Much like the internet has transformed how information is stored and communicated without geographical borders, Bitcoin allows money to flow from one part of a planet to another without anyone capable of stopping or reverting the transaction.

Within 15 years of its launch, Bitcoin has become the ninth-biggest asset in the world.

Our Bitcoin thesis is actually straightforward. Bitcoin will probably not make you an overnight millionaire, but in the long term, you’ll be better off holding BTC than storing your wealth in any of the other fiat currencies in the world.

Bitcoin is at the sweet spot between stability and upside potential.

Let’s dive in.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Bitcoin?

Bitcoin is functionally a peer-to-peer version of electronic cash designed to enable one party to send funds to another without needing an intermediary like a bank, payment processor, or other financial institution.However, to fully understand Bitcoin, we need to think of it in terms of Bitcoin (the blockchain network) and Bitcoin (the currency $BTC).

Bitcoin, the network

The Bitcoin network serves as the infrastructure that enables the creation, transfer, and verification of $BTC. It provides a decentralised platform where transactions are processed, recorded, and secured using blockchain technology.The network is decentralised in the sense that no single entity controls it. Instead, it is maintained by a global community of users and miners. Anybody can set up a node to participate in the management of the Bitcoin network.

The miners compete to solve complex mathematical problems (PoW consensus) to validate transactions and add new blocks to the blockchain. Miners are rewarded with new bitcoins (block rewards) and transaction fees for their efforts, incentivising them to secure the network.

The network's security is achieved through cryptographic techniques and the PoW mechanism, making it extremely difficult to alter transaction history. The network's design and operation ensure that all transactions are transparent, immutable, and resistant to censorship.

Bitcoin, the currency

Bitcoin ($BTC), the currency, is a digital asset and medium of exchange that operates on the Bitcoin network. It is the network's native currency, used to facilitate transactions and incentivise participants like miners.Bitcoin's capped supply of 21 million coins makes it a deflationary currency. This scarcity is designed to increase Bitcoin's value over time as demand grows.

As a form of money, Bitcoin is highly divisible, with one Bitcoin being divisible into 100 million smaller units called satoshis. This allows for microtransactions and flexibility in pricing.

Bitcoin transactions do not require personal information, offering a level of privacy. Anyone with an internet connection can access and use Bitcoin regardless of where they are in the world.

Who created Bitcoin?

The team behind Bitcoin is shrouded in mystery, primarily because its creator, Satoshi Nakamoto, remains an anonymous figure despite the widespread influence of their invention.Nakamoto was active in developing Bitcoin until December 2010, after which they gradually reduced their involvement in the community. Satoshi then handed over control of the Bitcoin source code repository and network to Gavin Andresen, a prominent developer, and other members of the community while fading into the background.

The identity of Satoshi Nakamoto has never been confirmed, and their exact motivations remain part of Bitcoin's enduring enigma. The anonymity of Satoshi has led to numerous speculations and investigations, but none have definitively uncovered who they really are.

The bullish case for Bitcoin

The bullish case for Bitcoin is simple – it is the future of money.Bitcoin emerged from the need to protect personal freedoms, sovereignty, and privacy. In a world where centralised institutions like banks can freeze accounts and governments can garnish your money, Bitcoin exists as a decentralised form of money immune to the overreach of governments and their agents.

For example, the Canadian Truckers' protest saw government intervention to freeze funds, showcasing the vulnerability of personal finances to state actions. Financial service live Mercury can suddenly decide to stop serving an entire demographic of users, and other services like PayPal can decide to only offer send-only services in certain countries, severely limiting financial autonomy.

In a world where any country or institution can freeze and confiscate the financial assets of any individual, self-custody and decentralisation become paramount.

But beyond its philosophical origins, there are five primary economic reasons to be bullish about Bitcoin.

