If you’re up to date, you’ve probably read our recent report covering Arbitrum’s biggest opportunities. Arbitrum is a new Layer 2 protocol that’s taken the crypto world by storm.

For those who enjoyed the first report, we have a surprise for you: part 2!

Except this time, we’ve found three projects that are still in their early stages. Some don’t even have tokens yet!

Let's check out these three assets, find out what they are, and how you can invest!

TLDR

- Tapioca DAO is a platform built using LayerZero technology (which allows messages to be passed between multiple blockchains). Tapioca is an eagerly anticipated project that aims to allow users to borrow and lend across more than 12 different blockchains.

- We are monitoring the Tapioca IDO (initial decentralized exchange offering). Expectation for launch is March 2023, but no precise date has yet been set.

- Factor DAO is a decentralised asset management protocol that helps users create unique portfolios and indices using a range of yield-bearing assets, tokenised baskets, and derivatives.

- We’re not participating in Factor DAO’s IDO. Instead, we’ll be waiting for the product to launch before deciding to invest.

- Lexer Markets is a decentralised perpetual and spot exchange. It offers a hybrid liquidity mechanism to enable trading on a vast range of markets, including crypto, forex (foreign exchange), NFT derivatives, commodities, and equity indices.

- We’ll be waiting for Lexer Market’s full tokenomics and details of the IDO before we decide whether to invest.

Tapioca DAO

Tapioca DAO is a borrowing platform built using LayerZero technology. It aims to enable borrowing and lending across 12+ blockchains, including Arbitrum (its main network), Ethereum, Binance Smart Chain, Optimism, Polygon, Fantom, ZKSync, Cosmos and Avalanche.Tapioca’s main products will include:

Singularity: makes it easier for users to borrow and lend money across different blockchain networks. Unlike other DeFi money markets, the lending market is isolated. This means the funds are separated so riskier assets can be used as collateral, helping to reduce risk and increase the amount of money available.

Yield Box: allows users to deposit tokens and generate yield. It uses different strategies to manage risk and automate the rebalancing of funds across multiple chains. Initially, only low-risk strategies will be offered, but Tapioca plans to offer medium and high-risk ones in the future.

Big Bang Markets (usd0): enables users to mint a stablecoin called usd0. This is accepted as collateral on the platform for borrowing and lending across different networks. There’s no borrowing cap, but a debt ceiling function can be enabled to manage risk.

These are all great features, but what about Tapioca’s tokenomics?

