'Cryptonary's Picks' explainer

The 2022/23 bear market was tough. Crypto was under attack on all fronts - from centralised entities proving why centralisation is bad (*cough* FTX) to an aggressive Federal Reserve tightening policy to combat high inflation (that they caused); we’ve rarely had a moment to catch our breath.

However, 2024 is a new year. The Fed is at the end of the tightening cycle, and many of the bad actors in the space have been purged; there is renewed optimism about the market.

So, with this renewed optimism - what’s the plan?

The crypto market is huge, with tens of thousands of assets. It’s our job to find the most promising assets and relay that information to you so you can make the most informed decisions.

Yet, with a team of seven researchers (and growing), it can often be challenging to reach a consensus on what assets we should put forward as “the best.”

So, we’ve devised a new system for identifying promising assets, reviewing them, and reaching a unified conclusion on each one.

The previous iteration of this, Skin in the Game (SITG), became too centralised. With the new methodology, we want to distribute decision-making amongst researchers as evenly as possible.

Not only that, we want the community to have a bigger say in the assets that we talk about regularly.

Last Friday, we presented 'Cryptonary’s Picks', our new tool for keeping tabs on our favourite assets in the market. Today we are back with an explainer on the rationale behind it.

How does it work?

The process has been simplified and is much more flexible than before:- Any researcher brings up an asset they’re interested in or presents a thesis on a sector we should be covering.

- If we write a report on the asset, it is added to our internal list.

- At the start of each new month, seven team members vote on which new assets they believe should be added to CPro picks.

- The vote asks two questions.

- Should this asset be added to Cpro’s picks?

- Do you have this asset in your personal portfolio?

- Assets with votes from more than three researchers are then added to Cpro picks. We also include the number of team members (out of 7) with the asset in their portfolio.

- This works both ways—if any researcher thinks an asset is done or a profit target is hit, we will remove it via the same process.

- Every asset that makes it to the list is then segregated into one of three categories - low risk, medium risk, and high risk.

Consequently, this methodology gives members a better idea of each asset's risk profile.

When do you update Cpro picks?

We update Cpro picks in the first week of each month.

How do you choose what asset to add or remove?

All team members who participate in the vote are required to read the research and do additional research to form a well-thought-out opinion on the assets. Our team has some big brains, but nobody is perfect, and no thesis is bulletproof. All team members are encouraged to think critically before voting for or against any asset.

Why are some assets highlighted and others are not?

When we update Cpro picks, we highlight the new picks with a “Newly Updated” tag. This tag often shows up with a blue highlight. You will also notice the blue highlight when we update the price targets of older assets on the list. We typically remove the tag after one week.

Why is the team not holding all the assets?

One of the criteria determining whether we write a report is whether we would buy it with our own money.

If we don't think an asset is a good investment, we don't cover it.

Sometimes, the project is trending, but we have concerns, so we may write about it to warn people to be careful. Other times, we may cover a project that offers a good short-term opportunity: get in, get out.

But other than these two situations, the assets we write about, we are reasonably convinced they are great opportunities.

However, this does not necessarily mean that all the team members would buy an asset just because we wrote about it.

The first reason an asset may be in Cpro picks without not being the portfolios of many team members is that we don't have unlimited funds. In the same way that we recommend sound portfolio management to the community, we also practice it in our personal finances.

In addition, we believe that it is not fair to buy a tiny (for instance, $100 worth) bit of a coin just so we can tell people we hold the asset; so if an asset won’t get a significant size in our portfolios, we may love it but can afford to buy it yet.

Other reasons an asset in Cpro picks may not be in our personal portfolios include the following:

- We love it, but we are waiting for a better entry price (we often include recommended entry prices in reports)

- Our individual portfolios already have coins from that sector, and we would prefer to diversify into other sectors.

So, which assets made the cut?

The assets in Cryptonary's Picks

By separating all assets into one of the three categories (low, medium, high risk), we hope that members have an easier job making sense of the list.Low-risk assets

The low-risk assets are those we see as having little chance of failure - they are part of the furniture. However, with low risk comes a lower reward.

You'll still get outsized reward compared to TradFi, but the assets are relatively less-volatile than the assets in the other categories and, therefore, lower risk.

Unless stated otherwise, the price targets for the assets on this list are long-term. Some assets may not have a price target - we will be updating that in the coming weeks.

- Bitcoin holds the spot as the “King” of the crypto market.

- It has the largest market cap and is the most widely adopted. Thus, as an investment, BTC represents the lowest-risk asset in the market.

- We have a price target of $145k for 2024.

- If BTC is the King of the crypto market, Ether is undoubtedly the King of DeFi.

