Revisiting our options winner: this project is on track for success

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

Options are a versatile and complex financial instrument that big institutions and sophisticated traders love.

Therefore, building a decentralised options platform on a blockchain is no small feat. It's akin to reinventing the wheel in a world where the terrain is constantly shifting. Yet, while many projects struggle to move from concept to reality, our options winner has been making significant strides in shipping innovative products and growing its user base.

It's a straightforward story of ambition, hard work, and real results that's reshaping what we expect from the sector.

Let’s dive straight into an update.

TLDR

- Lyra has launched Lyra V2, a custom Layer 2 blockchain built using the OP Stack.

- Lyra has introduced well-balanced and sustainable tokenomics for V2.

- Volumes and capital efficiency of V2 have been impressive so far

- Lyra is building a UX that abstracts away from all complexities specific to using a blockchain - this is bullish for institutional adoption

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Options - a quick introduction

Options are derivative assets that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) before or at the option's expiration date. They are an essential component of financial markets.Briefly speaking, there are two main types of options:

Call options

- A call option gives the holder the right to buy an underlying asset at a specified price (strike price) before or at the expiration date.

- Investors typically buy call options if they believe the price of the underlying asset will rise.

- A put option gives the holder the right to sell an underlying asset at a specified price (strike price) before or at the expiration date.

- Investors usually buy put options if they anticipate that the price of the underlying asset will fall.

We have been long bullish on crypto options and have released multiple reports covering crypto options as far back as 2022.

Initially, we went with Premia as an options platform winner; however, gradually, we lost faith in Premia due to its poor development. We flipped our options bet from Premia to Lyra as a winner in the crypto options market.

However, since we last covered Lyra, there have been many positive developments, and we think it is time to provide an update to our members.

Lyra V2 debuts

In Dec 2023, Lyra launched its V2. That is probably the most important upgrade in Lyra’s history.

So what is V2, and how is it different from the previous version?