1. Bitcoin as a store of value

Bitcoin has increasingly been recognised as a viable store of value, often referred to as "digital gold." For starters, Bitcoin's supply is capped at 21 million coins, making it inherently scarce. This scarcity mimics that of precious metals, particularly gold, which has historically been a reliable store of value.Interestingly, Bitcoin is a better store of value than gold because, due to Bitcoin's pre-programmed mining schedule, everyone knows exactly how much new supply will be minted each year, all the way out to 2140. The same can’t be said for gold or other precious metals.

2. Bitcoin as a hedge against inflation

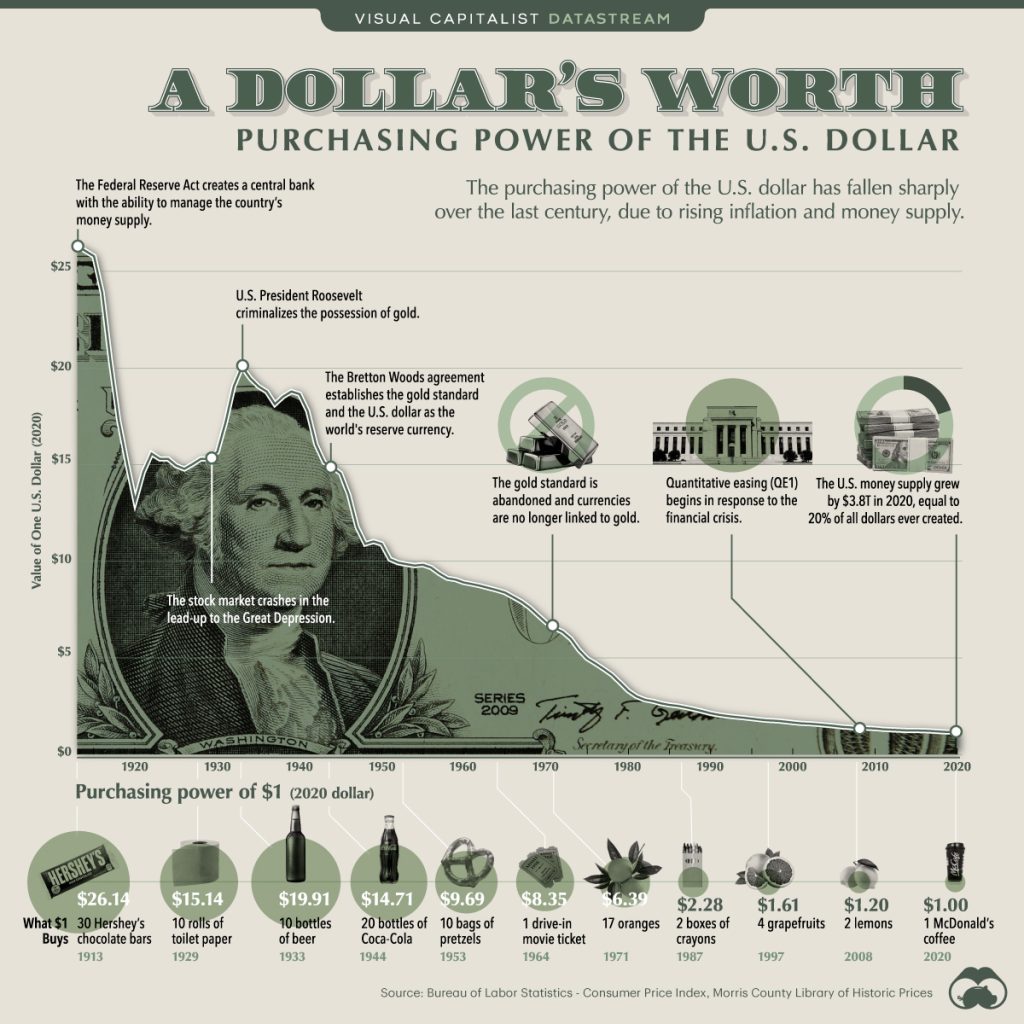

Bitcoin is often touted as a hedge against inflation, a critical factor given the monetary policies and economic uncertainties in the world today.Central banks around the world have engaged in aggressive monetary policy measures, such as quantitative easing, leading to concerns about inflation and the devaluation of fiat currencies. The inflationary pressure has eroded the purchasing power of many currencies and $1 dollar today is worth much less than $1 from 20 years ago.

