How do you know which tokens deserve a spot in your portfolio?

The truth is, many people don’t know how.

The market is dynamic; conditions can change in an instant, and if you make decisions based on trending news, you are already too late.

But you can stay ahead of the informational curve and spot opportunities before they are mainstream because you’ve got your own team of technical analysts, market researchers, OGs, and degens in the Cryptonary community.

CPro Asset Updates gives you the latest scoop on the most exciting assets in the most exciting sectors of Web3.

Simply put, these are the assets on our watchlist, providing you with an excellent starting point to build a solid portfolio.

Ready to get ahead of the market?

Let’s dive in!

TLDR 📃

- THORChain (RUNE) is alive, with 2023 record volumes throughout August. There are hints of a THORChain x MetaMask integration lined up for September 👀

- Perpetual Protocol (PERP) pumped 157% out of nowhere after a large TVL gain. But hang on, it’s not likely to continue as the Foundation transferred tokens to Binance, and there’s a 1% unlock next week. Dump inbound?

- Synapse (SYN) suffered a setback when a liquidity provider sold 9 million SYN. Yet, the protocol is still functional, and our thesis remains unchanged.

- We stopped following NEWO because New Order’s merger with Synonym Finance invalidated our original thesis.

- We will, however, be adding unshETH (USH) to our watchlist - for more info, read on!

Disclaimer: This is not financial or investment advice. Any capital-related decisions you make are your full responsibility and yours only. The information made available in this report is NOT for replication. The purpose is to share the thought process behind our decision-making for entertainment purposes only.

THORChain continues to thrive 💪

Streaming swaps has been a huge success, and the THORChain team continues to give us more conviction as each week passes.

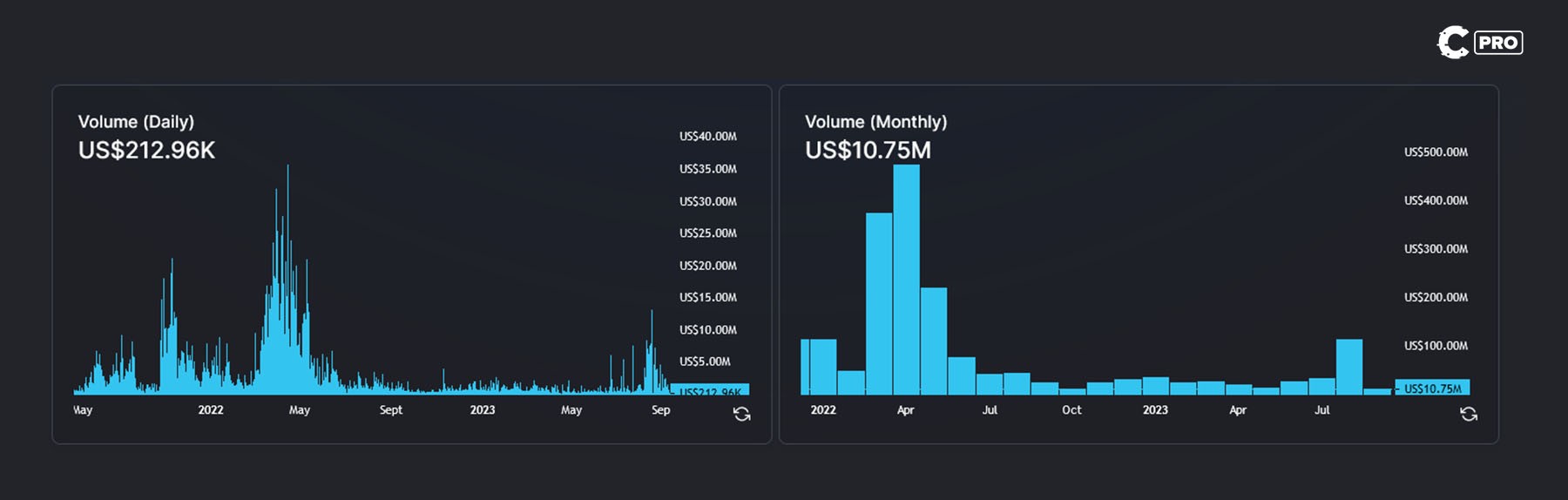

THORChain posted its highest volume since November 2022 - the peak of the FTX travesty.