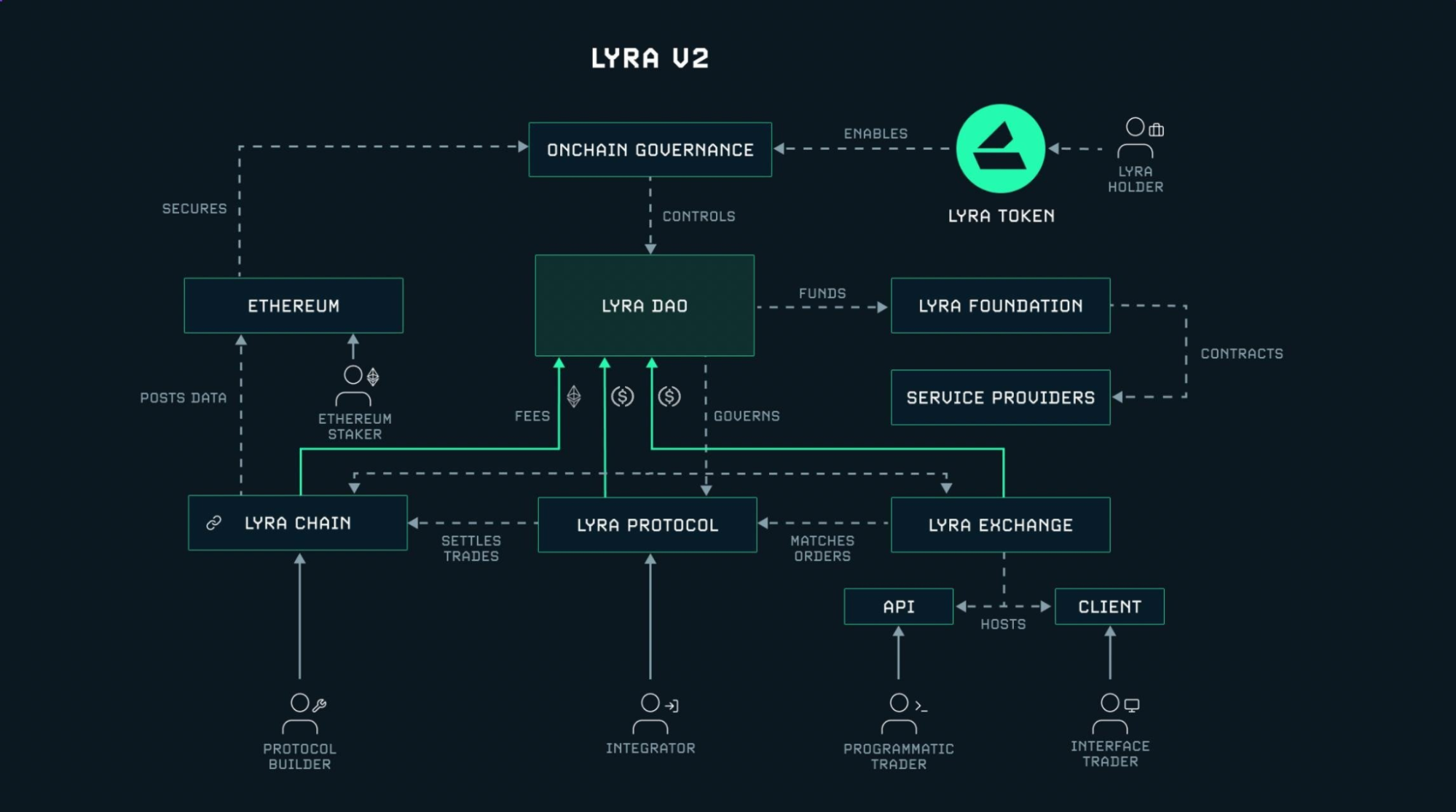

Lyra V2 is a high-performance, self-custodial, and flexible crypto trading platform catering to perps and options traders. V2 consist of 3 components: Lyra Chain, Lyra Protocol, and Lyra exchange.

Lyra chain

Lyra chain is a fully customisable and flexible L2 appchain built using the OP Stack.It settles transactions on Ethereum and uses Celestia for data availability, which results in high throughput, low latency and cost-effective execution.

It has smooth deposits/withdrawals from Ethereum and L2s, where if you deposit more than $1000 from Ethereum and more than $100 from L2s, all gas costs are covered by the Lyra.

Lyra also has native account abstraction, meaning you don’t have to pay for gas or even have a wallet when using the Lyra chain. This emulates the UX of CEXs while also being self-custodial.

Lyra protocol

The Lyra protocol is a collection of smart contracts that form a decentralised and self-custodial derivatives protocol. This allows for creating options, perpetual futures, and an upcoming spot trading market.The protocol has three main components: subaccounts, managers and assets.

Subaccounts are the base unit of the Lyra Protocol stored as ERC-721-compliant NFTs. Before starting trading on Lyra, a user must create an account. This is the only time you will sign any transaction. After that, the whole trading process abstracts away from signing transactions.

Managers are immutable smart contracts that specify certain rules for subscribed subaccounts. The managers specify margin rules, enforce liquidations, and are responsible for settling all trades.

Assets - cash assets such as USDC, European options, Perpetual futures on a given underlying asset and wrapped ERC20 assets such as wBTC.

Lyra exchange

This is the front-end for Lyra V2, offering self-custodial service with zero cost and low-latency matching.It will have two types of users.

- UI Traders: Access Lyra Exchange through the GUI (front end).

- API Traders: Access Lyra Exchange via API.

