Vitalik on ETH staking & MetaMask's tax controversy

What's causing a stir? There's now a code that can extract a seed phrase from a Ledger. And the kicker? Companies responsible for restoring seed phrase backups could potentially be forced to reveal this data to governments. Want to know more? Take a deep dive into our detailed analysis here.

TLDR 📃

- Ledger is feeling the heat for a new method that extracts seed phrases.

- MetaMask gets slammed for a controversial clause in their Terms, suggesting they can withhold taxes.

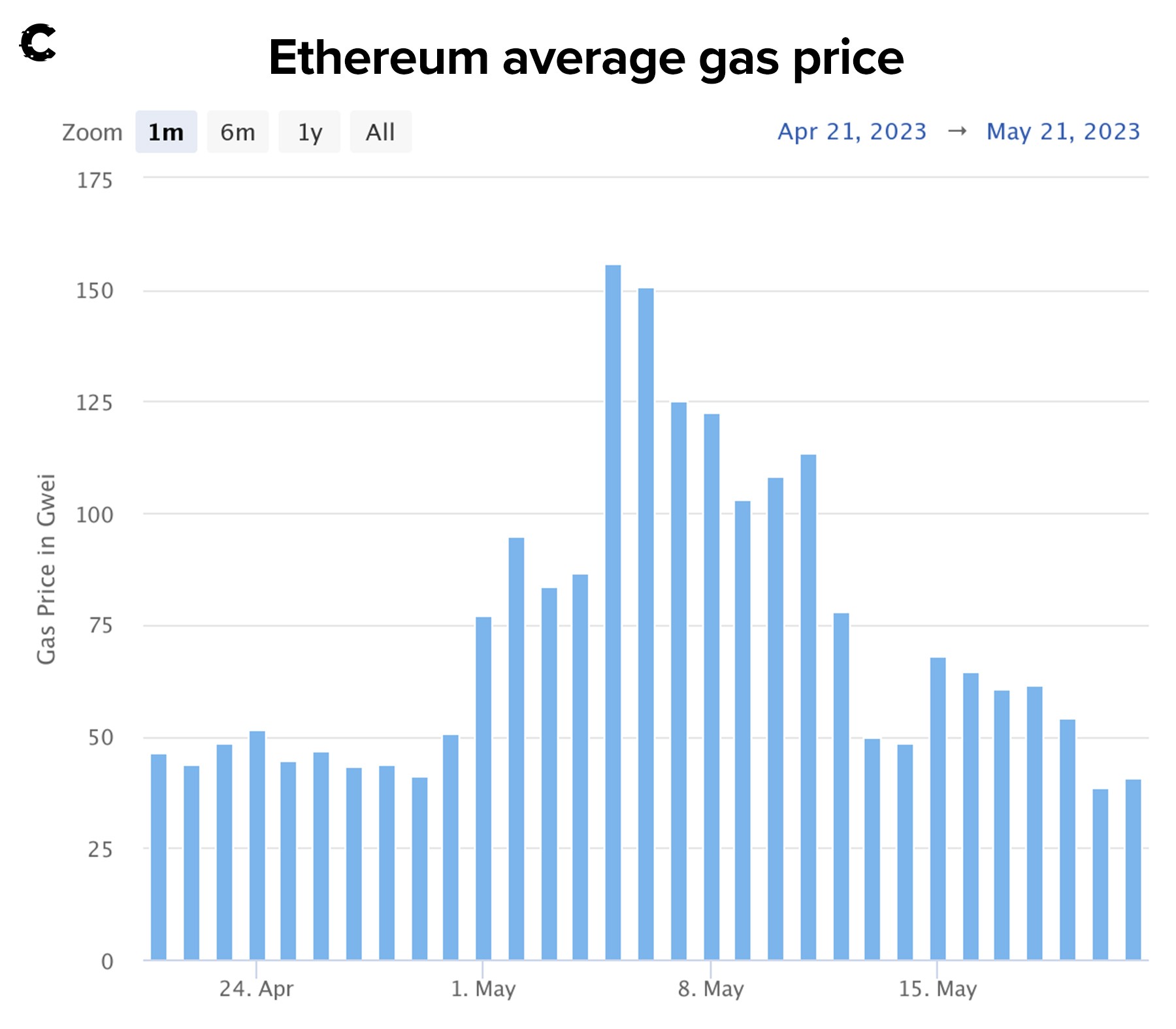

- Breathe easy! Gas prices are back to a comfortable 40 gwei average.