Tokenomics

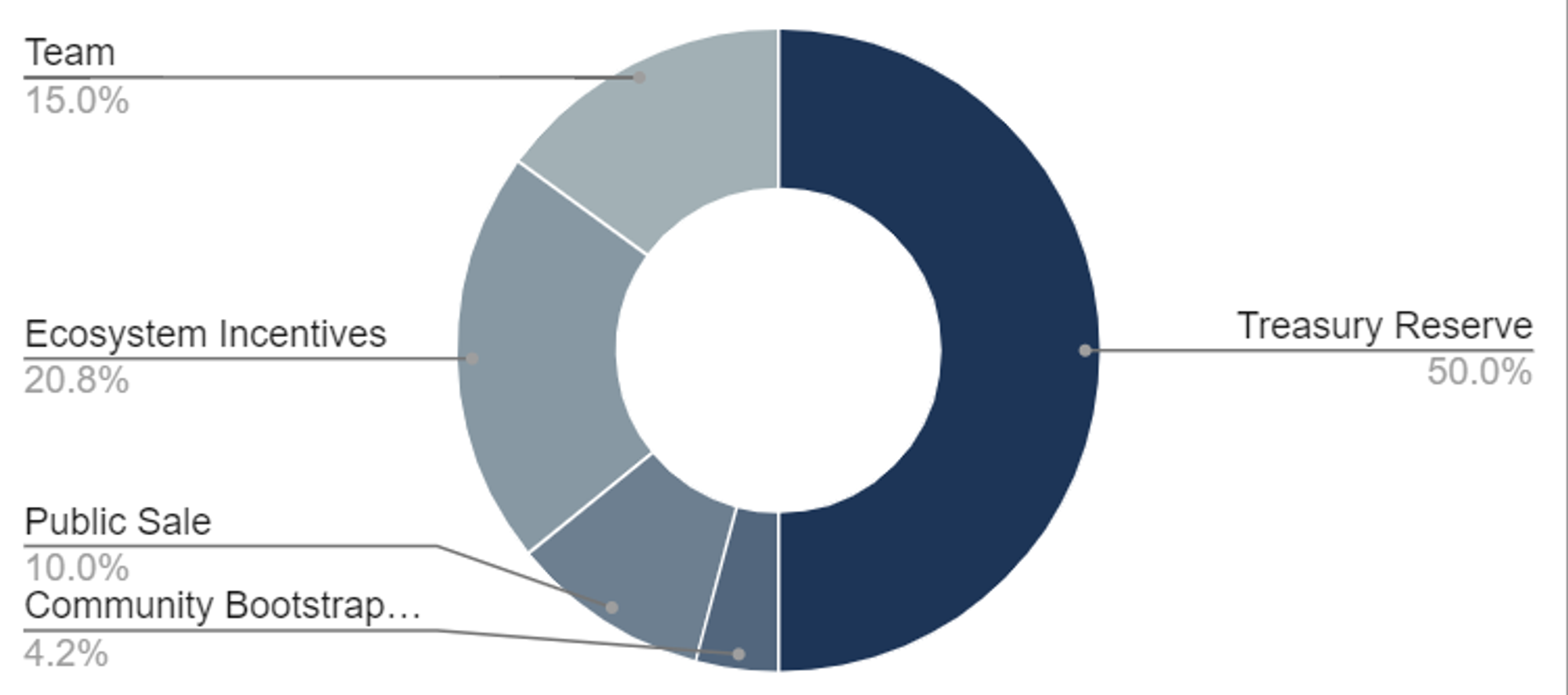

$TAP is Tapioca’s governance token. It has a maximum supply of 100M.

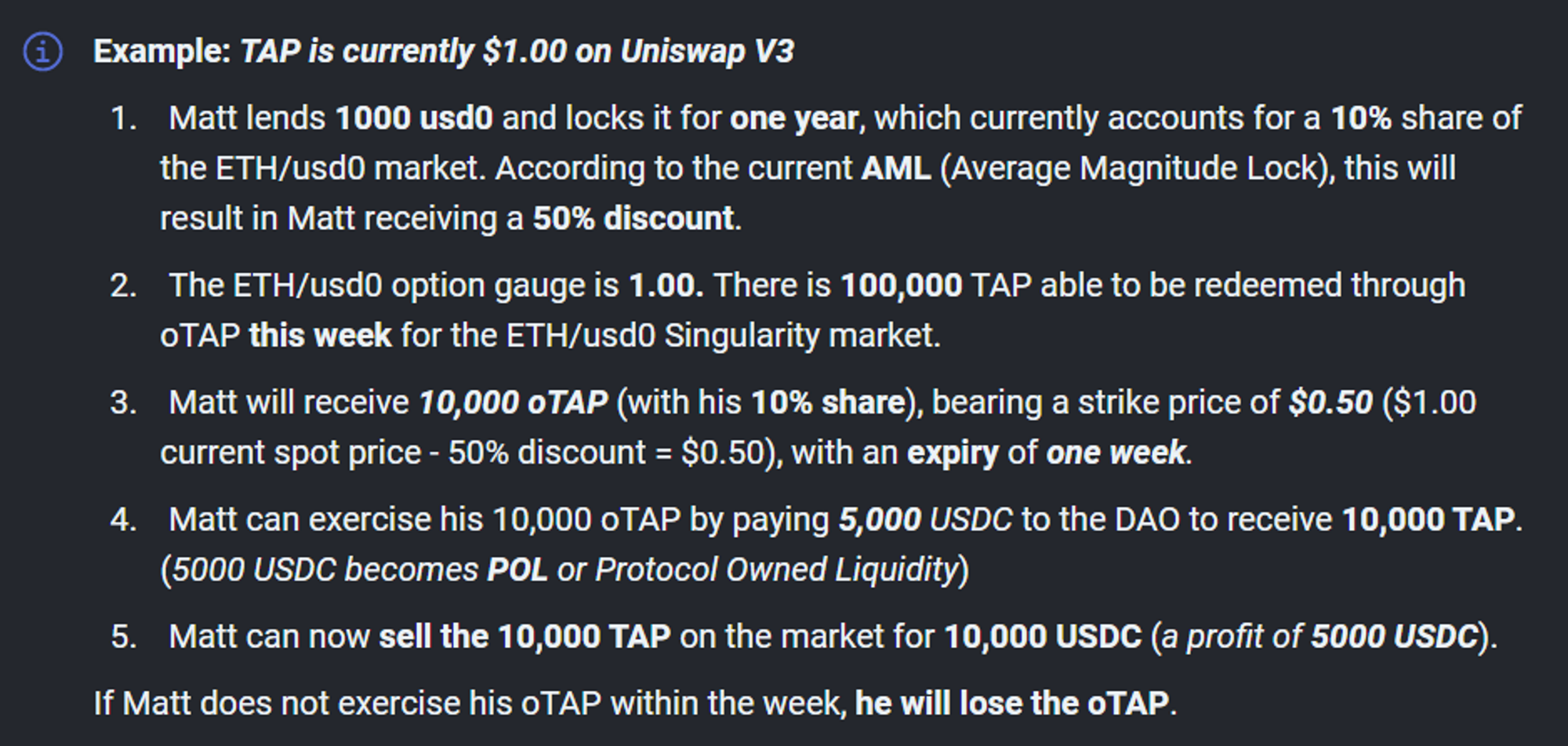

$TAP can only be obtained through the DAO Shares Options program (DSO) or on the free market.

