VisaNet by Visa Inc. is the world's leading payment network. It regularly handles anywhere from 2,000 to 4,000 transactions per second and has the capacity to handle over 50,000 more.

On the other hand, the Bitcoin network can only handle seven transactions per second. The Ethereum network, central to the operation of many decentralised finance (DeFi) protocols, can only handle 20 to 30 transactions per second. Both networks are also subject to high transaction fees.

If we want to replace the centralised, traditional financial system with a decentralised alternative, then it becomes imperative that it be at least usable as the incumbents. This is a huge problem that needs to be solved to advance DeFi and the wider cryptocurrency economy further.

While Ethereum developers are certainly working on solving these issues with L2 scaling and Proof-of-Stake, this blockchain has already solved this scalability issue, and that's why we believe that this third-generation blockchain is a game-changer.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Solana?

Solana is a fast and efficient blockchain platform designed to facilitate the fast, cheap, and scalable execution of decentralised applications (dApps).Launched in 2020, Solana aims to overcome the limitations of other blockchain platforms by implementing innovative technologies that enhance its scalability and performance. The blockchain is capable of processing over 710,000 transactions per second (TPS) without requiring additional scaling solutions, making it ideal for real-time applications such as games and financial services.

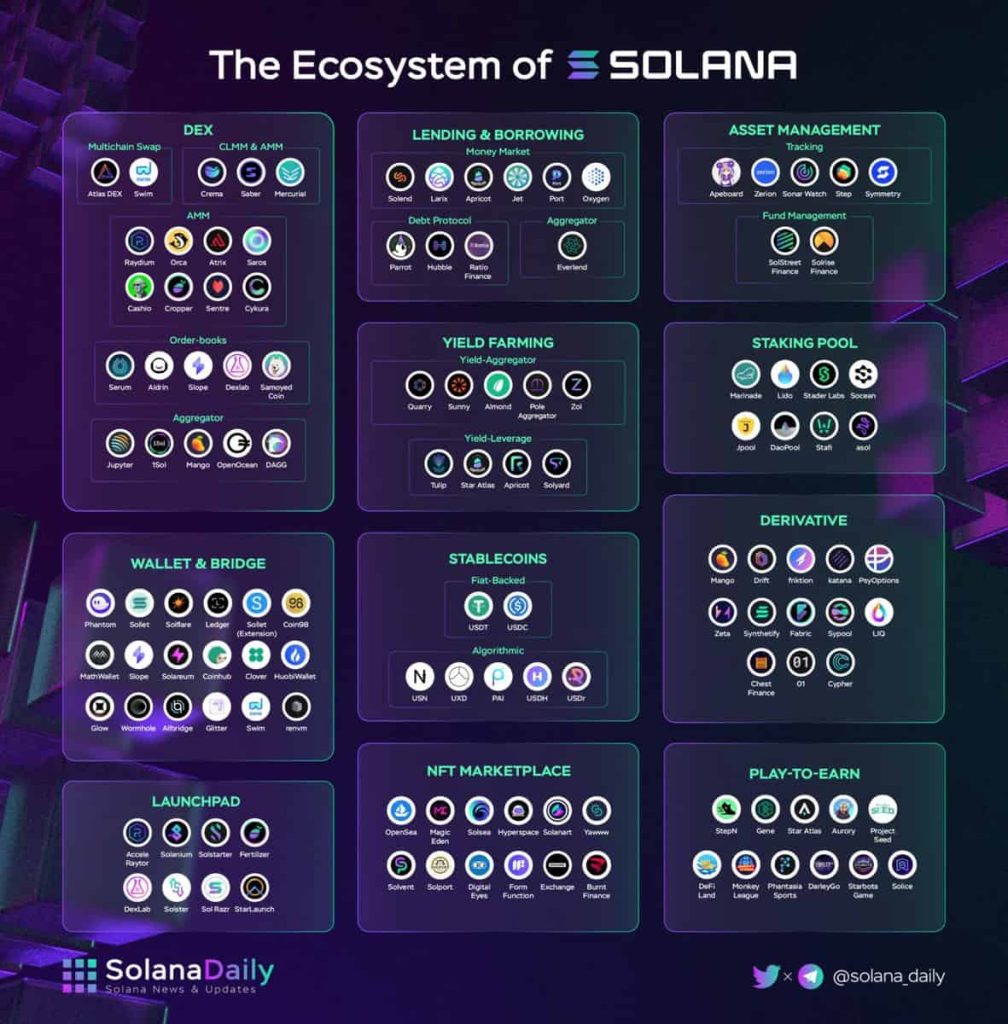

Solana's architecture supports the creation of smart contracts and DApps, offering a versatile solution for various use cases, including decentralised finance (DeFi) platforms and non-fungible token (NFT) marketplaces.

Unlike Ethereum, which relies on multiple blockchain layers for scaling, Solana achieves scalability with a single-layer architecture maintained by a network of powerful computers capable of storing vast amounts of data.

Its native currency, SOL, is used for transferring value and securing the network through staking. It has quickly become one of the top 10 cryptocurrencies by market capitalisation.

How does Solana work?

At the core of Solana's protocol is Proof of History, which provides a cryptographic timestamp for each transaction, serving as a digital record of events occurring on the network.The Proof-of-History (PoH) is not a consensus mechanism per se; it is a component of Solana's Proof-of-Stake consensus feature. PoH is the main innovation that has allowed Solana to boast such fast and efficient transaction processing and verification compared to conventional blockchain networks.

What is Solana's innovation?

Before discussing the investment thesis and potential economic opportunities in Solana, it is important to set the stage by examining Solana's innovation. Solana's technological innovation is a fundamental driver of SOL's potential as a viable asset before other factors such as narrative, sentiment, and liquidity.Solana's Proof of History (PoH)

Solana uses Proof of History, a sequence of computations that allows for the cryptographic verification of the passage of time between two events. This efficient tracking of events contributes significantly to Solana's high throughput and fast block creation time, making it well-suited for applications that require swift and reliable processing.Other blockchains rely on sequential block validation, which requires validators to talk to each other to reach a consensus on the passage of time when a transaction occurs. This slows down the network because every validator node on the network must confirm the previous block of transactions before the next block can begin.

