Bears win in the short-term, bulls win in the long-term

In a market where Bitcoin's price has seen dramatic highs and unsettling lows, the battle between short-term bears and long-term bulls is heating up. While short-term holders appear shaken by recent corrections, long-term investors are doubling down, convinced that the best is yet to come.

Why you should read this report

- Are short-term holders and long-term investors playing entirely different games? Discover what on-chain metrics reveal about their diverging strategies and sentiment.

- Is the recent Bitcoin drop a sign of more pain to come, or just a temporary setback? Discover what key indicators reveal about short-term market sentiment.

- Why are whales still moving large amounts of BTC to exchanges? Could this signal a looming selloff, or is there more to the story?

- Long-term holders are quietly accumulating—what do they know that others don't? Uncover the data that suggests a bullish future despite current market volatility.

- With Bitcoin trading below its all-time high, is it still on track to hit $145,000 by 2025?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Bitcoin's post-halving blues

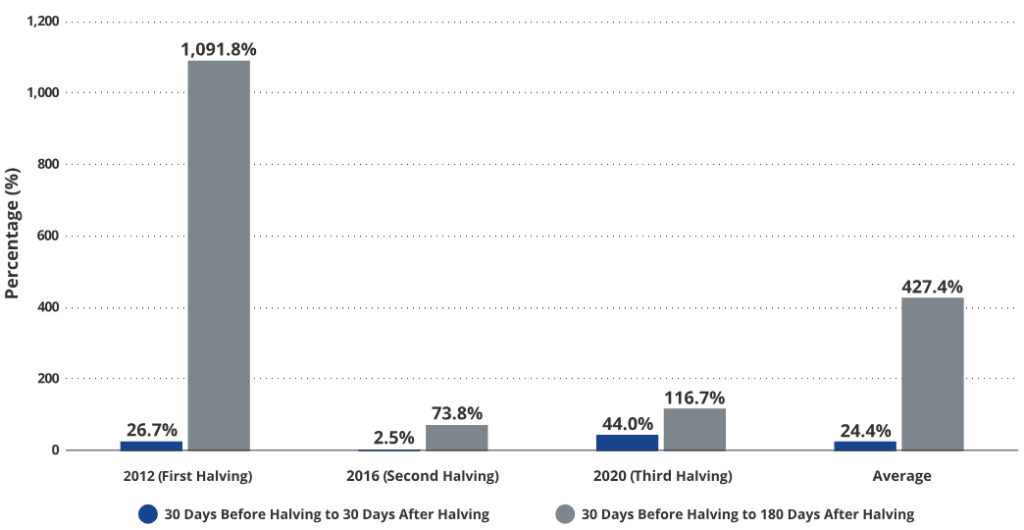

2024 was the first time in Bitcoin's 15-year history when price broke through ATH before the halving event. Considering the strength of that momentum, it is somewhat disappointing that Bitcoin is now trading ~20% below its ATH, almost four months after the halving.For context, Bitcoin has recorded an average of 427.4% gains in the 30 before-to-180 days after the last three halvings.

However, this time around, it has been experiencing a notable correction recently. It dropped from $69,598 on July 29 to $51,380 on August 5, its lowest price since February 25. It recovered a little since August 5, reaching $60,000 on August 14.

After the ETF approval and the latest halving, expectations about BTC's price grew, with many people predicting that it would achieve $100,000 by mid-2024. That didn't happen.

Now, the big question is: Does BTC still have the potential to reach $145,000 by 2025?

Is this enough reason to be disappointed in Bitcoin's performance?