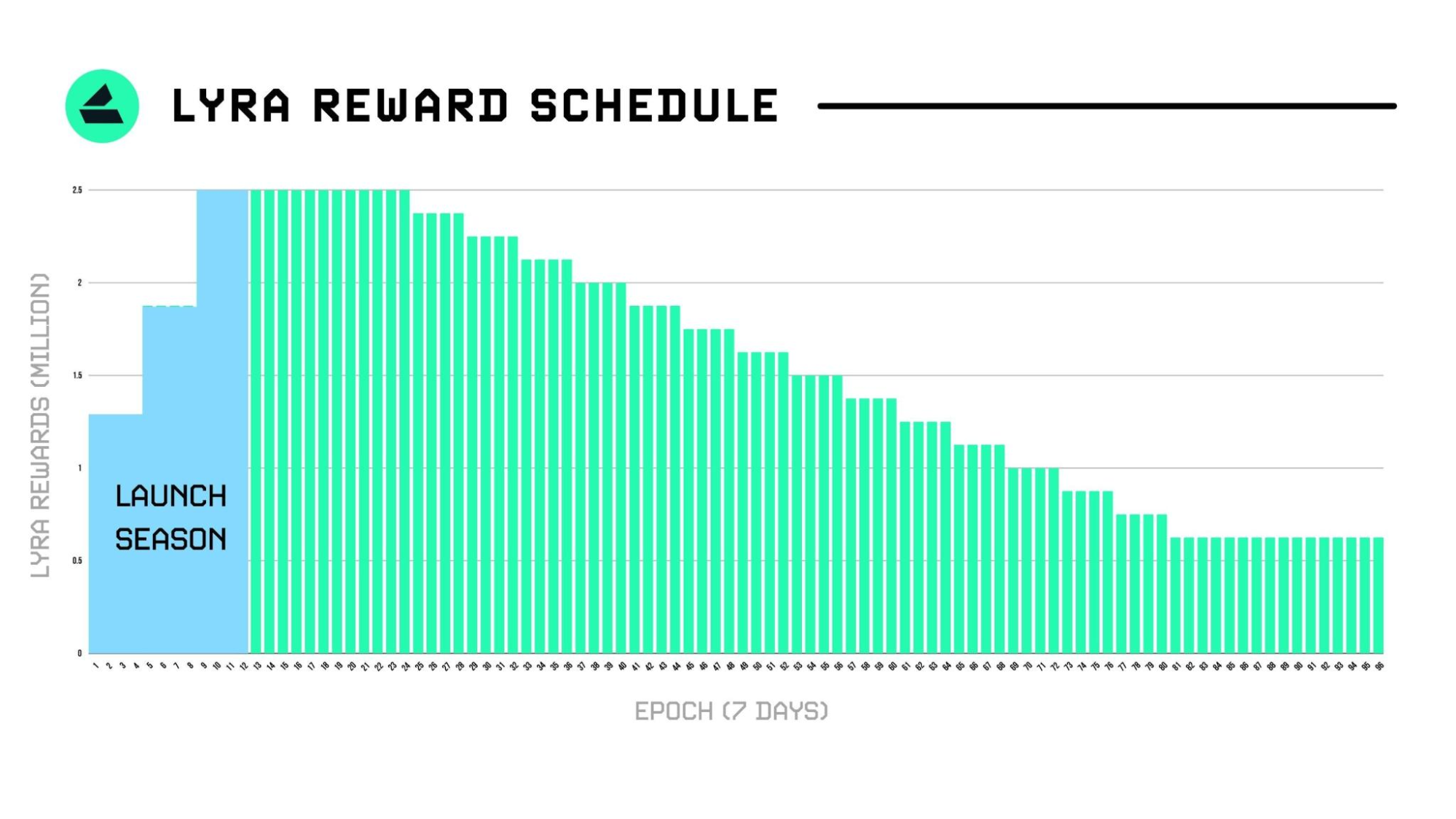

Tokenomics V2 will make a big difference

With the launch of Lyra V2, there have been very important changes to tokenomics as well. New tokenomics has several purposes:

New tokenomics has several purposes:

