A quick primer

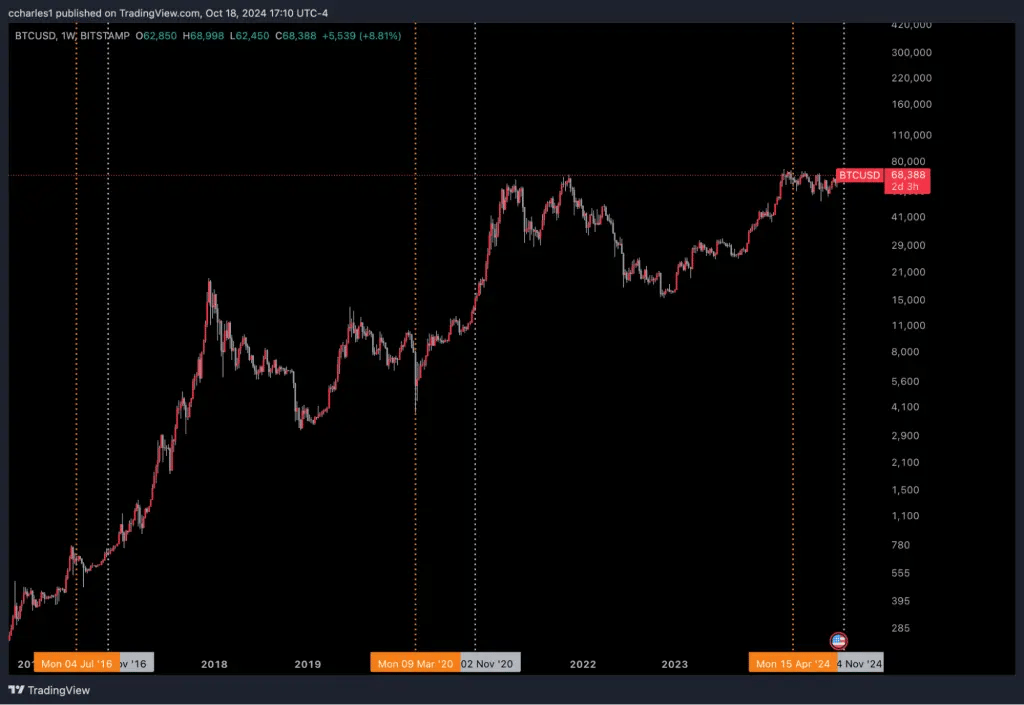

Before we dive in, let’s take a moment to look at where we’ve been. Memecoins have been around for a while, but what if we told you the fun is just beginning? Dogecoin, the original meme king launched in 2013, took until 2021 to hit a billion-dollar market cap. Shiba Inu followed, reaching $11 billion in just three years. Then came Pepe, skyrocketing to $4 billion in under a year. But things are moving faster now. In 2024, WIF hit a $4 billion market cap in just four months, and SPX6900? It went from $10 million to $1 billion in only one month.Do you see the pattern? The pace is accelerating, and the stakes are getting higher. Memecoins are becoming an increasingly accepted and legitimate asset class.

However, this is just the beginning. The next wave might just be the wildest ride yet.

Let's dive in...

Key questions:

- What are the drivers behind the rapid growth of memecoins?

- How do memecoins differ from other asset classes?

- Why will they keep outperforming this cycle?

- How memecoins will reach a trillion-dollar valuation as a category?

- Cryptonary's winners of the category

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

So why Memecoins?