- Gear up, Ethereum developers are getting ready for the Danksharding upgrade set for later this year.

- Vitalik drops wisdom on the potential risks of staking ETH twice.

- Check this out - there are now 0(!!) validators in line to unstake their ETH.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make is your full responsibility.

Ledger Recover’s fiery reception 💣

There's quite a buzz in the crypto sphere this week. Ledger has launched a program that could aid users in recovering their seed phrase, but only if they choose to opt in.MetaMask can withhold taxes?! 👀

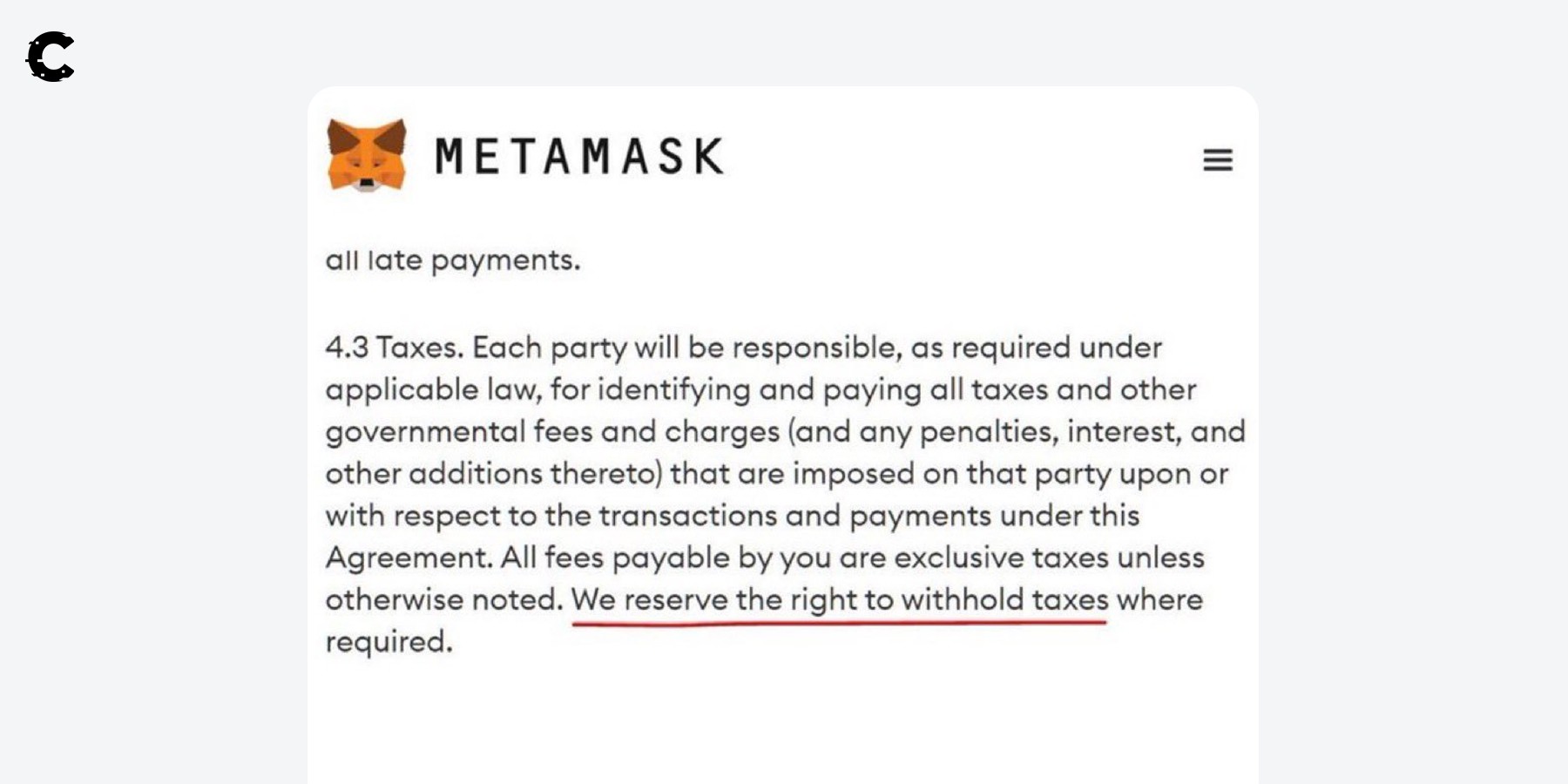

The crypto storm continues as MetaMask updates their Terms of Service, hinting at potential tax withholding on transactions. Given the recent Ledger fiasco, it didn't take long for crypto enthusiasts to turn their ire towards MetaMask.

But before the pitchforks are fully raised, let's clear up a misunderstanding. The taxes MetaMask might withhold are strictly for payments made to them for using their services. So breathe easy! They can't touch taxes on your everyday transactions or DeFi trades. We'll save the pitchforks for a real fight, promise.

Two-week memecoin season ends ✌️

As tensions simmer in the wallet provider world, we finally witness a cool-down in gas fees. The aftermath of the recent memecoin mania has led us back to more agreeable rates.This frenzy hit a fever pitch with ben.eth's launch of PSYOP, a rug pull from get-go. The scheme? A pool set up by ben.eth with an inflated token price, and tokens distributed to presale participants based on this high rate. As expected, the value crashed spectacularly the moment trading began, with PSYOP tumbling 58% within a single day.

Despite the tumult, coins and tokens are still the lifeblood of liquidity, with Uniswap contracts guzzling the lion's share of gas at the now standard 40 gwei average.

Fun fact: Did you know? Uniswap stands tall as the largest DEX out there, a staggering four times bigger than the next four DEXes combined! Keep up with DEX market share here.