- Powering the expansive Ethereum ecosystem, Ether is the lifeblood of DeFi, and it’s difficult to envision a circumstance where this will change anytime soon.

- We have a price target of $9000 for 2024.

- The Solana network is a poor man’s Ethereum.

- Not because it’s inferior but because transaction fees are minuscule compared to Ethereum, so it’s more usable for the average user.

- We have a price target of $500 for 2024.

- This protocol is the literal link between crypto and outside systems.

- Chainlink oracles and price feeds are an integral part of the DeFi ecosystem and will continue to hold this place for the foreseeable future. Hence, LINK can be considered a low-risk asset.

- We have a price target of $42.50 for 2024.

- Avalanche has one of the most active ecosystems after Ethereum.

- Like Solana, Avalanche has brought a few revolutionary features to blockchain technology. Again, at this stage, Avalanche is part of the crypto furniture.

- We have a deep dive report coming up in a few days, and you’ll find our 2024 price target on it.

- Originally an Ethereum L2, Polygon has since moved away from its roots.

- One of the more familiar ecosystems, Polygon is locked in a battle with other similar protocols like Avalanche and Solana for dominance as the number one candidate to potentially supplant Ethereum.

- Price target soon!

- It is one of the two major Ethereum L2 protocols.

- Optimism was the first Optimistic rollup L2 built on Ethereum, and we expect it to continue to have a large influence on the Ethereum ecosystem for a while to come.

- Price target soon!

- The second of the major Ethereum L2 protocols.

- Although Optimism launched first, Arbitrum has come out on top as the most active Ethereum L2. Thus, it is a low-risk asset from a risk of failure perspective.

- We have a price target of $30.

Medium-risk assets

These assets are mid-table assets - the Goldilocks assets. They balance the potential of solid upside while avoiding a full-degen strategy.

- One of our top picks from the first batch of Polkadot parachains back in 2021.

- Astar has been working heavily with institutions and governments in Japan. The links created through the Polkadot ecosystem and the work being done externally outside the crypto space give Astar an advantage over its peers.

- We have a price target of $6.

- Our interest in Convex stems more from its relationship with Curve than the CVX token itself.

- Investing in CVX is our method of gaining exposure to Curve Finance’s revenue and activity. For more information, we recommend reading the report linked above.

- We have a price target of $71.40.

- DYDX represents our bet on the budding decentralised derivatives market.

- The user experience and user interface of the dYdX exchange, as well as its proactive development schedule, places dYdX above its peers.

- We have a price target of $76.50.

- Taking advantage of the Ethereum staking scene, Frax is one of the top liquid staking protocols.

- Frax’s product goes way beyond liquid staking - they are like the Swiss-army knife of DeFi.

- We have a price target of $50.

- Injective has grown rapidly due to its flexible blockchain design.

- Built using the Cosmos architecture, Injective is a chain built for DeFi protocols. As a bonus, it was among the first to connect Solana to the wider crypto space (without bridges).

- We will be working on a report for Injective as a matter of urgency - stay tuned!

- Leveraging the power of zero-knowledge (zk) technology, Mina is in the race to create a reliable zk ecosystem.

- Although the timeline has been disappointing for Mina’s development, they’re taking on one of the toughest challenges in crypto - zero-knowledge ain’t easy!

- We have a price target of $46.

- Pendle is a relatively new protocol, targeting the institutional side of things with its interest-rate swap product.

- Although it’s not a product we expect the masses to use, the TradFi rate-swap market is huge. We see Pendle as a protocol that is extremely well-positioned to dominate that market once DeFi becomes more mainstream.

- We have a price target of $3.62, although this is conservative and may be updated in the future.

- There’s one thing that all crypto degens have in common - they love to gamble.

- Rollbit fills that niche and is one of the more popular odds markets out there.

- We have a price target of $2.27.

- There can be such a thing as “too much” conviction. But when we see a sure thing, we cannot ignore it. Everything about THORChain screams, “this is excellence.”

- THORChain is a cross-chain DEX that allows users to swap their BTC to almost any other asset in a completely decentralised manner. It’s so good that even North Korea is using it!

- We have a price target of $90.

- Synthetix is another decentralised derivatives protocol but with a twist.

- Unlike dYdX, SNX benefits from direct usage as collateral within the Synthetix ecosystem.

- We have a price target of $40.