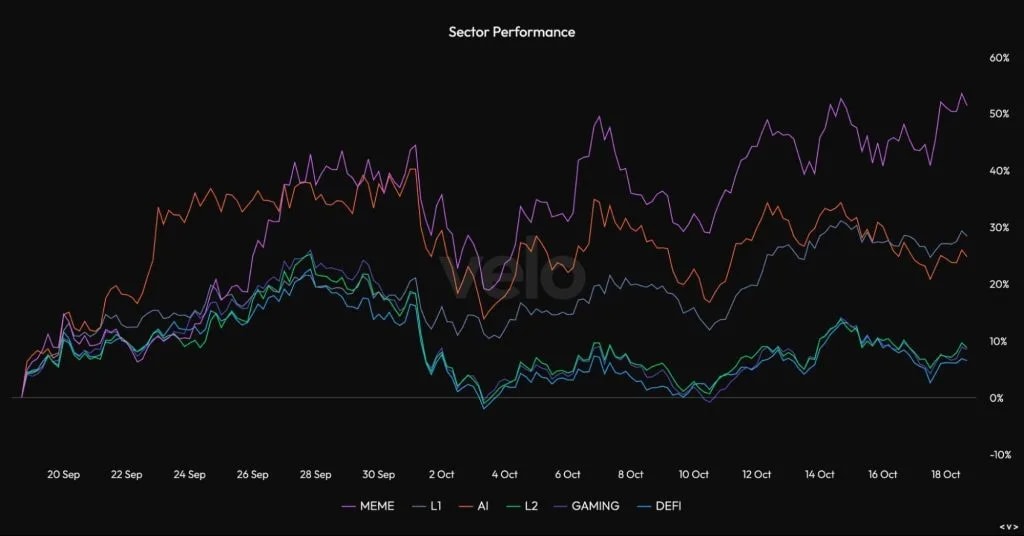

Memecoins have this cycle's best-performing sector, outperforming AI, Gaming DeFi, and other sectors. Memecoin can make an average Joe with a few thousand dollars a legit 6-7 figures in a short time.

We believe memecoins will continue to dominate the market, and let us tell you why.

The need to belong

As our world grows larger and more connected, people are feeling lonelier than ever. A report from just last year revealed that 50% of American adults experience loneliness. They are calling it the loneliness epidemic. This is where memecoins come in.Memecoins are not just tokens to bet on; they are movements fueled by passion, belonging, and shared identity to get behind. Dogecoin, Pepe, and WIF didn’t succeed just because they only were funny or just because they were viral. They thrived because of the communities that rallied behind them, uniting 1000s of people across the globe. And here’s the beauty: anyone can be a part of it in a world where “belonging” often comes at a steep cost or investments of countless hours.

Memecoins offer a community for as little as a single dollar. This means that anyone can be part of a movement, surrounded by thousands of like-minded individuals, all united behind a common belief for the price of a cup of coffee. That’s the power of meme coins. Anyone can be a part of them, anywhere, any time, no matter who you are.

The global gambling epidemic

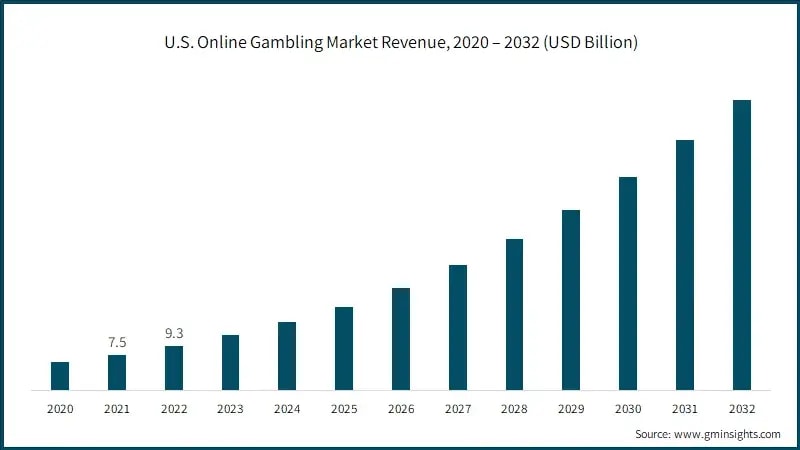

Currently, 1 in 2 adults in the U.S. gamble, and casino revenues are soaring, hitting a staggering $160 billion a year, with no signs of slowing down. In fact, it is growing by 5% annually. Even more interesting is that nearly half of that revenue is generated online, and digital/crypto gambling platforms are growing. The message is clear: people crave the thrill of hitting it big, and that desire is only growing stronger by the day.As online gambling spreads like wildfire, we predict this appetite will fuel a meteoric rise of meme coins. Memecoins offer the same electrifying excitement as gambling but with far better odds and the same potential for massive rewards. With billions of dollars pouring into the gambling industry yearly, meme coins are primed to ride this wave.