Picture a relay race with three runners and the racetrack as a snapshot of time. The sum of the distance each runner has covered signifies the total work done, but the second runner cannot begin running until the first runner passes the baton to them.

Each validator on the Solana blockchain measures time with its own clock by encoding it using a sequential-hashing Verifiable Delay Function (VDF). Each transaction made on the Solana blockchain is time-stamped, which allows the validator nodes to record and organise them without needing confirmation from the other nodes.

Going back to the relay race analogy, with the Solana blockchain, all three runners can run simultaneously without needing to wait for a baton to be passed. Collectively, they are doing the same amount of work as other teams, but they do the work in one-third of the time it takes others to complete the race.

The Solana network is even faster than this, but this analogy can help us understand one of the main reasons its Solana is so much faster than other blockchains.

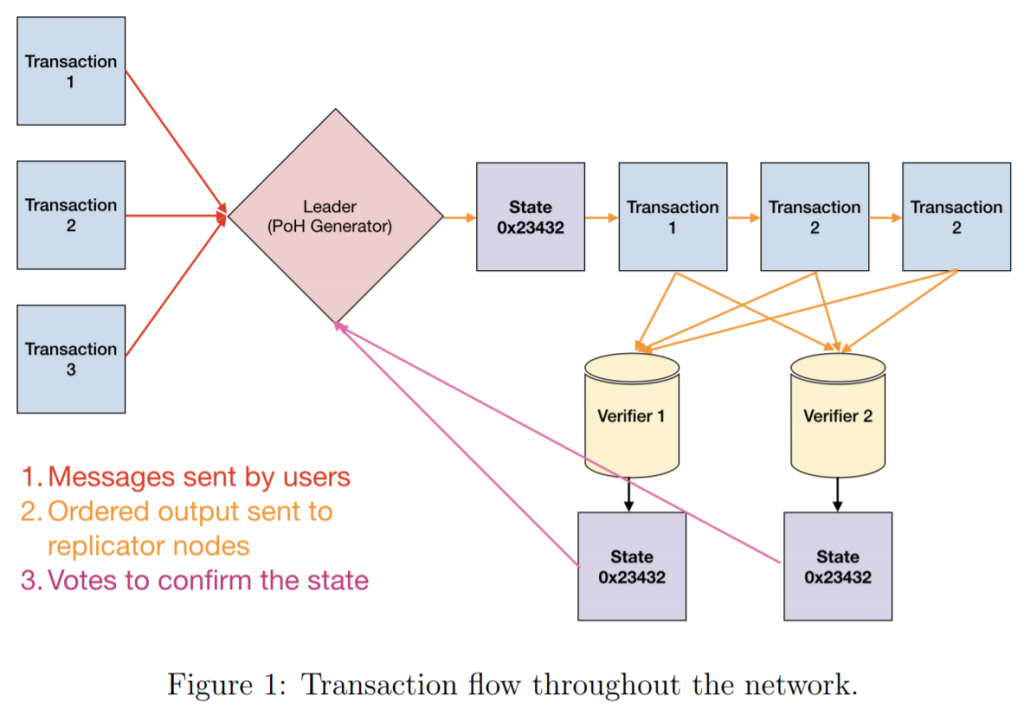

In Figure 1, you can see that three transactions are executed simultaneously and that the 'Leader' node, which represents the Proof-of-History generator, organises these transactions in the proper order. This model suggests a centralised process. The Leader node is rotated every four blocks and delegates to a verifier node.

This process is called Delegated Proof-of-Stake and uses the VDF algorithm based on the timestamp of each transaction. This produces a new network state that is then shared with other verifier nodes, which carry out a similar transaction using copies of the original network state.

The nodes then vote to confirm the ledger's state, creating the next set of transactions. These new transactions are then ordered using the new network state as a reference point. This process repeats itself continually.

Tower BFT

BFT stands for 'Byzantine Fault Tolerance', named after the Byzantine Generals' Problem. It is a feature of distributed networks that allows a consensus or agreement on the same value or outcome to be reached even when some of the network nodes give inaccurate information or fail to respond.In simple terms, the objective of the BFT mechanism is to prevent system failure by distributing decision-making across the network so that the influence of any faulty or malicious nodes is reduced. This process secures the integrity of the network. All blockchains have some form of BFT built into their coding.

The Solana blockchain Tower BFT consensus mechanism is a variant of the BFT algorithm that uses PoH as its cryptographic clock to reach consensus inside the blockchain. This is important because each node can create many different versions of the Solana ledger, which work independently, but only one is correct.

To ensure that the correct state of the ledger is maintained, validator nodes must vote on and establish consensus on which ledger is accurate. Once their collective vote is locked in, that particular version cannot be changed, and this will become the new iteration of the ledger. The new ledger is then passed on to the 'Leader' node so that new transactions can be processed, as seen in Figure 1.

Other innovations

Combining PoH with Tower BFT has led to Solana's main innovative breakthrough; however, six other new developments have also improved Solana's network speed. These improvements include Turbine, Gulf Stream, Sealevel, Pipelining, Cloudbreak, and Archivers.- Turbine increases the efficiency of bandwidth usage, allowing for a faster transaction settlement.

- Gulf Stream eases the process of block confirmation, improving the network throughput.

- Sealevel allows thousands of smart contracts to run parallel to each other as long as they are in the same state of the blockchain, improving runtime.

- Cloudbreak achieves scalability by organising a database that allows transaction data to be simultaneously read and written.

- Archivers are enabled through the PoH technology, which distributes the ledger across millions of replicator nodes around the world. This allows the decentralised storage of data, reducing hardware requirements. The Solana network generates an estimated four petabytes (4000 terabytes) of data every year, and it would be cumbersome, forcing every node to store all of the data Solana generates. This sheer volume of data can limit network membership to a centralised few that have the necessary storage capacity. Archivers allow more members to access the network and store their data.

- Pipelining creates streams of input data that are shared amongst various nodes, allowing them to be processed faster. This can be understood through the analogy of cleaning clothes. You must wash, then dry, and then fold each load of clothes. If you have several loads, you can place one load in the washing machine, another in the dryer, and you can fold another simultaneously. You will end up with the same amount of work completed but much shorter time than if you washed, dried, and folded one load before starting another.

