Now, BTC is in recovery, its dominance is rising, and the price is pumping. But what does this mean for altcoins?

More importantly, how is Smart Money preparing for a post-BTC-ETF market environment?

Today, we analyse recent moves in the crypto market to assess their implications.

We also review the failed FXS halving trade and the importance of quickly invalidating losers.

But it's not all gloom - RBX remains compelling amid ongoing whale accumulation.

Let’s dive in.

Key takeaways

- The recent market-wide price slump was primarily driven by leverage. Bitcoin is recovering fast, but the recovery is slower for altcoins.

- The liquidation event underscores the dangers of excessive leverage without proper risk management, but it also presents an opportunity to snag promising altcoins at a discount.

- Smart Money shows a slight increase in altcoin exposure post-crash, suggesting resilience despite the possibility of a potential sell-off.

- Smart Money's FXS halving trade was invalidated due to insufficient gains. On the positive side, RBX stands out amid market gloom and remains attractive to Smart Money.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Bitcoin's rising tide vs ETH and SOL

With news indicating a high likelihood of the Bitcoin Spot ETFs’ approval on Wednesday, BTC continues to steal the show. For starters, BTC dominance has risen extremely fast, from 51% in late December to 54.53%.Of course, a rise in BTC dominance mostly benefits BTC rather than altcoins. Comparing the BTC, ETH, and SOL charts shows that altcoins haven’t quite recovered as fast as Bitcoin. But more on that in a bit.

BTC

There have been various rationales for Bitcoin’s slump in early January. But from a Smart Money perspective, the charts indicate the crash was mostly driven by leverage.You see, the BTC rally in early January was likely due to traders taking long BTC positions on leverage ahead of the ETF – the dramatic increase in funding rates corroborates this angle.

Adding an interesting layer to this scenario, some Smart Money players saw the massive number of leveraged positions and couldn’t pass up the opportunity to go ‘stop hunting’. And as the price fell, liquidations were triggered, wiping out many leveraged traders.

Thankfully, BTC has not only recovered but also surpassed its pre-Janaury crash levels, demonstrating current demand and strength thanks to the ETF. BTC is now trading up near $47K, and its funding and open interest are much lower than before the crash, indicating less leverage now, which is healthier.

ETH

The liquidation event had a greater impact on ETH, which is still struggling to recover. This indicates that leverage also drove much of ETH’s recent price action.

And with the focus on BTC now, there is less appetite for long ETH after this wipeout.

SOL

With SOL, it becomes even more apparent that the upside was leverage-driven. As there was less demand after the crash, the price did not easily recover.

The slow recovery in ETH and SOL is a theme among many altcoins. And that’s why BTC dominance rose so quickly – simply because altcoins did not recover as strongly.

What does the liquidation event teach us?

The key lesson here is to avoid leverage without proper risk management. During this liquidation event, 20x longs got wiped out by 5% drops, and a cascading effect triggered liquidations down to traders with 10x or even 5x leverage.But beyond the lesson, there’s also an opportunity.

For traders betting on altcoins to track BTC's ETF gains, trading with leverage was an enticing (albeit dangerous) proposition. The resulting liquidations decimated altcoin demand, leaving buyers reluctant to reinvest after such a near miss.

With BTC dominance rising in response to news of the upcoming ETFs and halving, now is not the best time for altcoins. But BTC’s dominance won’t continue to rise indefinitely. So, this is an opportune moment to identify promising altcoins to hold long-term before they start rallying strongly when BTC dominance eventually declines.

How is the Smart Money positioned?