The anatomy of a bull market

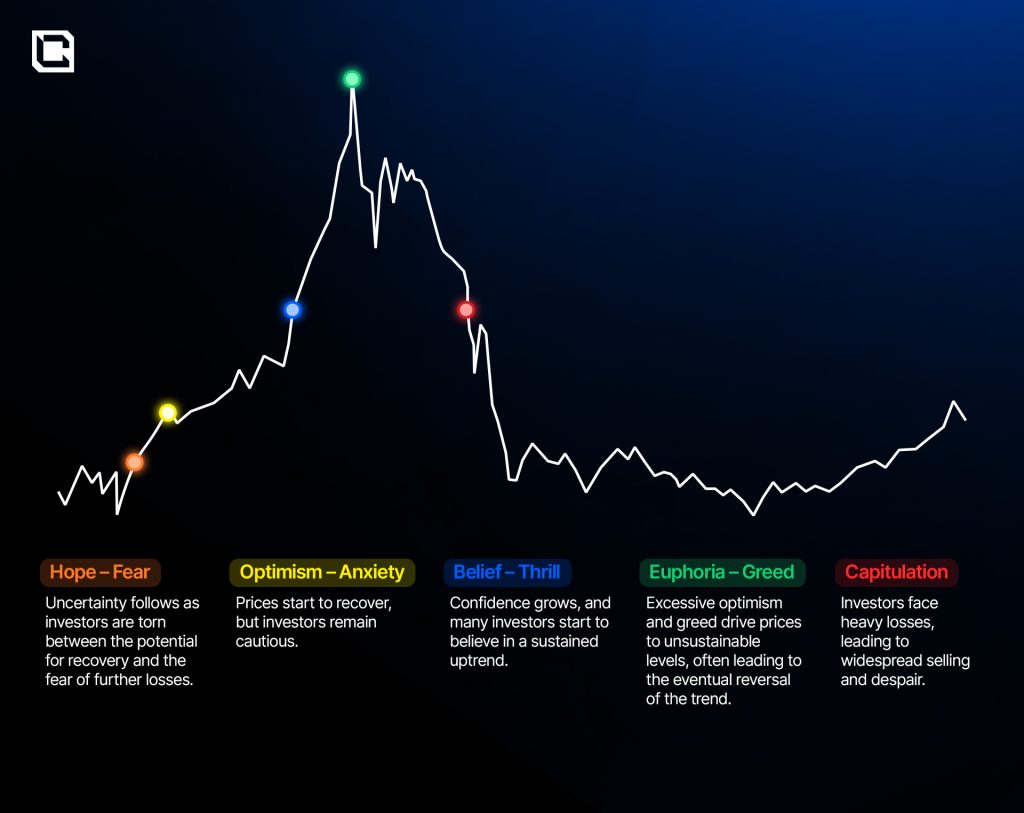

Take any bull market, and you can divide it into five overlapping yet distinct phases.- Capitulation occurs when investors face heavy losses, leading to widespread selling and despair.

- Hope — Fear represents the uncertainty that follows, as investors are torn between the potential for recovery and the fear of further losses.

- Optimism — Anxiety arises as prices start to recover, but investors remain cautious.

- Belief — Thrill sets in as confidence grows, and many investors start to believe in a sustained uptrend, though some remain sceptical.

- Euphoria— Greed marks the cycle's peak, when excessive optimism and greed drive prices to unsustainable levels, often leading to the eventual reversal of the trend.

Please pay attention to the phases, as we will be referring to them many times in this report.

Key indicators suggest a shift in investor sentiment. However, the story is more complex when we analyse and compare short-term and long-term holders' metrics.

On-chain analysis shows that while short-term holders don't appear to be very confident in BTC, long-term holders are resolute in their bullish stand.

They are backing it by accumulating more, and what's more, BTC whales and institutions are following suit.