The bullish case for Solana

Ethereum has solidified its position as the leading smart contract platform, prioritising decentralisation and security - core tenets of blockchain technology. Its strength is facilitating high-value transactions, focusing on censorship resistance and trustless execution.However, Ethereum needs help meeting the surging demand for low-cost, high-volume applications like micropayments, gaming, and social media. While we remain confident in Ethereum's Layer-2 scaling roadmap, it is important to recognise Solana as a compelling alternative for certain use cases.

As discussed in an April 2021 article, Solana's unique design balances decentralisation and security while optimising usability, throughput, and scalability. This strategic positioning makes Solana well-suited for applications involving high transaction volumes and low-value transactions.

Solana is simply the people's blockchain, and inasmuch as the mainstream adoption of Web3 doesn't stall or stop, Solana is well-positioned to continue to be a major player in the decentralised economy. While Solana was badly hit during the last bear market and the attendant headwinds from the FTX fallout, the Solana ecosystem has bounced back with a vengeance due to its very high throughput, negligible transaction costs, and excellent user interface.

Market opportunity

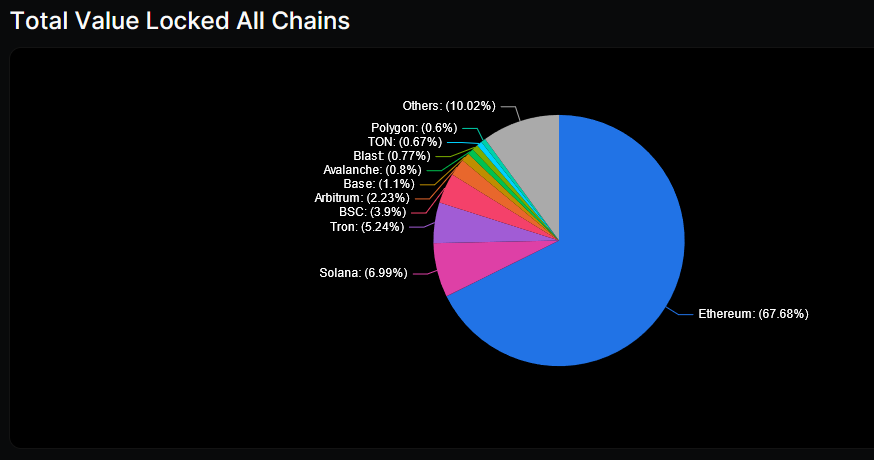

Solana's target market primarily involves high-frequency operations like payments, trading, gaming, AI, and DePIN.In terms of TVL, Solana holds a ~7% market share within the scope of DeFi. With a TVL of $11 billion to Ethereum's $108 billion, Solana is roughly 10% the size of Ethereum.

Solana's relative size in DeFi does not negate the use of liquid staking for capital efficiency, allowing staked interest-bearing tokens to be used within DeFi protocols. This is why we think the start of LSD-Fi protocols, which are DeFi primitives built on top of liquid staking protocols, will be a massive step for Solana to attract new liquidity.

One example is stablecoins over-collateralised by SOL, leveraging liquid staking tokens to generate yield. This concept already exists on Ethereum with protocols like Lybra Finance. Recently, the largest DEX aggregator on Solana Jupiter has been the firstto propose a design to launch a similar stablecoin on Solana.

Solana's advantage over Ethereum is that its staking yield is higher, averaging 7-8% on the highest-yielding liquid staking protocols. This means that if a stablecoin backed by staked SOL were to launch, its yield would average around 7-8%, based on staking reward, and outperform the yield users can earn on ETH-backed stablecoins.

We are looking forward to more designs like this that leverage LSTs to create products for users to generate higher returns on their assets on Solana.

Firedancer: The next big step for Solana

Blockchain networks' scalability and transaction throughput hinge on efficient data propagation, with Solana emerging as a leader in data capacity.However, current limitations in Solana's transactions per second (TPS) and block time necessitate a transformative catalyst, and Firedancer, a revolutionary Solana validator client by Jump Crypto, presents a compelling solution.

At the 2023 Breakpoint event, Firedancer's introduction on the testnet showcased a remarkable performance leap, surpassing the existing Solana Labs client by 10 to 100 times.

Firedancer is crucial because it changes how Solana scales. It moves the limitations from software to hardware, aligning with the idea that as technology gets better, Solana can handle more transactions. While reaching 1 million TPS might take a bit of time, Firedancer sets the stage for big improvements in scalability.

The tests on the testnet show that Solana's efficiency notably improves when running on Firedancer, suggesting it can handle more transactions as hardware evolves.

This anticipated improvement positions Solana competitively, potentially reaching 5,000 TPS or even 10,000 TPS in the medium term—a substantial enhancement compared to the current 500 TPS for non-vote transactions.

The complete Firedancer suite is anticipated to go live on the testnet sometime later this year. This phased-release approach strategically places Firedancer as a significant catalyst for Solana's development.

SuperToken: Catalysing innovative use cases

Solana has rolled out a major innovation called SuperToken, previously known as Token2022. This new token standard will eventually replace Solana's current SPL standard.SuperToken is important because it enables developers to build novel use cases that were not previously possible on Solana. In some cases, SuperToken unlocks functionality that is not even achievable on Ethereum, giving Solana a competitive edge.

SuperToken adds a tremendous number of new capabilities. Here are some examples to highlight why this is impactful.

- Immutable ownership: Prevents unauthorised token transfers, ensuring secure transactions

- Confidential transfers: Enables private transactions via zero-knowledge proofs, enhancing DeFi privacy

- Interest-bearing tokens: Allows tokens to accumulate interest, enabling staking rewards

- Transfer fees: Facilitates sustainable community funding by redistributing percentages of fees

- Transfer hooks: Triggers custom programs during token transfers, allowing use cases like royalty distribution

- Non-transferable tokens: Prevents token transfers, suitable for ticketing to prevent scalping

Driving ecosystem innovation with VC funding

Venture capital (VC) is pivotal for crypto innovation, and the Solana ecosystem is uniquely positioned to benefit from VC participation.