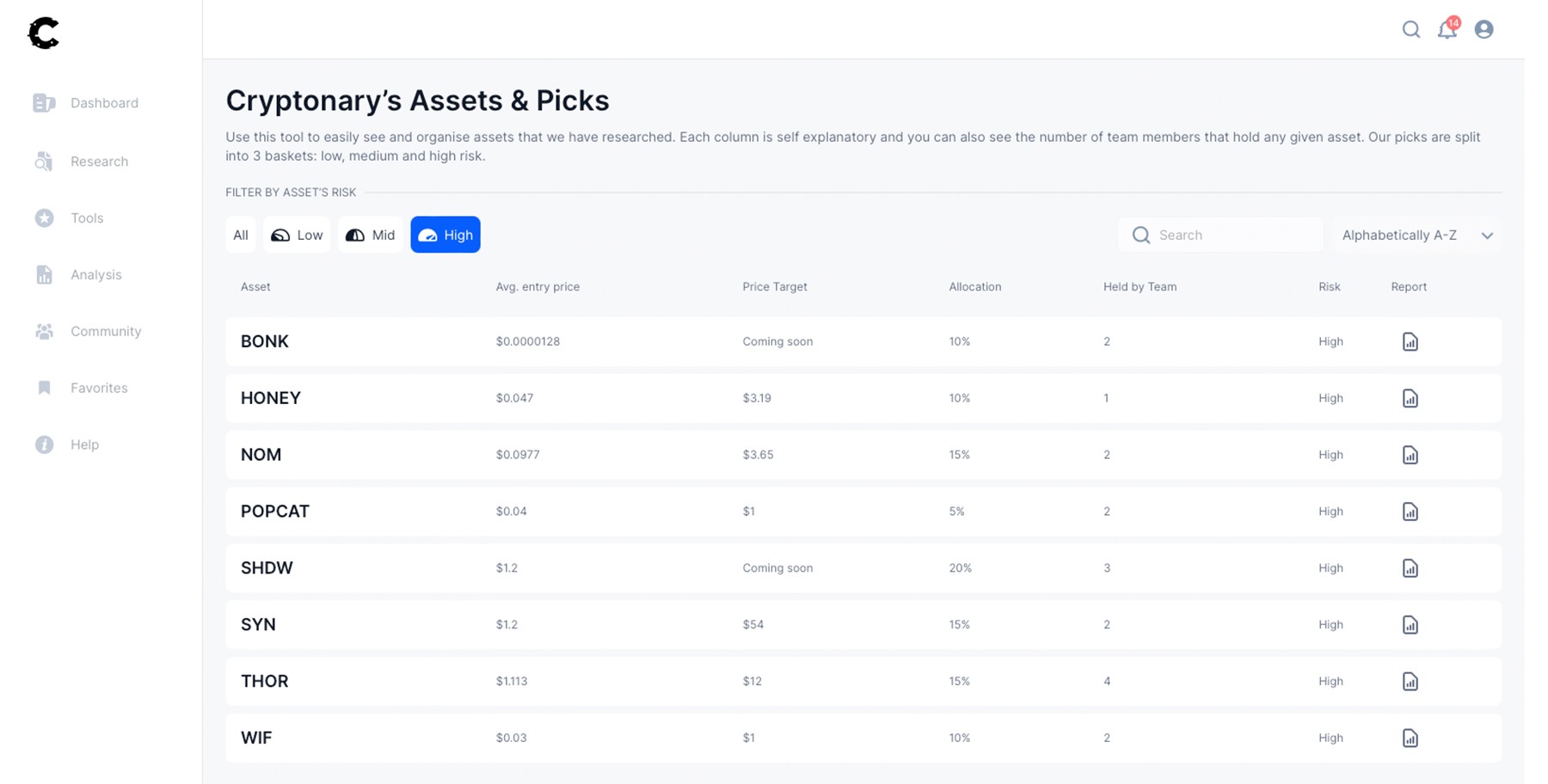

High-risk assets

The high-risk assets are likely to change over time, so we will not list them here as this report is meant to cover the “conviction” bets and act as a reference for members to keep up to date.

However, you can find the high-risk assets and their entry prices within the tool by clicking the “high risk” section.

What can you expect going forward?

This list is not final and will be dynamic depending on our collective changing biases. The market dynamics change daily, and we need to be nimble with our strategy.Marrying your bags is never the way; sure, conviction is important, but don’t let it blind you.

We will constantly be scanning the market to find the next opportunity or trend to provide you with maximum value. Additionally, we are working on further tools to aid you in your crypto journey - our assets tool is just the beginning.

We’ve also gotten several questions and suggestions in Discord. We’ve already responded to some of these directly. However, we are now collating all the questions and suggestions to provide robust answers and implement some of the feedback where applicable.

Stay tuned for further updates - we promise it will be worth the wait!