$1.08 BILLION passed through THORChain’s infrastructure, a 140% increase over July.

THORSwap posted even more impressive numbers:

Volumes for August were $112.4 million, up a massive 243% over July.

But that’s not all - there’s a potential catalyst coming up in September…

Rumour has it that a THORChain x MetaMask integration is on the horizon!

Although just a rumour, THORmaximalist has been a solid source of information over these last years.

It goes without saying that being able to cross-chain swap using THORChain within MetaMask will drive volumes to, quite frankly, utterly ridiculous levels.

However, you should note that a MetaMask integration might be a bit of a buzzkill for THOR - competing with MetaMask for traffic isn’t easy. An integration would mean that MetaMask becomes a pseudo-frontend for THORChain.

But our thesis is that any volume from MetaMask is new volume, and THORSwap should continue to accrue volume.

Why?

MetaMask fees are frustratingly expensive for higher-value swaps, so going directly to THORSwap will still be the better (and cheaper) option for most.

So, how do we take advantage?

There are two options:

- RUNE: is the safer bet and a direct benefactor if a MetaMask integration is on the cards.

- THOR: higher risk, but higher reward. For more info on the thesis, check out SITG.

WTF happened to PERP? 💭

PERP is inexplicably up 157% in the last week after a year and a half of doing, quite literally, nothing.

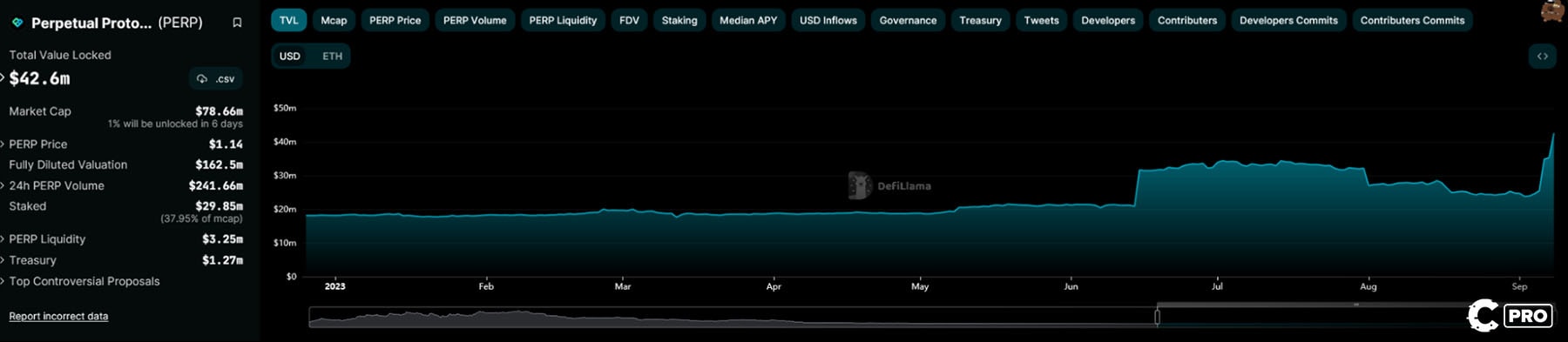

We’ve had a look at the information and searched through the data, and the only possible explanation we found was a sharp increase in TVL:

TVL increased by a massive 76% in just a couple of days this week, up to $42.6 million from $24.2 million.

Whatever happened, it appears that the PERP Foundation is looking to capitalise on the move, depositing tokens to Binance:

If the plan is to sell those tokens, it’s unlikely PERP will continue this run, and there is an unlock next week that will release a further 1% of the supply.