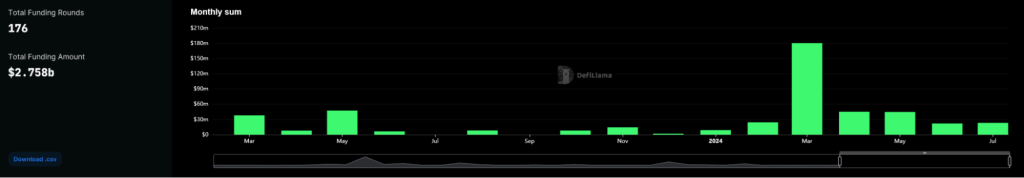

VC funding of Web3 projects generally slows down during bear markets, and Solana saw an 85% decline in monthly VC funding, from $115 million in 2021 to $17 million in 2023. However, new capital has flowed, and March 2024 saw the highest numbers raised since January 2024, with $180 million raised in total. The Solana ecosystem has raised $2.758 billion in VC funding throughout its history. The six months of January to June 2024 accounted for $325.4 million, or ~12% of the total.

This shows a healthy and growing interest in investment in Solana's ecosystem. According to Solana Foundation data, Solana hackathons have attracted over 50,000 participants and resulted in 3,000+ project launches. Past winners have raised $600 million in follow-on funding.

So, where does that leave SOL against its competition?

Solana's competitive edge

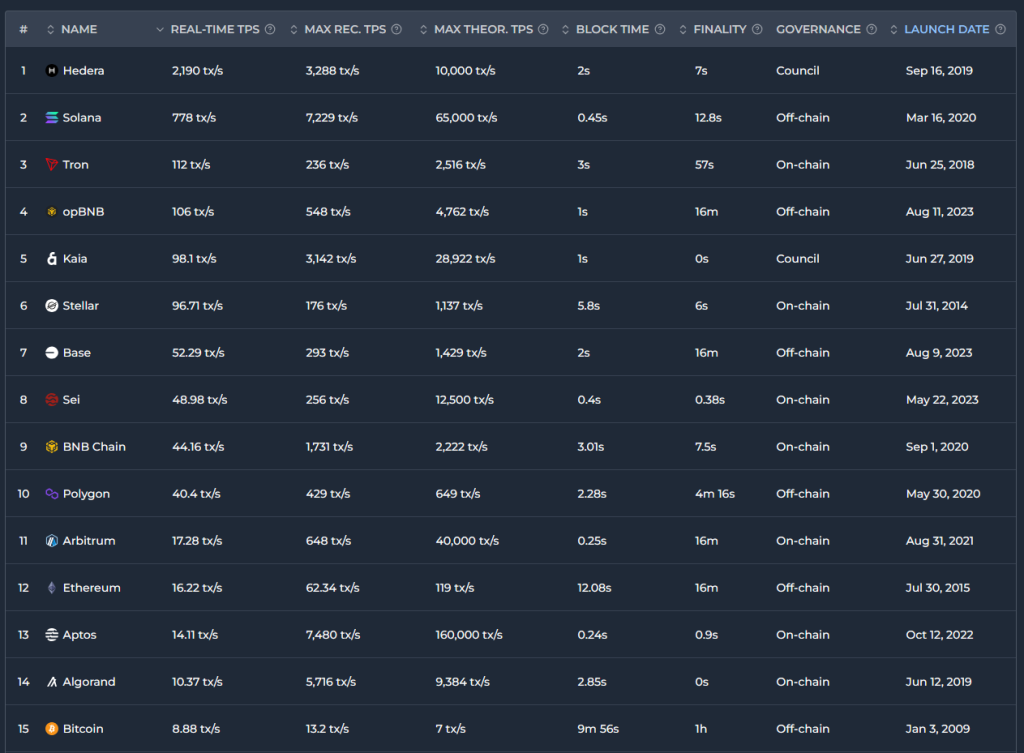

Solana has consistently shown its speed and cost per transaction to be superior to most other chains - only Hedera is posting faster speeds.

Its main competitor is Ethereum, but it has struggled to attract the same level of capital. However, in actual infrastructure metrics (speed, cost per tx, and finality time), Ethereum will struggle to get anywhere near Solana in the foreseeable future.

Ethereum's Layer 2s, like Arbitrum, Optimism, zkSync, etc., are essentially offshoots of Ethereum. However, they benefit from the trust that Ethereum has built up based on continuous reliability and a proven track record.

Solana's valuation exercise + price targets

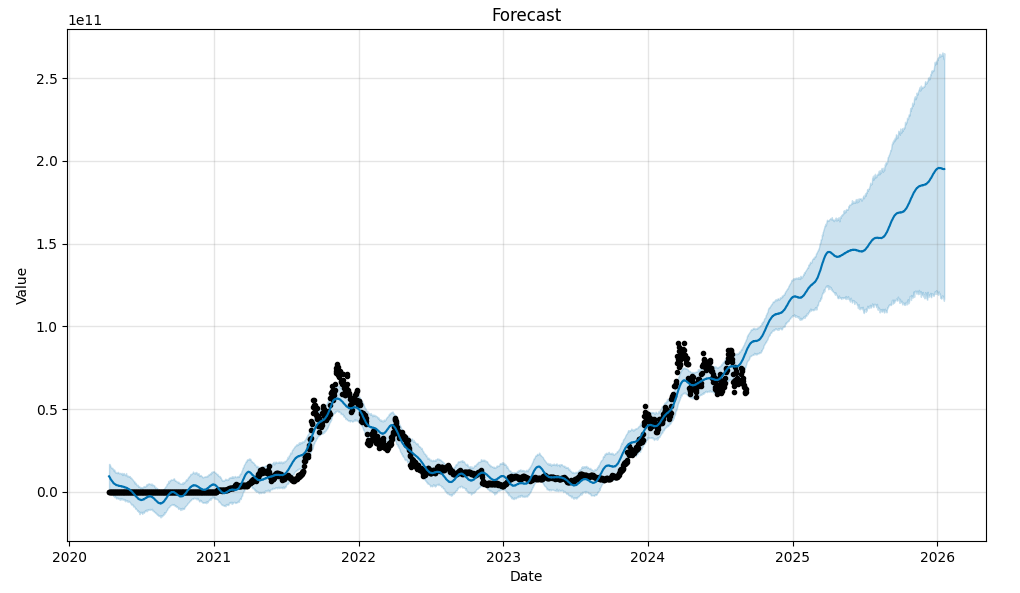

Similar to our previous valuation frameworks, we employed a mix of quantitative and qualitative methods for Solana’s valuation. We downloaded the historical market cap of Solana and utilised a machine-learning model based on proprietary data to forecast future market cap, resulting in the following projections:For the 24/25 cycle

The graph shows a time series forecast with actual values (black line) and predicted values (blue line) along with a confidence interval (shaded area).