Short-term scenario

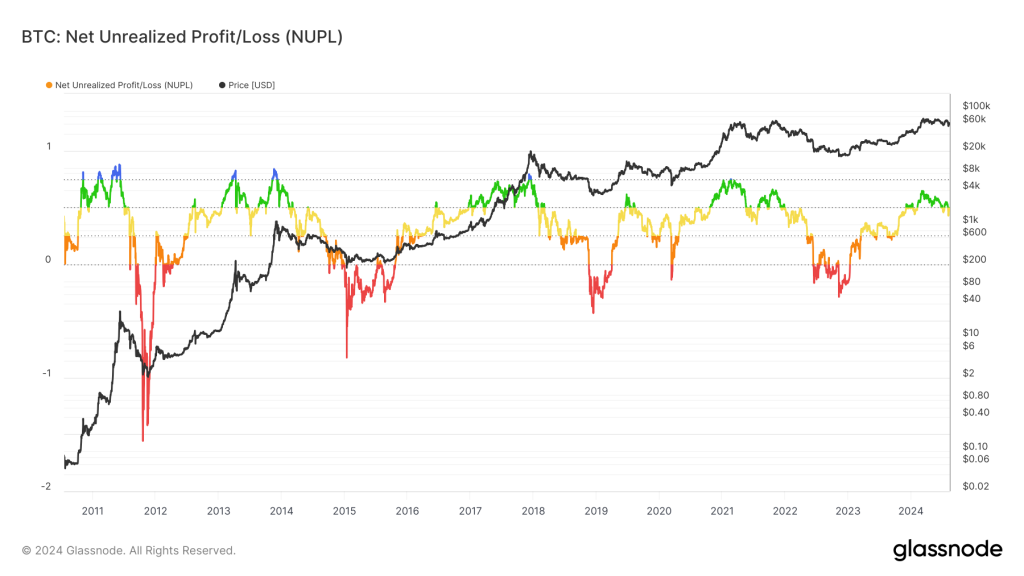

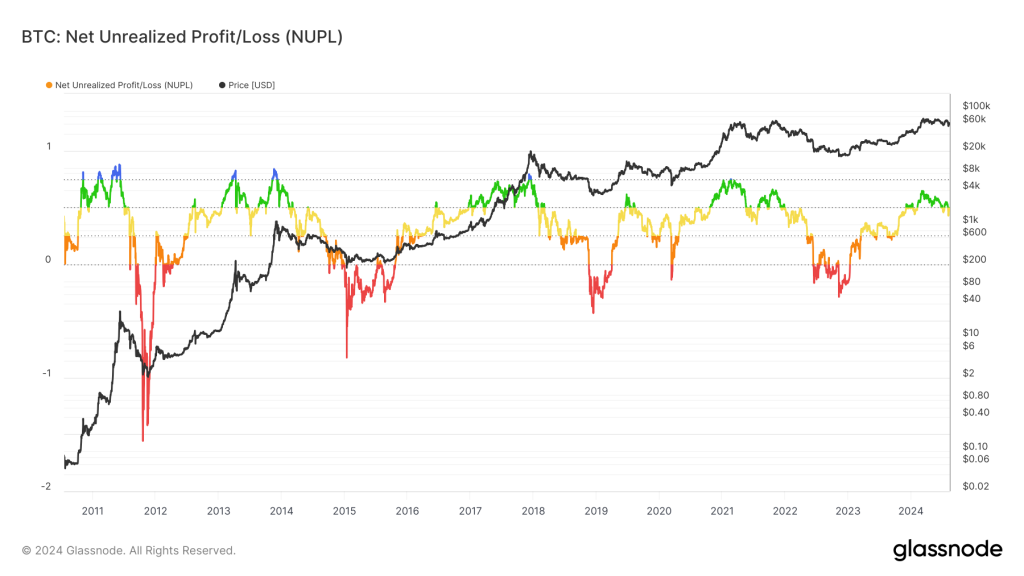

The Net Unrealized Profit/Loss (NUPL) is a metric used to measure the unrealised profits and losses of investors, reflecting market sentiment and potential turning points.

NUPL is calculated by subtracting the realised capitalisation from the market capitalisation and then dividing it by the market capitalisation.

A positive NUPL indicates that investors are, on average, in profit, while a negative NUPL suggests net losses.

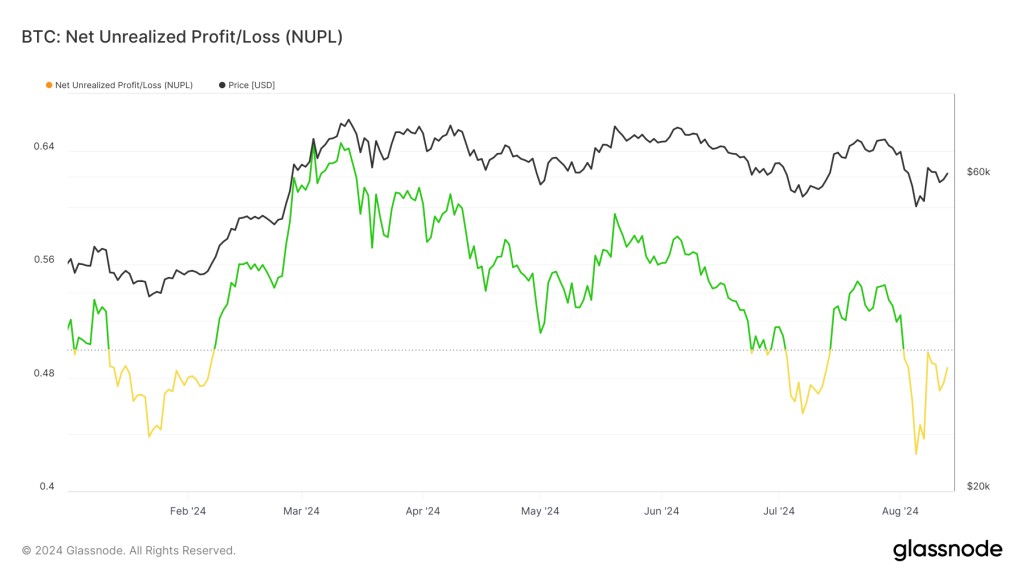

The current state of the BTC NUPL metric is below the 0.5 threshold and transitioned from green (indicating high unrealised profits) to yellow (indicating lower unrealised profits and nearing net losses).

