AI has gained significant traction recently, and AI-related tokens have performed well in the market.

However, the AI sector within crypto is still relatively small, with room for substantial growth. Nosana is uniquely positioned to capture a significant part of that growth.

Let's dive in!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Nosana?

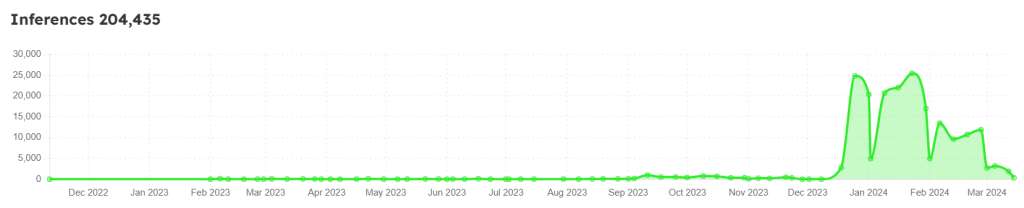

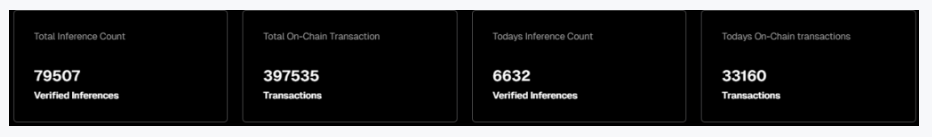

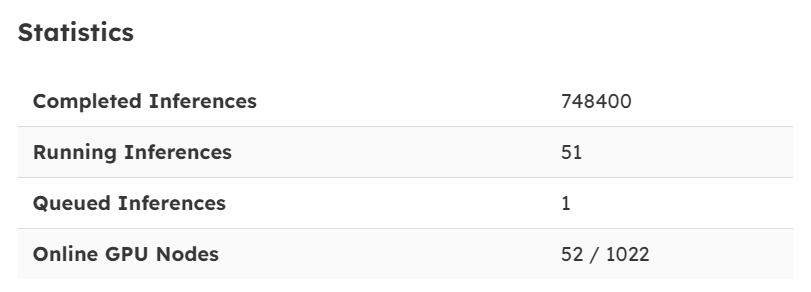

Nosana is a decentralised and open-source cloud computing marketplace dedicated to AI inference and decentralised GPU power. It aims to revolutionise software automation by utilising community-contributed computing resources, particularly GPUs, to run tasks for open-source projects and AI workloads.With Nosana, AI users can train and deploy models more efficiently without needing expensive hardware investments. Nosana achieves this by leveraging underutilised consumer hardware, thereby making powerful GPU resources more accessible to a broader range of users. This approach addresses the global GPU shortage by creating a decentralised grid where idle GPUs can be leveraged for computational tasks. Nosana is in its early "Genesis" stage, undergoing rigorous testing. Despite this, it has already achieved over 200,000 AI model inferences, outpacing competitors like IO.net. However, Nosana currently has only 99 GPU nodes, which is lower than other providers, indicating potential areas for growth.

Key features

- Decentralised GPU network: Nosana provides a decentralised GPU network. It allows GPU owners to rent their idle GPUs to AI users who need powerful hardware to train and use their models faster. This creates a new way for individuals and smaller entities to access the necessary hardware for AI development.

- Affordable GPU access: By connecting GPU owners with AI users, Nosana makes GPU access more affordable for companies and developers, addressing the shortage of GPUs in the market.

- A powerful suite of tools: Nosana provides users with a powerful suite of tools to help them get the most out of their GPU resources, making it easier than ever to access the power of AI.

- Easy-to-use APIs and flexible pricing: Nosana offers easy-to-use APIs and flexible pricing options, making it easier for developers to access and utilise computing power.

- AI-powered CI/CD automation: Nosana pioneers the use of AI-powered CI/CD automation, which reduces software bugs and enhances user trust.

- Nosana explorer: The platform provides a detailed interface for inspecting the test grid in real time, offering transparency and insights into the network's performance and statistics.

- Monetisation opportunities: Nosana enables users to monetise their hardware by participating in the GPU compute grid, thus unlocking additional earning potential. The platform allows consumers, miners, and businesses to monetise their idle hardware, contributing to the AI revolution and earning substantial rewards.