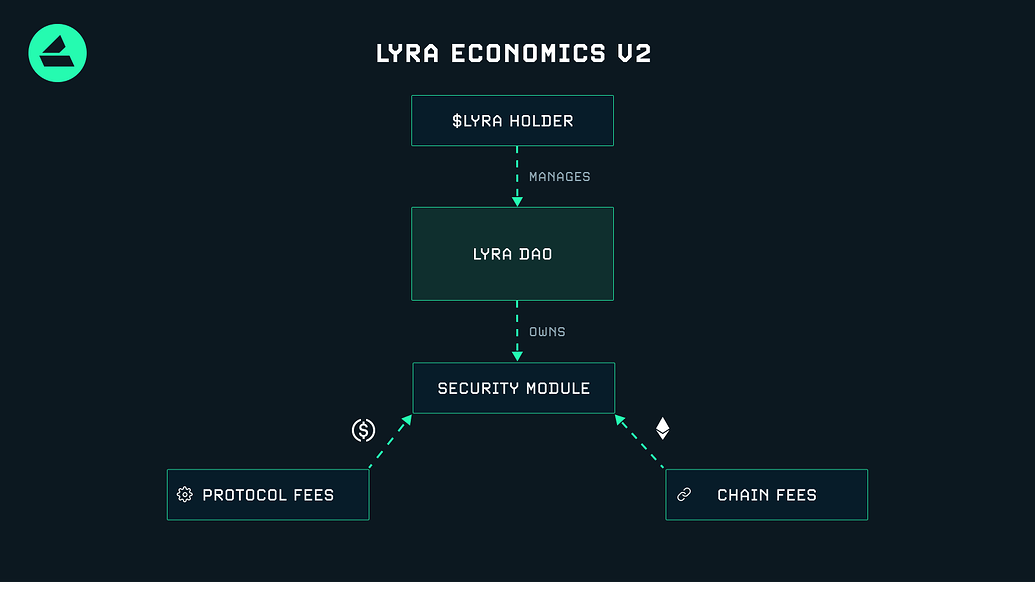

- Decentralize governance and ownership of Lyra Chain and the V2 protocol

- Promote the adoption of the protocol by key stakeholders

- Provide a path to sustainability for the DAO

We have seen in the case of Kwenta that bootstrapping the platform with its own token can result in a loyal and sticky user base if it is done properly.

What is even better is that, unlike Kwenta, the Lyra community is taking care of the demand side of the token from the beginning, which leads us to the next section…

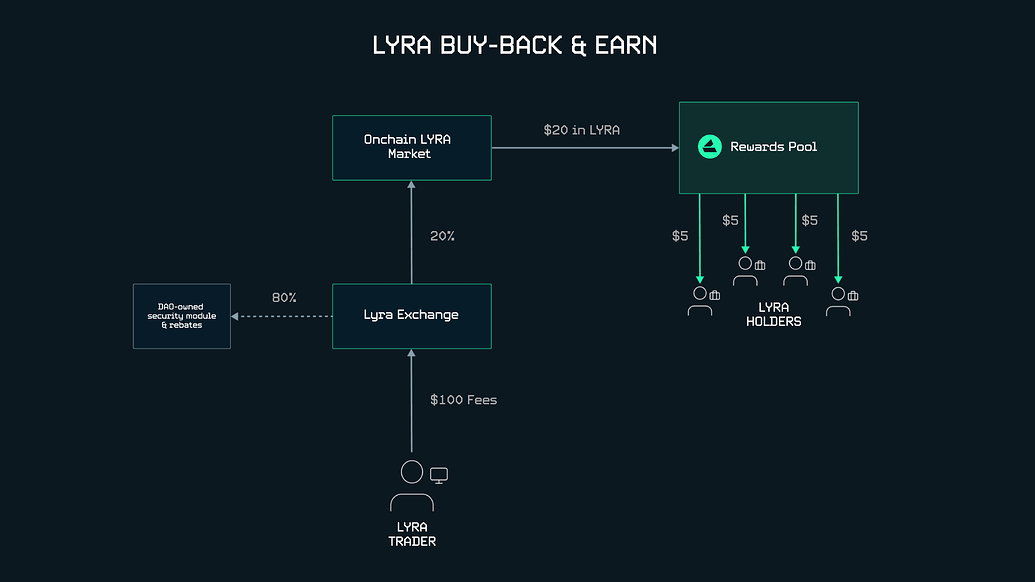

Security module and buy-back & earn

Sustainability is one of the priorities in Lyra V2. Previously, Lyra didn’t have any direct value accrual except for governance.Obviously, just giving away tokens to users is not sustainable. To disincentivise farm-and-dump behaviour, there must be a reason to hold the token.

Secondly, to be a sustainable options platform, there needs to be an insurance fund to ensure the safety and solvency of the protocol during extreme market conditions.

Initially, the dev team advocated for fees generated by the platform to be directed solely to the security module (insurance fund). That would make sure that the protocol is safe and solvent at all times. However, that would crash the price of Lyra and make the incentives program less and less valuable over time.

This resulted in active discussions in Lyra’s Discord. Certain community members (including the Cpro team) pointed out that it is not a sustainable path. The token should have a direct value accrual that matches the selling pressure from the incentives program.

Fortunately, the team considered that, and the final proposal for voting on fee distribution looks like this.

80% of fees generated will be stored in a security model, and 20% of fees will be used to buyback Lyra from the market and distribute it among Lyra holders

20% is just the beginning. If the security module grows sufficiently big, DAO can vote to increase Lyra buyback from 20% to 30%, 40% of fees.

We believe this is excellent and well-balanced tokenomics that would ensure both the protocol's security and the DAO's sustainability.

