Bitcoin (BTC) price prediction

Bitcoin price prediction remains highly sought after as the cryptocurrency has soared from cents to an all-time high of $103,525. This coin's volatility creates both challenges and opportunities. That’s why we’re here to provide you with the latest price prediction on Bitcoin.

We at Cryptonary provide you with the most accurate price prediction for all sorts of coins, including Bitcoin. You can also request an on-demand BTC price prediction by joining our Discord Community.

Our Price Prediction Model

Unlike others, we don't rely on automated methods because there’s a higher chance of getting a wrong prediction. There are many factors to consider when accurately predicting a cryptocurrency's price.That's why our team of Cryptonary analysts carefully research each cryptocurrency and give you a detailed price prediction using technical analysis to help you make the most profit. This prediction is based on a technical analysis of the coin rather than just general sentiment. We also offer various things like:

- Market Updates: Done a few times per week based on macro indicators.

- Market Directions: Provides details on current market conditions and patterns.

- On-Demand Analysis: Offer analysis of a coin according to your request.

With that said, here’s our Bitcoin price prediction.

Geopolitics shake crypto—BTC leads recovery

16 June 2025Bitcoin rebounded after geopolitical tension triggered a healthy flush. With $107K acting as key resistance, markets now await confirmation of a breakout or a fresh rejection.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