The inflationary pressure is even worse in developing economies, leading to hyperinflationary peaks in Zimbabwe and Venezuela, where it costs 14 million VEF to buy 1 chicken.

Unlike fiat currencies, which can be printed at will, Bitcoin’s issuance is predictable and decreases over time (via halving events). The indiscriminate money printing regime has consistently reduced the purchasing power of fiat currencies, necessitating the need for a hedging mechanism – Bitcoin fits this bill because it is not connected to other economic indices that determine the value of fiat currencies in international economies.

3. Bitcoin as an investment

Bitcoin presents a compelling investment opportunity due to its unique characteristics and market dynamics. Only 21 million Bitcoins will ever exist, and the limited supply creates a dynamic where increasing demand can drive significant price appreciation.As global awareness and adoption of Bitcoin grow, the potential for sustained demand is substantial, especially as trust in fiat currencies erodes. Limited supply + increasing demand = Price Appreciation

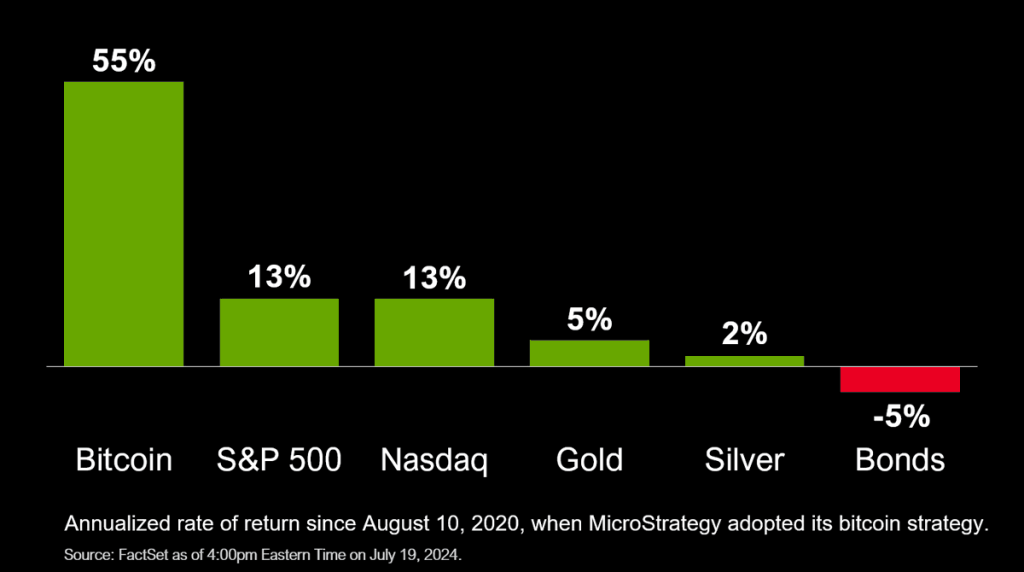

Bitcoin is the safest and least-risky way to make money in the crypto space. Over the past years, it has been the best-performing asset among stocks, commodities, and other traditional assets.

However, despite the strong outperformance of Bitcoin, the upside still remains unparalleled.

If Bitcoin were to capture a 5% allocation of global wealth, which is estimated at around $450 trillion, it could lead to a market cap of approximately $22.5 trillion. That is roughly 22x upside potential, with BTC’s price reaching $1.3m per coin if these estimates materialise.

4. Bitcoin as a settlement layer

Bitcoin serves as the backbone of the crypto economy, providing a secure and reliable settlement layer for various digital transactions. Its ability to facilitate large-scale transactions with ease and stability positions Bitcoin as the cornerstone of any significant crypto investment strategy.The Bitcoin blockchain is one of the most secure and resilient networks, owing to its decentralised nature and extensive computational power dedicated to its maintenance.