Impressive volumes, fees, and the Lyra wallet

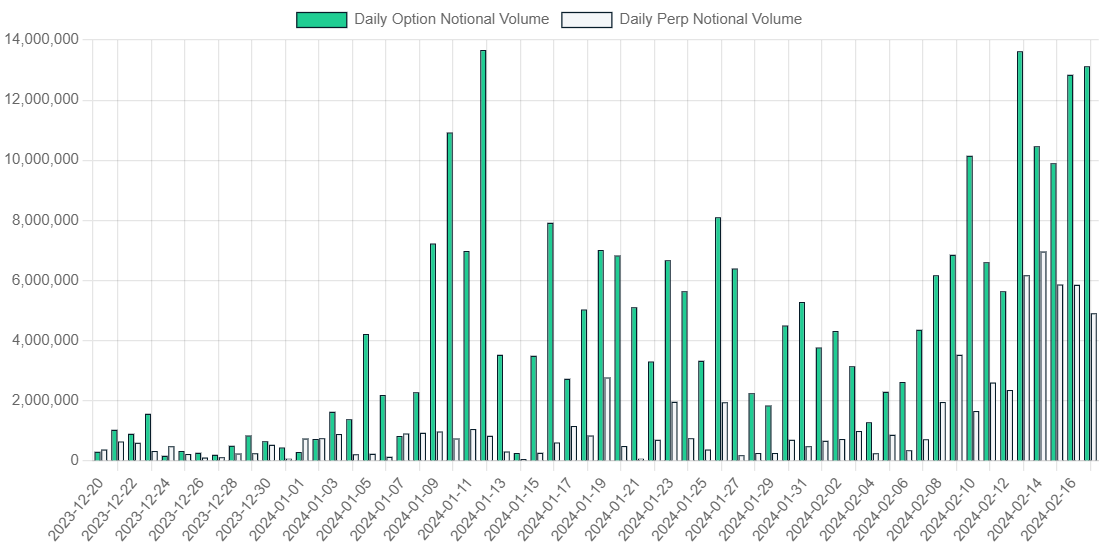

The launch of Lyra V2 has certainly been a success. It has been crushing it in terms of volume, consistently occupying the number 1 spot among options trading platforms. It is THE most capital-efficient options platform by far.