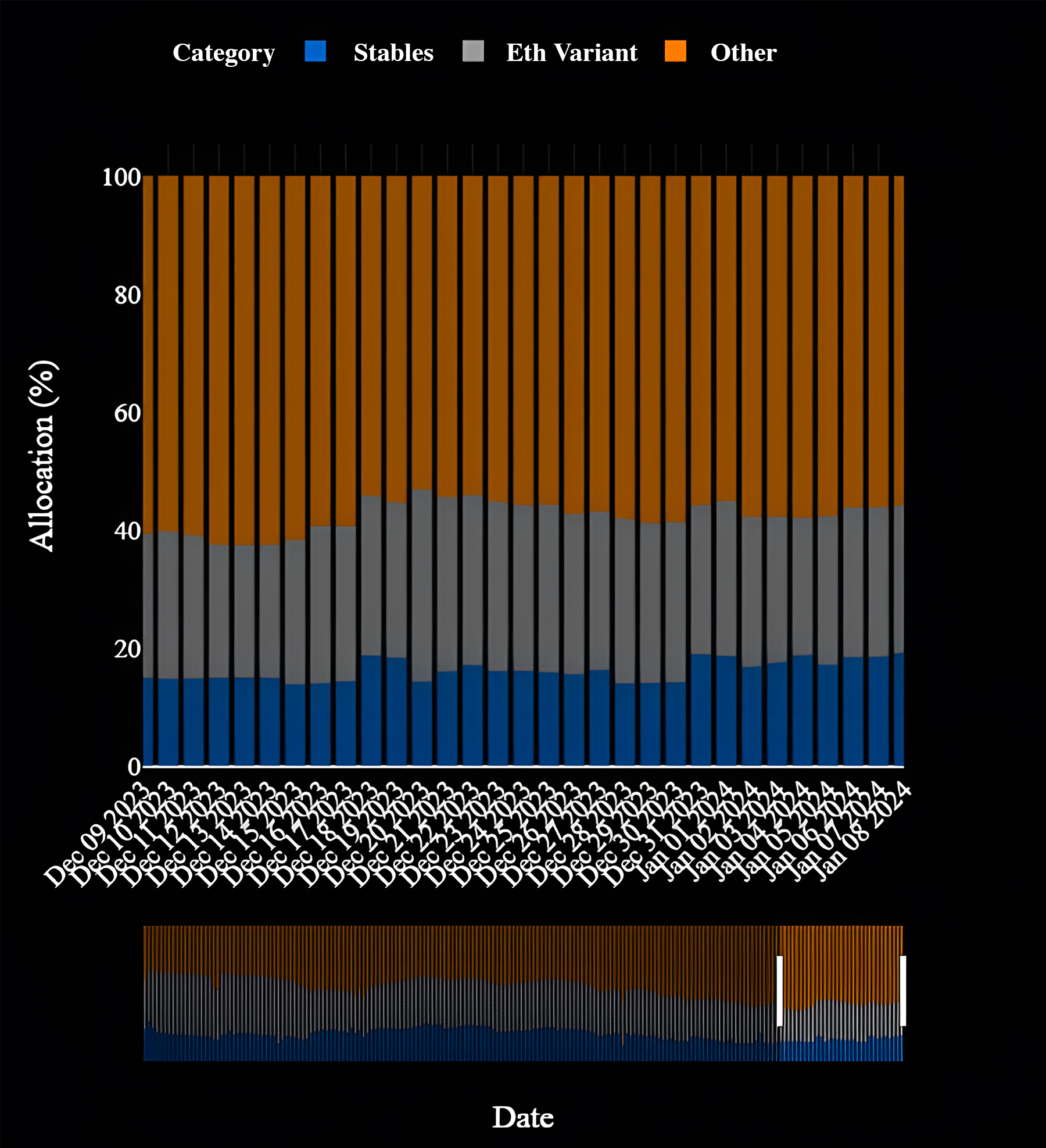

Analysing active Smart Money wallet behaviour shows slight increases in altcoin exposure since the crash, rising from 54.84% on January 1 to 55.44%.ETH declined as Smart Money likely bought the dip on altcoins with their ETH, falling from 26.49% to 25.3%.

On stablecoins, these initially declined but have since increased to 19.25% as people take profits on the recent rally.

Similar trends emerge when examining aggregate Smart Money holder data from Nansen. Overall stablecoin holdings have decreased to lows not seen since December 2021, now at just 10.22% in a downtrend since early 2023.

Some profit-taking has occurred, with holdings rising from 8.89% on Dec 23 to 10.22%, likely ahead of the BTC ETF in case it's a sell-the-news event. But most smart money seems comfortable holding minimal stablecoins.

This suggests that despite traders largely ignoring altcoins, as seen by their underperformance compared to BTC, Smart Money remains confident in their altcoin holdings and has not backed down.

Some profit-taking indicates an expectation of a sell-off on "sell the news." However, Smart Money investors are mostly not getting shaken out by the recent market crash.

Trade analysis: FXS and RBX

This section delves into a detailed analysis of two notable trades from our last Smart Money report: FXS and RBX.We focus on dissecting the dynamics of these trades, understanding the factors that led to their current market positions, and drawing insights that can guide future trading strategies.