Several efforts are underway to enable a thriving ecosystem of dApps for the Bitcoin community. One such project, Stacks, is enabling Bitcoin smart contracts, Bitcoin DeFi, and Bitcoin SocialFi, among others. If these initiatives come to fruition, they will unlock new use cases and expand Bitcoin’s utility.

Bitcoin’s $1.2 trillion market cap represents a vast reservoir of latent capital that can be harnessed through decentralised applications and services. As part of a flywheel economy, Bitcoin can drive financial innovation, promote economic inclusion, and transform how value is created and exchanged globally.

5. Institutional participation

Further, Bitcoin's unparalleled liquidity makes it the most attractive cryptocurrency for high-net-worth individuals, institutions, and even countries looking to enter the crypto market. El-Salvador has set the stage for countries accepting $BTC as legal tender; Germany received a lot of backlash for selling the BTC it seized from Movie2k.to, and Donald Trump's hint of the BTC strategic reserve for the U.S. was widely applauded.Liquidity is critical for large-scale investors, as it ensures the ability to buy or sell significant amounts without causing substantial price fluctuations.

Bitcoin boasts the highest trading volumes and market depth among all cryptocurrencies. This extensive liquidity allows for substantial transactions with minimal slippage, providing a stable and reliable entry and exit strategy for large investors.

For instance, institutional players such as hedge funds and investment firms require the capacity to execute multi-million dollar trades efficiently, which Bitcoin readily facilitates. The trend of institutional adoption underscores Bitcoin's status as the go-to asset for large-scale investors. Companies like MicroStrategy, Tesla, and Square have allocated substantial portions of their treasury reserves to Bitcoin, citing its liquidity and store-of-value properties.

Financial institutions such as BlackRock, Fidelity and Grayscale offer Bitcoin investment products such as Exchange-Traded Funds (ETFs), making it easier for institutional clients to gain exposure to Bitcoin without the complexities of direct ownership.

Beyond the potential for price appreciation, Bitcoin also offers a new asset class for investors seeking diversification. Its low correlation with traditional assets like stocks and bonds can help reduce overall portfolio risk. Many investors see Bitcoin as a strategic hedge, particularly during economic downturns or financial market instability.

6. Regulatory clarity

Regulatory clarity and the approval of Bitcoin ETFs are crucial for mainstream adoption. As regulators around the world develop clearer frameworks for cryptocurrency, it paves the way for more institutional and retail investors to enter the market. Bitcoin ETFs, in particular, provide a convenient and regulated way for investors to gain exposure to Bitcoin without directly owning the asset, further driving demand.As we highlighted in our Crypto x Politics report, Bitcoin alignment among politicians has increasingly become a strategic manoeuvre to win votes and garner appeal from a broadening base of cryptocurrency enthusiasts and tech-savvy citizens.

As the popularity of Bitcoin surges, politicians recognise the potential to tap into a demographic that values financial innovation and decentralisation. By aligning with Bitcoin and its values, these politicians aim to portray themselves as forward-thinking and in tune with modern economic trends, attracting support from younger voters and those disillusioned with traditional financial systems.

Such endorsements can influence public perception and policy, potentially leading to more favourable regulatory environments and wider adoption.

Bitcoin’s valuation exercise + price targets

What is Bitcoin worth today? What could Bitcoin be worth tomorrow?While no one can predict the future with absolute certainty, valuation models and frameworks provide us with tools to make educated guesses about Bitcoin's potential economic upside.

Given Bitcoin's paradigm-shifting nature as the first digital currency of its kind, traditional valuation benchmarks often fall short. Here, we explore some Bitcoin price targets based on different valuation models.