- Partnerships: Nosana has formed strategic partnerships with several organisations, including Aurory for AI-powered gaming experiences, Matrix One for AI avatars, PiKNiK for multi-GPU setups, AlphaNeural to democratise AI model development, and Arbius for advanced generative AI capabilities. These collaborations aim to expand the utility and robustness of the Nosana platform.

Team

When evaluating early-stage Web3 projects, the composition of the team is a critical factor that can significantly influence the project's likelihood of success. In these environments, unproven technologies often present high risks, and ultimately, the people behind the project drive its development and potential. Essentially, investing in a project like Nosana means placing a bet on the strength, expertise, and vision of its team.- Jesse Eisses: Founder and CEO of Nosana. He has over ten years of experience in the crypto industry and has developed funded companies in executive-level leadership roles.

- Sjoerd: Code guru: Extensive knowledge of coding languages and programming. 10+ years in the crypto and corporate industry with experience developing funded companies at executive-level leadership roles. He studied AI at Amsterdam University.

- Wesley: This marketing expert boasts over 7 years of experience in brand development, team leadership, and managing various marketing budgets. Responsible for crafting the strategy for Nosana's advertising, branding, and customer outreach; they hold a Double Psychology major from Amsterdam University and a post-master degree in Digital Marketing and strategy.

- Laurens: Math genius and allround developer.

- Sean: Sean is a successful entrepreneur who is passionate about creating value and making an impact through his ventures. As an active advisor, mentor, community builder, and coach, he supports both aspiring and established entrepreneurs on their journeys. He regularly shares his knowledge and expertise on innovation, leadership, growth, and sustainability.

The bullish case for Nosana

For the 2024/2025 bull run, Crypto x AI is shaping up to be a winning narrative. While most of the attention in the market is on memes, and we have a Memecoin Supercycle, AI coins also stand a chance to win big, especially when the next leg of the bull run kicks off and the market enters the thrill and euphoria stage.

We view Nosana as a key potential outperformer among AI-related coins. Nosana is also positioned as a strong contender in the DePin x AI sector, with room for growth as it moves from testing to full-scale implementation. As AI continues to unfold its potential, Nosana's role in this narrative seems not just promising but pivotal, positioned right at the intersection of technology and opportunity.

Nosana has significant upside potential, particularly as the need for cost-effective and scalable computing solutions increases with the rise of AI and other data-intensive applications.

Computational power is a new oil necessary for the advancement of AI, and Nosana is positioned right at the heart of the AI revolution. The coming years will likely see these dynamics play out, with significant implications for industries, economies, and global technology leadership.

The market potential for AI and GPUs

Artificial intelligence (AI) has entered a new era in recent years, with applications going mainstream and attracting substantial investment. AI is now reshaping industries and is projected to generate over $10 trillion in economic value by 2030. Across various sectors—such as large language models (LLMs), diffusion models, and autonomous vehicles—AI innovations are transforming how we interact with information and technology.Autonomous vehicles, for instance, are poised to revolutionise transportation, logistics, and even urban planning. Beyond these technological achievements, AI advancements create new markets and disrupt existing ones, fostering a new wave of entrepreneurship and investment.

At the core of these AI advancements are Graphics Processing Units (GPUs). Originally designed for rendering graphics, GPUs are now indispensable for AI training and inference due to their ability to efficiently handle parallel processing tasks. As AI continues to grow more sophisticated, the demand for GPUs is expected to rise exponentially.

However, a few centralised players like Nvidia and Microsoft currently dominate the GPU market. These companies provide essential hardware for AI research and development, but their dominance makes the market susceptible to supply chain disruptions and monopolistic pricing.

Nosana's opportunity in decentralising GPU resources

Nosana aims to disrupt this centralised GPU market through decentralisation. By leveraging blockchain technology, Nosana allows users to share their idle computational resources, creating a decentralised network that democratises access to GPUs.This model offers a cost-effective and scalable AI training and deployment solution, addressing the scarcity and high costs associated with centralised providers. Decentralised platforms like Nosana can accelerate the development and adoption of AI technologies across industries by making these crucial resources more affordable and accessible.

Moreover, Nosana's approach lowers the entry barriers for startups and researchers, fostering a more diverse and competitive marketplace. This could further drive AI innovation by enabling more actors to participate in the development of cutting-edge solutions.

The demand for scalable computational power will intensify as AI becomes increasingly integrated into everyday life, from personalised medicine to automated financial services. Nosana is uniquely positioned to capitalise on this growing need by offering an innovative, decentralised solution that meets current and future AI demands.