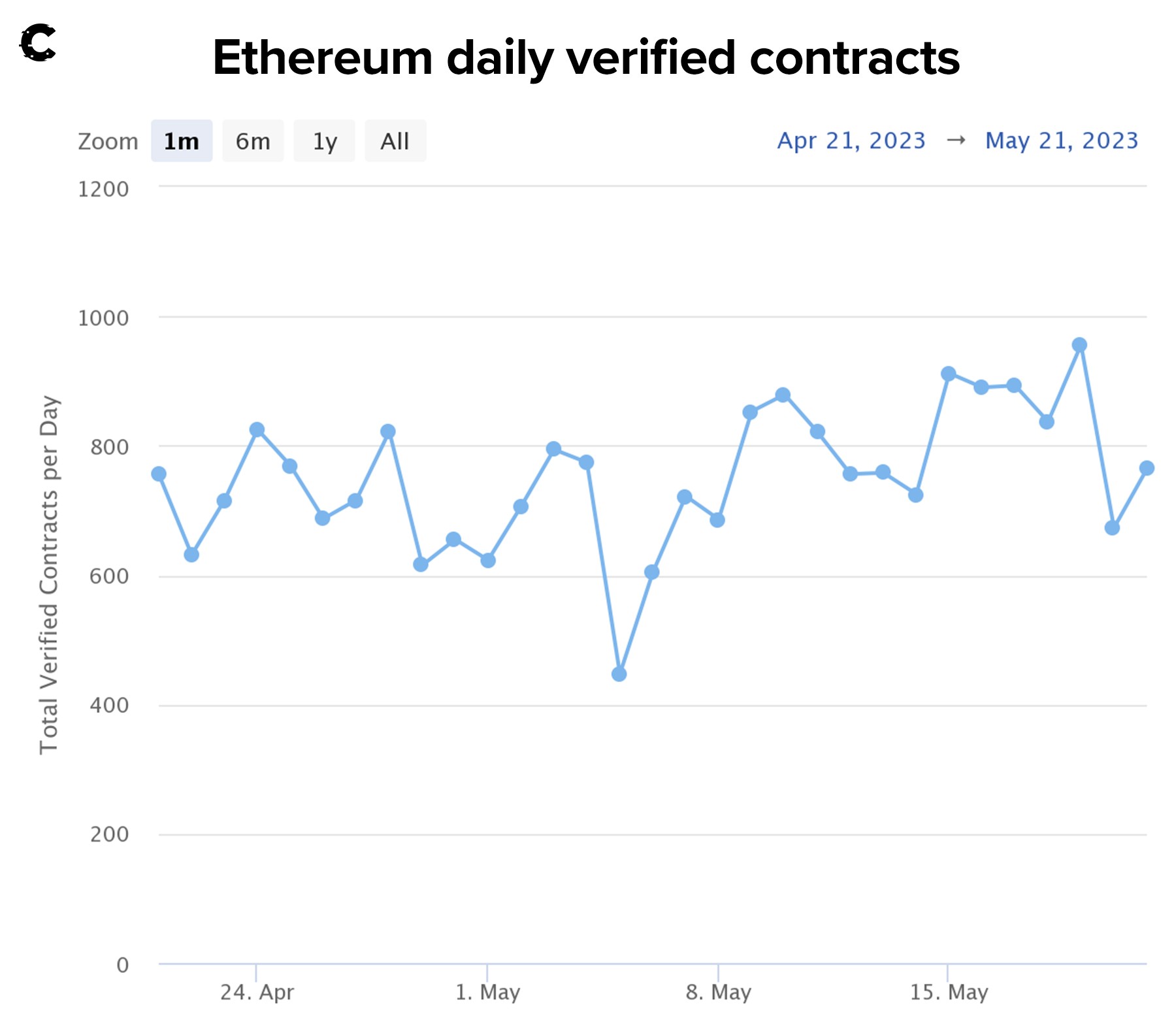

In line with gas activity, Ethereum contracts took a slight dip, hitting a recent low before inching upwards. This is likely due to paused projects resuming their operations.

Danksharding comes closer

High gas fees on Ethereum recently sparked a similar hike on Layer 2s, with trades on Uniswap averaging well over $1 - a bit counterintuitive, isn't it?Layer 2s, after all, are competing for the same block space as regular transactions. But don't despair, there's an upgrade in the pipeline that could help distinguish between the gas fees paid by individuals and Layer 2s. It's called Dankshardingand it's the next big thing our Ethereum developers are brewing.

During the latest All Core Devs call, Ethereum developers unveiled plans to ready up for the debut of Danksharding in the upcoming Cancun upgrade this year. Layer 2s will be saved once again!

On another positive note, Ethereum developers have reached a consensus to implement a new method aimed at simplifying the analysis of staking activity. A win for not just stakers and analytics tools, but also for a burgeoning group of individuals called the "re-stakers".

Staking ETH.. twice??

Staking ETH has meant locking it up, until now. This was the big downside to staking, and so protocols have launched to make it possible to use ETH even if it is staked.A new protocol named Eigenlayer allows staked ETH to be simultaneously staked on other networks too. This gives stakers another avenue to generate yield, but also has some potential risks that Vitalik spoke about in a blog post.

Restaking will mean new opportunities for penalties if people on the service misbehave. Vitalik argued that no matter how severe the penalties are, forking the Ethereum blockchain to fix problems should not be an option.

In essence, Vitalik doesn’t want Ethereum to bail out restaking services if they mess up.