For us? Perp is a no-go after this run.

On the other end of the price action spectrum, we have a bit of a problem…

Or is it an opportunity? 👇

Synapse takes a beating 🤕

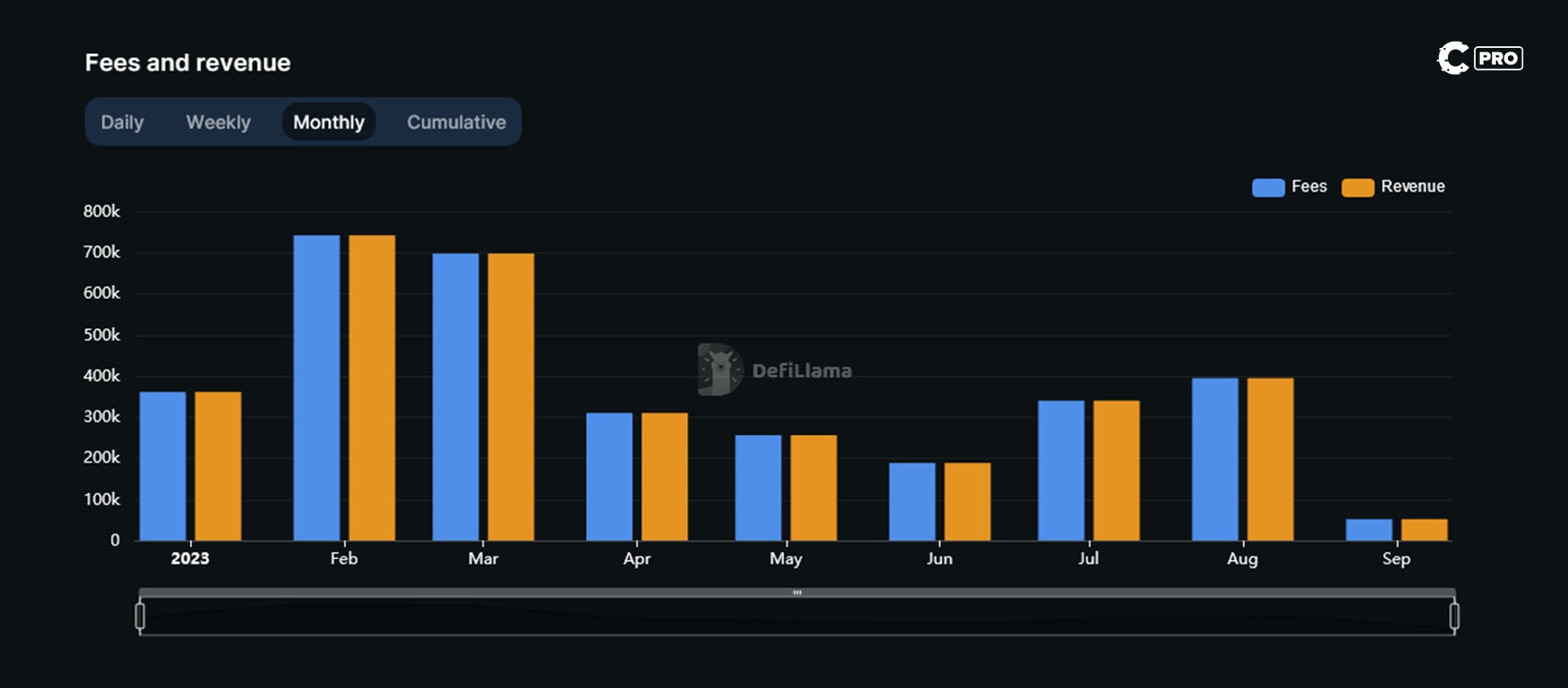

We bought SYN as one of the assets in our Skin in the Game portfolio, and it does the unthinkable and breaks below all-time lows. 😂Why?