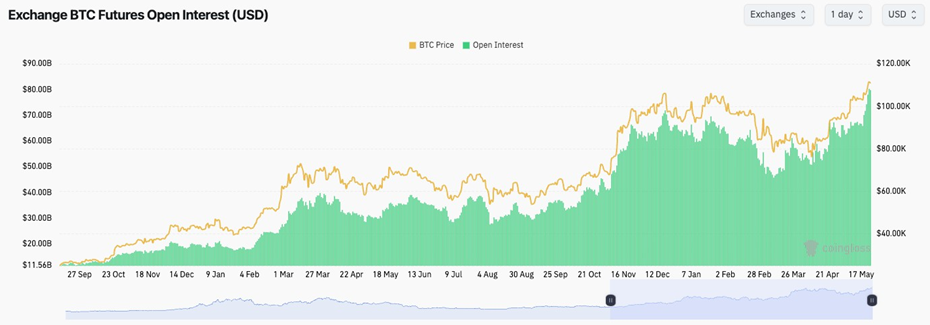

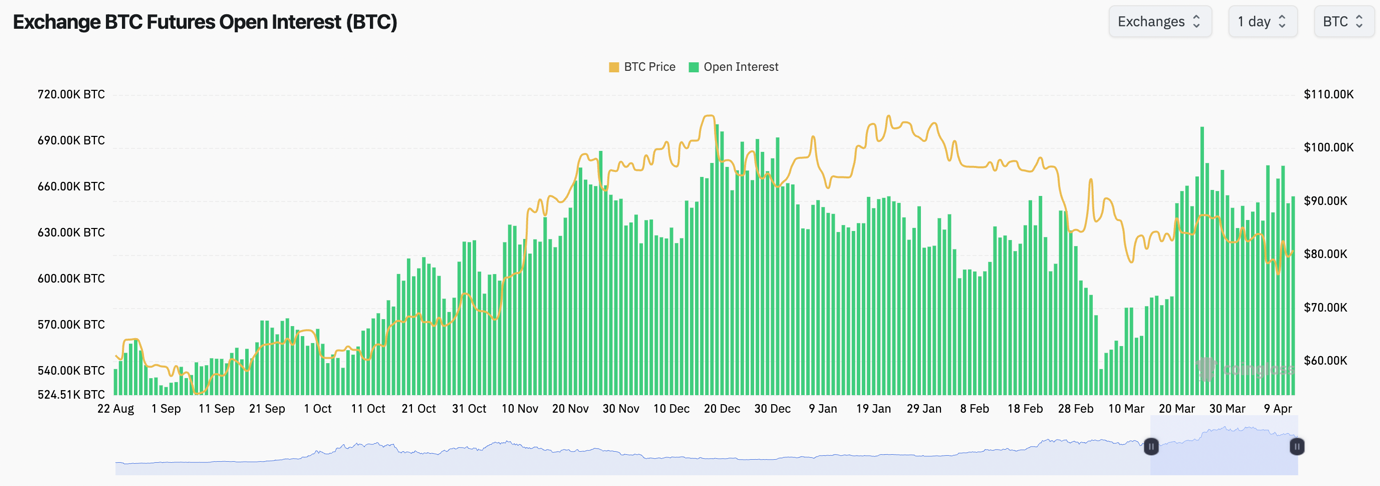

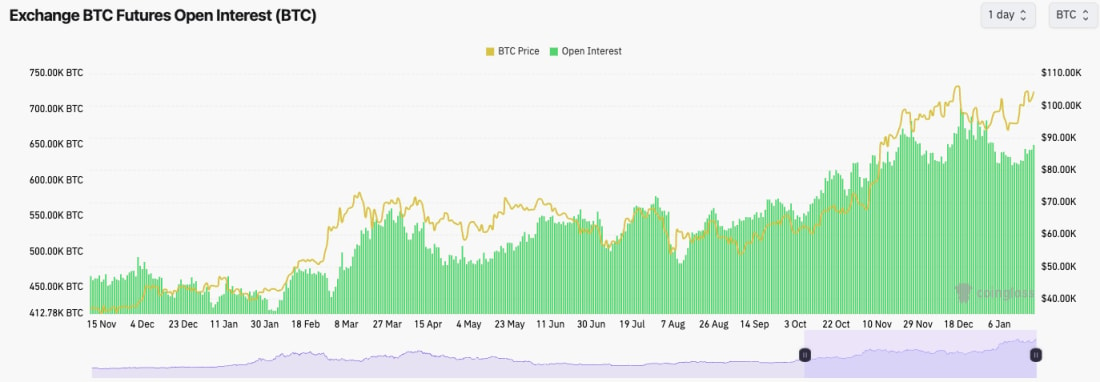

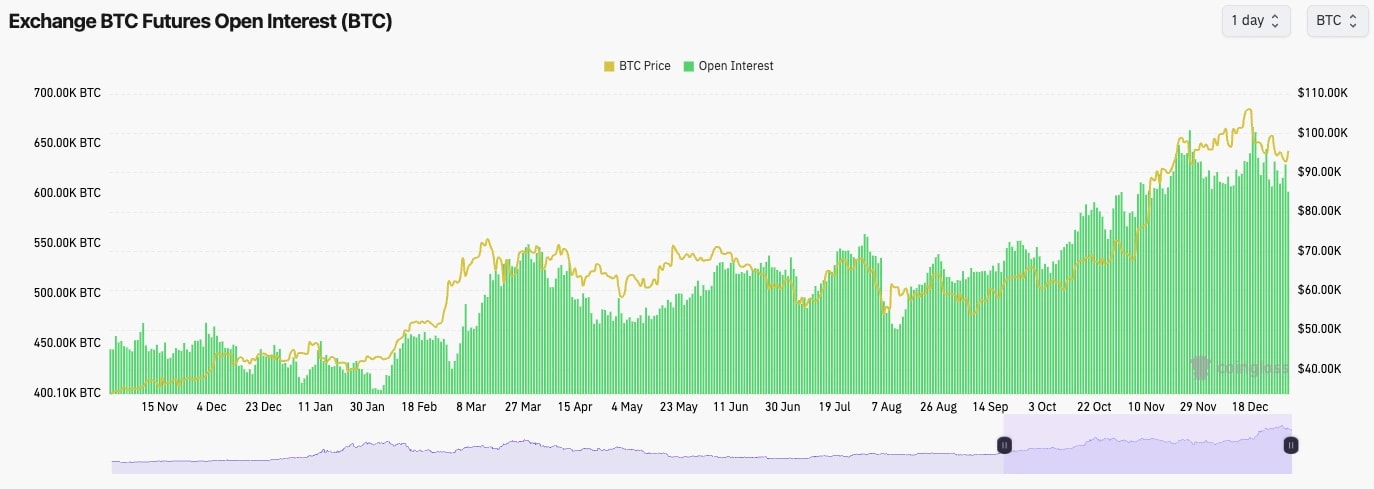