Based on the model above, we came up with three different scenarios.

- Bearish scenario: Our machine learning model suggests that the mcap of Solana is expected to reach $119b ($119,510,000,000) by the end of 2025. The current supply of Solana is 466,966,893, while inflation is 5% annually. Thus, by 2025, the circulating supply is expected to be 490,315,237. Considering future market cap and circulating supply, it will result in $243 per SOL in the bearish scenario.

- Base scenario: Our machine learning model suggests that the mcap of Solana is expected to reach $194b ($194,757,000,000) by the end of 2025. By 2025, the circulating supply is expected to be 490,315,237. Considering future market cap and circulating supply, it will result in $397 per SOL in the bearish scenario.

- Bullish scenario: Our machine learning model suggests that the mcap of Solana is expected to reach $285b ($258,671,000,000) by the end of 2025. The current supply of Solana is 466,966,89, while inflation is 5% annually. Thus, by 2025, the circulating supply is expected to be 490,315,237. Considering future market cap and circulating supply, it will result in $527 per SOL in the bullish scenario.

- Best scenario: In this scenario, the market can exceed our expectations and things that we previously didn’t consider come up or believed were low-likelihood events. Potential changes might include a drastically new tech stack or the failure of Ethereum with full capital flowing to Solana, making it the de-facto platform for smart contracts and DeFi. To account for this scenario, we are doubling our bullish scenario to account for euphoric scenarios where things can get crazy.

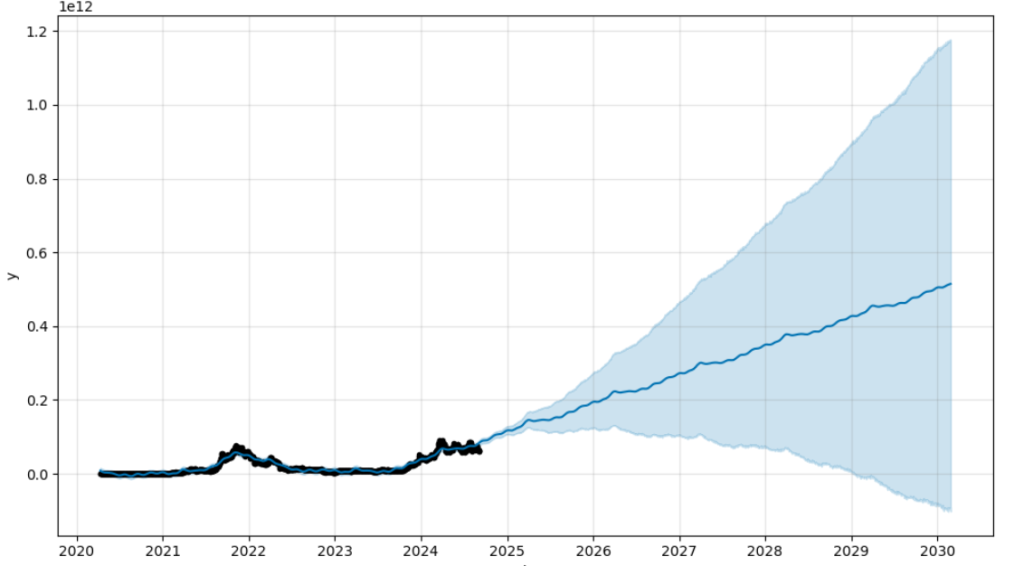

For 2032

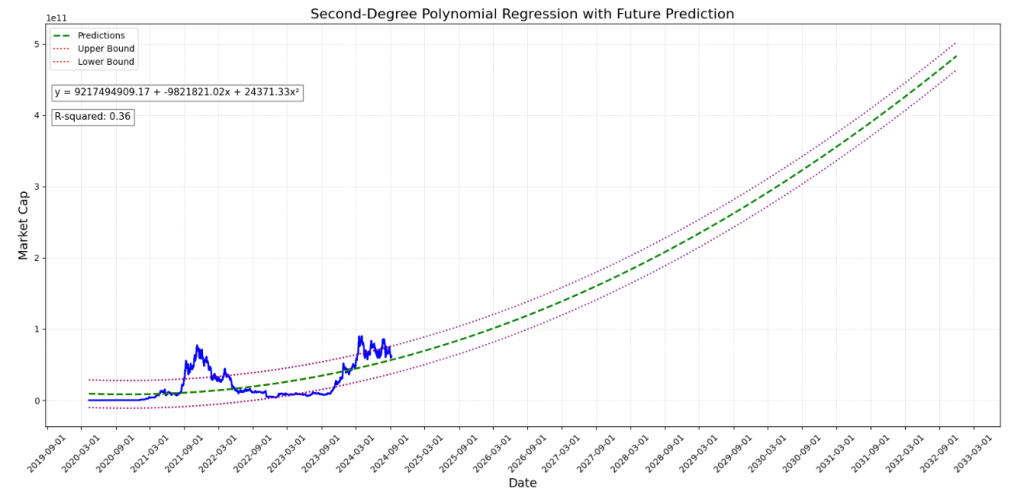

For long-term projection, our previous model resulted in a massive prediction uncertainty: the confidence interval widens significantly over time, indicating a high potential error in the predictions, especially after 2025.