A bet on internet culture

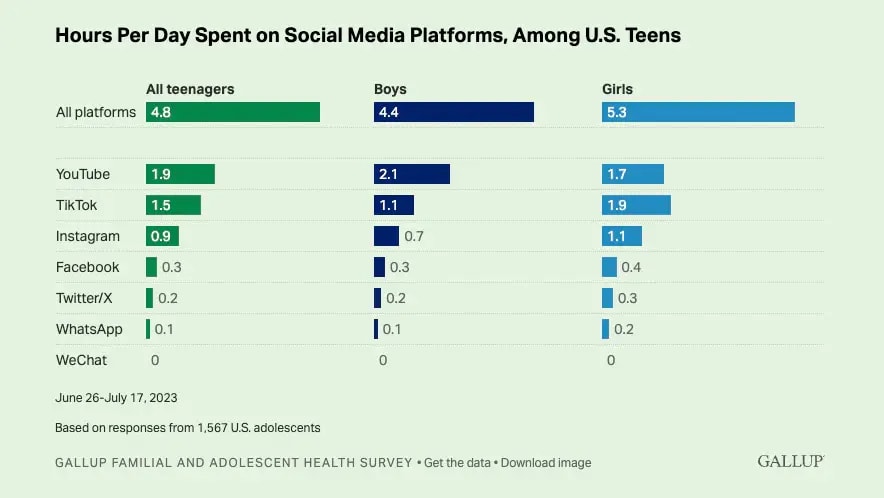

Social Media: 35% of the GenZ population in the United States are said to have a social media addiction; on top of that, it is noted that GenZ alone will waste ten years' worth of their lives staring at a phone screen. Yikes! But it isn't all bad; this is very bullish. The online culture gets increasingly sticky with the increased time spent online. What does this mean? This means that memes, famous characters, and, most importantly, memecoins embodying these things will only increase in staying power and relevance as more and more people transfer into the digital age. Internet culture has gotten to the point where not knowing of certain memes can leave you out of people's vocabulary, further showing just how important it is. Assets like Popcat, Pepe, and WIF aren't just crypto memes; they can become cultural landmarks, still generating millions of impressions outside of the crypto space.

As the world continues to shift online, meme coins will only grow in relevance and staying power, positioning themselves at the heart of this new digital era. The bigger the internet culture becomes, the stronger these memes—and the coins that represent them—will rise.

Where NFTs were weak, Memes were strong

In the last cycle, NFTs took the world by storm, with top pieces selling for hundreds of thousands, sometimes millions, of dollars. But that was three years ago, and the landscape has changed. Trading volume has plummeted, and collectors who once paid a fortune are now lucky to get 70% of their investment back. So, why are memecoins different? NFTs had three fatal flaws.First, the price. At the peak of NFT mania, getting into something like BAYC required $300,000—an insane barrier that only the already wealthy could cross. And while people crave belonging, NFTs limit that access. Memecoins, on the other hand, opened the doors for everyone, allowing anyone for a few bucks to be part of thriving communities.

Second, the number of tradable assets. Major NFT collections capped their numbers at 10,000, meaning only a select few could be part of the movement. Compare that to meme coins, where millions can rally behind a single coin. It’s said that if 260 million people stand behind a cause, they can spark a revolution. Keep that number in mind.

Finally, NFTs were challenging to understand. The average person couldn’t grasp why a picture of a monkey was worth six figures when they could print it for 10 cents. Memecoins, by contrast, are easy to get. If you understand Bitcoin, you understand meme coins.

Memecoins are accessible for as little as $1, and the top three coins already have nearly 10 million holders—just 3.85% of the critical mass needed for a revolution. Think that’s bearish? Think again. This shows how early we are in the game. When that number doubles or quadruples, the impact will be huge.