The FXS halving trade

Our FXS halving trade has been invalidated. While FXS showed a decent beta to ETH, the gains were not impressive enough, and the halving did not impact the price as much as in previous years.We suggested cutting the position two weeks after the halving on January 3 if FXS failed to show meaningful performance.

From the halving until then, FXS performed from $8.17 to $9.27, a 13.46% gain that was insufficient to show significant results.

Since then, after the broader market crash, FXS really started underperforming due to less appetite for both ETH and altcoins. A cohort of traders likely also sold as they were in a similar trade.

Though our FXS halving trade did not pan out as hoped, all is not lost. Trading is a probabilities game, and sometimes, the odds do not fall in our favour despite careful analysis. But invalidating this trade means we move on, wiser and hungrier.

This does not change much for long-term holders, as we detailed the FXS events for them previously. The trade itself is done, and FXS will not be covered going forward in Smart Money.

RBX: A silver lining in the market gloom

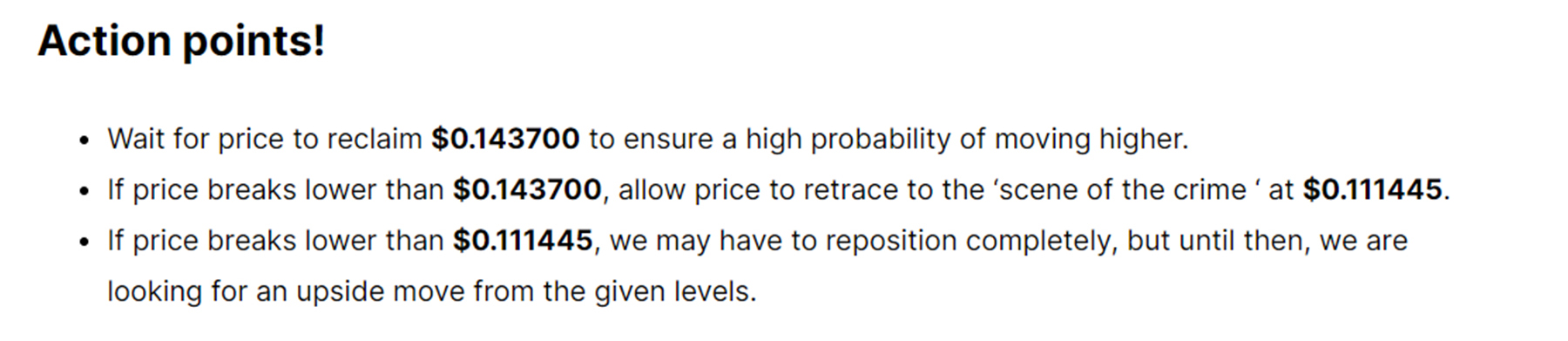

Also, a quick update on RBX. We have good news here. RBX has reached the levels we highlighted as an entry point for spot for buying last week. We highlighted $0.1437 as our ideal entry price. This is also the level that RBX would need to hold so as not to get invalidated.

After a while, we finally reached our $0.1437 target on the 7th of January, and the price quickly bounced back from this level. It is now sitting at $0.1521, meaning that it did not break lower. We are in this trade at the time of writing from the levels outlined.

There has also been a new smart money wallet that we have identified which purchased between January 1, 2024, and January 6, 2024, a total of approximately 670,000.68 RBX tokens for a total amount of approximately $111,545.30

Our two largest smart money wallets we have been tracking for RBX have also continued to hold RBX, still holding 2,959,809 RBX and holding 3,200,886 RBX.

We have great news for you if you're interested in RBX or keen to learn more about RabbitX. We working on an in-depth analysis of RBX this week - stay tuned.

In that deep dive, we'll explore the project in detail, provide a potential valuation, and discuss the long-term potential of the token. So, keep an eye out.

Cryptonary’s take

The current market conditions increasingly favour Bitcoin (BTC) over altcoins, particularly with the impending launch of the BTC ETF, which is expected to boost BTC’s dominance further.However, this trend also unveils an opportunity to scout for promising altcoins. These are likely to rally when Bitcoin's dominance starts to wane, following the typical market cycle where a decline in BTC dominance often leads to capital flowing into altcoins.

Predicting the exact timing of this shift is challenging, but it's an important trend to monitor. Potential declines following the BTC ETF launch could present opportunities akin to the previous crash, adversely affecting leveraged traders.