Bitcoin's valuation models

- Bitcoin & intrinsic value

- Bitcoin halvings

- BTC stock-to-flow

1. Bitcoin’s intrinsic value model

The intrinsic value of Bitcoin is a subject of debate among economists and investors. Unlike traditional assets such as stocks or real estate, Bitcoin does not generate cash flow or have a physical form. However, its intrinsic value can be assessed based on several factors:- Utility as a medium of exchange: Bitcoin's ability to facilitate peer-to-peer transactions without intermediaries adds to its value proposition as a currency.

- Store of value: Often compared to gold, Bitcoin is viewed as a hedge against inflation and currency devaluation, contributing to its perceived intrinsic value.

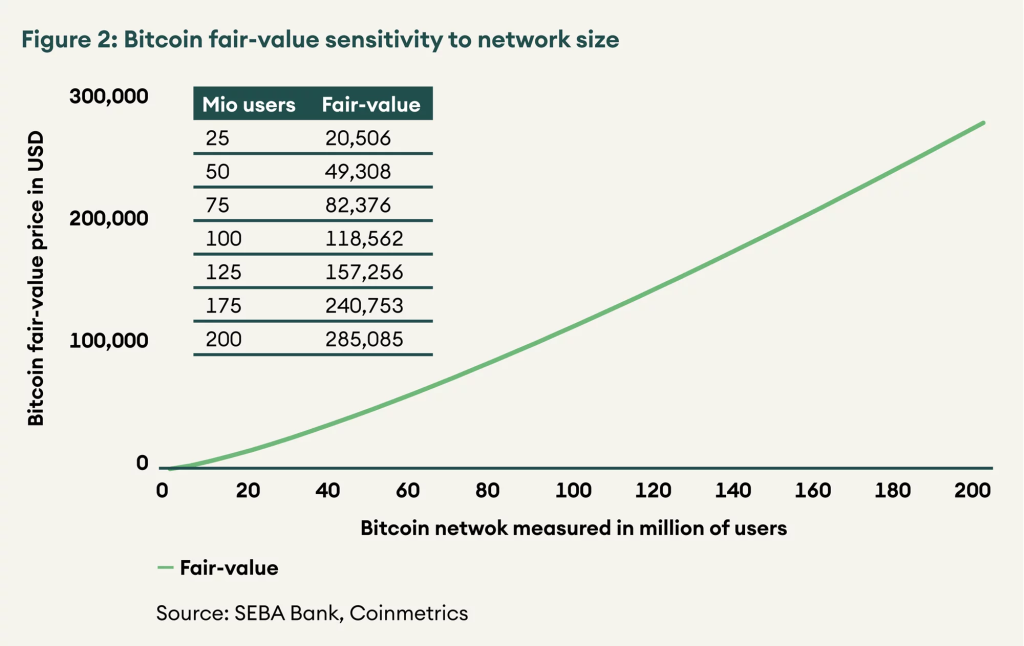

- Network effects: The growing number of users and acceptance by merchants and institutions enhance Bitcoin's value as a widely recognised and accepted digital asset.

The increased institutional adoption and regulatory clarity positioned BTC with a fair value of $50,000 with a network of about 50 million users in 2023 and a fair value of $285,000 when its network grows to 200 million users.

2. Bitcoin halvings model

Bitcoin halving occurs approximately every four years, in which the reward for mining new Bitcoin blocks is cut in half. This event is designed to control the supply of Bitcoin, making it more like scarce resources such as gold. It is a critical event in the Bitcoin ecosystem and significantly impacts the entire crypto market.- Impact on supply and demand: With fewer Bitcoins entering circulation, the reduced supply often leads to increased scarcity, potentially driving up prices if demand remains constant or increases.

- Historical price trends: Historically, Bitcoin has experienced significant price increases in the months following a halving. For example, the halvings in 2012, 2016, and 2020 were followed by substantial bull markets.

Van Eck has argued that BTC’s mathematically guaranteed scarcity, coupled with its trajectory to solidify its position as a key international medium of exchange to ultimately become one of the world’s reserve currencies, puts us on track to have 1 BTC be worth $2.9 million by 2050.