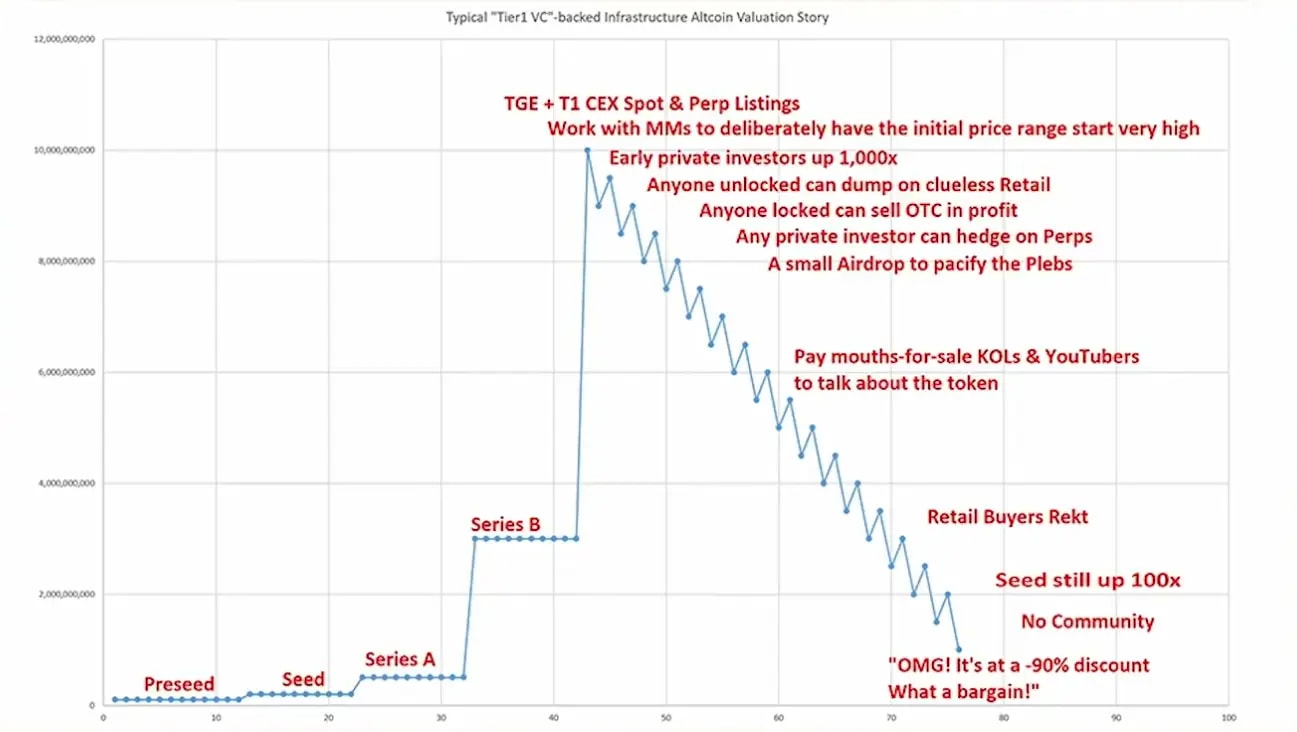

Extreme valuation of new altcoins

Further, the proliferation of memecoins is a response to deeper issues in the crypto market, particularly the extreme valuation of new altcoins. These tokens promise groundbreaking technology and utility (restacking, zero knowledge, 69-page long whitepapers), but VCs and insiders inflate their valuation by launching at low-float (low % of the supply circulating) and high fully-diluted valuation.By the time the token is launched and listed on centralised exchanges, insiders are up 1000x and control more than half of the supply. Retail investors, drawn by the pseudo-new tech or utility, become exit liquidity for these early stakeholders who sell off at peak retail demand, leaving regular investors with substantial losses. As a result, the community never gets rich and moves to more speculative yet fairer plays.

Thus, memecoins act as a social outcry against this greed, rejecting the promise and complexity of overpriced altcoins. By rallying around simpler, culturally resonant tokens, the retail community is expressing frustration and reclaiming some control in a market that, despite its decentralised promise, is dominated by insiders when it comes to altcoins.

The future says UP

Timing is everything when it comes to risk assets, and the stars are aligning right now. This year is an election year, and history shows that election years combined with Bitcoin halvings often ignite massive rally points in crypto markets. But that's not all. We also see early signs of increased interest in meme coins from venture capitalists and funds, entities with deep pockets. Their involvement will be crucial in pushing meme coins into the mainstream, and their growing attention is a bullish signal for the space.What’s more, crypto hasn't even scratched the surface of the social awareness it typically reaches during a bull market. It’s flying under the radar for most, with only crypto natives paying attention. But once Bitcoin surges past $70k and Solana breaks out, there’s a strong chance that retail investors will come flooding back into the market. When they do, the spotlight won’t be on traditional altcoins but on meme coins.

$1 trillion memecoin thesis

Yeah, a trillion-dollar market cap is a bold prediction, and maybe even crazy, however, let’s look at some altcoin valuations at the peak. XRP has reached over $100b at the peak. ADA - $90b at the peak. DOT - over $50b last cycle.XRP, ADA, and DOT were vaporware altcoins but they collectively reached a $240b market cap because they had very strong cults. We get it, $240b isn’t $1t. It is a strong leap, but let us tell you why we expect this cycle's cults to reach much higher valuations relative to previous cycles.