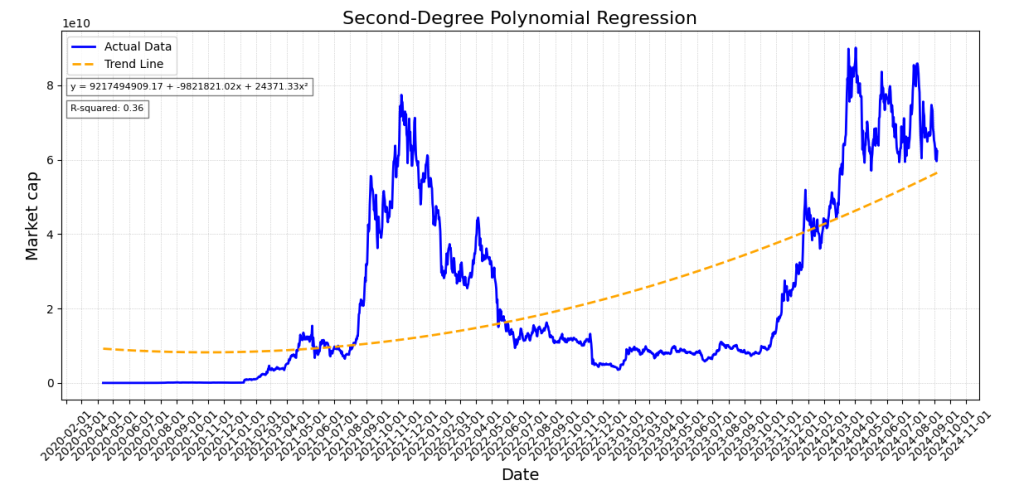

For this reason, we decided to employ a different statistical model. To be more specific, we used a second-degree polynomial model that resulted in R²=0.3454.

The Y-axis represents the market capitalisation of SOL, while the X-axis represents time. The fitted line (rising yellow line) shows a steady upward trend, indicating an accelerating growth pattern over time, consistent with the quadratic nature of the model.

This model isn’t perfect either, and it explains about 34.54% of the variance in the data. However, we improved the model by adding/substrating 1 standard deviation of errors for higher accuracy, which again resulted in 3 different scenarios.

- Bearish scenario: Based on this model, the mcap of Solana is expected to reach $463b ($463,965,354,840) by the end of 2032. The current supply of Solana is 466,966,893, while inflation is 5% annually. However, the inflation rate is expected to go down gradually at a rate of 15% per year, eventually stopping at 1.5% inflation per year. Thus, by 2032 the circulating supply is expected to be 592,703,416. Considering future market cap and circulating supply, it will result in $782 per SOL in the bearish scenario.

- Base scenario: Our machine learning model suggests that the mcap of Solana is expected to reach $483b ($483,386,167,508) by the end of 2032. The circulating supply is expected to reach 592,703,416 by that time. We will assume here that revenue (fees generated by the network) will burn half of the inflation. Considering future market cap and circulating supply, it will result in $879 per SOL in the bearish scenario.

- Bullish scenario: This scenario suggests that the mcap of Solana is expected to reach $502b ($502,806,980,176) by the end of 2032. The circulating supply is expected to reach 592,703,416 by that time. Since this is a bullish scenario, we will assume that the network fees will be enough to burn all the newly emitted tokens. Thus, the supply won’t change (inflate) in this scenario and will remain the same at 466,966,893 tokens. Considering the future market cap and circulating supply, it will result in $1076 per SOL in the bullish scenario.

- Best scenario: In this scenario, the market can exceed our expectations and things that we previously didn’t consider come up or believed were low-likelihood events. Potential changes might include a drastically new tech stack or the failure of Ethereum with full capital flowing to Solana, making it the de-facto platform for smart contracts and DeFi. To account for this scenario, we are doubling our bullish scenario to account for euphoric scenarios where things can get crazy.

Cryptonary's definitive price targets on SOL

Over the short term, we are confident about Solana’s upside potential, and we think it has a decent shot at hitting the 24/25 price targets.However, 8 years is a very long time in crypto, so, we wouldn’t be too concerned about Solana’s long-term prospects for 2032. At the peak of this bull run, we will reevaluate Solana’s position as we head into the 2027/2028 cycle, and we will then be in a better position to be more confident about what 2032 potentially holds for Solana.

How to buy SOL

1. Buying on a centralised exchange

- Step 1: Choose a centralised exchange

- Step 2: Create and verify your account

- Sign up for an account on the chosen exchange and go through the verification process,

- Step 3: Deposit funds

- Deposit funds into your exchange account. You can typically use bank transfers, credit/debit cards, or cryptocurrency transfers.

- Check the exchange's supported payment methods if you are depositing fiat currency (like USD or EUR).

- Step 4: Buy SOL

- Navigate to the trading section of the exchange.

- Search for the SOL trading pair (e.g., SOL/USD, SOL/EUR, SOL/BTC).

- Decide on the amount of SOL you want to purchase and choose between a market or limit order.

- Market order: Buy SOL at the current market price.

- Limit order: Set a specific price at which you want to buy SOL. The order will be fulfilled once the market reaches your specified price.

- Review the order details and confirm the purchase.

- Step 5: Withdraw SOL to your wallet

- After purchasing SOL, it's a good practice to withdraw the tokens to a secure wallet like Phantom for safekeeping.

2. Buying via Phantom wallet

- Step 1: Install Phantom wallet

- Download and install the Phantom wallet extension for your browser from the official Phantom website.

- Create a new wallet or import an existing one using your recovery phrase.

- Step 2: Secure your wallet

- Write down and securely store your recovery phrase. This phrase is crucial for recovering your wallet in case of loss or device failure.

- Step 3: Fund your Phantom wallet

- Deposit SOL directly into your Phantom wallet by transferring it from a centralised exchange where you've purchased SOL.

- Alternatively, deposit other Solana-supported tokens like USDC or USDT if you plan to swap them for SOL.

- Step 4: Use the built-in swap feature

- Open the Phantom wallet and navigate to the "Swap" tab.

- Choose the token you wish to swap (e.g., USDC) and select SOL as the output.

- Enter the amount you want to swap and review the transaction details, including the estimated network fees.

- Confirm the transaction and approve it within the Phantom wallet.

- Step 5: Verify the transaction

- Once the transaction is complete, you'll see the updated SOL balance in your Phantom wallet.