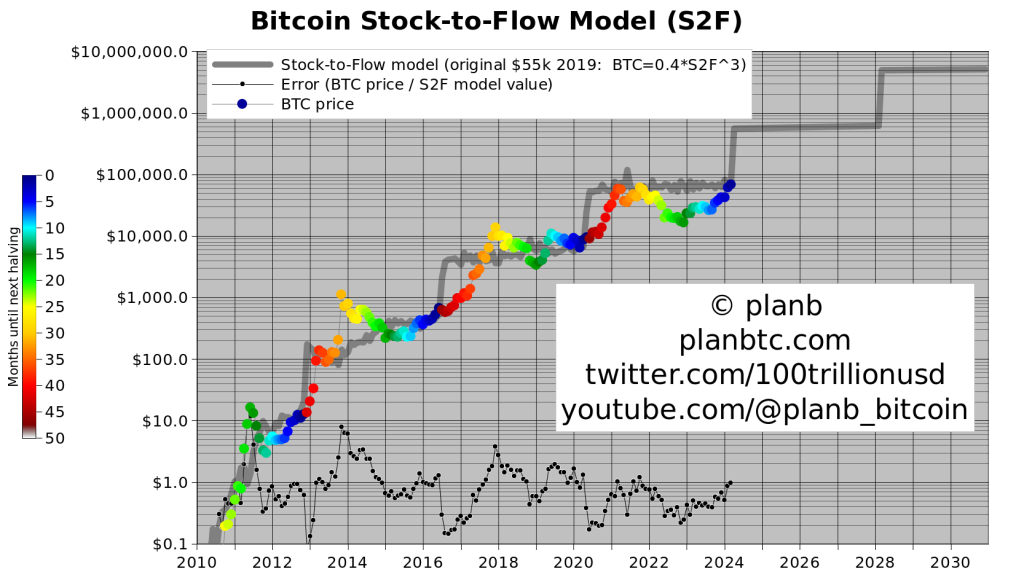

3. BTC stock-to-flow (S2F) model

The stock-to-flow (S2F) model is a quantitative framework used to predict the price of Bitcoin based on its scarcity. While the concept of stock-to-flow is not new and has been used for many commodities such as gold and silver, the Bitcoin stock-to-flow model was originally popularised by an anonymous individual known as Plan B.- Formula and concept: The model calculates the ratio of the existing stock of Bitcoin (total supply) to the flow of new Bitcoins being mined (annual production). A higher stock-to-flow ratio indicates greater scarcity and, according to the model, potentially a higher price.

- Price projections: The S2F model has been used to forecast Bitcoin's price by analysing historical data. It suggests that Bitcoin's price tends to increase as its scarcity increases, with notable price targets following each halving event. The predictability of Bitcoin's supply adds a layer of confidence to these projections, making the model appealing to investors who value scarcity as a determinant of price.

The exact supply of Bitcoin is known at all times, whereas no one truly knows the total amount of gold or silver available in the world. This precise knowledge allows Bitcoin's stock-to-flow ratio to be known and accurate for decades, unlike other commodities, where estimates are often speculative.

Despite its popularity, the S2F model has faced criticism for relying heavily on historical data and assuming that past trends will continue into the future.

Cryptonary’s valuation model

Our valuation model for Bitcoin takes into account a combination of macro context, current market dynamics, future projections, and significant catalysts that will influence Bitcoin's price in both the short and long term.Current situation: Market cap: ~$1.2 trillion | Price: ~$60k

2025 Bitcoin price projections

We project a $145k bull case price target for BTC by the end of the 2024/2025 bull run based on the following catalysts.First, despite showing mixed signals, economic indicators are creating an environment conducive to Bitcoin's growth. While some forward guidance from companies suggests a weakening consumer base, retail sales and personal spending remain strong, buoyed by high personal incomes. This resilience and potential economic slowdowns have already positioned central banks to adjust interest rates, increasing liquidity and benefiting risk assets like Bitcoin.

