We hope you’ve had a great holiday season enjoying the love of family and friends.

In Q3 2023, the crypto winter ended, and it is becoming increasingly clear that the crypto spring is underway.

But what does 2024 have in store for crypto?

Our 2024 started with Bitcoin price targets – our price targets for Bitcoin range from $60k on the low end up towards a staggering $220k high mark – details in the report.

Next, we detailed the incredible rallies we envision for marquee altcoins. As money flows downmarket into large and small caps alike, we anticipate a blitz scale search for outsized returns before mass adoption drowns out asymmetric upside in crypto.

Nonetheless, while our overall sentiment is bullish, the actual reality that we will experience still depends on how macroeconomic factors play out.

For instance, in our last macro outlook, we noted that “It’s possible we have a liquidity crisis in early 2024. If this were to happen, markets would sell down meaningfully. Yet, this would cause the Fed to step in, which would be bullish for risk assets. But of course, the pullback/crash before this would see prices decline meaningfully in that short period.

Of course, no one has a crystal ball. However, based on our understanding of the past and knowledge of the present, we think we have a decent idea of what to expect this year. And all things being equal, Cryptonary is overwhelmingly bullish on crypto in 2024.

Key takeaways

- Bitcoin price targets remain bullish, between $60K and $220K. But what will drive this growth?

- Solana's lower market cap allows higher return potential, but Ethereum maintains dominance in terms of market cap.

- DeFi will progress, but upstart sectors like DePIN may start gaining significant traction.

- Is this the year that crypto payments finally take off?

- Will Coinbase retain its pole position in US markets, and what will happen to Binance?

- On memecoins - WAGMI or NGMI?

- Something interesting is happening at the intersection of crypto and AI.

- Which small-cap coin has the best chance of joining the top 10 by market cap?

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

BTC, ETH, and SOL price targets

Across the Cryptonary team, we see the current bull run pushing Bitcoin over $100k, Ethereum over $10k, and Solana over $500 by the end of the year 2024.Based on individual projections, our average bull case projections for Bitcoin is $142k, Ethereum should rally as high as $8.7k, and we have Solana sitting pretty at $712.

Our base case averages see Bitcoin at $80k, Ethereum at $5.5k, and Solana around $387.

If the markets take a downturn, our bear market averages put Bitcoin at $47k, Ethereum at $2.8k, and Solana at $176.

TLDR: barring any major black swan events, the general direction for crypto is northbound.

Comparison table

Individual spotlights

Digging deeper into Asad's projections, he sees Bitcoin potentially surging to $220k in an extremely bullish scenario driven by mass retail and institutional adoption. His Ethereum top forecast of $11k is similarly based on explosive growth.Cryptonary’s take

Overall, we see upside potential for the crypto market in 2024 but remain cautious in base and bear cases if macro conditions decline.Should you put your money in BTC, ETH or SOL?

Well, the upside appears more limited for Bitcoin relative to Ethereum and Solana, which could see larger multiples from current prices.

ETH vs SOL

Overall, we believe Solana can outperform Ethereum in 2024 due to its lower market cap and greater growth potential. However, most Cryptonary team members don’t foresee Solana surpassing Ethereum in overall market cap.The projections of individual team members vary from moderately bullish price targets to parabolic growth up to 5x for Solana.

Key factors influencing their opinions include expected advances for both networks, risk appetite, NFT and memecoin trends and the total value locked in DeFi protocols.

Individual spotlights

Adam believes Solana fits the criteria of lower cost and greater returns that will appeal to new crypto investors. He expects memecoins and NFT projects to drive growth on Solana. His thesis aligns with the broader view that Solana will outpace Ethereum in percentage returns due to its lower market cap.Victor stands out with one of the most bullish Solana outlooks for 2024. He straightforwardly projects Solana will outperform Ethereum across ROI and opportunity cost over the next year.