Tapioca uses the DSO to incentivize liquidity and sustain growth. It rewards users with a receipt token (tOLP). Users can lock this token for a set period before receiving oTAP, which enables them to purchase $TAP at a discounted price.

66.5% of the supply is dedicated to the program. There will be no mercenary capital or liquidity mining.

Here's how it works:

$twTAP

twTAP stands for ‘time-weighted $TAP. It’s obtained by locking $TAP and allows users to participate in DAO governance. The protocol distributes 100% of revenue to users who lock twTAP.Cryptonary’s take

Tapioca DAO is a hugely ambitious project that combines several concepts from earlier DeFi projects like SushiSwap and Abracadabra.Its tokenomics are carefully engineered to provide holders with sustainable revenue.

There is also a high demand for stablecoins and a cross-chain lending market that solves liquidity fragmentation, so if it achieves its goals, it has the potential to become very large.

How to get involved

If you wish to participate in the Liquidity Bootstrapping Pool (which is essentially the IDO for $TAP), the deadline is March 2023; no exact launch date has yet been set.Joining their Discord is the best way to stay up to date. The team holds AMAs (ask me anythings) and offers information about how to participate in the testnet launch and when the mainnet will be launched.

Factor DAO

Factor DAO is a decentralised asset management protocol in a late stage of development. It offers powerful tools to help users create unique portfolios and indices using a range of yield-bearing assets, tokenised baskets, and derivatives.Its aim is to integrate with numerous DeFi protocols and make it simple for anybody to create their own investment strategy and charge fees for managing the assets of those who deposit money.

Factor DAO’s main products will include:

- Tokenized baskets: act like permissionless index funds or ETFs (exchange-traded funds). A basket contains multiple different assets and allows investors to easily get exposure to their selected index.

- Yield pools: allow creators to deploy permissionless, non-custodial pools for borrowing and lending. This also allows the use of yield-bearing tokens. Each lending pool is isolated, so there’s no contagion risk for other pools.

- Derivatives: Factor plans to allow users to create, settle, and trade decentralized derivatives on any underlying asset. However, this is planned for a bit later in its development, and there's not a lot of information available yet.

The maximum supply of $FCTR will be capped at 100M. There will be zero emissions beyond this number.

VeFCTR: Factor allows token holders to lock their $FCTR tokens in exchange for veFCTR.

VeFCTR tokens are not transferable and will progressively lose value until the locking period expires and the original FCTR tokens can be reclaimed. veFCTR tokens holders can create and vote on proposals in Factor’s DAO, and receive 50% of all platform fees.

Cryptonary’s take

FactorDAO is intriguing - it provides customers with a novel approach to managing their assets. Given that many crypto investors likely prefer to have a managed portfolio rather than trade for themselves, a product like FactorDAO will undoubtedly attract interest.The token’s value accrual also implies that holders will benefit from FactorDAO's growth.

Our only concern, and reason for not investing, is that FactorDAO has opted to launch its token before providing users with a working product. We’ll wait for the product to drop and then take a fresh look. Watch this space for more on Factor.

If you still want to get involved

FactorDAO announced its public sale, which was scheduled to take place on Camelot DEX on the Arbitrum chain from February 20th to 24th.10% of the entire $FCTR supply will be available for public purchase through a fair launch, via a price discovery process.

$FCTR’s initial price will be $0.10, with the ultimate price determined by demand at the end of the public auction.

REMINDER! Cryptonary will not be investing in the IDO as previously stated.