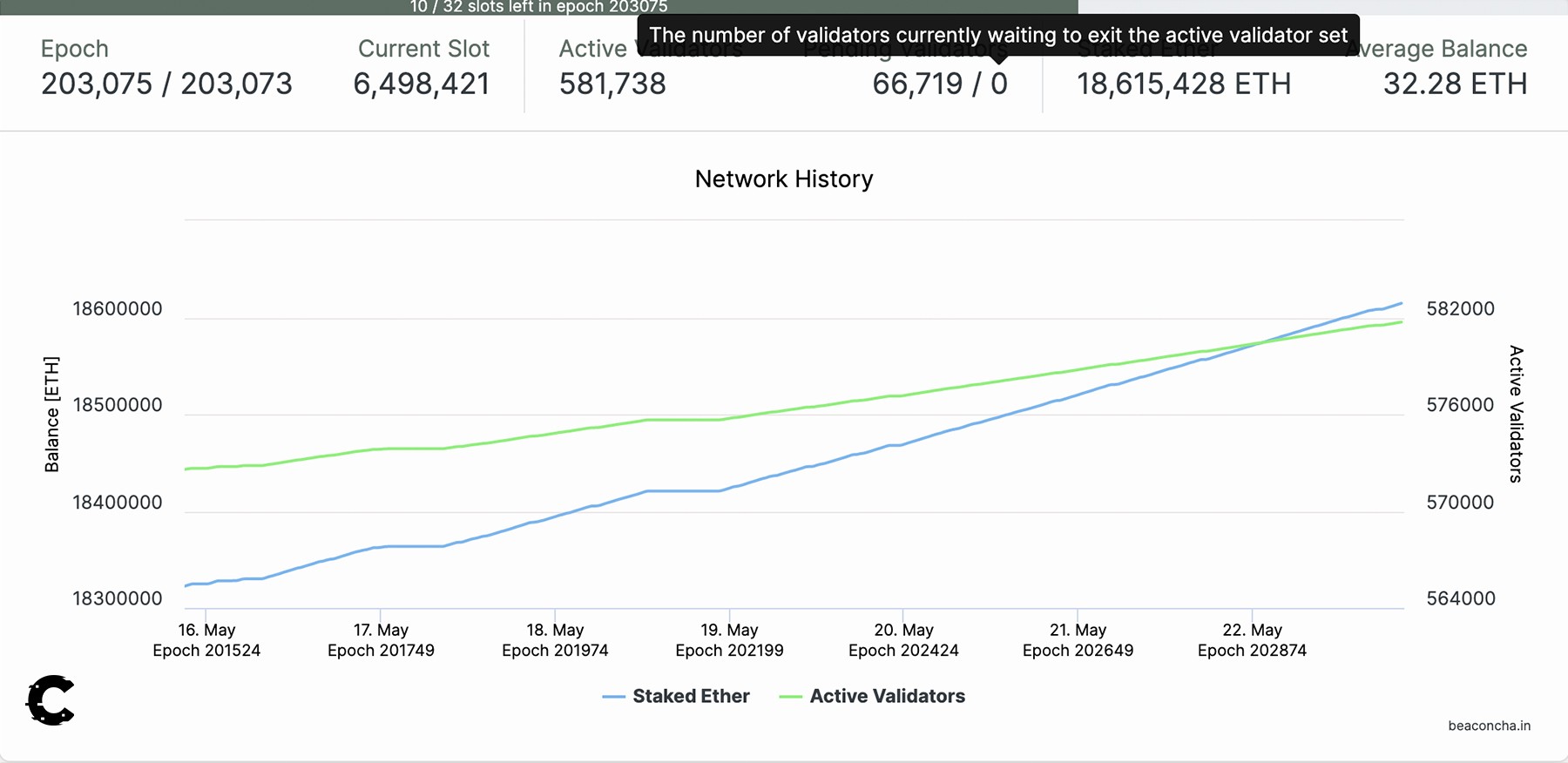

Unstaking queue vanishes 😶🌫️

Staking on Ethereum continues to explode in popularity. The queue is so long that it takes 37 days to become a validator now. On the other hand, unstaking happens instantly since there are 0 validators looking to unstake. Diamond hands if we’ve ever seen them 💎🙌🏽Validators are holding on to their rewards instead of selling them. Stakers are growing beyond the 32 ETH minimum, resulting in enough extra ETH to spin up new validators. This has caused the amount of ETH staked to exceed the number of validators for the first time ever!