Cryptonary’s take

We see upside for both Ethereum and Solana in 2024 but believe Solana’s superior growth prospects position it well to be the year’s top-performing layer-1 blockchain.However, Ethereum remains the "blue chip" crypto asset that warrants a larger allocation for conservative investors.

Based on the projections of several team members, the growth versus risk balance points to Solana potentially 5xing or more in 2024.

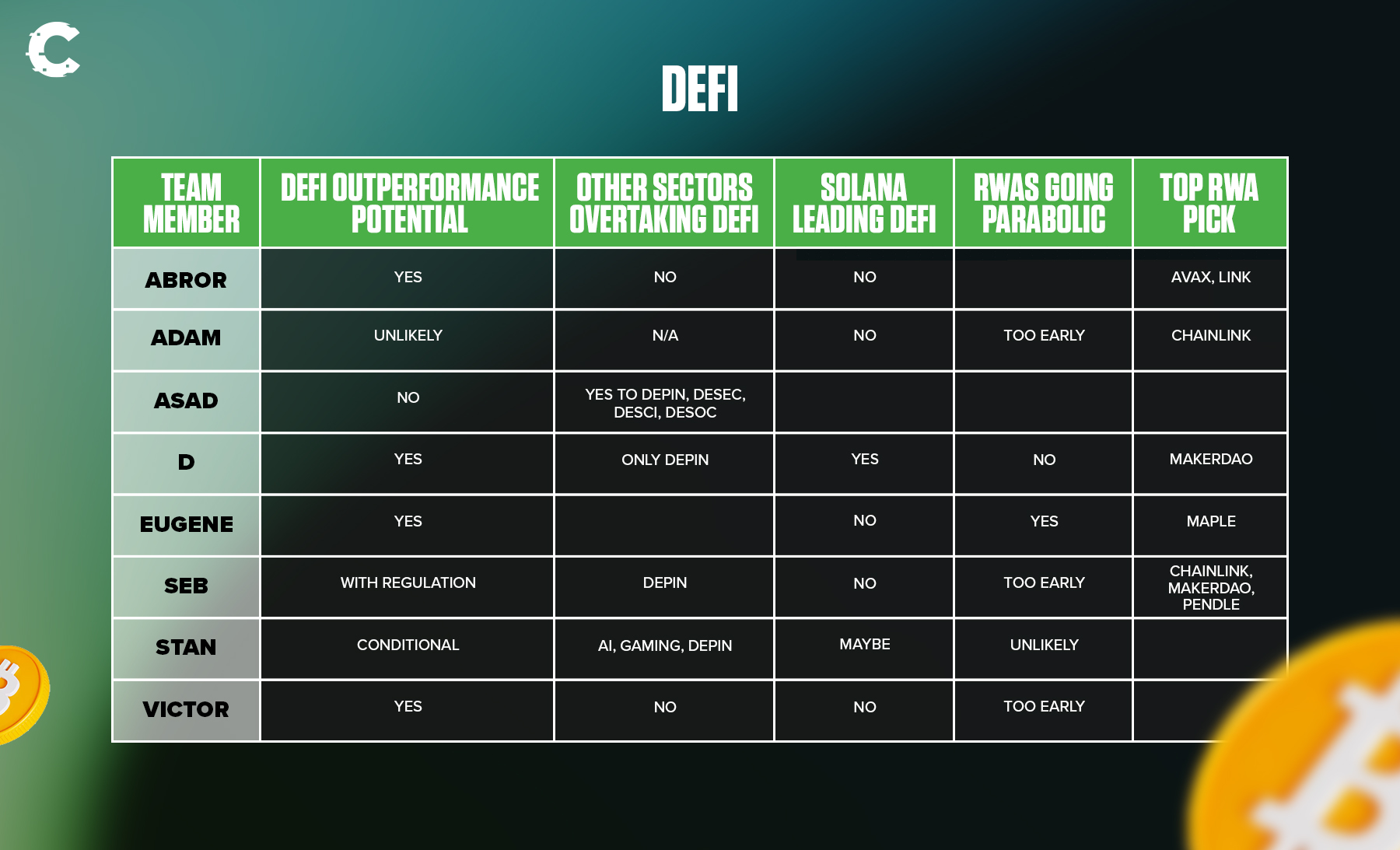

DeFi

Overall, we see potential for DeFi growth in 2024, but we believe other emerging sectors like DePIN, DeSci, and DeSOC may start to gain more traction.Most Cryptonary team members don't believe Solana will become the dominant DeFi blockchain in just one year.