Risks to consider before buying SOL

While the report thus far has consistently supported our bullish stance on Solana, we must address potential risks and considerations crucial for making informed investment decisions.FTX estate holdings

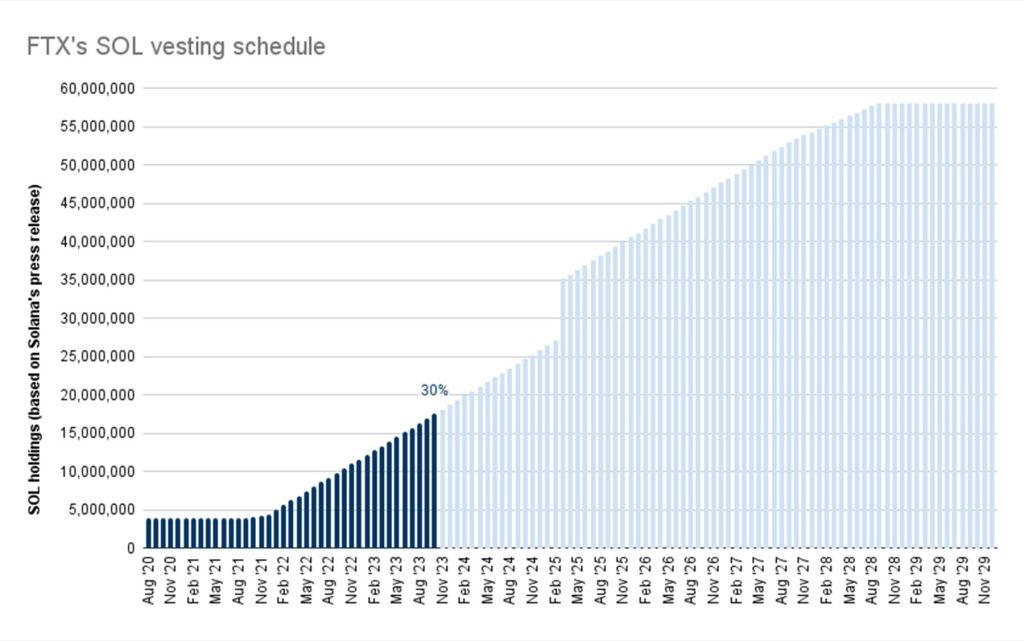

The FTX estate still holds $3,251,514,416 in vested SOL, scheduled to unlock over the next 6 years. This introduces additional selling pressure on Solana, with a total of 58,086,686 SOL vested.As of now, 17,543,782 SOL has been unlocked. This amount is expected to increase to 26,437,269 by January 2025, representing an additional 8,893,487 SOL that will be unlocked. That's equivalent to $497,267,672 worth of SOL in selling pressure.

The amount of SOL that unlocks will then steadily increase in 2025, as seen in the chart below.

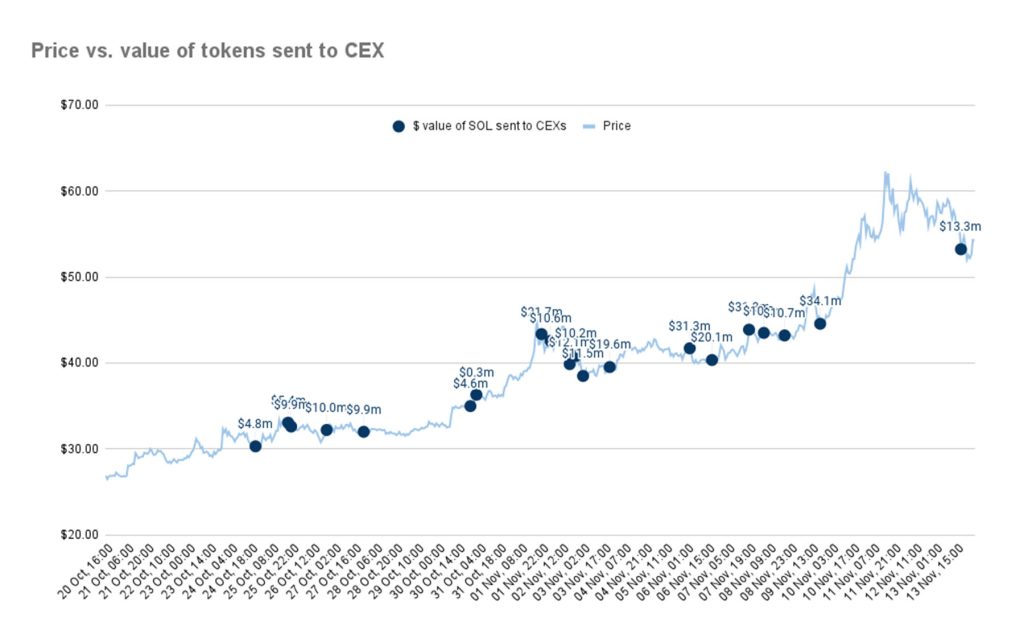

While $497,267,672 sounds like a significant amount of selling pressure, it is important to note that in the last few months, the FTX Estate has sold 6,995,678 SOL, worth $283,004,537, at an average price of $40.45, and this has not halted SOL from rallying further.

Regarding the SOL that FTX can directly sell, the FTX cold wallets currently hold almost no more SOL. While they still possess some liquid SOL, it's staked in liquid stake solutions. A 1.25 million SOL is still locked but could be easily withdrawn and sold.

The FTX estate has sold 6,995,678 SOL without much price impact. This liquid amount of SOL amount might slow down SOL's growth in the coming months. However, it shouldn't cause major downturns unless the overall market sees a significant decline in the coming months.

We also don't foresee the upcoming sales of vested SOL from the FTX Estate adversely impacting SOL from now until 2025 to the extent that it significantly underperforms.

However, in our valuation of SOL, we have considered this risk and adjusted our assessment of SOL relative to ETH downward, establishing a more conservative target.

Increased competition

The second risk for Solana is a more straightforward one that applies to any blockchain or protocol currently enjoying an advantage: increased competition.While Solana is currently at the top of its class in many aspects, there is a risk that existing or new blockchains may improve to outperform Solana. This outperformance may allow them to capture market share in its specific niches.