This downward movement in NUPL suggests that many investors are starting to experience unrealised losses or reduced profits. This could undermine their confidence in BTC, leading to new corrections.

Historically, such declines in NUPL have often preceded further price drops or extended market consolidation periods, indicating waning investor confidence and increased selling pressure.

However, that's not the whole story. There is also a vast difference in the NUPL between long-term and short-term holders.

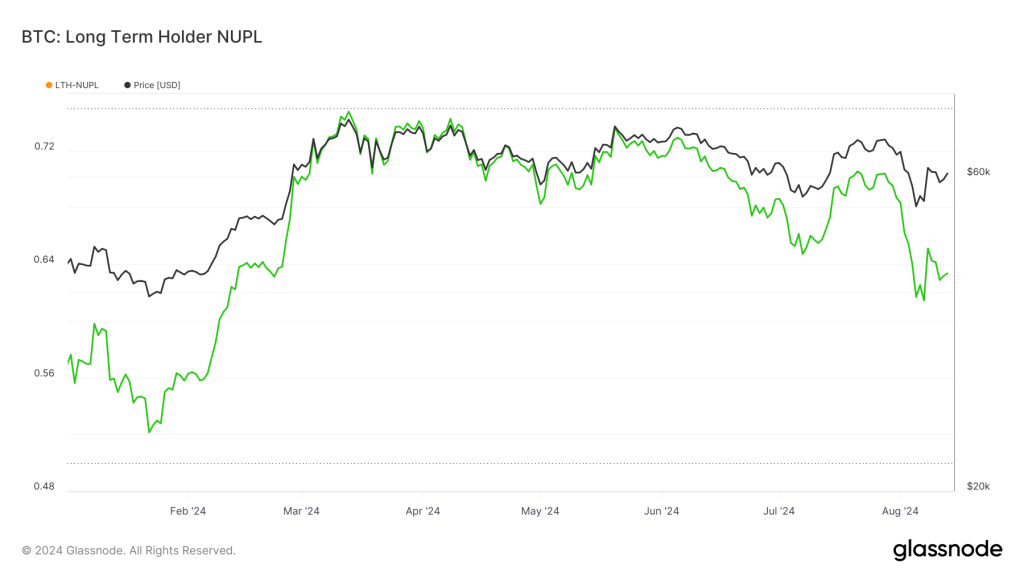

For long-term holders, even with considerable spikes in BTC price and recent corrections, year-to-date data shows they have been in profit, always in the "Belief—Denial" zone. This is an important long-term metric for BTC, showing that long-term holders still believe in the asset even with the spikes and corrections that occurred throughout the year.

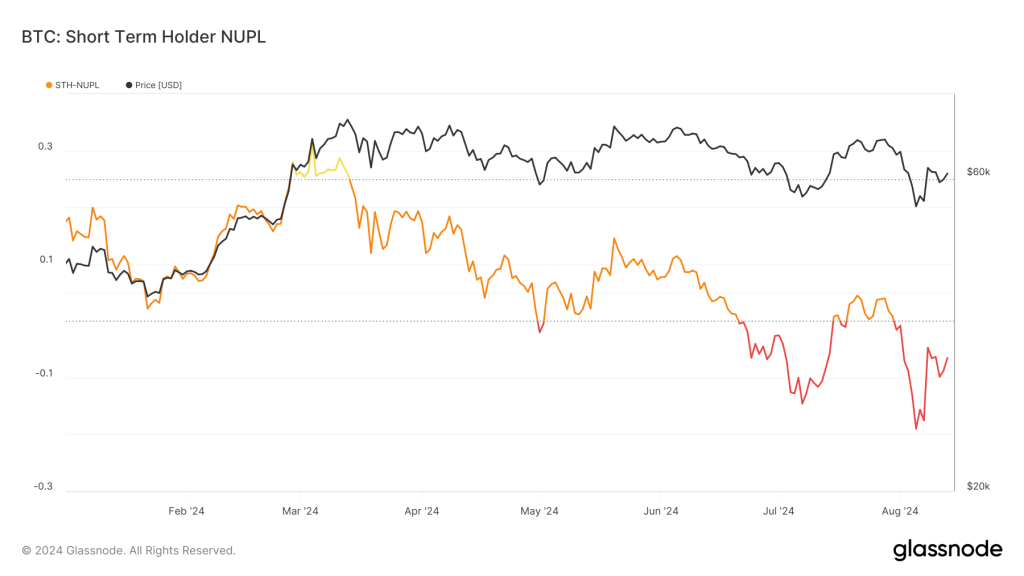

Short-term holders entered the capitulation stage

Short-term holders NUPL, however, paint a different picture. It has recently entered the "Capitulation" stage, showing that short-term holders are experiencing losses in their BTC positions overall.