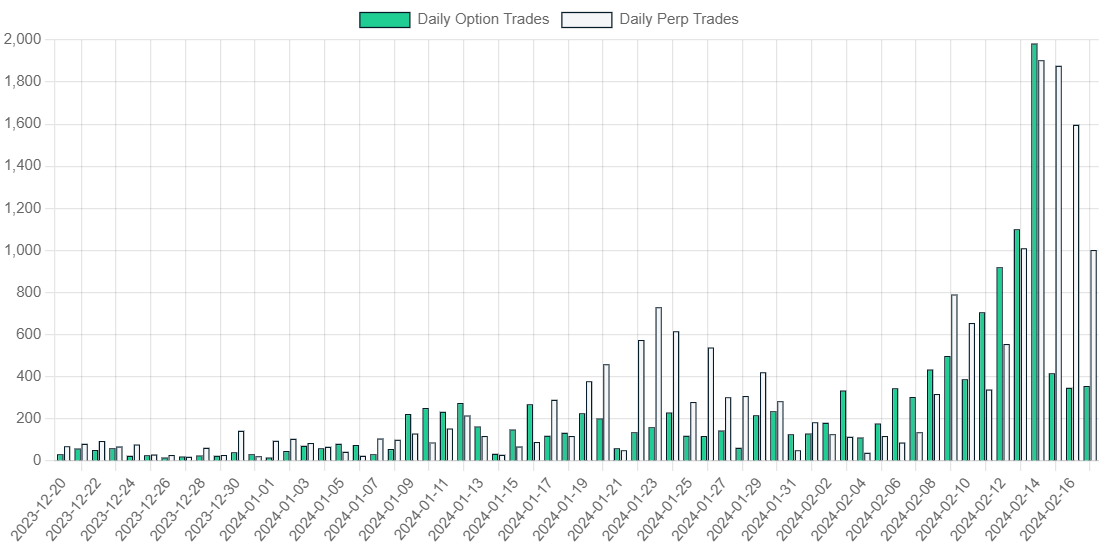

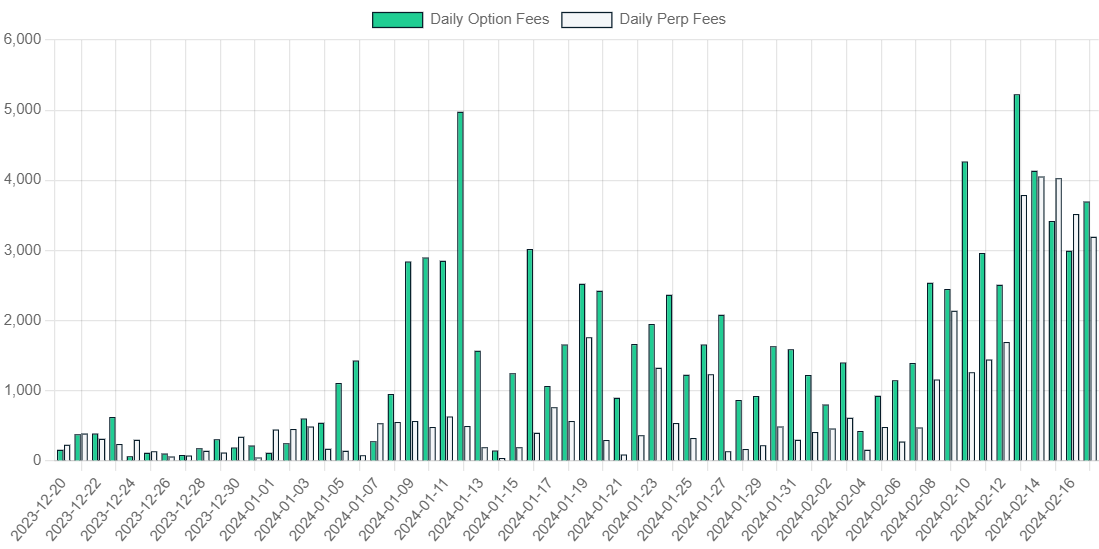

Volume, fees generated, and the number of trades happening on Lyra are trending up.

Lyra wallet

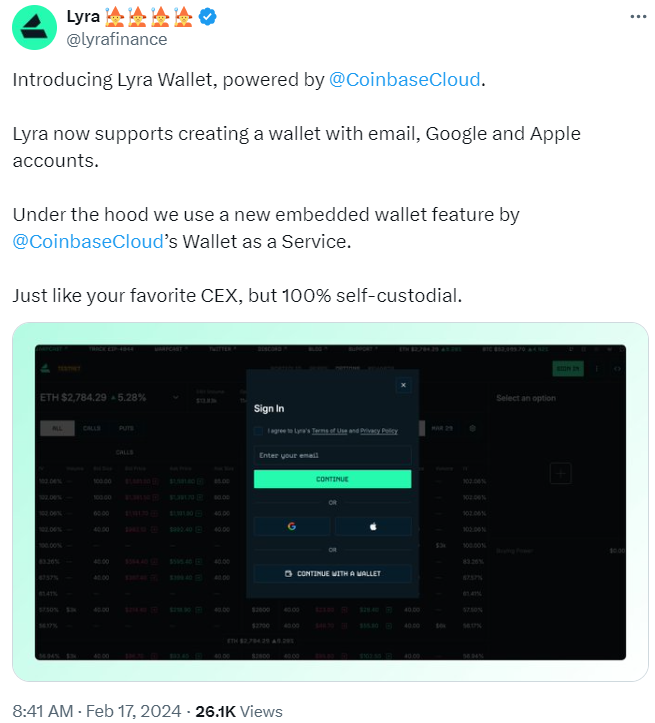

The team launched a Lyra wallet powered by Coinbase. It is a self-custodial embedded wallet that offers a seamless and secure way to store and manage digital assets.This innovative wallet solution allows users to create a wallet with just their email, Google, or Apple account, making it easy for crypto novices and experienced users to get started.

This abstracts away all the complexities of storing and managing seed phrases and private keys. The private key can be exported at any time.

We believe this is huge for onboarding institutions and players from traditional finance because it abstracts away most of the complexities related to using blockchain.

Cryptonary’s take

Since we last covered Lyra, the protocol has evolved a lot—many bullish upgrades and developments.The team has also demonstrated that they can ship high-quality products and listen to the community when it comes to the sustainability of the DAO.

Institutions and traditional finance love options. With its developments, Lyra is abstracting away from all the blockchain complexities that are hard to grasp for traditional finance users.

This opens a door for onboarding big institutions such as funds, money managers and banks. Interestingly, we are already hearing rumours that they are whitelisting accounts on Lyra.

We still believe Lyra can get a chunk from CEXs and win in an options space.

Therefore, we remain bullish on Lyra and maintain our initial price target of $0.90 by 2025.

Cryptonary, OUT!