Built on Solana

Building Nosana on Solana offers several competitive advantages due to the inherent characteristics of the Solana blockchain, which are particularly beneficial for a GPU-sharing platform like Nosana. Here are some key reasons why this is a significant competitive edge:- High throughput: Solana is renowned for its ability to process up to 65,000 transactions per second (TPS), thanks to its unique Proof of History (PoH) consensus combined with the traditional Proof of Stake (PoS) mechanism. This high throughput is crucial for Nosana, as it enables the platform to handle large computations and data transactions efficiently without bottlenecks.

- Low transaction costs: Solana offers some of the lowest transaction fees in the blockchain space, typically fractions of a cent per transaction. For Nosana, this translates to reduced operational costs when executing a high volume of transactions, such as distributing tasks to GPUs or settling payments, making the platform economically viable for both users and providers.

- Robust ecosystem: Solana has a vibrant and rapidly growing ecosystem, providing various tools and integrations to enhance Nosana's functionalities. Being part of this ecosystem allows Nosana to leverage collaborations, shared technologies, and a broader user base.

High adoption

Nosana, a rapidly emerging GPU-sharing platform on the Solana blockchain, is already demonstrating notable competitive advantages as it transitions from its 'Genesis' phase—focused on testing and refinement—towards full-scale operational deployment.Despite being in the early stages of development, Nosana has already processed over 200,000 inferences, a significant achievement that highlights its strong potential and early market traction.

For comparison, IO.net, another GPU-sharing platform on the same blockchain, has processed around 80,000 inferences. This is particularly striking given that IO.net's latest valuation exceeds $1 billion—more than double that of Nosana—despite handling less than half the number of inferences.

This discrepancy underscores two key points: Nosana's current market valuation may be underappreciated, and its platform is proving to be both efficient and in high demand. As the global demand for computing power continues to rise, Nosana is well-positioned to capitalise on this trend.

As Nosana moves from its testing phase to full operational deployment, the platform is expected to see a further surge in inference activity, solidifying its presence in the market. Given its current performance metrics—outpacing established competitors in critical areas—Nosana is poised for significant growth and a potential upward market revaluation as it achieves broader adoption and operational maturity.

Good tokenomics

Nosana (NOS) stands out in the current DeFi token cycle due to its distribution strategy, which sharply contrasts with many other projects in the space.A common issue in crypto, particularly with new token launches, is the prevalence of low-float, high-fully-diluted-valuation (FDV) tokens.

These tokens often see a significant portion of their supply allocated to insiders at much lower prices, posing a risk of these insiders selling (or "dumping") their holdings on retail investors once the token gains market traction and price increases. Despite massive underperformance since launch, insiders are still up significantly in unrealised profits, waiting to extract as much value as possible through these tokens.

Nosana's tokenomics deviates from this norm. It has already achieved over 80% of its tokens in circulation.

This high circulation percentage is significant because it minimises the risk of market manipulation typically associated with large insider holdings ready to be sold off.

By ensuring that a majority of its tokens are already distributed to the public, Nosana fosters a more democratised and potentially stable pricing environment, reducing the likelihood of price crashes following insider sell-offs.

This distribution enhances trust among potential investors and aligns more closely with the decentralised ethos of the blockchain and DeFi sectors. Investors looking to engage with DeFi tokens are increasingly wary of projects that could subject them to the whims of a few well-placed insiders.

In its current state, Nosana offers a more equitable foundation, likely attracting those who are looking for investments where token distribution does not skew heavily in favour of initial backers or development teams.

That is a significant competitive advantage from an investment perspective.

Nosana's valuation exercise + price targets

Similar to our previous valuation frameworks, we employed a mix of quantitative and qualitative methods for Nosana's valuation.We downloaded the historical market cap of Nosana and utilised a machine-learning model based on Prophet library to forecast future market cap, resulting in the following projections:

For 24/25

The graph shows a time series forecast with actual values (black line) and predicted values (blue line) along with a confidence interval (shaded area).

- Bearish scenario: This scenario suggests that the mcap of Nosana is expected to reach $188m ($188,862,325) by the end of 2025. The current supply of NOS is 83,400,00 tokens (83.4%). However, 100% of the supply is expected to be fully circulating (100,000,000 tokens) by the end of 2025. Considering future market cap and circulating supply, it will result in $1.89 per NOS per our bearish scenario.