Short-term holders had a special moment at the beginning of March when BTC's price grew from $51,000 to $71,000 between February 23 and March 13. That marked an important moment when short-term holders, overall, had good profits. After that, BTC entered a consolidatory phase, and their profits were lost.

It's important to keep tracking NUPL because if long-term holders NUPL enter the "Hope—Fear" or "Optimism—Anxiety" stages, which is not close to happening according to the charts, this will show that long-term investors are now in a loss, which could drive huge selloffs.

For now, this appears extremely improbable, at least in the next few months.

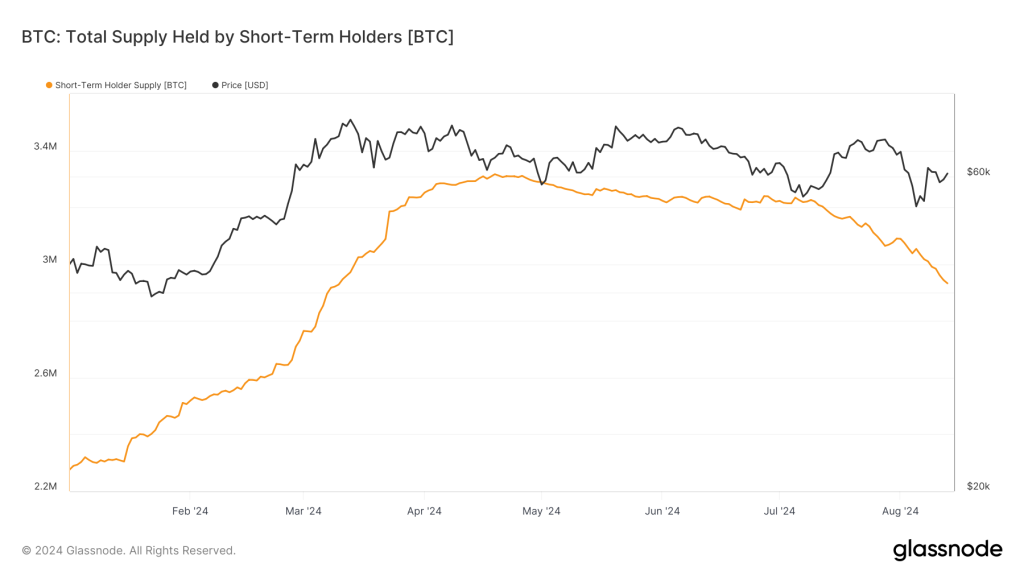

Another important point about short-term holders: Total BTC supply held by short-term holders hit a year-high on April 18. In the first four months of 2024, BTC prices grew from $44,000 to $70,000, naturally attracting more investors.

However, since that peak, the total supply of BTC held by short-term holders has stagnated and dropped heavily since July 11, going from 3.2M to 3M in three weeks.

This decline in supply held by short-term holders, alongside the falling BTC price, suggests that short-term investors are exiting the market, possibly due to declining confidence or taking profits in a weakening market.

The rapid reduction in short-term held BTC indicates increased selling pressure, which historically can lead to further price declines as market sentiment turns bearish. This data supports the argument from the NUPL analysis that we are in the "Capitalisation" phase among short-term investors.

This has also been impacted by the overall market state, with the S&P declining by 3.67% in the last 30 days. That suggests that many short-term investors may not be convicted enough to keep holding their BTC as the whole market looks bearish, and in a crisis, cash is king.