And on real-world assets (RWAs), opinions are split on whether they will go parabolic in 2024 or if they are still too early.

But if you are interested in playing at the edge with RWAs, interesting picks for exposure to this segment include AVAX, LINK, Maple, and MakerDAO.

Comparison table

Individual spotlights

D believes DeFi has a "fighting chance" to outperform based on the modern crypto degen demographic. He is very bullish on Solana becoming the top DeFi blockchain in 2024 due to its speed, low fees, and fun UX. However, he does not believe RWAs will go parabolic yet.Eugene sees DeFi strongly outperforming, facilitated by layer 2 solutions. He believes RWAs will go parabolic as it's impossible to link real-world assets without tokenisation. His top RWA pick is Maple Finance.

Cryptonary’s take

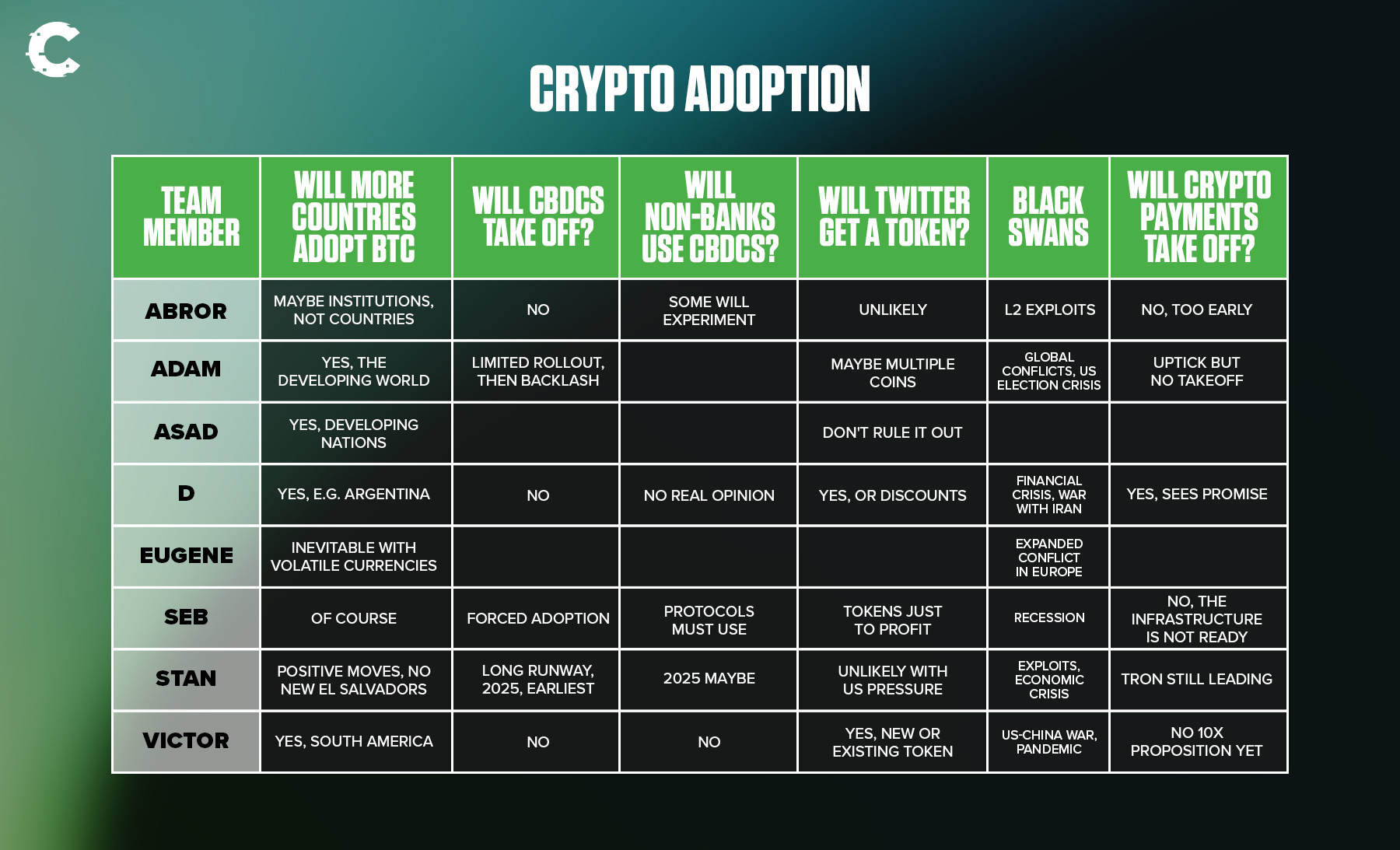

Overall, we see the potential for DeFi to continue growing, especially with layer 2 adoption, but some emerging web3 sectors may start to take off even faster. Opinions vary on RWAs and Solana's potential to lead DeFi long-term. Again, key projects to watch include AVAX, LINK, Maple, and MakerDAO.Crypto adoption

We see continued Bitcoin adoption by countries, especially in the developing world, as governments look to stabilise local currencies and economies.However, there is less consensus around central bank digital currencies (CBDCs), with most team members expecting limited traction in 2024.

Opinions are mixed on whether Elon Musk will integrate crypto into Twitter this year. However, Asad believes that the most entertaining option is the most likely pathway for Elon – so don’t rule out Doge.

When the team was asked to share their thoughts on potential black swan events that could derail crypto in 2024, the recurrent themes were global conflicts, economic crises causing more quantitative easing, and crypto-specific risks like exploits.

By the way, we don’t see crypto payments going fully mainstream yet, though some protocols may gain more adoption in specific use cases or regions.

Comparison table

Individual spotlights

Adam sees further Bitcoin adoption concentrated in the developing world, especially across Africa and South America, where demand is high. However, he believes CBDCs may get an initial limited rollout in 2024 but will face public backlash and get pulled back. He thinks crypto payments won't fully take off yet in 2024, either.Victor believes there is a decent chance another South American country will put Bitcoin on its balance sheet in 2024. He also thinks crypto payments still need to prove a 10x improvement over traditional options before fully taking off.