A wave of rate cuts has already begun around the world. However, we still anticipate rate cuts by the US Federal Reserve, which is expected to be a stronger catalyst compared to rate cuts in other countries.

Secondly, the approval of spot Bitcoin ETFs is impacting Bitcoin's price trajectory. The ETF approval and participation from major financial players like BlackRock, continues to establish the institutional interest in Bitcoin. ETFs usually open the market to a broader range of institutional investors, injecting substantial capital into Bitcoin.

As seen with gold, the historical correlation between ETF approvals and asset price surges suggests that Bitcoin's market is on track to experience a similar appreciation. This increased accessibility and legitimacy provided by ETFs will continue to drive demand and propel Bitcoin's value upward.

Another mmetric is the Bitcoin Energy Value by Capriole. This metric measures Bitcoin's intrinsic value in terms of the cost of raw joules of electricity that the Bitcoin network consumes Bitcoin's price is currently below its Energy Value.

Bitcoin's price breaks substantially above its energy value in euphoric bull periods. This metric suggests to us that this period is yet to come for this cycle, and the current period is similar to that of Q2 to Q3 2020 before the major Bitcoin price breakout of late 2020 going into 2021.

The above metrics suggest that Bitcoin is in a consolidation phase before a euphoric bull phase. The euphoric bull phase might take another couple of months (potentially 3 more months). However, the euphoric bull period is coming.

Finally, the last Bitcoin halving in April 2024 added another layer of potential upward pressure on Bitcoin's price. This event, which reduces the rate of new Bitcoin issuance by half, traditionally results in a supply shock that has historically led to significant price increases.

As the halving coincides with broader economic trends and potential ETF approvals, Bitcoin's scarcity, combined with heightened demand, positions it for substantial growth.

This scarcity can drive up demand, pushing the price of BTC higher. Generally, it takes 4-6 months after the event for supply & demand dynamics to really kick in and drive the price of BTC up.

These factors and favourable on-chain metrics indicating undervaluation underpin the projection that Bitcoin could reach $145,000 by 2025, presenting a compelling opportunity for investors amid evolving market conditions. Based on the arguments above, we have derived the following price targets for BTC in 2025.

- Base case: $110k

- Bull case: $145k

- Best case: $250k

2030 and beyond price projections

We believe that if Bitcoin were to capture a 5% allocation of global wealth, which currently sits at around $450 trillion, it could lead to a market cap of approximately $22.5 trillion.Thus, our longer-term price target for Bitcoin sits at $1.3m by 2030, accounting for a 22x upside potential from current prices.

Risks to consider before buying Bitcoin

We are confident that over the long term, you’ll be better off owning Bitcoin than not having it. However, in the short term, Bitcoin’s price is still subject to wild volatility that is probably incomprehensible in traditional assets.Over the last 15 years, Bitcoin has consistently recorded 30% to 70% drawdowns from its ATHs.

- Market risks

Volatility: Bitcoin is known for its high volatility. The price of Bitcoin can experience significant fluctuations in a short period of time, which can be a risk for investors and lead to substantial losses.

- Regulatory risks

For example, hostile attitudes from governments around the world or banning the usage or storage of crypto assets can pose risks to the cryptocurrency market, including Bitcoin. However, we are seeing gradual improvement in the regulatory front these days around the world.

- Operational risks

Invalidation criteria

Our thesis on Bitcoin could be invalidated in the short term if we experience any or a combination of these macro events.In the long term, we believe that Bitcoin is the future of money. Barring a black swan event that obliterates the network or civilisation as we know it, Bitcoin is on track to be the future of money.

- Macro environment

- Big players selling

- Potential exploits

Quantum computers could solve complex mathematical problems exponentially faster than classical computers, risking the integrity of Bitcoin's encryption and transaction records.

- Depleting security budget

How to buy BTC

Dollar-cost averaging (buying equal amounts every day/ week/month) in BTC has been one of the best strategies throughout Bitcoin's history.-

Buying on a centralized exchange

-

-

- Step 1: Choose a centralized exchange

- Step 2: Create and verify your account

- Sign up for an account using your email address and create a strong password.