Nima Capital, a VC that should provide liquidity with granted tokens, rugged around 9 million SYN in two transactions within a minute of each other. This was around $3.5-4 million worth of SYN.

Obviously, with a huge unexpected sale like that, SYN’s price could do nothing but head to the gutter.

The main question is - are we still confident?

Synapse is still one of the top bridges - the infrastructure was unaffected by the liquidity dump.

Until the incident, Synapse's revenue had been trending higher, and over the last month, Synapse bridged around $91.25 million worth of assets.

Additionally, the treasury remains well funded - the loss of the tokens is a big hit, but operationally, Synapse appears to be fine.

We still anticipate the chain going live in the coming months, so the SITG thesis remains unchanged… but this event may present an opportunity.

There are two plays:

- For degens, the unexpected sale looks like an opportunity to scoop up more SYN at a discount.

- For those playing it safe, waiting for more info from the team might be worthwhile to find out what happened and what’s being done to mitigate the damage.

Stay tuned.

With Cryptonary always looking to connect readers to the most exciting opportunities in Web3, some earlier picks will inevitably lose their lustre.

And because we provide unbiased, unfiltered, unsponsored, ads-free market coverage, we don’t hesitate to call it as it is! 👇

We’re dropping NEWO ⛔

We’ll be dropping NEWO from our watchlist. Many of you have been asking for an update, so here’s the scoop.New Order has voted to merge with Synonym Finance, a cross-chain money market. Our investment into New Order was based on their value proposition of an “on-chain venture firm.” With this pivot, New Order is no longer satisfying our thesis; thus, we have exited.

We will need to conduct a separate evaluation of the merits of Synonym Finance to determine whether or not to invest in the new project.

While Synonym leverages some interesting concepts, other cross-chain money markets (such as Radiant and TapiocaDAO) have already piqued our interest, and we are holding off on investing in Synonym at this time.

Is there anything new we’re watching to replace NEWO? 👇

We’re adding USH 😎

A new addition to our watchlist is unshETH’s governance token, USH.unshETH got a lot of bad press throughout the Summer as the protocol was exploited for $375,000 in June. TLDR: The team didn’t manage the fallout from the ordeal properly.

But, with their fingers in the LSDFi space, this is a protocol that’s too hard to ignore.

There are a couple of reasons it makes our watchlist:

- Low market cap: With an MCap of ~$1.8 million, USH is attractive for obvious upside potential reasons.

- Under the radar: The protocol has largely been forgotten after the exploit and the poor stakeholder management. However, recent price action would suggest it has not completely faded from memory.

- New product launch: unshETH has just unveiled its latest product, Project Sentience, which directly adds value to the USH token over time.

- Protocols expressing partnership interest: Despite the bad rep, some protocols are still interested in doing business with unshETH.

- Altered tokenomics: USH has been decimated by inflation emissions, vesting emissions, and incentives. Inflation has been reduced by 60%, and the team has extended their vesting schedule.

- Recently raised cash: unshETH raised $3.3 million at the end of August, with a market cap of $1.2 million.

However, we’re not in the business of hiding alpha, which is why we’re bringing it to you today!

Tell us your thoughts; we’re interested to hear them!

One glance update

Here’s the full list of assets we have our eyes on, with each sector ranked in terms of market attention:

We want to run a poll…

Right now, we have extensive coverage of the following assets: But we have some assets on our watchlist that we are yet to cover with a proper deep dive:- USH

- STG

- RPL

- LDO

Cryptonary’s take 🧠

This month's focus remains infrastructure, as that’s where the capital has been flowing.USH is a bit of a wildcard due to its less-than-satisfactory history, but we’ll be monitoring developments there closely - you never know, it might turn up in Skin in the Game!

In a few weeks, we will bring you another update on assets on our watchlist; until then, stay bullish!

As always, thanks for reading. 🙏

Cryptonary, out!