Cryptonary’s take

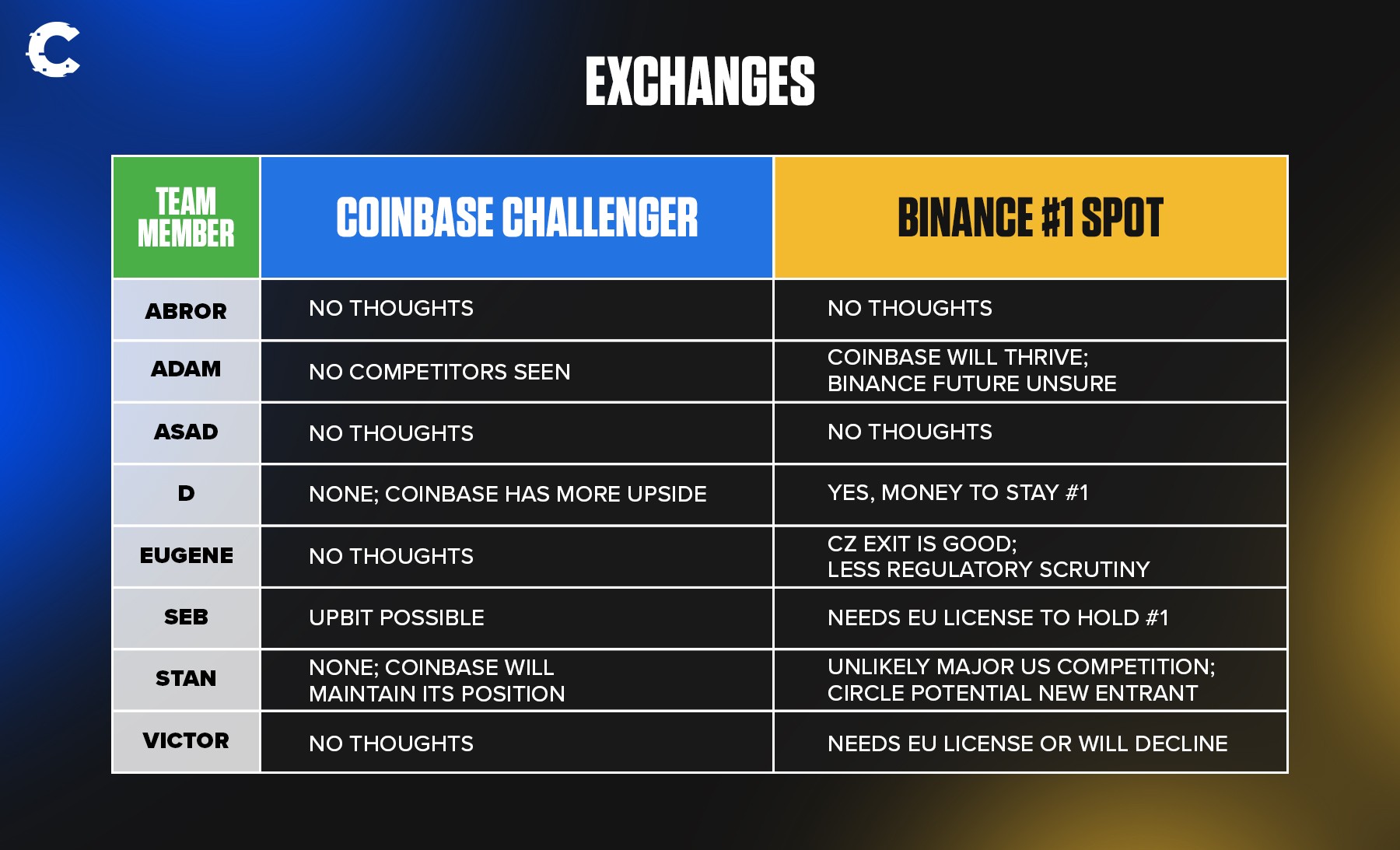

We expect ongoing Bitcoin adoption progress in 2024, primarily in emerging markets facing currency and economic instability. Crypto payments also likely require more infrastructure development and real-world validation before reaching widespread global use.Exchanges

Overall, we do not have strong opinions on potential Coinbase competitors entering the public markets in 2024. Most of the team believes Coinbase will maintain its dominant position, with Circle as the only potential new entrant named.As for Binance retaining the #1 spot in volumes, responses are mixed - some team members believe Binance can hold the top position if they obtain EU licensing. In contrast, others think the regulatory scrutiny and CZ's exit signal declining fortunes ahead.

Comparison table

Individual spotlights

Adam believes Coinbase will continue thriving, citing the potential for the COIN stock price to be a "big winner" in 2024. However, he thinks the future for Binance is more uncertain amidst regulatory issues and CZ's exit.Eugene has an interesting contrarian take on CZ's Binance exit. He sees it as a positive step to reduce regulatory pressure, with less concentration of power in one individual. In Eugene's view, this could ensure Binance's continued dominance.