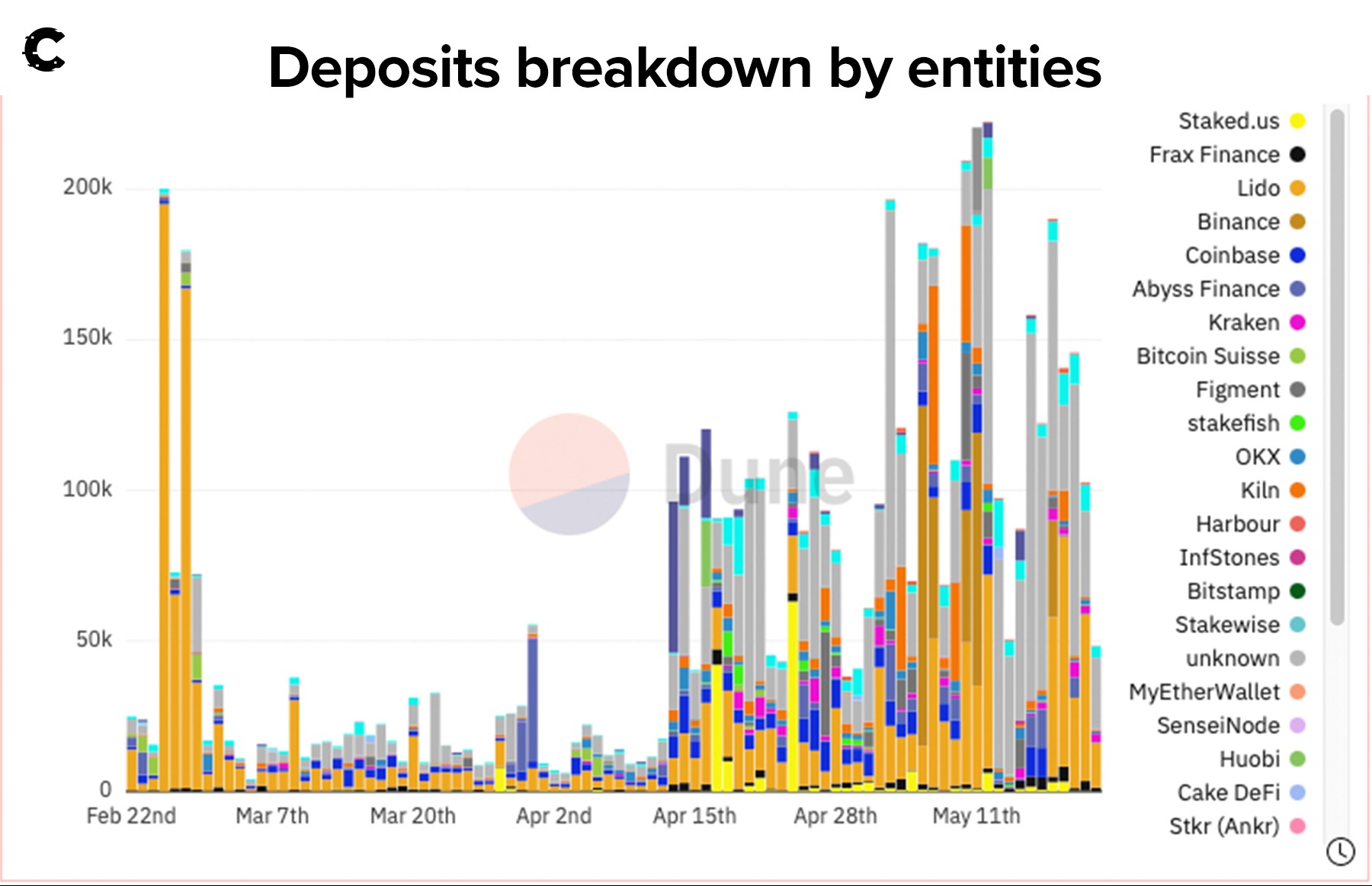

Liquid staking solutions are still the market favorite with Lido capturing the most new market share. Lido enabled unstaking on May 15th and has actually seen a net inflow since, a total of almost 230,000 ETH ($425M+).

ETH price analysis 📈

As gas fees cooled, volume was mostly low while ETH held stable, forming a tighter channel of peaks and valleys. The quiet price action likely indicates a strong movement in either direction coming soon. Which direction? Let’s dive into the charts.

ETH is testing again the $1,850 “key level to watch” that we’ve had marked for weeks. If it is able to close up a daily candle inside it - amazing, bulls will have a chance. Though, they’d have to breakout above $2,000 to complete their mission.

On the other hand, the more likely route is that ETH rejects $1,850 and falls back down - leading it to continue its downside trajectory to $1,400.