There are two points that we will be monitoring for this:

1. Ethereum's advancements in scaling and Layer 2 adoption

If Ethereum progresses more rapidly than anticipated with its scaling roadmap and effectively embraces layer 2 solutions, this could pose a risk for Solana. It becomes particularly noteworthy if Layer 2 solutions with comparable performance and capabilities to Solana emerge. It will be important to monitor new layer 2 solutions like Layer N and Nil, which will launch soon, and compare their performance with Solana.2. Launch of a new layer 1 blockchain with similar objectives

Currently, no existing layer 1 blockchain can compete with Solana in terms of its usability and stability. However, the potential launch of new blockchains with similar goals poses a risk. One blockchain we are monitoring as a potential competitor is Monad, which utilises a technology similar to Solana and is built on the EVM.So far, we don't perceive competition as a significant risk because these blockchains have a massive disadvantage. Compared to Solana, they've had less time to develop a community, culture, and ecosystem. Additionally, the Ethereum scaling roadmap has mostly experienced delays. However, if we observe notable developments that alter our thesis, our community will know first.

Blockchain outages (honourable mention)

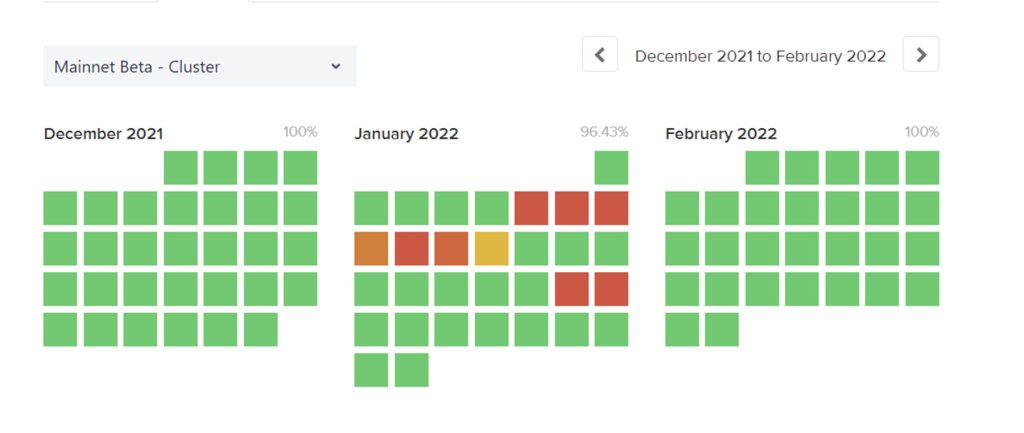

One of the key issues Solana faced in 2022 and the start of 2023 was its constant struggle with blockchain outages. Users began to lose trust in the reliability of the blockchain, and institutional players essentially started to view Solana as a failed experiment.

However, a notable transformation occurred in the first half of 2023. Solana has had only one outage in February and none for the remainder of the year. This signifies a substantial improvement in network stability, nearing nearly 100% uptime in 2023, with the last quarter showing consistently positive performance.

The story is the same for 2024, with Solana maintaining its hot streak of uptime. The introduction of the 1.14 network upgrade played a pivotal role in resolving these outages, enhancing speed and scalability. It has put Solana in a stronger position to focus on innovation rather than patching bugs.

After 1.14, the next significant upgrade was v1.16, which introduced substantial benefits to the Solana network and its users and enhanced the platform in several key ways.

- Dramatic RAM usage reduction for validators: v1.16 introduces a substantial drop in RAM requirements for validators, decreasing from ~120GB to ~39 GB. By shifting from RAM to disk-based account indexing, operational costs and hardware requirements for validators are markedly reduced. This efficiency gain improves overall network performance and lowers barriers to entry for new validators, promoting further decentralisation and enhancing security.

- Confidential transfers for privacy: Integration of Confidential Transfers, based on zero-knowledge proofs, enables encryption of token balances and transaction amounts on SPL tokens. Unlike anonymity alone, this prioritises confidentiality without sacrificing security. The privacy upgrade makes Solana more appealing, especially for users who value transaction confidentiality.

- Enhanced support for zero-knowledge proofs: v1.16 brings improved support for zero-knowledge proofs via alt_bn128 syscalls, streamlining the development of complex, privacy-oriented dApps. This expands Solana's use cases and value proposition, making it adaptable for diverse applications and attractive to a wider developer/user base.

Cryptonary's take

We are bullish on Solana, and that bias is obvious, but this isn't mindless bullishness.Solana is uniquely positioned to win due to its remarkable scalability, unparalleled speed, and robust ecosystem. With its innovative Proof-of-History (PoH) consensus mechanism, Solana delivers an unrivalled capacity to handle thousands of transactions per second without compromising security or decentralisation. This technical edge allows it to support a thriving ecosystem of decentralised applications (dApps) that require high throughput and low latency, such as DeFi platforms, NFT marketplaces, and Web3 applications.

We are confident that the SOL token deserves a spot in your portfolio because it represents not just a cryptocurrency but an entire ecosystem poised for exponential growth. Solana's strong fundamentals, strategic vision, and active community support provide a solid foundation for its long-term success.

Investing in SOL means investing in a future where blockchain technology becomes more accessible, efficient, and impactful. The time to capitalise on Solana's potential is now, as it continues to build momentum and capture market share across various sectors. This is not just a fleeting trend; Solana is shaping the future of decentralised technology, and it is well-positioned to deliver substantial returns on investment.

Content ledger

- Proving History with Solana: Proof of History

- Staking Solana

- Is Solana ready to take on Bitcoin and Ethereum?

- Will Solana surge back with a ChatGPT integration?

- What happens to Solana after the FTX collapse?

- Compressing the Solana chain

- https://cryptonary.com/market-notes/solana-defies-death-with-nasa-grade-record/

- Is Solana in trouble? Worst, base, and best-case scenarios

- Is Solana all hype and no substance?

- Is Solana back from the dead? Four vitals to monitor

- Can Solana become the Apple of crypto?

- Down but not out - Why Solana remains a compelling long-term bet