- Base scenario This scenario suggests that the mcap of Nosana is expected to reach $441m ($441,090,288) by the end of 2025. The current supply of NOS is 83,400,00 tokens (83.4%). However, 100% of the supply is expected to be fully circulating (100,000,000 tokens) by the end of 2025. Considering future market cap and circulating supply, it will result in $4.41 per NOS per our base scenario.

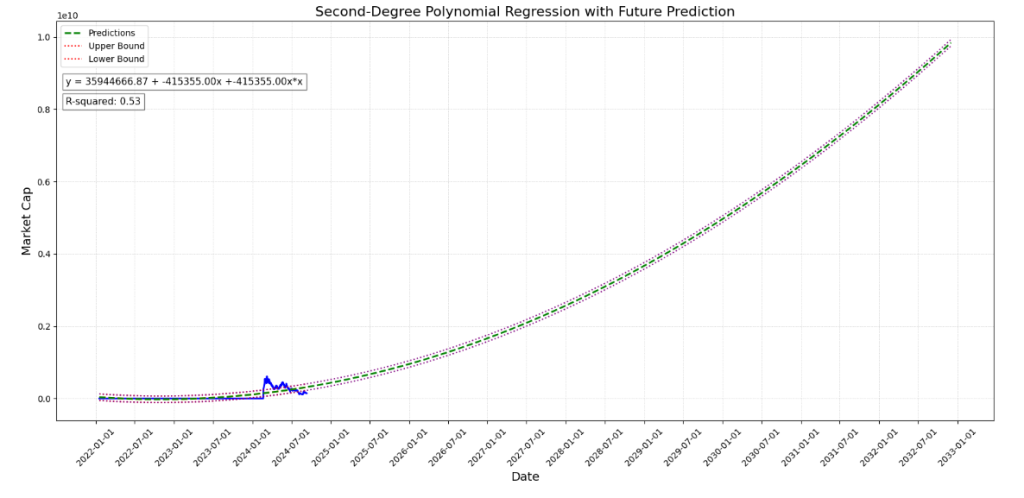

- Bullish scenario. For the bullish scenario, we employed a slightly different model. Since the beginning of the year, memecoins have taken the main stage while all other sectors have bled. As a result, if we take historical price action and feed it into our previous model, it will result in very conservative targets. However, since it is a bullish scenario, we expect AI/DePIN narratives to gain traction. Therefore, for this scenario, we decided to use a slightly different approach that is more likely to capture the growth trajectory of NOS.

- Here is our model:

- The model suggests that the mcap of Nosana is expected to reach $1.5b ($1,509,523,591) by the end of 2025. The current supply of NOS is 83,400,00 tokens (83.4%). However, 100% of the supply is expected to be fully circulating (100,000,000 tokens) by the end of 2025. Considering future market cap and circulating supply, it will result in $15.09 per NOS per our bearish scenario.

- Best scenario: In this scenario, the market can exceed our expectations and things that we previously didn't consider come up or believed were low-likelihood events. Potential changes might include a significant shortage of computing power across the globe combined with the massive proliferation of AI modelling.

- To account for this scenario, we are doubling our bullish scenario to account for abnormal scenarios where things can get crazy.

For 2032

Our previous model resulted in massive prediction uncertainty for long-term projection. Therefore, we opted for a different model about which we have more confidence. The model is presented below.

The Y-axis represents SOL's market capitalisation, while the X-axis represents time. The fitted line (rising green line) shows a steady upward trend.

- Bearish scenario: Based on this model, we can expect Nosana to reach $962m ($962,613,562) by the end of 2032. The current supply of NOS is 83,400,00 tokens (83.4%). However, 100% of the supply is expected to be fully circulating (100,000,000 tokens) by the end of 2032. Considering future market cap and circulating supply, it will result in $9.62 per NOS per our bearish scenario.

- Base scenario: This model suggests that the mcap of Nosana is expected to reach $1.06b ($1,065,955,182) by the end of 2025. The current supply of NOS is 83,400,00 tokens (83.4%). However, 100% of the supply is expected to be fully circulating (100,000,000 tokens) by the end of 2025. Considering future market cap and circulating supply, it will result in $10.65 per NOS per our base scenario.

