And while the runup of the last three months is an exciting foretaste of the bull market, we are just getting started.

This means there is still time to strategically position yourself to get a share in the upside of assets (especially low caps) that will outperform during this bull run.

The challenge, however, is that many low-cap assets lack direct value-accrual, have bad tokenomics and don’t have strong narratives that can drive bullish tailwinds.

But today, we present you with a low-cap asset that checks all the right boxes.

Sounds exciting? LFG!!!

Introducing Sonne Finance

Sonne Finance, launched in Jan 2023, is a decentralised lending protocol on Optimism and Base – it has a market cap of a mere $5m. The project was forked from the battle-tested Compound V3; however, the team applied different parameters for lending markets and created investors-prioritising tokenomics.But why do we believe Sonne is a great low-cap opportunity?

Check out the thesis!

Our thesis on Sonne Finance

Despite being a Compound clone, Sonne has superior tokenomics. However, it is currently undervalued. With the right tailwinds, Sonne Finance can deliver substantial gains in the short term due to its small market cap, value accrual, and supporting narratives.Sonne Finance gets the best of Optimism and Base

Sonne is part of two growing ecosystems. We previously covered both Optimism and Base, and it’s undeniable that things are playing out well for both of these ecosystems.Optimism is home to many protocols that Cryptonary is bullish on – think Synthetix, Velodrome and, up until recently, Lyra.

In addition, many protocols (E.g. Lyra, Aevo, opBNB, and many more) are launching their chains (appchains) based on OP Stack. All of this works together to grow and enhance the network effects within the Optimism ecosystem.

Moving on to Base - it is also built on OP Stack. And more importantly, Base is growing through its affiliation with CoinBase. CoinBase is one of the leading centralised exchanges and is a custodian for 9 out of the 11 ETFs recently approved.

Being part of these two growing ecosystems puts Sonne in a promising position where it can experience a trickle-down effect from the successes.

EIP - 4844

Another upcoming catalyst that will potentially benefit Sonne Finance is the Ethereum Improvement Proposal 4844 (EIP - 4844). EIP-4844 is expected to arrive in Q1 or Q2 and drastically reduce transaction costs on Ethereum L2s.Once live, EIP-4844 will make L2s more competitive, reignite the L2 narrative, and potentially boost L2 ecosystem assets to new highs. Of course, you can play it safe by betting on ARB or OP to benefit from potential upsides from EIP-4844.

However, ARB and OP are low-risk, low-reward options due to their tokenomics. Both are governance tokens with no value capture. Also, they have upcoming token unlocks, which can suppress the price.