Lexer Markets

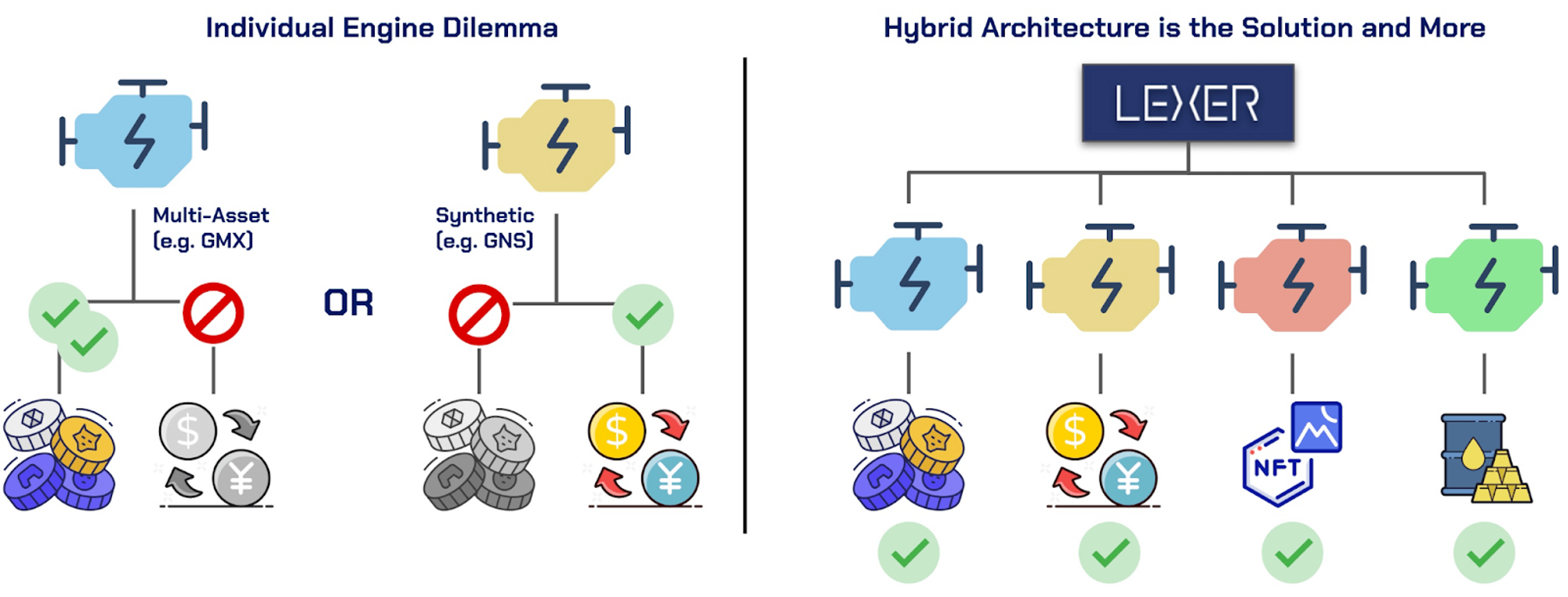

Lexer Markets is the latest addition to the ongoing war between DEXs on Arbitrum to obtain the highest market share.Lexer is a decentralized perpetual and spot exchange. It offers a hybrid liquidity mechanism to enable trading for a vast range of assets, including crypto, forex, NFT derivatives, commodity, and equity indices.

Lexer offers two different pools for its source of trade liquidity. The first is a multi-asset backed pool, similar to GMX’s GLP. This consists of large-cap cryptocurrencies like Bitcoin and Ethereum as well as stablecoins. A second pool, called the synthetic pool, contains only stablecoins.

Now for our usual inspection of the tokenomics…

$LEX: the governance and utility token. Users can stake $LEX to earn 30% of protocol fees, distributed in ETH.

veLEX: represents staked $LEX. While ‘ve’ tokens are normally locked for some duration, I confirmed in Lexer’s Discord channel these tokens can be freely unstaked.

There are no released tokenomics for Lexer with regard to supply cap and distribution.

Cryptonary’s take

What distinguishes Lexer Markets from a decentralized exchange like GMX is that it doesn’t focus on one type of asset. GMX's concept worked, and Lexer is expanding it by integrating several liquidity models into a single trading platform to grow into other asset classes, such as NFTs and forex. This could give it an advantage over competitors.Now here’s the best part - the potential to provide NFT derivative trading, a fairly new product but one with significant potential given the interest in NFT speculation (not to mention the enduring interest in NFTs, full stop).

While not all tokenomics are accessible yet, the fact that 30% of the revenue will be shared with token holders is exciting. We love value accrual.

We’ll follow the project's progress and provide an update when we have more information. We’ll be waiting for the full tokenomics and details of the IDO before we decide whether or not to invest. Again, stay tuned for more on Lexer.

How to get involved

Lexer Markets has not yet specified a launch date for its IDO or its token. The IDO will apparently take place on Camelot as well, but for the time being, the best way to get involved is to join their Discord.The protocol is currently running a "paper trading" competition on the mainnet, allowing users to test the system without using actual money. You may register for their V2 trading competition on the project’s website, which is a good way to test it.

Action Points

- Dig into part one of our Arbitrum watchlist. We cover three existing protocols that we’ve invested in.

- Join Tapioca DAO's Discord to stay up to date. If we decide to invest, we’ll also write an update for you.

- We’re not participating in FactorDAO’s IDO. We will wait for their product to launch, and depending on performance, invest. If you want to participate nevertheless, here’s how.

- Join Lexer Markets' Discord and register for their V2 trading competition, test out the product, and stay up to date on the potential token launch.