Cryptonary’s take

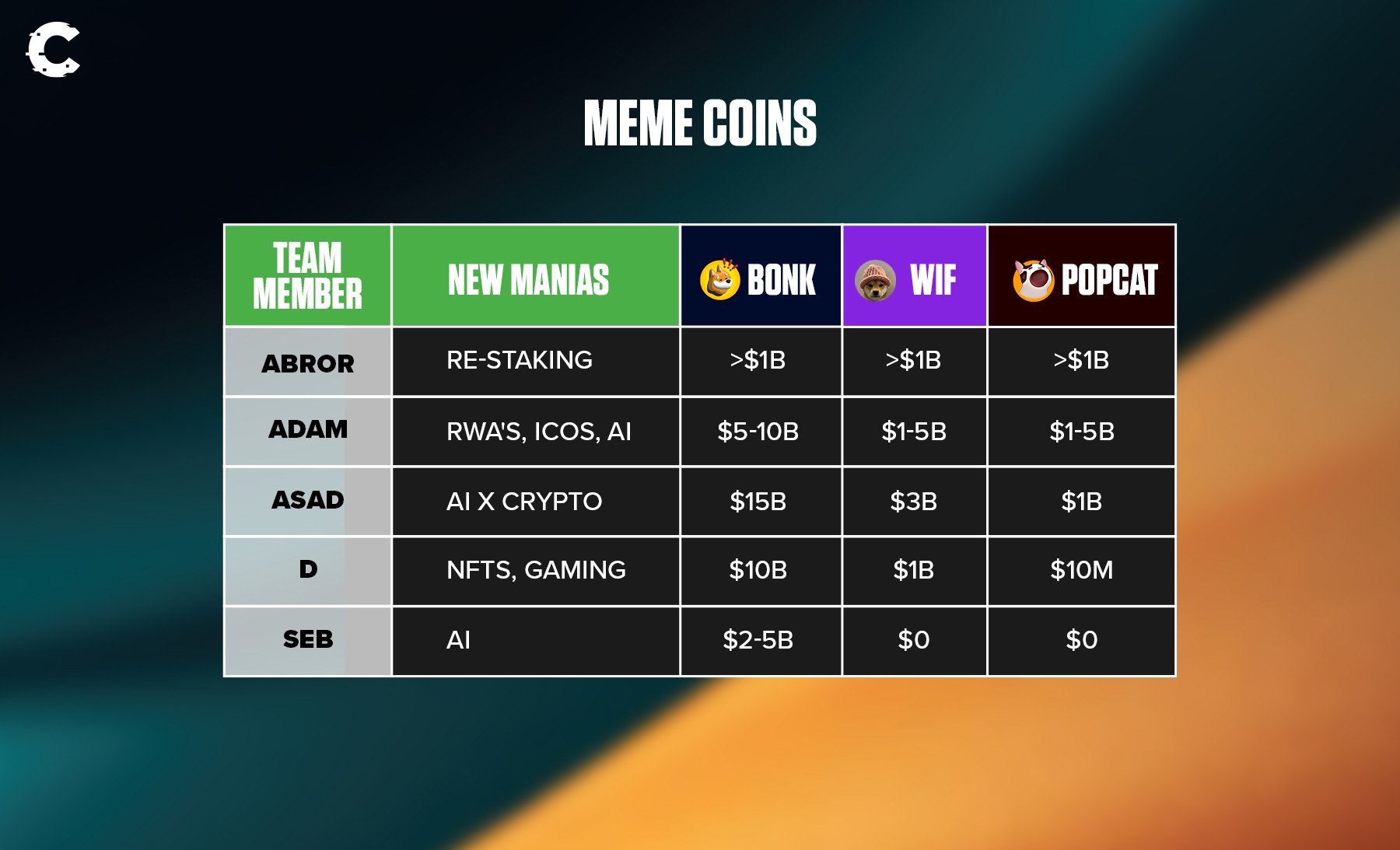

Overall, we see little threat to Coinbase's dominance of US crypto markets, while Binance faces more uncertainty in retaining the global #1 spot depending on regulatory outcomes, especially in Europe. CZ's exit could either undermine or strengthen Binance in the long run.Meme coins

Overall, we think that speculation in memecoins will continue to play a major role in crypto markets in 2024.Most of us expect new speculative manias around areas like NFTs, gaming, DeFi, and social tokens.