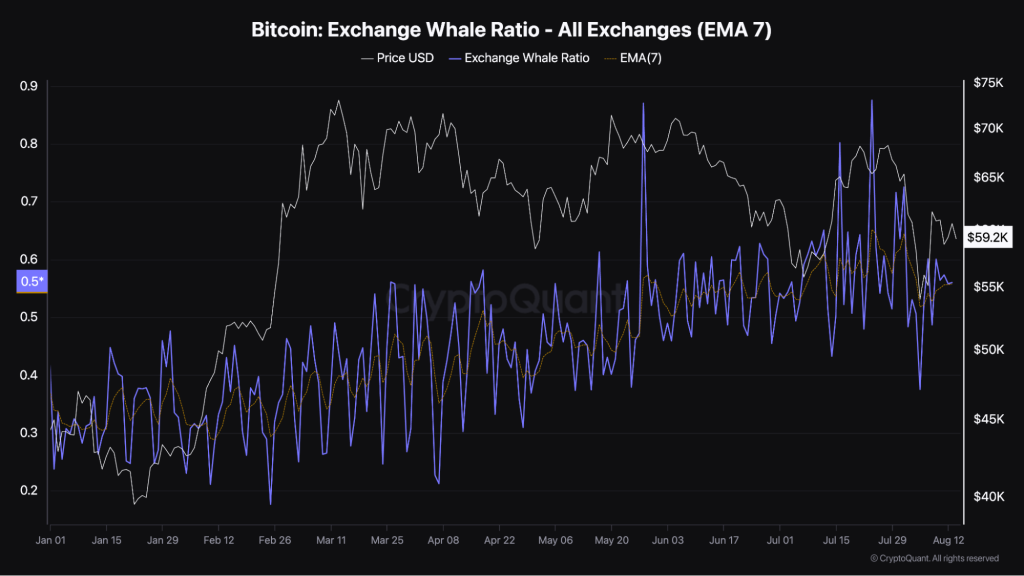

Whales are still sending BTC to exchanges

How about whales? We know that whale movements can impact the whole market, and this is especially true on BTC.When we analyse the BTC Exchange Whale Ratio 7D Exponential Average, we see that it increased from 0.46 to 0.64 between June and July. This metric measures the ratio of the top 10 inflows to the total inflows on the most relevant exchanges in the market.

The larger this ratio, the more it indicates that whales are sending their BTC to exchanges. This can be a significant signal, suggesting that some whales may be preparing to capitalise on their investments by selling their BTC, at least partially.

Source: CryptoQuant

This potential increase in selling pressure from large holders can have a bearish impact on the market, as it might lead to downward price movements. Historical data suggests that the BTC price usually rises when this ratio is stable or decreasing.However, when this ratio increases, the chances of the price having new corrections are higher. The recent rise in the Exchange Whale Ratio and the corresponding decline in BTC's price supports a bearish outlook. This was precisely what happened with price in the last few days.

As the Exchange Whale Ratio and its 7D EMA grew, BTC price declined heavily, dropping from $68,000 on July 27 to $54,000 on August 4. However, the Exchange Whale Ratio 7D EMA started to decline heavily in the last two weeks, indicating that maybe whales are not that bearish anymore.

Short-term outlook looks consolidatory

Analysing historical data, we see that the recent ratio, although declining, is way above the values it reached earlier this year. For example, its 7D EMA was at 0.29 before February's BTC price surge versus 0.55 now.This suggests that whales are still sending significant amounts of BTC to exchanges compared with the amounts they were sending in previous months this year, even though this ratio recently declined.

That could mean that, on the one hand, there is less potential for tremendous selling pressure coming from these whales. On the other hand, the ratio is still bigger than previous records, suggesting a short-run price stabilisation.