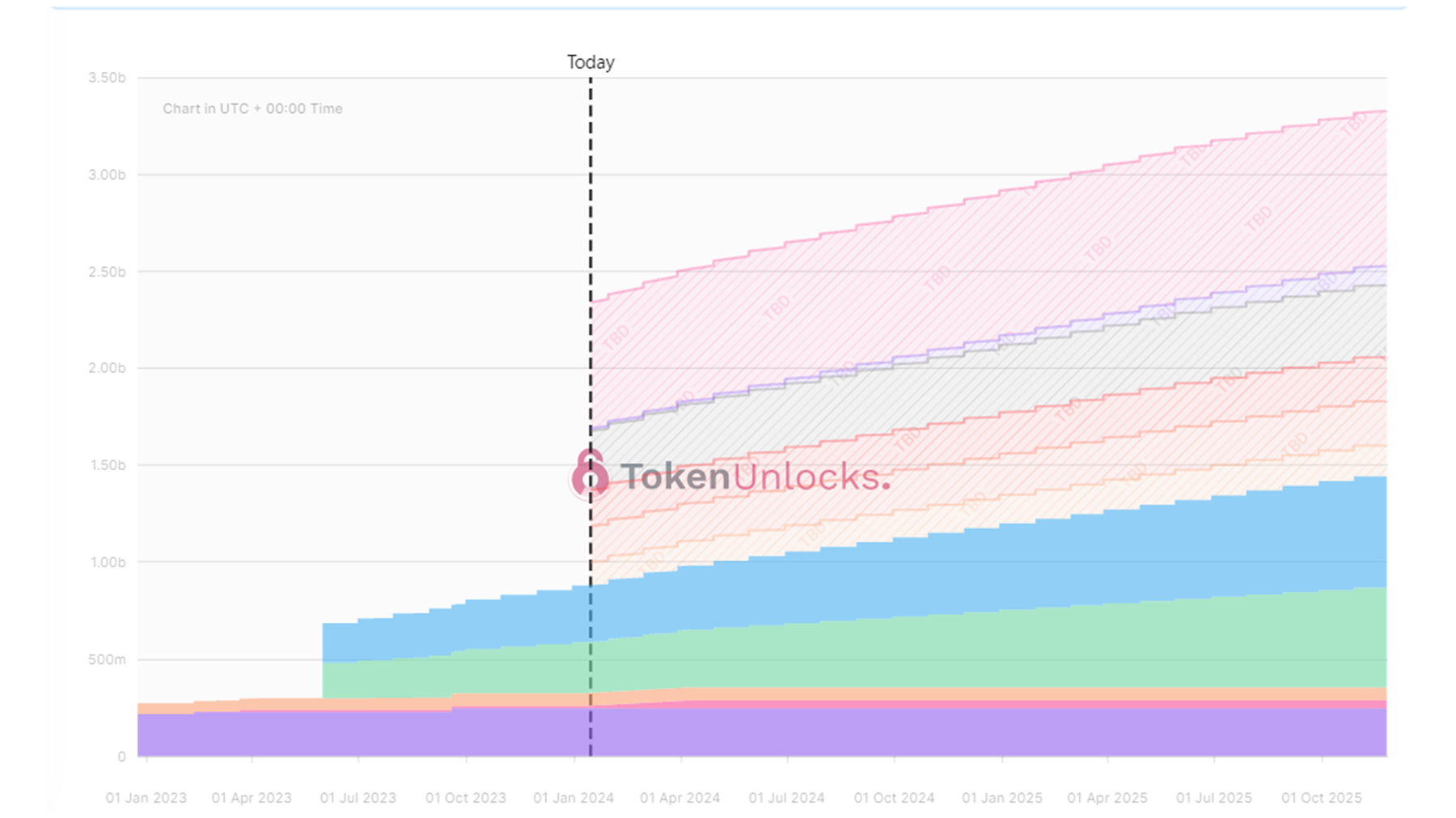

OP token unlocks schedule

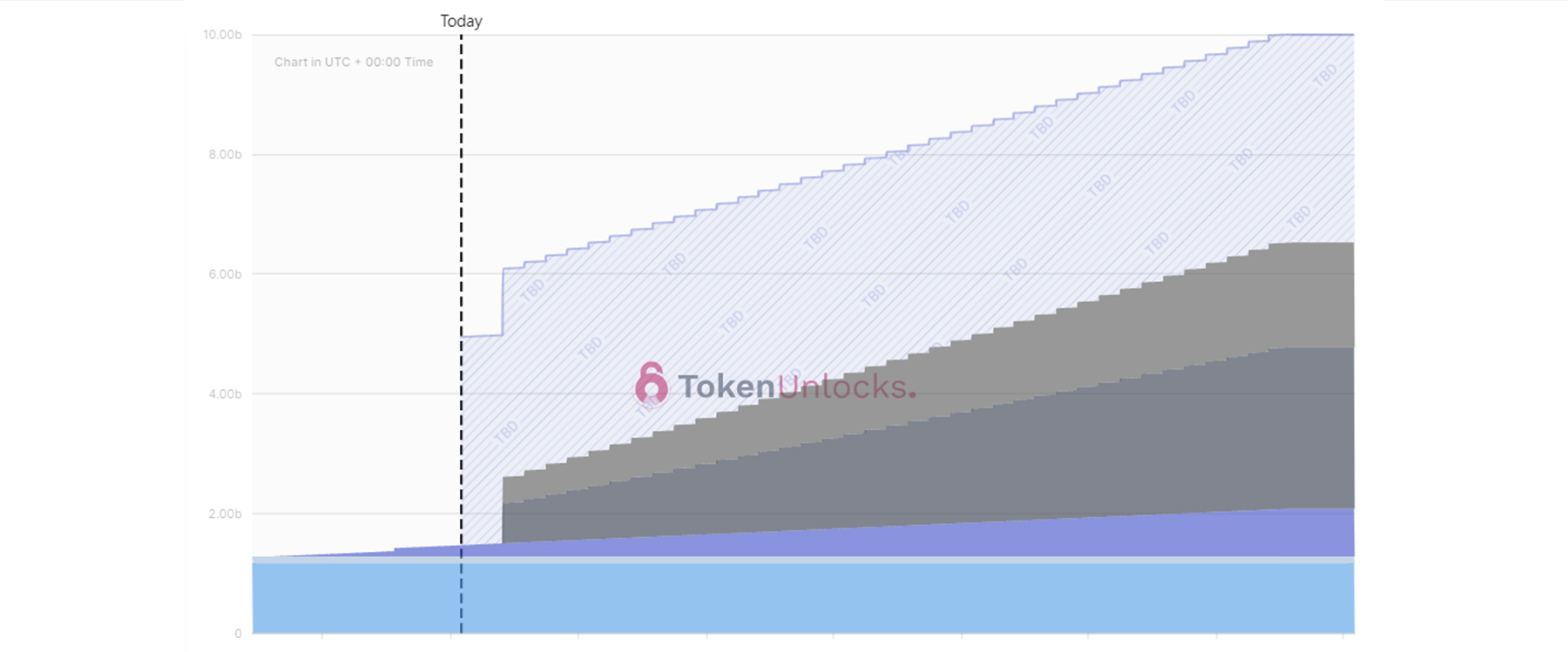

Arb token unlocks schedule

But if EIP-4844 does indeed drive attention back to L2s, their ecosystems, in general, will perform well – and Sonne Finance could potentially deliver better upsides than OP and ARB.

Capital rotation into ETH

Narratives oftentimes drive crypto markets, and as narratives change, capital follows. We believe EIP-4844 and ETH ETF capital will cause capital to rotate back into the Ethereum ecosystem.Right after the approval of Bitcoin Spot ETFs, BTC dumped while ETH pumped slightly. The market is telling us its next moves. With a potential ETH ETF narrative gaining traction, we believe the Ethereum ecosystem will have its chance to shine.

Now, let’s dive into the fundamentals.

Fundamentals

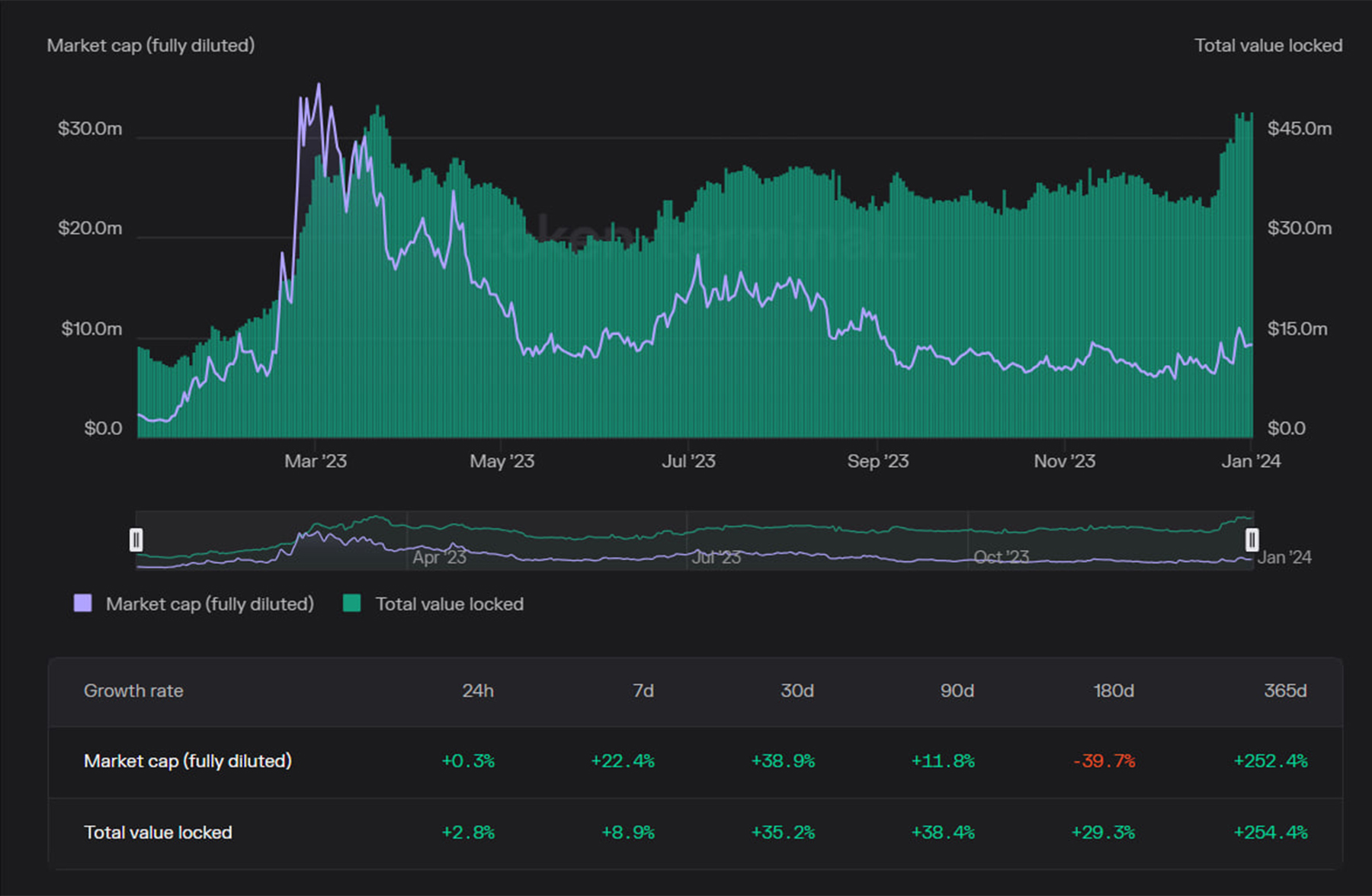

Sonne Finance’s market cap (Mcap) is tiny, which provides the asset with huge upside potential.- Mcap (circulating): $5.7m

- Market cap (fully diluted): $8.27m

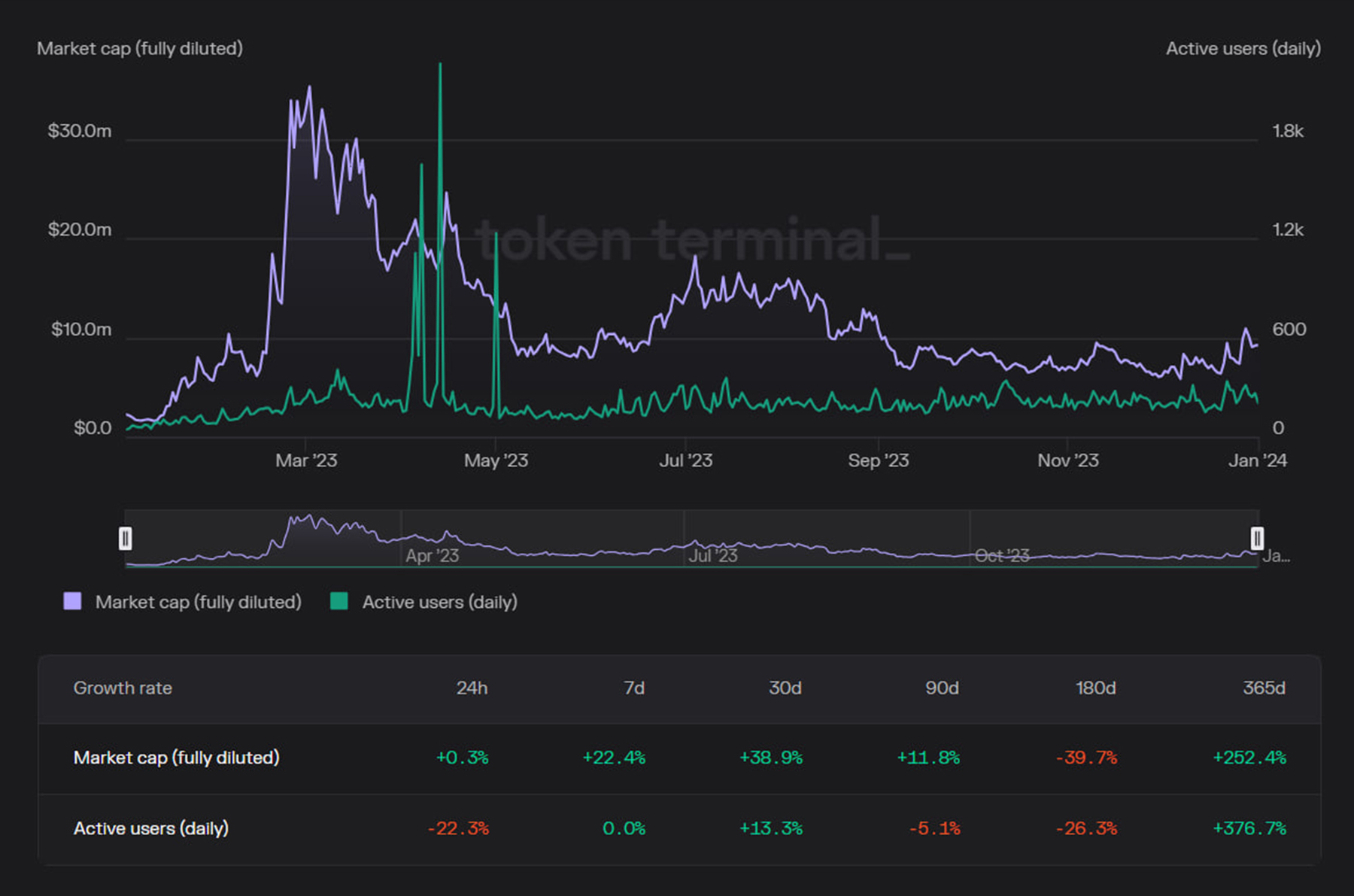

The number of active users isn’t growing as fast, but it is sticky. Sonne had around 50-90 daily active users at the beginning of the year. However, for the last six months, the number of daily active users averaged between 150 - 300 daily active users.

Financials

During 2023, Sonne Finance generated $4.2m in fees and $560k in revenue, which, according to the current mCap, results in the following multipliers:- P/F ratio (circulating): 1.36x

- P/F ratio (fully diluted): 2.08x

- P/S (circulating): 10.17x

- P/S (fully diluted): 15.62x

This results in the following multipliers, showing that Sonne Finance is undervalued compared to Compound.

Tokenomics

The best part of Sonne Finance is its beautiful tokenomics.There are two income streams for Sonne stakers.

- ALL fees generated by the protocol are distributed to Sonne stakers.

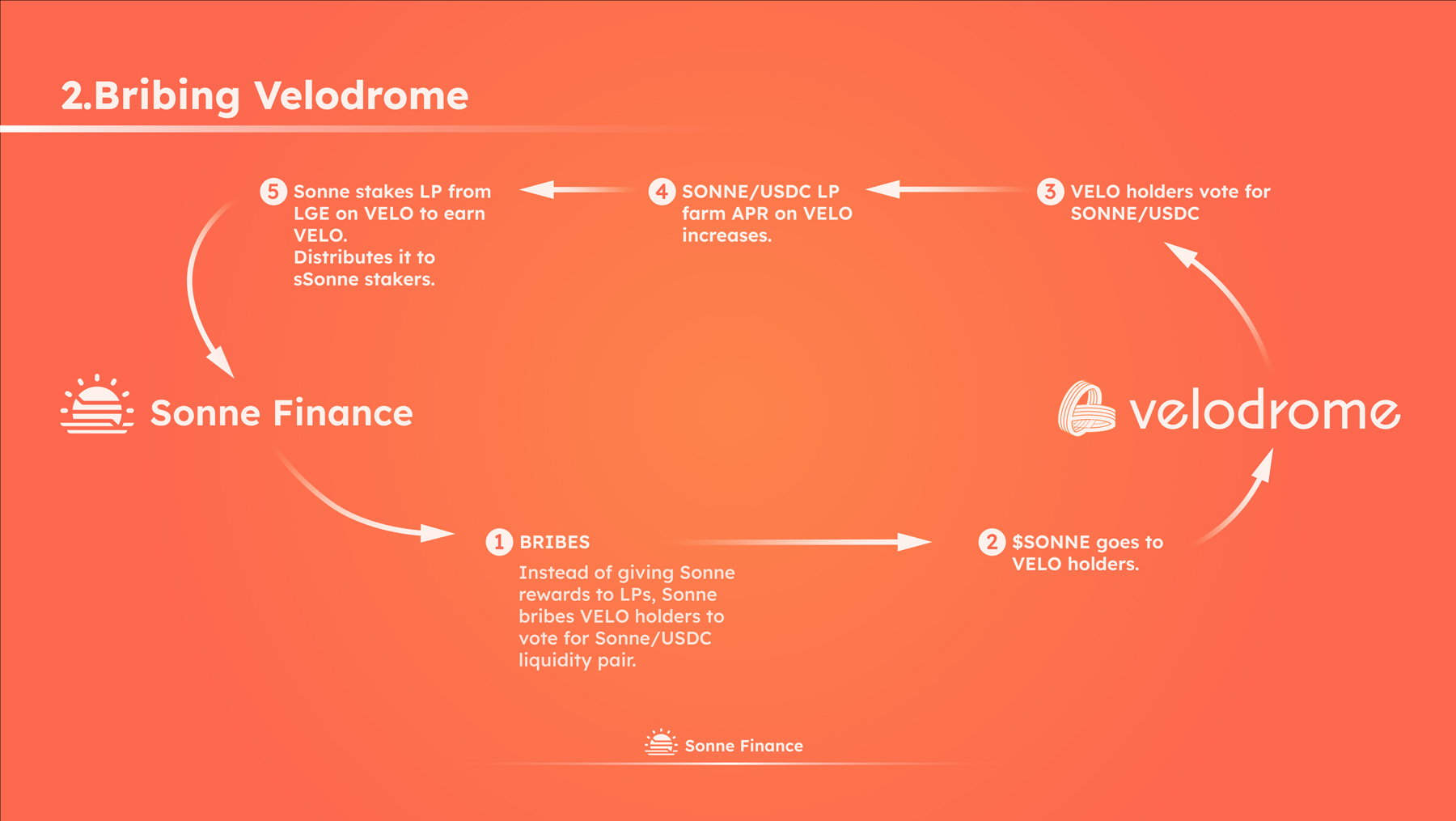

- They bribe the Sonne/USDC pool on Velodrome. Velodrome incentivises the pool, but since the main liquidity provided to this pool is the protocol itself, all rewards go to Sonne stakers again.

3. There is also a 3rd stream. However, due to its seasonality, we consider it an additional bonus.

Being a native lending protocol on Optimism makes Sonne eligible for grants, and Sonne has been consistently receiving OP rewards and distributing 100% of them to Sonne stakers. They recently received another grant and will distribute it to Sonne stakers again.

There are two options for stakers to get a share of these rewards.

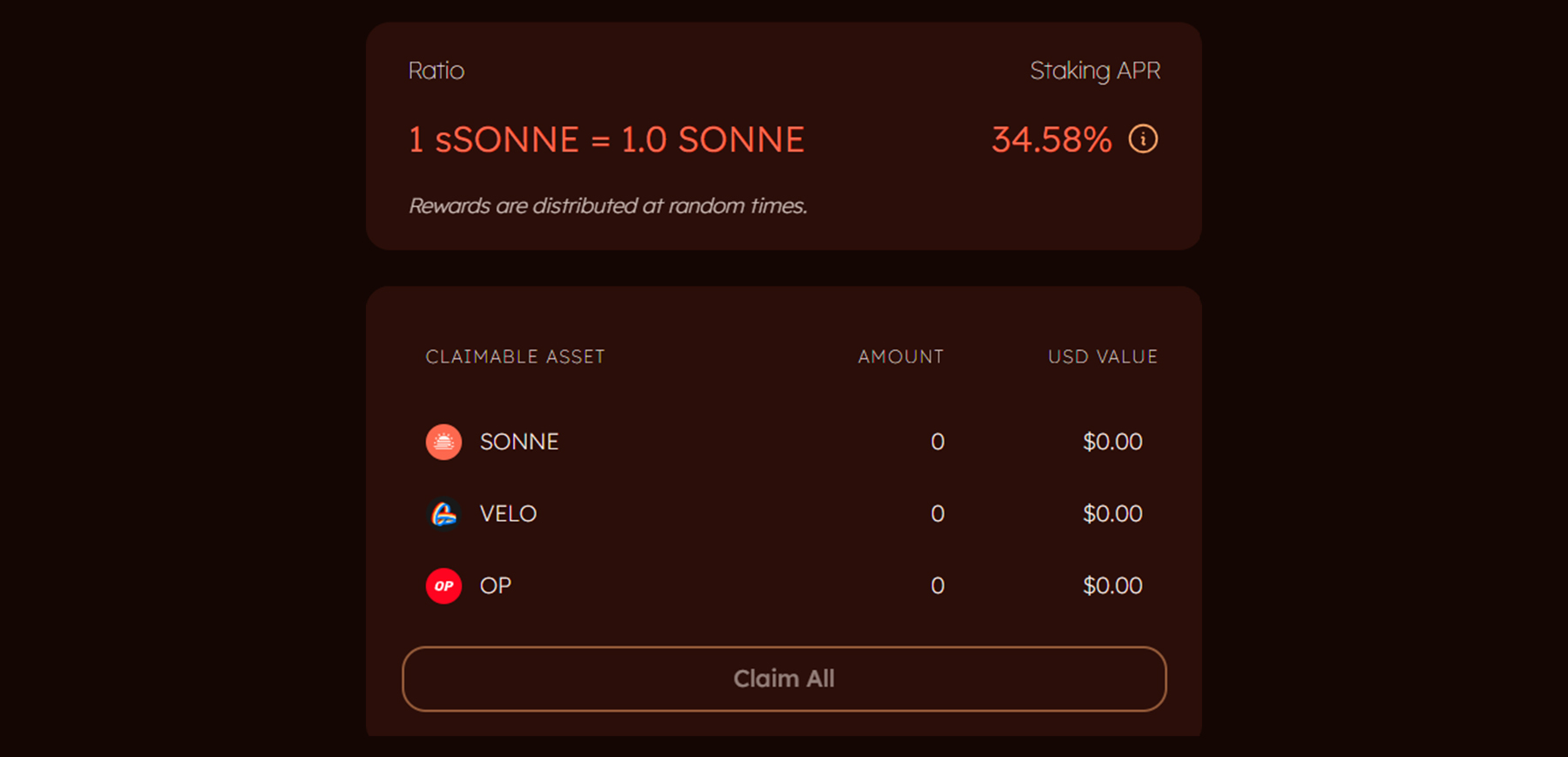

- sSONNE rewards: Stakers can stake $SONNE as sSonne, and protocol will buy back $SONNE from the market and distribute it to stakers.

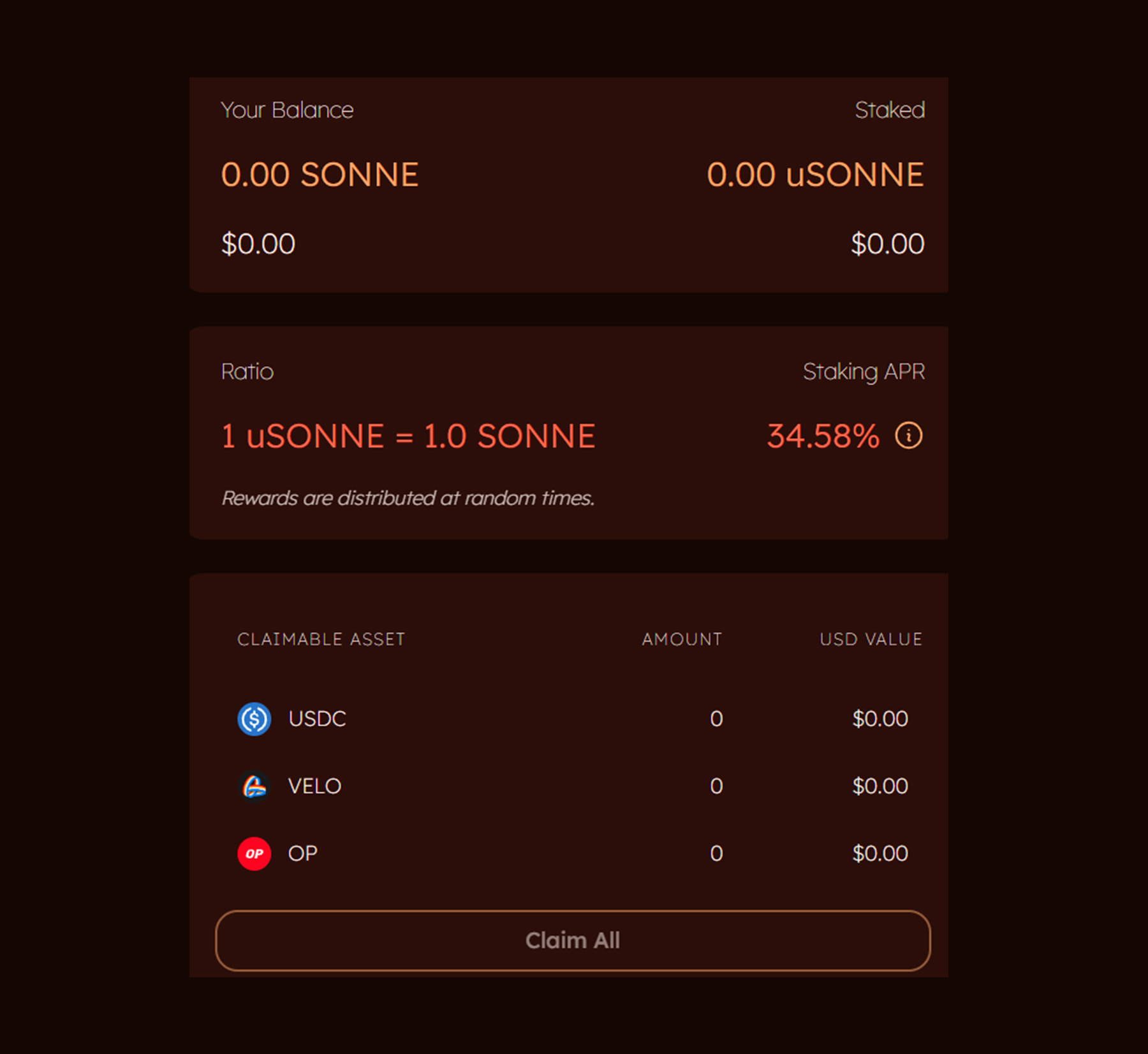

- uSONNE rewards: Stakers can stake $Sonne as uSonne, and protocol will buy back $USDC and distribute it to stakers.

Bonus metrics

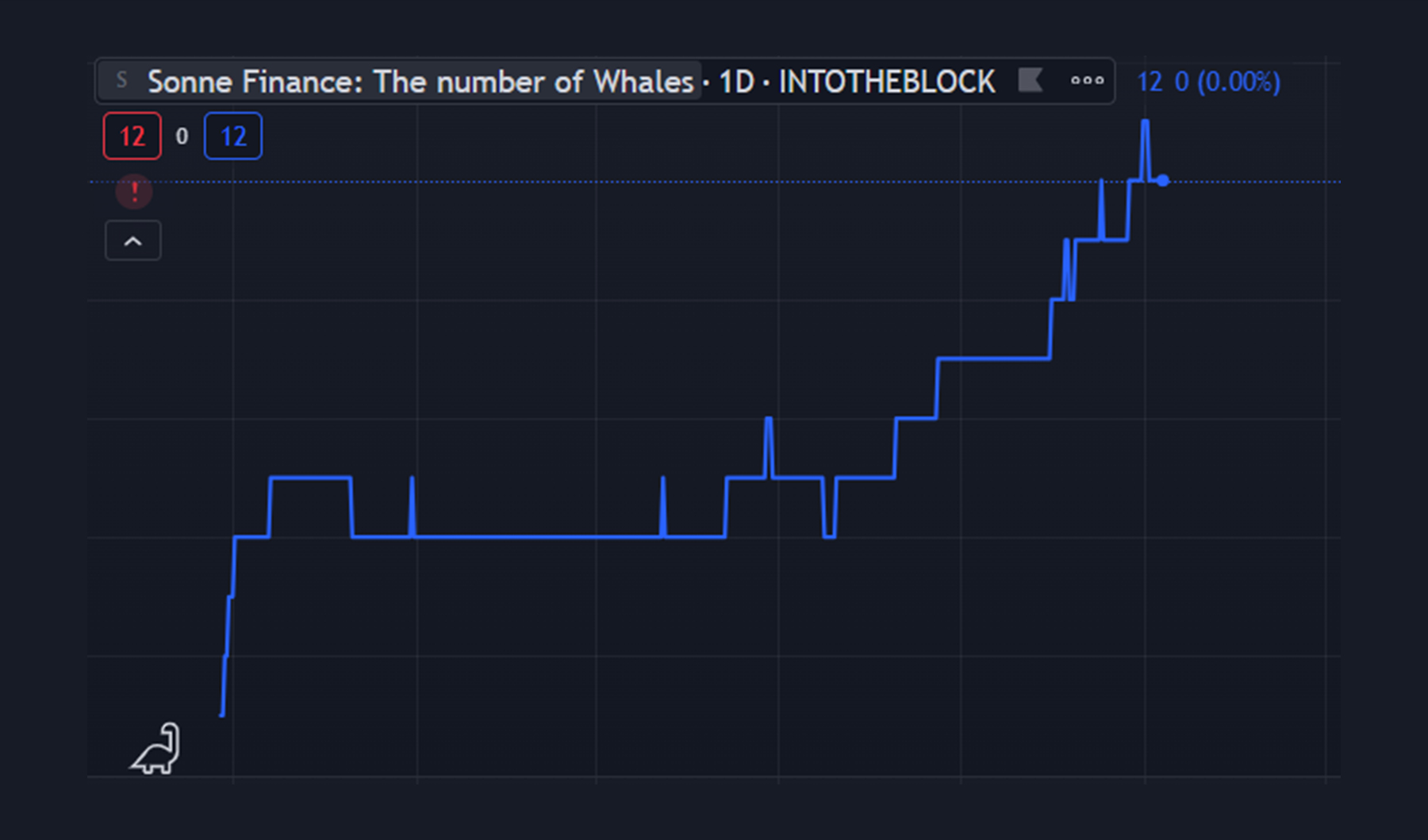

Some projects (For example, Segment Finance) are forking Sonne Finance’s tokenomics and code to start lending markets on other chains. This adds to our confidence in the quality of the project. The best part is that they reward Sonne stakers with airdrops, see here and here.Additionally, we’ve observed that the number of whales and investors is increasing, which indicates the growing interest in this asset.

Token distribution and team

There are many rugs and scams in crypto, especially among low caps.However, with Sonne Finance, the team is doxxed. Sonne Finance had previously applied for an Optimism grant, requiring team members to go through KYC. Therefore, the likelihood of a team rugging is minimal.

The team had previously built other dApps, such as SpookySwap. The Sonne Finance team is currently focused on Business Development (BD). The team also has lending markets for financial NFTs (E.g. veVelo) on their roadmap. Additionally, they are open to incorporating RWA into their lending markets.

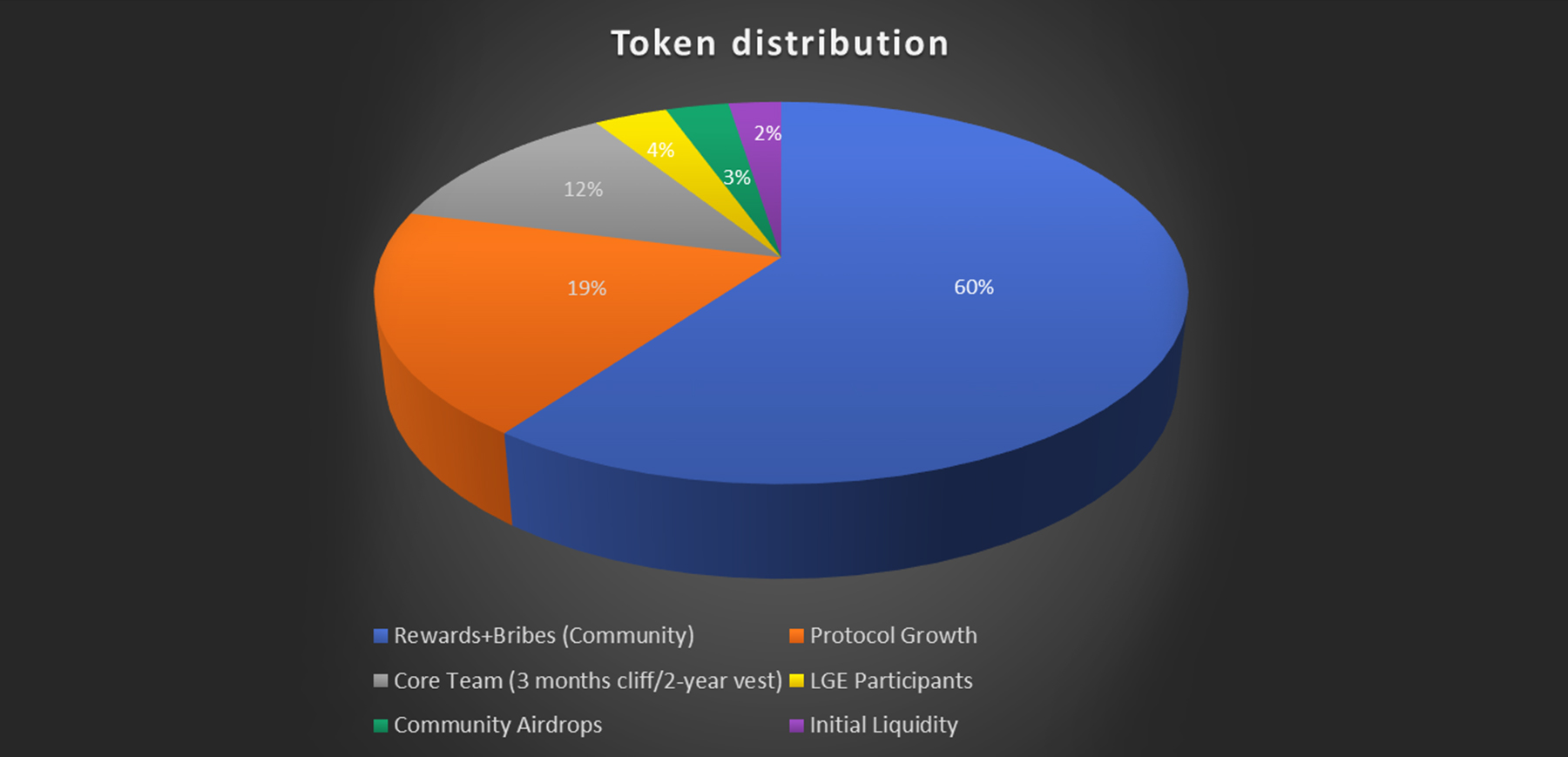

The token distribution looks good, with a heavy focus on community.

Price targets

Even though it might be hard for Sonne to compete with giants like Compound and AAVE at this stage, the protocol is young, and the tiny market cap suggests room for growth.The value accrual of the token is strong, and we love tokenomics that reward investors. Looking at the fees the protocol is generating, the market cap is lagging.

Going 10x from $5m to $50m sounds relatively easy (some meme coins have bigger market caps).

Sonne Finance just needs the right narratives (EIP-4844, L2s, ETH ETF, Real-yield), and we should be on a solid uptrend.

We look forward to seeing a narrative switch to ETH and L2s through Q1 and Q2; Sonne Finance is positioned to ride that wave.

Therefore, we have the following scenarios:

Bullish case targets: 10-15X

Base case targets: 5-10X

Bearish case targets: 1x-2x

However, it is important to clarify that we currently see Sonne Finance as a short-term opportunity to ride on the wings of the upcoming narratives.

For the long term, it needs to be reevaluated (after Q2). We will revisit our thesis and decide whether Sonne Finance deserves a spot in your portfolio as a longer-term play.

Interestingly, the Sonne team has plans to expand to NFT liquidity markets and RWAs (borrowing USDC with your house) – fingers crossed on how well they execute.

Reality check

If we are right, and the thesis plays out as expected, you can make multiples in your investment in just 3-6 months.However, if we are wrong, you will still be creating steady cash flow from staking $SONNE and enjoying consistent real-yield, Velo rewards, OP rewards and maybe periodic airdrops.

Invalidation criteria

Our thesis on Sonne Finance will be invalidated if alt-L1s continue to dominate the narrative and EIP-4844 is delayed. Simply put, Sonne Finance’s TVL and fees will drop significantly.Technical analysis

Here’s how we could consider playing $SONNE from here.

On a weekly timeframe, we can potentially see a bullish divergence, indicating a potential reversal and subsequent run.

Therefore, from a technical perspective, given that we don’t see new lows, accumulating in a purple box (between $0.055 - 0.08) would position us well for a potential reversal and, then, upside.

Cryptonary’s take

We believe Sonne Finance is well-positioned to benefit tremendously from upcoming narratives. It is a tiny-cap gem with attractive tokenomics that prioritises investors.That said, it is a high-risk investment since the lending sector has lots of competition. Perhaps this is the reason it might have been overlooked. We aren’t thrilled with the user numbers, but that’s also part of the risk when betting on a relatively new player competing against Compound and Aave.

Despite heavy competition, Sonne Finance appears to have found a sticky user base. With the right narratives and catalysts, the user base can grow, benefiting Sonne stakers with consistent cash flow (crypto flow).

Buying into Sonne Finance under the $5m mCap (if it goes there) would be ideal (both from a technical and fundamental perspective) for positioning ourselves for upcoming months.

Again, we will need to reevaluate the potential of this project for further upside after Q1/Q2. For now, it is an attractive short-term opportunity.

Cryptonary, OUT!

Update - 15 May, 2024

Sonne Finance got hacked

What happened?Today, Sonne Finance suffered a significant exploit on the Optimism network, resulting in a loss of $20 million.

The exploit was possible due to a known vulnerability in the Compound V2 forks, which Sonne Finance is based on. The Sonne Finance team has temporarily paused the protocol on Optimism to contain the damage and prevent further losses.

The exploiter stole $20 million in WETH, Velo (VELO), soVELO and Wrapped USDC (USDC.e). These are the exploiter-related addresses; he is being actively tracked and monitored by the team.

0xae4a7cde7c99fb98b0d5fa414aa40f0300531f43 0x4ab93fc50b82d4dc457db85888dfdae28d29b98d 0x02fa2625825917e9b1f8346a465de1bbc150c5b9 0xbd18100a168321701955e348f03d0df4f517c13b 0x7e97b74252b6df53caf386fb4c54d4fb59cb6928 0xae4a7cde7c99fb98b0d5fa414aa40f0300531f43 0x9f09ec563222fe52712dc413d0b7b66cb5c7c795 0x5d0d99e9886581ff8fcb01f35804317f5ed80bbb 0x6277ab36a67cfb5535b02ee95c835a5eec554c0

The version of the platform on the Base chain isn’t affected and remains functional.

How did Sonne FInance respond?

The team discovered the exploit after 25 minutes and immediately paused all markets on the Optimism network to prevent further losses. This action contained the damage and ensured that no additional funds could be exploited.

Sonne Finance's team expressed their willingness to offer a bug bounty to the attacker in exchange for the return of the stolen funds. In this case, they won’t pursue any further investigation. This is a common practice in the industry aimed at incentivising ethical disclosure of vulnerabilities.

The exploiter funded his wallet from Binance. Therefore, we believe he has incentives to return funds because he is probably KYCed on the Binance exchange, and his identity is easily identifiable.

The team also is also closely with security experts and relevant stakeholders to investigate the exploit in an effort to return the funds. Cyvers is a Web 3 security firm with whom the team seems to be in contact to find the quickest resolution.

What does this mean for your SONNE finance position?

The coin is down over 50% since the exploit and seems to have some demand.

However, even though the vulnerability won’t be exploited anymore, it is a tricky situation; it depends on how well Sonne Finance navigates this challenge to restore confidence.

What we would like to see is for the team to recover funds, make users whole and regain the confidence of their users.

If there is a positive development, buying at these prices might provide a great discount. However, we would like to see funds recover first; until then, we remain out of Sonne.

If they don’t recover the funds and users have to bear the loss, it will be detrimental to the protocol, and the coin will seriously struggle from here.

We will continue to watch this and provide more updates.

This is a developing story.