Ethereum ecosystem 🌐

DeFi (Decentralised Finance)

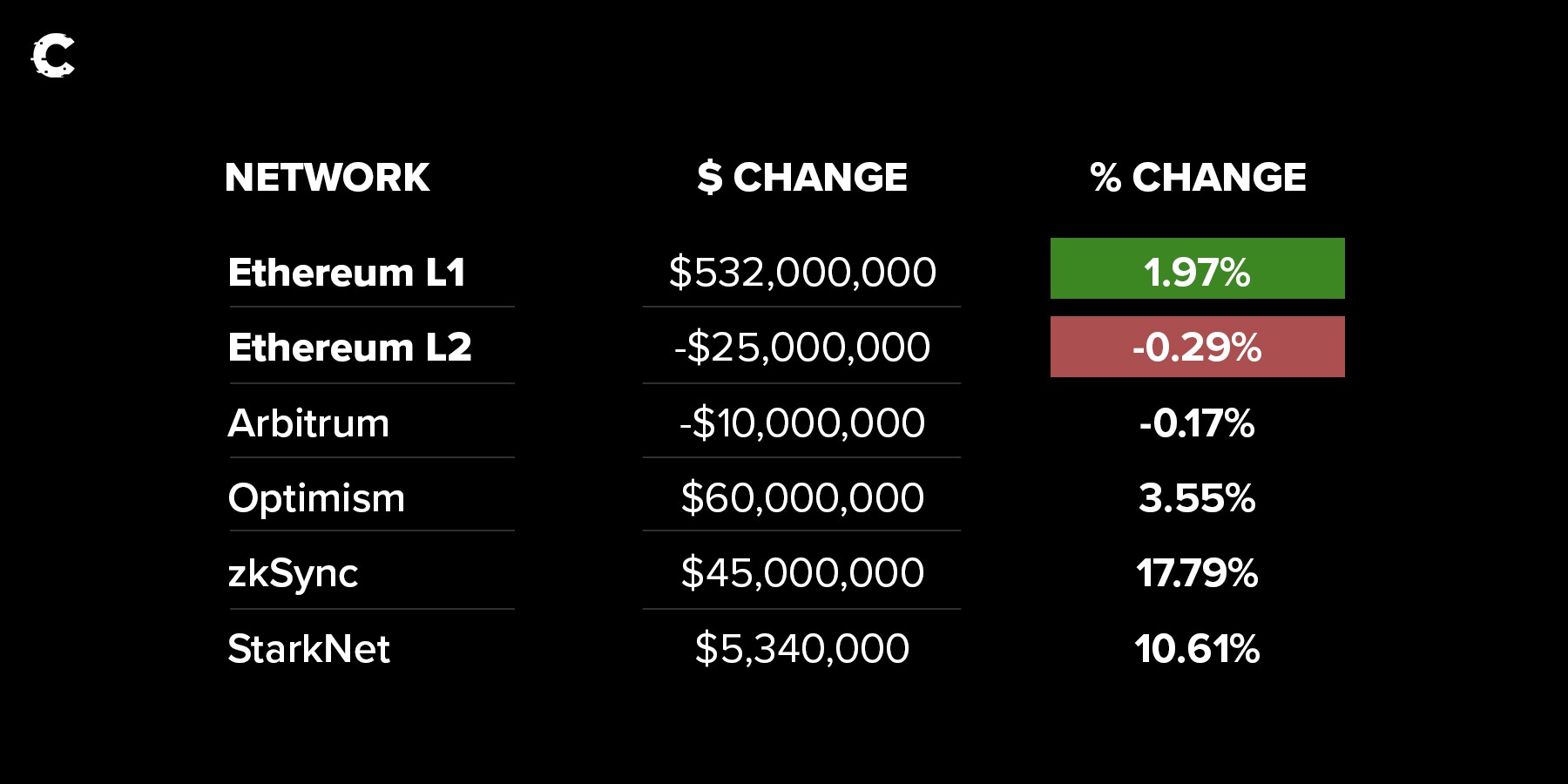

The DeFi landscape remains relatively quite but one L2 in particular stands out with the most amount of capital added in the last week: Optimism. We actually think some details deserve your attention, read this.