Long-term scenario

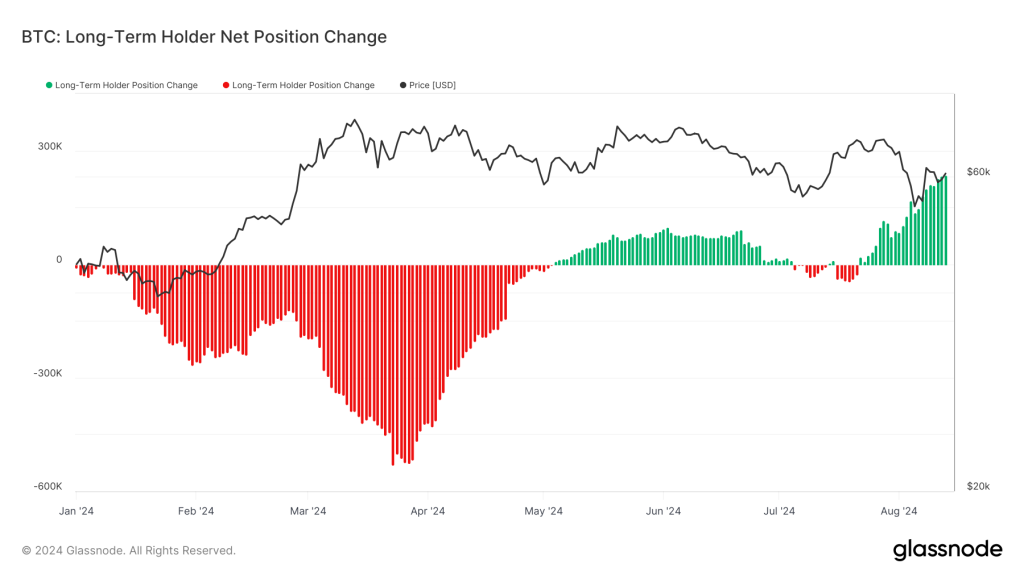

If data shows that short-term holders are potentially selling and many are at a loss, it also tells us that long-term holders still seem to believe in BTC fundamentals, suggesting a bullish long-term outlook.The BTC supply held by long-term holders decreased from 14.3M in January to 13.4M on April 8. During that same period, BTC's price grew from $44.9k to $71k. The pattern is clear: as BTC prices started to grow daily, long-term holders possibly began to capitalise on their gains.

After this, BTC prices entered a consolidation cycle, with the total supply held by long-term holders following this trend during April and growing slightly during June. Following another consolidation in July, the total supply held by long-term holders started to grow heavily again over the last three weeks.

This increase suggests that long-term holders may be accumulating BTC again after months of lateralisation, anticipating new rises in the coming months.

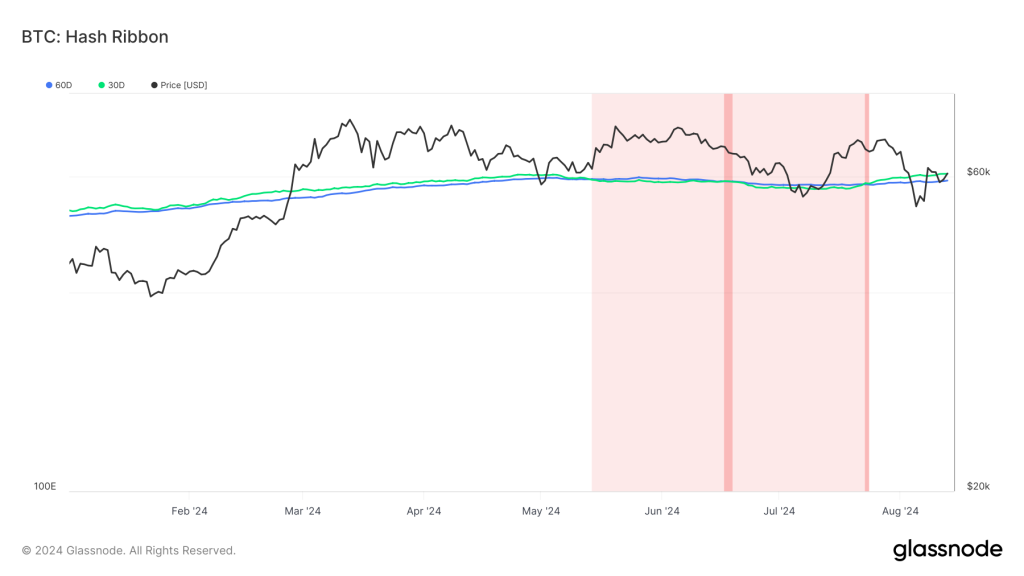

Let's check out the Hash Ribbon, an intriguing indicator that might give us some insights. This metric suggests that Bitcoin usually hits bottom when miners throw in the towel because mining becomes too costly.

When the hash rate's 30-day moving average (MA) crosses above the 60-day MA, it signals that the worst of the miner capitulation is likely over. This happened in the last few days. Not only this, but the distance between them has been growing steadily in the last few days, suggesting that the worst days of correction might be over.

So, even if some metrics point to a bearish state or an accumulation phase in the short-term, long-term holders and the current Hash Ribbon for BTC show that now might be a good time to hold on to your or buy more BTC.

The message is clear: short-term holders are having difficulty trying to time BTC movements. Long-term holders have been much more successful in terms of profits. This IS NOT the time to be selling your BTC.

BTC at $145k in 2025 is still a strong thesis based on long-term holders' activity and NUPL. Looking at historical data, long-term holders have been in profit for almost two years now, and this profit has just increased in the last few months.