However, we disagree on how dominant memecoins will be, with some seeing it as more cyclical based on market conditions.

Price targets for major meme coins are generally optimistic, with most seeing billion-dollar market caps as achievable if the overall crypto market performs well.

Comparison table

Adam's projection about POPCAT is dependent on Asia’s love for cats.

Individual spotlights

Asad thinks not having memecoin exposure could become a liability. Asad expects BONK to potentially reach a $15 billion market cap, the highest projection from the team. He cites hype around AI intersections with crypto fueling renewed speculative manias.Seb believes memecoins typically mark market tops when greed sets in. He projects BONK potentially reaching a $2-5 billion market cap but sees WIF and POPCAT going to zero.

Cryptonary’s take

We broadly agree that speculation around meme coins shows no signs of fading. Asad's optimism on top memecoins indicates scope for continued exponential growth if conditions align.Long story short, monitoring both hype-driven gains and contrarian signals will remain prudent in 2024.

Crypto x AI

Overall, we do not believe that AI will kill or significantly reduce crypto's hype.Most members see AI and crypto as complementary technologies that can positively reinforce each other.

Potential synergies identified include using AI to improve crypto platforms, securing AI models with crypto infrastructure, using crypto to incentivise data collection and model training, and having AI agents utilise crypto for payments and resources.

Individual spotlights

D provided an extensive list of potential intersections between crypto and AI, highlighting projects leveraging crypto for AI graphics, storage, compute, training data, and more.Stan also had an insightful take, noting that AI and crypto convergence could include AI agents using crypto infrastructure for payments and access to digital resources, innovations like "zkML" allowing smart contracts to query AI models securely, and tokens providing a means to reward individuals for fine-tuning models and collecting valuable real-world data, intersecting with DePIN.

Cryptonary’s take

In summary, we see strong promise in the fusion of AI and crypto, with each field able to reinforce and improve the other through multiple technical and economic synergies. Rather than rivals, they should be viewed as allies in digital transformation.Others

Overall, we have mixed views on which small-cap altcoins have the potential to break into the top 10 by 2024. A couple of team members mentioned Thorchain as having potential.On Base getting a token in 2024, most of us don't believe Base will launch a token in 2024.

On other major altcoins pulling a Solana in 2024, opinions also varied on whether 2024 will be the year for a Cosmos rally. A few members see the potential for Avalanche to see increased adoption of dApps, but not to the same degree as Solana.

Regarding opportunities for liquid staking, some cited Solana, while others pointed to new chains like Monad. There was general agreement that decentralised physical infrastructure projects like Helium have strong potential.

Comparison table

Individual spotlights

D sees potential for some smaller cap alts like Injective, Monad (if it launches a token), and Sei to potentially approach the top 10. He thinks Cosmos could have a rally but not a "supersonic" one. He is also very bullish on DePIN projects, citing real-world use cases and necessity.Seb singled out Thorchain as having top 10 potential thanks to its popularity and use case as a DEX router. He doesn't see Cosmos or Avalanche rallying in the same way and thinks they serve different niches.

Cryptonary’s take

We see the potential for some smaller altcoins to make moves, but a top-10 positioning may be a stretch in 2024. We agree decentralised infrastructure has strong real-world use cases. The team is mixed on Cosmos and Avalanche's likelihood to rally big.Final take

Reviewing our 2024 crypto market projections, the emerging themes are continued growth and maturation across the broad crypto market despite lingering volatility. Macro permitting, we look forward to seeing new all-time highs for Bitcoin.As always, do your own research, but we are optimistic that there is a chance 2024 will deliver life-changing wealth creation as crypto continues to become entwined with the global economy – starting with the spot BTC ETF approval.

Of course, risks around regulation and economic shifts present some lingering concerns. Yet, the core trajectories for crypto point upwards – but note that our projections are ambitions, not absolutes.

Cryptonary, Out!