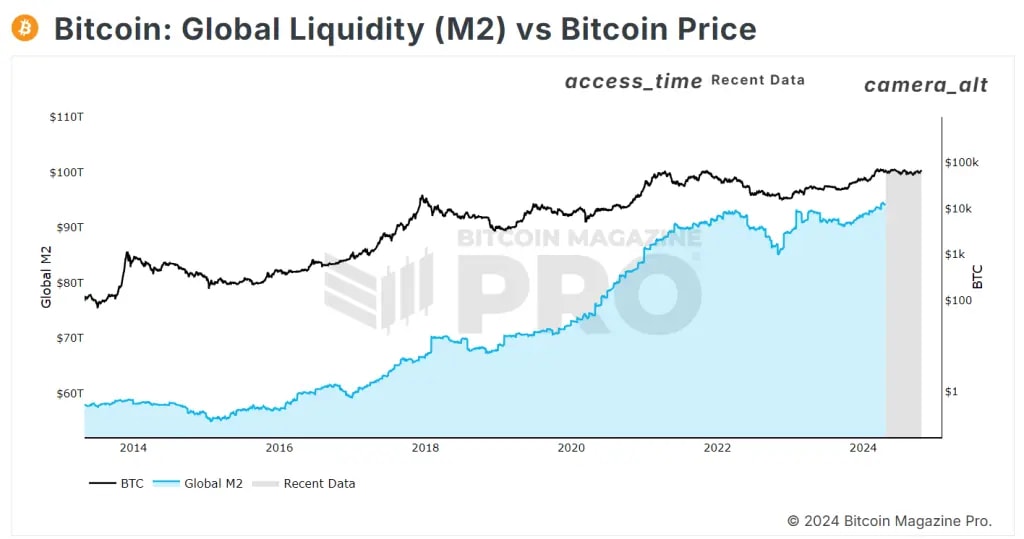

First, with rate cuts happening across the globe, the global money supply is about to breakout and reach new all-time highs.

Second, the approval and proliferation of crypto ETFs (Exchange-Traded Funds) have made investing in digital assets more accessible and legitimate for mainstream investors. This institutional validation can reduce perceived risks and attract more capital into the crypto ecosystem.

As more institutional players enter the market, the overall liquidity of the crypto space improves, creating a more conducive environment for the dominant category (memecoins) to thrive.

Third, compared to the last cycle, we expect Bitcoin, Ethereum and Solana to reach much higher market caps. We expect Bitcoin to reach $120k - $180k per coin. That is 2x to 3x compared to the ATH in the previous cycle. New ATHs for BTC, ETH, and SOL will lead to a trickle-down effect, where wealth will flow further along the risk curve once new highs are reached, facilitating much higher valuation for memecoins.