That thesis could be invalid if long-term holders NUPL started to drop heavily, reaching 0 or below, which seems extremely unlikely to happen in the following months.

Historical data suggests that the signal for the top of BTC happens when the NUPL ratio hits values above 0.75. This was correct based on previous strong corrections in 2012, 2013, 2014, and at the end of 2017.

The NUPL ratio for BTC currently sits at 0.47, which is still far from the 0.75 threshold, suggesting that we might still be far from new substantial corrections.

BTC looks undervalued now

BTC Mayer Multiple (MM) has recently reached 0.9, its lowest value since January 2023. It's back to 0.97, which is still an oversold condition since MM above or close to 2.4 suggests an overbought state and MM close to 0.8 suggests an oversold condition.

What should you do today?

Based on our analysis, although the short-term scenario can bring some volatility for BTC, the long-term scenario is still strong.It's necessary to monitor the long-term NUPL and Whales Exchange Ratio, as these metrics can spot potential selling pressures that could cause a price drop. Also, it is necessary to track the historical NUPL ratio, which is at a pretty healthy value right now.

The long-term holder net position change has been positive since July 22, showing that long-term holders are accumulating after the recent correction. On August 12, it reached its biggest value since May 11, 2023.

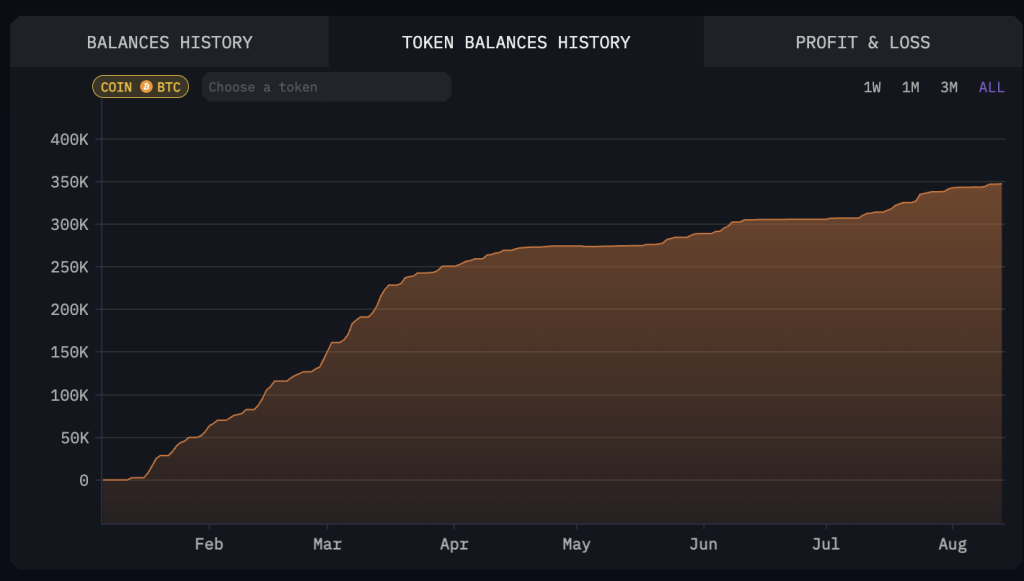

Since the last dip, Blackrock intensified its accumulation.

Source: Arkham

Since July 10, Blackrock added roughly 37,000 more BTC into its portfolio, currently at 347,000 BTC.If you already have some BTC, the smart choice now is to hold it. If you don't, now could be a good entry point since short-term holders are still selling quickly.

Based on that, entering BTC until $63,000 sounds like a reasonable decision if you want to build a new position or increase an existing one.

Cryptonary's take

The current state of the Bitcoin (BTC) market is transitioning from a period of correction to a phase of market consolidation in the short term. While the technical indicators suggest a bearish outlook in the near term, the long-term fundamentals for BTC remain strong.The NUPL ratio for long-term holders remains in the "Belief - Denial" zone, far from the 0.75 threshold that has historically indicated a market top. This suggests that there may still be significant room for BTC price growth in the coming months.

Based on these factors, while the short-term scenario may bring some volatility, the long-term outlook for BTC appears quite bullish.

As noted in our August 12 Market Direction report, "We expect the price to remain range-bound over the coming days, maybe even over the next week. We expect price to remain between $58k and $62k. However, it's also possible that price dips into the $56k to $57k area. If so, we would be buyers of specific altcoins or memes if they hit their price targets on another retest lower. "