- Complete the identity verification process by uploading a photo ID and providing additional information as required by the exchange.

- Step 3: Deposit funds

- Deposit fiat currency (USD, EUR, etc.) into your account via bank transfer, credit/debit card, or other supported payment methods.

- Ensure your account is funded before attempting to buy BTC.

- Step 4: Buy Bitcoin

- Go to the trading section of the exchange and find the BTC trading pair that matches your deposited currency (e.g., BTC/USD, BTC/EUR).

- Choose between a market or limit order:

- Market order: Buy BTC at the current market price.

- Limit order: Specify the price at which you want to buy BTC. The order will execute when the market price matches your limit price.

- Enter the amount of BTC you want to purchase and confirm the order.

- Step 5: Withdraw BTC to your wallet

- After buying BTC, it’s recommended to transfer it to a secure wallet.

- Withdraw BTC from the exchange to your personal Bitcoin wallet address for safekeeping.

-

-

Buying Bitcoin using a wallet app

-

-

- Step 1: Choose a Wallet

- Select a secure Bitcoin wallet. Options include:

- Mobile wallets: These include Trust Wallet, Exodus, or Mycelium.

- Hardware wallets: Like Ledger or Trezor.

- Download the wallet app or set up your hardware wallet.

- Select a secure Bitcoin wallet. Options include:

- Step 2: Set up your wallet

- Create a new wallet and securely back up the recovery phrase provided.

- Follow the setup instructions and enable security features such as two-factor authentication if available.

- Step 3: Fund your wallet

- Some wallets, like Trust Wallet and Exodus, have integrated features to buy Bitcoin directly.

- Use the “Buy” option within the wallet app to purchase BTC using a debit card, bank transfer, or other supported payment methods.

- Alternatively, you can transfer BTC from a centralised exchange to your wallet address.

- Step 4: Purchase Bitcoin

- If buying directly through the wallet, choose BTC, enter the amount you want to purchase, and select your payment method.

- Follow the prompts to complete the purchase. The BTC will be deposited into your wallet once the transaction is processed.

- Step 5: Confirm the transaction

- After the transaction is complete, check your wallet balance to ensure the BTC has arrived.

- Step 1: Choose a Wallet

-

- Via Phantom wallet

-

- You can now purchase Bitcoin (BTC) directly using the Phantom wallet.

- Open Phantom: Launch the Phantom application on your device.

- Initiate purchase: Click on the "Buy" button on the main interface.

- Select Bitcoin: Choose the Bitcoin token from the list of available cryptocurrencies.

- Specify amount: Enter the amount of Bitcoin you wish to purchase.

- Choose a provider: You can select a purchase provider from MoonPay, PayPal, Coinbase Onramp, or Robinhood.

- Complete the purchase: A pop-up window will appear for your selected provider. Log in or create an account to complete the transaction.

Cryptonary’s take

Bitcoin has earned legitimacy not only among niche groups of tech enthusiasts but also among government, institutions, and the general population. It has been battle-tested through multiple cycles and earned its status as a king of the crypto industry.While its decentralisation makes it one of the safest networks, its scarcity and limited supply have earned Bitcoin the status of “digital gold” and a “store of value.” Again, Bitcoin probably won’t make you an overnight millionaire, but this is one asset that you can’t afford not to own if you care about your financial future.

We remain bullish on BTC and consider it a “must-have” for your portfolios with low/medium risk profiles.

Content ledger

- State Of The Market: U.S. presidential election in view

- Bitcoin price surges to $73K! Here’s what you need to know.

- Macro analysis reveals why Bitcoin could hit $145k by 2025

- Cryptonary’s 2024 projections

- Our 9 Crypto Predictions for 2023

- Bitcoin ETF: What's the outlook?

- Bitcoin in a recession

- Case Study: Is Bitcoin surging faster than the 2017 bull run?

- Who is Satoshi Nakamoto?