- Bullish scenario: For our bullish scenario, we employed a different model. Since it is a bullish scenario, we opted for the best-fit exponential model to come up with the long-term valuation for Nosana instead of linear models. Our analysis resulted in the following model:

- This model suggests that the mcap of Nosana is expected to reach $9.8b ($9,844,115,652) by the end of 2032. The current supply of NOS is 83,400,00 tokens (83.4%). However, 100% of the supply is expected to be fully circulating (100,000,000 tokens) by the end of 2032. Considering future market cap and circulating supply, it will result in $98 per NOS per our bullish case scenario.

- Best scenario: In this scenario, the market can exceed our expectations and things that we previously didn't consider come up or believed were low-likelihood events. Potential changes might include a significant shortage of computing power globally combined with the massive proliferation of AI modelling in a short time. To account for this scenario, we are doubling our bullish scenario to account for abnormal scenarios where things can get crazy.

Cryptonary's definitive price targets on NOS

Over the short term, we are confident about NOS's upside potential, and we think it has a decent shot at hitting the 24/25 price targets.

How to buy Nosana

1. Buying on a Centralised Exchange

- Step 1: Choose a centralised exchange

- Step 2: Create and verify your account

- Sign up for an account on the chosen exchange and go through the verification process,

- Step 3: Deposit funds

- Deposit funds into your exchange account. You can typically use bank transfers, credit/debit cards, or cryptocurrency transfers.

- Check the exchange's supported payment methods if you are depositing fiat currency (like USD or EUR).

- Step 4: Buy NOS

- Navigate to the trading section of the exchange.

- Search for the NOS trading pair (e.g., NOS/USDT, NOS/SOL)

- Decide on the amount of SOL you want to purchase and choose between a market or limit order.

- Market order: Buy NOS at the current market price.

- Limit order: Set a specific price at which you want to buy NOS. The order will be fulfilled once the market reaches your specified price.

- Review the order details and confirm the purchase.

- Step 5: Withdraw NOS to your wallet

- After purchasing NOS, it's a good practice to withdraw the tokens to a secure wallet like Phantom for safekeeping.

2. Buying via Phantom Wallet

- Step 1: Install Phantom Wallet

- Download and install the Phantom wallet extension for your browser from the official Phantom website.

- Create a new wallet or import an existing one using your recovery phrase.

- Step 2: Secure your wallet

- Write down and securely store your recovery phrase. This phrase is crucial for recovering your wallet in case of loss or device failure.

- Step 3: Fund your Phantom wallet

- Deposit SOL directly into your Phantom wallet by transferring it from a centralised exchange where you've purchased NOS.

- Alternatively, deposit other Solana-supported tokens stablecoins like USDC or USDT if you plan to swap them for NOS.

- Step 4: Use the built-in swap feature

- Open the Phantom wallet and navigate to the "Swap" tab.

- Choose the token you wish to swap (e.g., USDC) and select NOS as the output.

- Alternatively, enter NOS' contract address: nosXBVoaCTtYdLvKY6Csb4AC8JCdQKKAaWYtx2ZMoo7

- Enter the amount you want to swap and review the transaction details, including the estimated network fees.

- Confirm the transaction and approve it within the Phantom wallet.

- Step 5: Verify the transaction

- Once the transaction is complete, you'll see the updated NOS balance in your Phantom wallet.

Risks to consider before buying Nosana

While the report thus far has consistently supported our bullish stance on Nosana, we must address potential risks and considerations crucial for making informed investment decisions.Macro risks

In crypto, macroeconomic factors wield significant influence over market behaviours and asset performance.Crypto assets lie at the far end of the risk curve. This positioning means that their performance is closely intertwined with broader economic conditions and investor sentiment.

When the macro environment is "risk-on", investors are more likely to pursue higher-risk assets, driving up demand and prices in the crypto market. During these periods, the market often experiences robust growth, buoyed by an optimistic investor outlook and increased capital inflows.

Conversely, investors tend to retreat to safer asset classes in a "risk-off" environment where economic indicators might be less favourable or uncertain—such as during political turmoil, financial crises, or significant policy changes. This shift in sentiment can lead to reduced demand for crypto assets, causing prices to drop and markets to perform poorly.

Given these dynamics, the performance of individual crypto assets, such as NOS, is significantly influenced by the general appetite for risk among investors. If investors feel confident and seek growth through riskier investments, NOS will likely see a positive impact. However, if global economic conditions worsen or uncertainties rise, NOS could face downward pressure as investors move away from riskier assets.