Layer 2’s

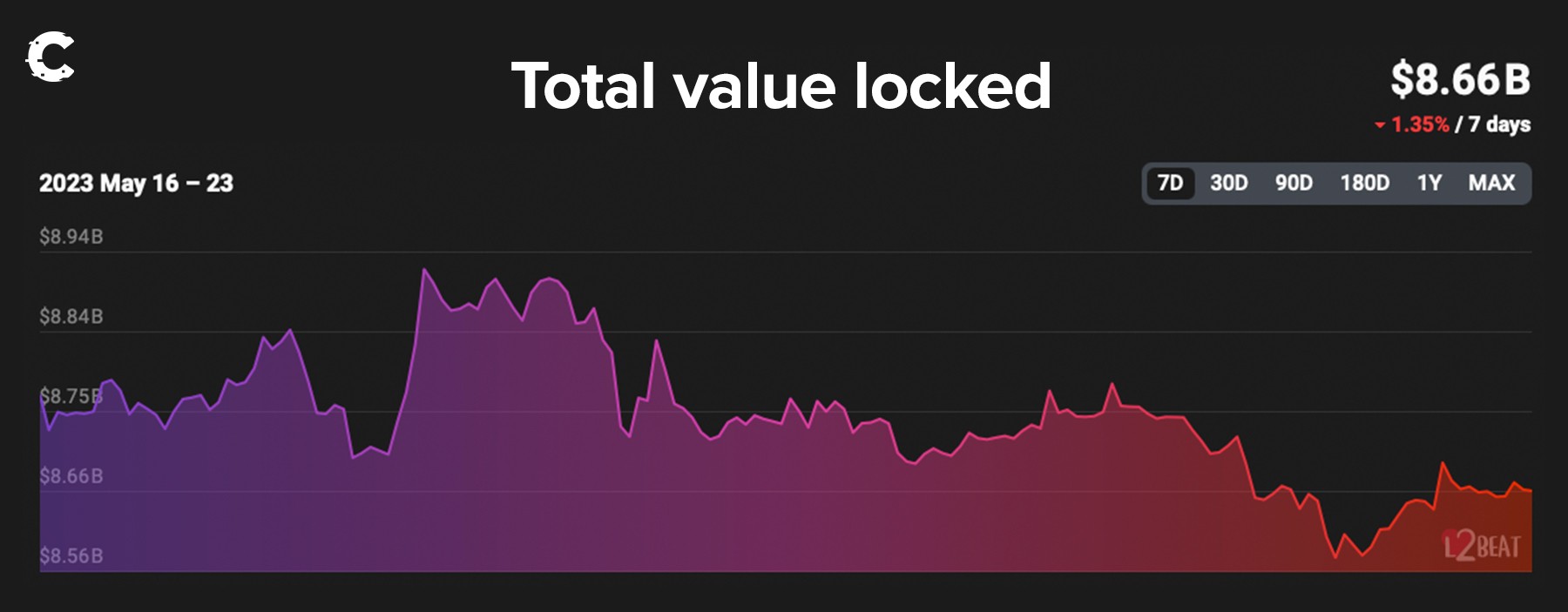

If there was any doubt that Layer 2’s are more popular when Ethereum is busy, this week is proof enough that is true. Layer 2 TVL increased right alongside gas fees on Ethereum, coming back down as gas has settled.

NFTs

You can always count on NFTs to be volatile. Blue chip NFT prices have been falling, and attention shifted instead to older but still memorable projects. Jack Butcher’s work was back in the spotlight, with Opepen Edition seeing a quick 4x and Chromie Squiggles back above 11 ETH. Mutant Apes are back below 10 ETH.Dive deeper into NFTs with our analysis here.

Cryptonary’s take 🧠

Despite the slowdown in market activity, Ethereum is still seeing growth in major metrics: staked ETH, contract deployment, and not gas fees (luckily). All while development, DeFi, and degens continue doing what we all do best: filling up block space.The calmer gas market should make it enjoyable again to explore the ecosystem, for all of us. We encourage you to take the opportunity and refer to these guides along the way and to experiment some more on Ethereum to get accustomed with the “Future of Finance”.

As always, thank you for reading 🙏🏼

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms