Explore the latest Ethereum (ETH) crypto analysis and predictions

- SOL/BTC ratio, ETH/BTC ratio, and BTC dominance: what investors need to know (August 14, 2024)

- SOL ETH ratio today: Is the 0.058 resistance about to break? (August 14, 2024)

- ETH BTC ratio today: 0.057 resistance in focus, what's next? (August 14, 2024)

- Ethereum price prediction today: Is $2,800 breakout or $2,500 pullback next? (August 13, 2024)

- Crypto technical analysis: Key insights on BTC, SOL, ETH, DOGE, and more (August 12, 2024)

- Ethereum (ETH) price prediction today: Will it hit a new high? (August 12, 2024)

- Ethereum (ETH) price prediction today: Will it surge past $2,200? (August 12, 2024)

- Crypto price predictions today: BTC, ETH, WIF, POPCAT, SOL analysis (August 12, 2024)

- ETH price prediction today: Can it surge past $2,875 resistance? (August 12, 2024)

- Ethereum (ETH) price prediction today: Is $2,200 the next ETH bounce? (August 12, 2024)

- Ethereum (ETH) price prediction today: $2,400 bounce or pullback? (August 9, 2024)

- Ethereum (ETH) price prediction today: Is $2,200 the breakout level? (August 8, 2024)

- Ethereum ETF: Key Resistance Levels and Market Dynamics (July 24, 2024)

- Price Prediction Bitcoin, Ethereum, Solana & Meme Coins (July 24, 2024)

Ethereum (ETH) price predictions

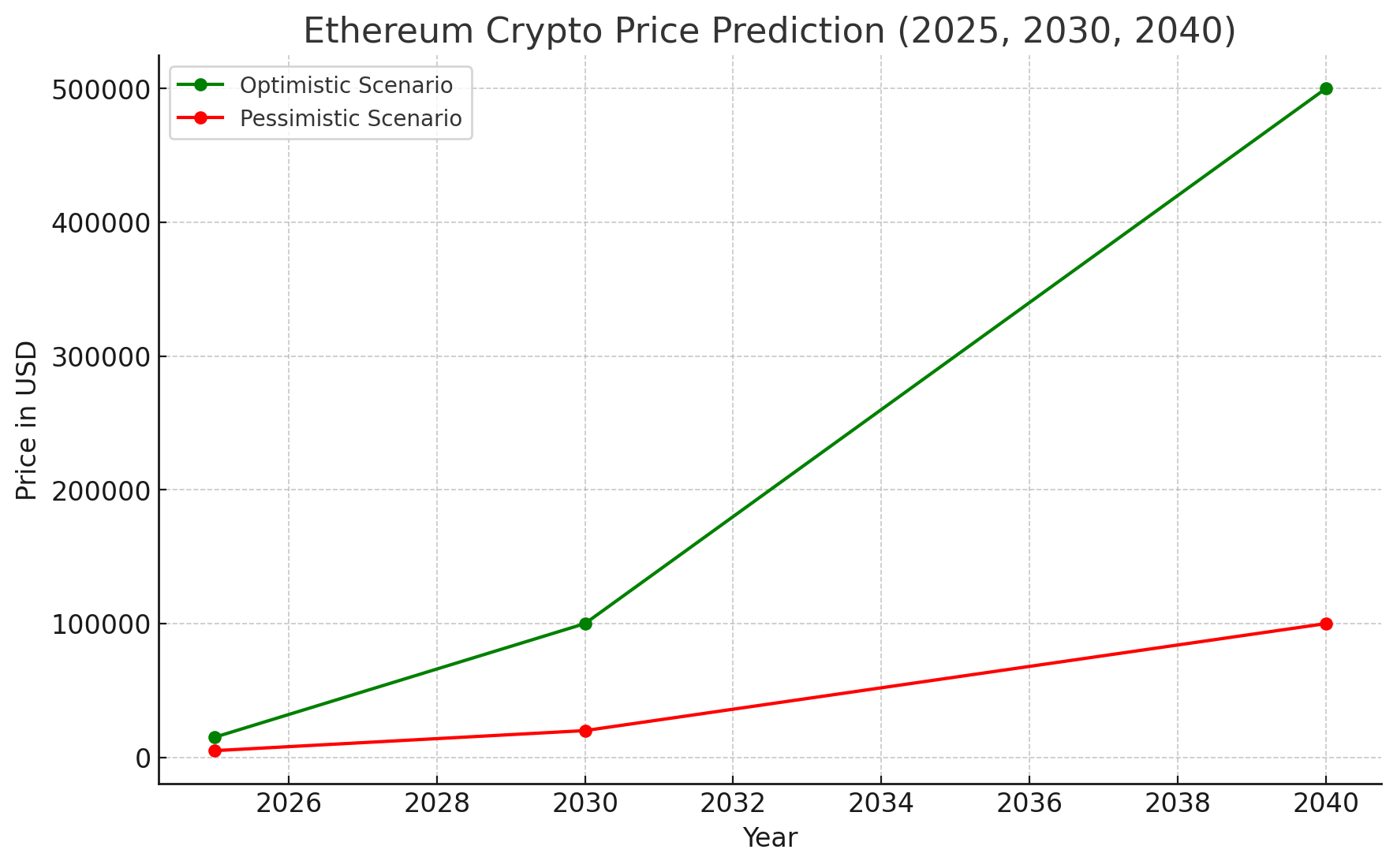

2025 price prediction

Optimistic scenario ($10,000 - $20,000):Why? If Ethereum successfully transitions to Ethereum 2.0, with its proof-of-stake (PoS) mechanism, and maintains its dominance in decentralized finance (DeFi) and smart contract platforms, the price could see substantial growth. Increased institutional adoption and Ethereum's role in NFTs and Web3 could further drive its value.

Key drivers: Successful Ethereum 2.0 upgrade, continued dominance in DeFi and NFTs, increased institutional adoption, and favorable macroeconomic trends.

Pessimistic scenario ($2,000 - $5,000):

Why? If Ethereum faces delays or issues with the Ethereum 2.0 upgrade, coupled with increased competition from other smart contract platforms, its price could face downward pressure. Regulatory challenges and potential market shifts away from Ethereum could also impact its price.

Key drivers: Delays in Ethereum 2.0, increased competition, regulatory hurdles, and potential shifts in market interest.

Ethereum (ETH) 2030 price prediction

Optimistic scenario ($50,000 - $100,000):Why? By 2030, if Ethereum has cemented its role as the backbone of decentralized applications (dApps), Web3, and DeFi, and if it continues to innovate and scale effectively, its price could see exponential growth. The widespread adoption of Ethereum as a platform for decentralized technologies could contribute to this scenario.

Key drivers: Widespread adoption of Ethereum in DeFi, Web3, and dApps, continuous technological innovation, strong community support, and integration into mainstream financial systems.

Pessimistic scenario ($10,000 - $20,000):

Why? If Ethereum struggles with scalability issues or faces stiff competition from emerging blockchain platforms, its price growth could stagnate. Additionally, if regulatory bodies impose stringent restrictions on Ethereum-based projects, it could hinder the platform's growth and value.

Key drivers: Scalability challenges, increased competition, regulatory pressures, and potential shifts towards other blockchain platforms.

Ethereum (ETH) 2040 price prediction

Optimistic scenario ($500,000 - $1,000,000):Why? If Ethereum continues to evolve and remains a core component of the global digital economy, it could become a cornerstone of the financial system, with extensive use in various industries. This would be driven by Ethereum's integration into global finance, its role in decentralized governance, and ongoing technological advancements.

Key drivers: Global financial integration, continuous technological advancements, strong market presence, and a stable or growing global economy.

Pessimistic scenario ($50,000 - $100,000):

Why? By 2040, if Ethereum is surpassed by more advanced technologies or fails to meet the evolving demands of the market, its price could stabilize at lower levels. The emergence of more efficient blockchain solutions could also challenge Ethereum's dominance.

Key drivers: Technological obsolescence, market irrelevance, regulatory challenges, and competition from more advanced digital platforms.

Factors affecting Ethereum price

Historical data analysisObjective: Understand the past behavior of Ethereum’s price, including trends, cycles, and patterns.

Steps:

- Collect data: Gather historical price data of Ethereum from its inception to the present, focusing on daily, weekly, and monthly prices.

- Identify trends: Look for long-term trends, including significant price movements correlated with major events like the Ethereum 2.0 upgrades or DeFi booms.

- Pattern recognition: Identify recurring patterns, such as bull and bear cycles, that may help predict future movements.

Objective: Gauge how the market feels about Ethereum, which can influence its price.

Steps:

- Social media monitoring: Track discussions on platforms like Twitter, Reddit, and specialized Ethereum forums.

- News analysis: Monitor news sources for developments related to Ethereum, including partnerships, technological updates, or regulatory changes.

- Community engagement: Assess the level of community and developer activity, as a vibrant community often correlates with a positive price outlook.

Objective: Use historical price data to predict future movements based on patterns and technical indicators.

Steps:

- Chart analysis: Use various timeframes to analyze Ethereum’s price movements and identify patterns such as double bottoms or ascending triangles.

- Indicators: Apply technical indicators like Moving Averages (MA), RSI, and MACD to predict potential price movements.

- Support and resistance levels: Identify key levels where Ethereum has historically found support and resistance, which can guide future predictions.

Objective: Assess Ethereum’s intrinsic value based on its utility, adoption, and broader market conditions.

Steps:

- Use case evaluation: Evaluate Ethereum's use cases in DeFi, NFTs, and dApps, which drive demand.

- Adoption rate: Analyze the adoption rate of Ethereum across various sectors, including institutional interest and developer activity.

- Partnerships and integrations: Investigate strategic partnerships that could enhance Ethereum's value.

- Regulatory environment: Consider how regulations may affect Ethereum’s adoption and price.

Objective: Understand how broader economic conditions might influence Ethereum’s price.

Steps:

- Global economic conditions: Consider the impact of global economic trends, such as inflation or recession, on Ethereum as a digital asset.

- Monetary policy: Analyze how central bank policies might affect the flow of capital into Ethereum.

- Market correlation: Assess how Ethereum correlates with other assets like Bitcoin or traditional financial markets.

Objective: Utilize AI models to predict future prices based on identified patterns and correlations.

Steps:

- Data feeding: Input historical price data and relevant economic indicators into the AI model.

- Model training: Train the model to recognize patterns that have historically led to price changes.

- Prediction output: Use the model to predict future prices, providing a range of possibilities with different probabilities.

FAQs

1. What is Ethereum and how does it work?Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). It operates on its own blockchain, using Ether (ETH) as its native cryptocurrency. Unlike Bitcoin, which primarily serves as a digital currency, Ethereum's blockchain is designed to support a wide range of applications beyond just currency. This includes DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and more. Ethereum's upcoming transition to Ethereum 2.0 will shift its consensus mechanism from Proof of Work (PoW) to Proof of Stake (PoS), aiming to improve scalability, security, and energy efficiency.

2. What factors influence the price of Ethereum?

Several factors can impact the price of Ethereum:

- Network Upgrades: Major upgrades like the transition to Ethereum 2.0 can influence Ethereum's price by improving its functionality and scalability.

- Adoption in DeFi and NFTs: Ethereum's extensive use in DeFi platforms and the creation and trading of NFTs drives demand for ETH, impacting its price.

- Market Sentiment: The overall sentiment towards Ethereum, influenced by news, social media trends, and institutional endorsements, can drive price fluctuations.

- Regulatory Environment: Changes in cryptocurrency regulations, especially those affecting smart contracts and dApps, can impact Ethereum's market perception and value.

Ethereum (ETH) is widely available on most cryptocurrency exchanges. To buy Ethereum, you typically need to:

- Create an account: Register on a cryptocurrency exchange that supports Ethereum.

- Verify your identity: Complete the KYC (Know Your Customer) process as required by the exchange.

- Deposit funds: Add funds to your account in fiat currency or other cryptocurrencies.

- Purchase Ethereum: Use the exchange’s trading platform to buy Ethereum. After purchasing, it's advisable to transfer your ETH to a secure wallet, especially if you plan to hold it long-term.

Investing in Ethereum, like all cryptocurrencies, carries significant risks due to its volatility. Ethereum has shown strong growth potential, especially with its key role in DeFi, NFTs, and the broader adoption of blockchain technology. However, it is also subject to market risks, regulatory changes, and competition from other blockchain platforms. Before investing in Ethereum, it’s essential to conduct thorough research, understand the risks, and consider your financial situation and investment goals. Diversification and a long-term perspective can also help mitigate some of the risks associated with investing in cryptocurrencies.