Loss of momentum in the AI narrative

Narratives in the crypto space can rapidly elevate the status and price of assets, as seen with AI and its significant outperformance relative to sectors like decentralised finance (DeFi), exchange-traded funds (ETFs), and Layer 2 solutions (L2). The excitement around AI, bolstered by advancements in technology and its integration into various sectors, creates a bullish sentiment that can lead to substantial price increases. In the fast-paced world of crypto, attention can shift quickly. If a new technology, innovation, or crisis emerges, it can divert attention and investment away from AI-driven assets.

In the fast-paced world of crypto, attention can shift quickly. If a new technology, innovation, or crisis emerges, it can divert attention and investment away from AI-driven assets.

NVIDIA stock price

The rise of the AI narrative in crypto is closely linked to the success of OpenAI's products and NVIDIA's dominance in AI hardware. As NVIDIA's stock prices soared, enthusiasm for AI-driven projects in the crypto space grew. However, this tight connection also introduces risks. Just as Bitcoin influences the broader crypto market, NVIDIA's performance heavily influences AI-related crypto projects. If NVIDIA faces challenges, it could lead to volatility and uncertainty in the AI-focused segments of the crypto market, including Nosana.Invalidation criteria

We are bullish on Nosana and confident that this coin will reward investors handsomely in the medium to long term. However, we have several invalidation criteria for NOS that could make us rethink our thesis and possibly stop being bullish about the project.Number of nodes

The active node count on Nosana is a critical metric for our thesis. With over 1,000 nodes currently providing computational power, Nosana is bridging the gap between the soaring demand for GPUs and the available supply.In the context of the ongoing global GPU shortage, Nosana's ability to maintain and increase its node count is essential. These nodes are not merely operational assets; they represent the platform's capacity to support the exponential growth in AI innovation. A robust and growing node count validates our thesis that Nosana is effectively contributing to the supply side of the GPU equation.

However, the scenario changes dramatically if there's a significant reduction in the number of nodes. Specifically, a 25% drop to 750 nodes would not be a minor fluctuation—it would fundamentally undermine our belief in Nosana's ability to sustain its role in this ecosystem. Such a decline would indicate potential challenges in the platform's operational model or in its ability to attract and retain node operators, which could have far-reaching implications.

Therefore, monitoring the number of active nodes is critical to Nosana's strategic viability. A drop to 750 nodes would necessitate a serious re-evaluation of Nosana's approach and strategy moving forward.

Solana's price

As Nosana operates within the Solana ecosystem, the performance of Solana's native token (SOL) plays a crucial role in the overall health of Nosana's platform and its economic model. Solana's price impacts transaction fees and influences the perception of the ecosystem's strength, liquidity, and development potential.A robust Solana ecosystem provides a strong foundation for projects like Nosana to thrive. However, significant and sustained declines in Solana's price would present serious risks to Nosana's growth trajectory.

A drastic drop in SOL's value could signal broader concerns about the Solana network's stability, which might deter developers, investors, and node operators from participating in projects built on the blockchain. This, in turn, could negatively impact Nosana's operational capacity and scalability.

As part of our invalidation criteria, if Solana's price were to experience a prolonged decline—specifically if it drops by 50% or more over a sustained period—this would raise red flags regarding the ecosystem's long-term viability. Such a scenario would necessitate a re-evaluation of Nosana's potential to capitalise on the Solana network's strengths.

In this case, we would have to reconsider our bullish stance on Nosana, as its success is tied to the health and vibrancy of the Solana ecosystem.

Cryptonary's take

Nosana is a decentralised crowd-computing platform built on the Solana network. It aims to revolutionise software automation by leveraging community-contributed GPU resources. It addresses the global GPU shortage by creating a decentralised grid for computational tasks, particularly in AI workloads.Nosana is still in its early "Genesis" stage but has already outpaced competitors like IO.net in terms of AI model inferences despite having fewer GPU nodes. The platform's native token, NOS, is used for incentives, payments, and governance.

The market for AI and GPU resources is expected to grow significantly, with GPUs being essential for AI development. Nosana, by offering affordable and scalable GPU access through decentralisation, positions itself as a key player in the AI and DePin sectors.

The platform has a strong team, solid tokenomics, and a competitive edge because it is built on Solana, which offers high throughput and low transaction costs. Nosana's early adoption and performance metrics suggest substantial growth potential as it transitions from testing to full-scale implementation.

Overall, Nosana is seen as a promising investment within the AI narrative, particularly within the Solana ecosystem, with the potential for significant upside as the demand for GPU is expected to continue to rise in the coming years.