Winners will keep outperforming

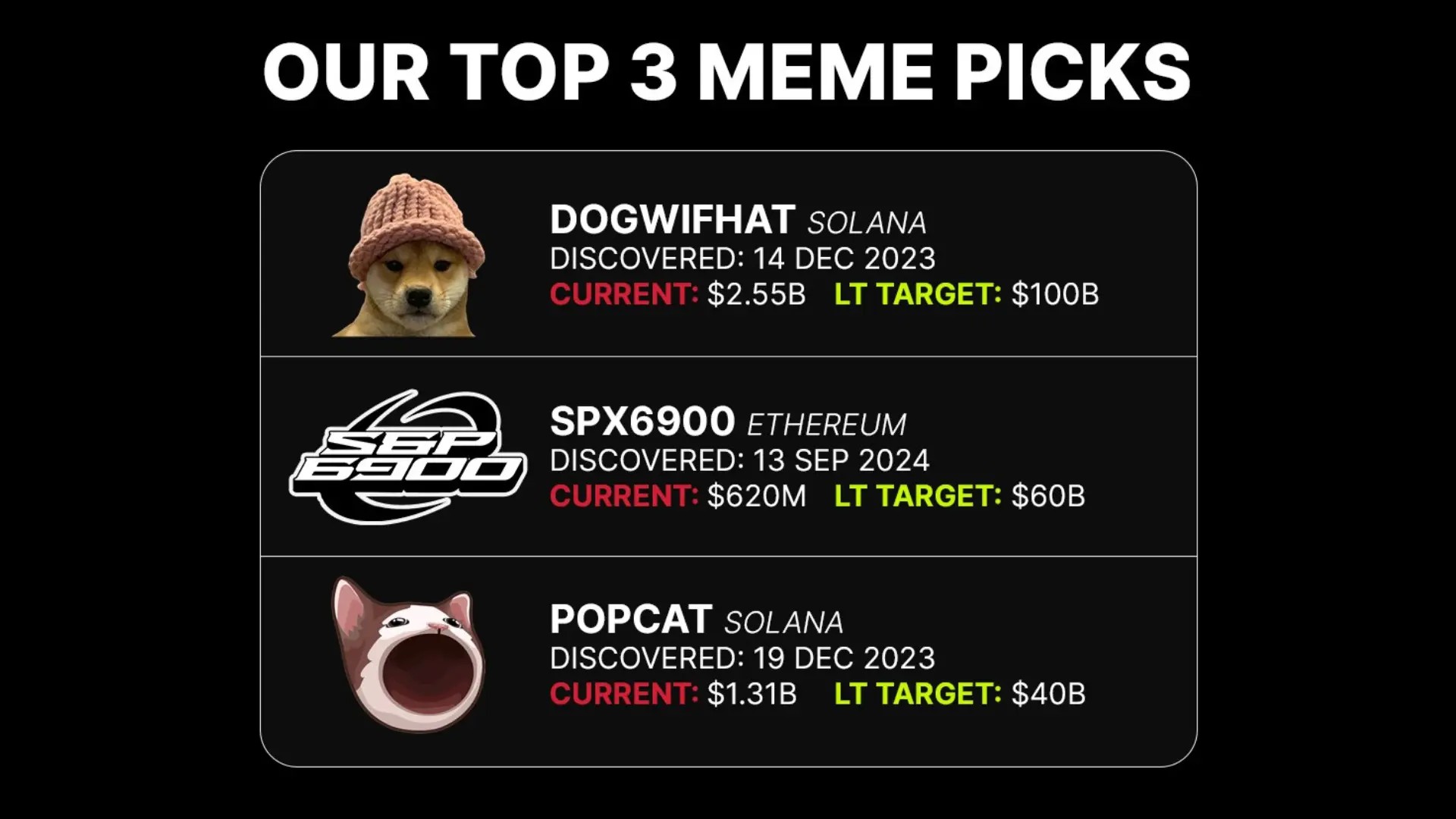

With our bull case laid out, how do we position for the most upside? Fortunately, at this stage of the cycle, the winners have already been identified. This is not the time to chase derivative plays; it is much better to focus on winners. If you have been with us for some time, you probably already know who the winners are:DogWifHat (WIF): Born in the trenches of the vibrant, if not slightly mad, ecosystem of Solana, WIF is the leader of the current memecoin supercycle. It has attracted both retail and professional investors, with projections as high as $100 per coin. It's one of the easiest bets currently in the market. The hat stays on!

SPX6900 (SPX): Our recent addition to our barbell portfolio. The strongest performer of the last 30 days. SPX6900 is a movement defying traditional finance. With strong community backing and multi-chain accessibility, we believe it can soar past the billion-dollar mark and even exceed $10 billion in a bull market as one of the targets. SPX is for those who can "believe in something".

POPCAT: POPCAT has one of the strongest charts in crypto. It is rapidly gaining traction as a new blue chip memecoin. Recently, it has crossed a billion-dollar market cap that we had predicted back in December of last year. Since then, POPCAT has undergone intense FUD but has always come back stronger, demonstrating exceptional performance. We remain highly bullish on POPCAT's potential in the 2024/25 cycle, seeing it as the strongest candidate to become a top cat coin for multiple cycles ahead. And, yes, the cat keeps popping!

These are our top 3 picks for meme coins going into the potential trillion-dollar meme coin super cycle; with whatever you feel most drawn to here, we believe each holds a prominent stake in its own way and is sure to trailblaze forward in its own light.

Cryptonarys take

Memecoins are no longer just a niche corner of the crypto world—they are rapidly gaining momentum. What started as a joke has now turned into something much larger, and we believe this is far from a fleeting trend.This is the beginning of a cultural movement. When you look at how small the market cap of memecoins is compared to other crypto asset classes, the path to a trillion-dollar valuation becomes more and more realistic.

And it’s not just speculation. The stars are aligning: more investors are noticing, the loneliness epidemic is driving people toward digital communities, internet culture is more influential than ever, and gambling figures continue to hit all-time highs.

Add in the upcoming U.S. election, and all the ingredients are in place for meme coins to take centre stage. Once Solana and Bitcoin hit new highs, retail investors will come flooding back, and meme coins will be leading the charge.

The real question is not whether memecoins will reach a 1 trillion dollar valuation —it’s why not. Yes, it’s bold, and yes, it’s risky, but if you just zoom out, the potential upside is undeniable.

Peace!

Cryptonary, OUT!