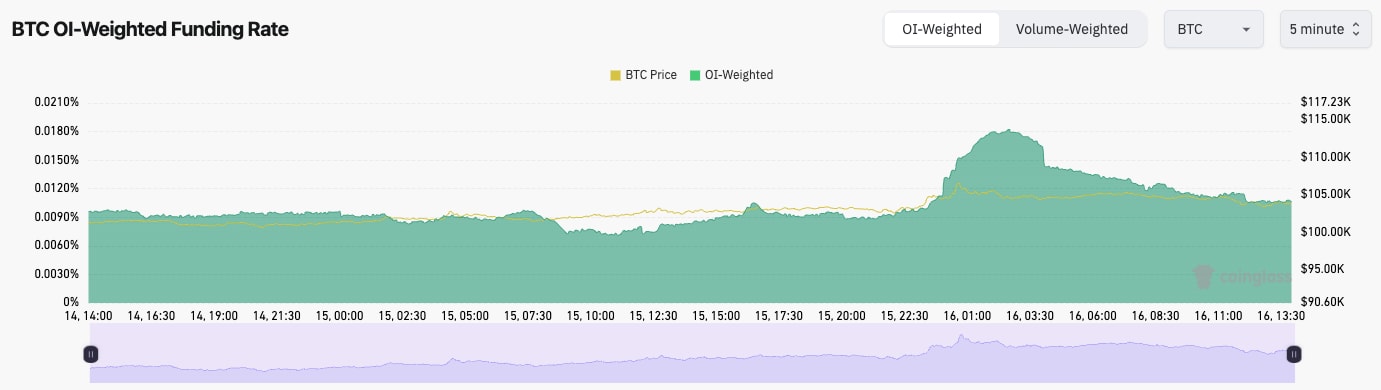

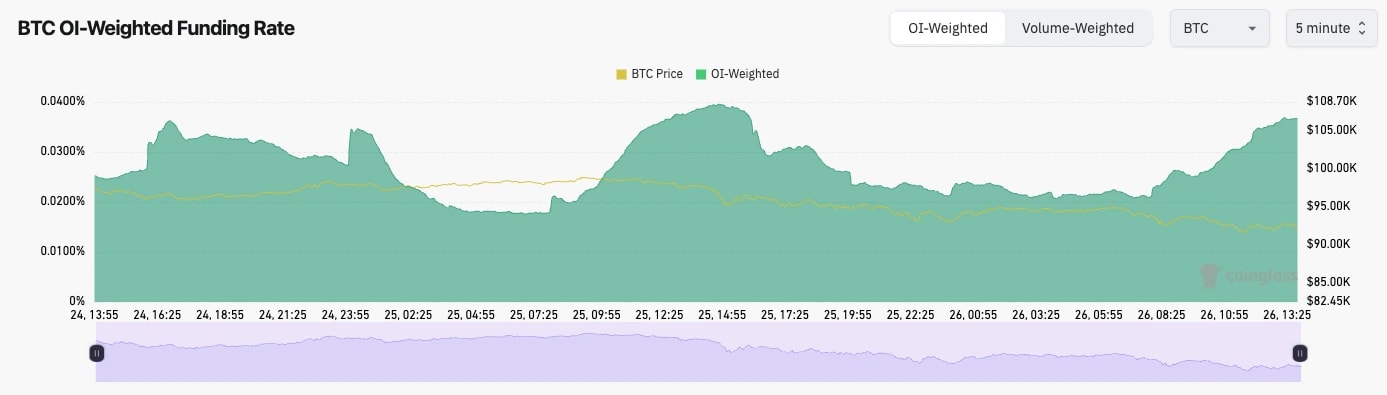

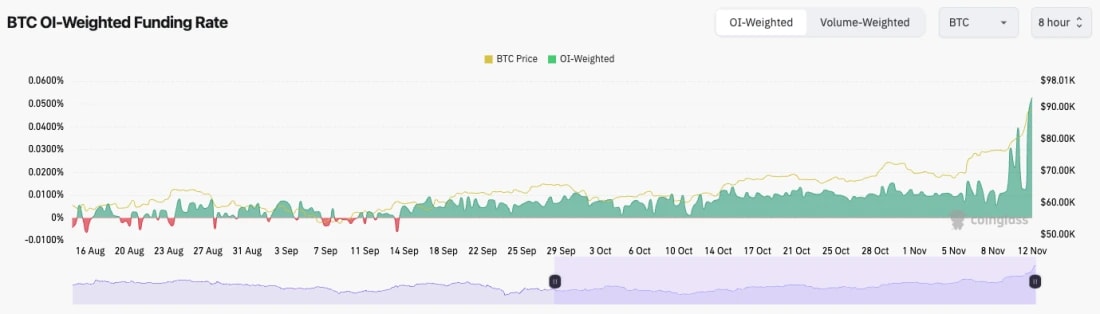

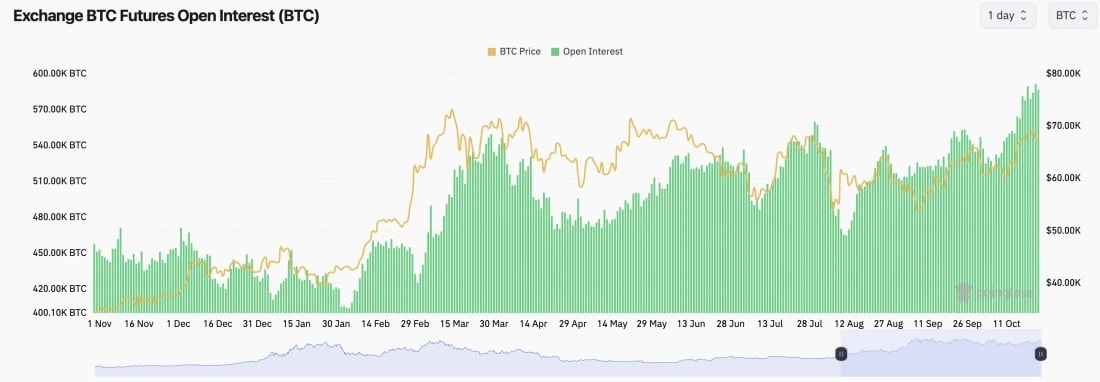

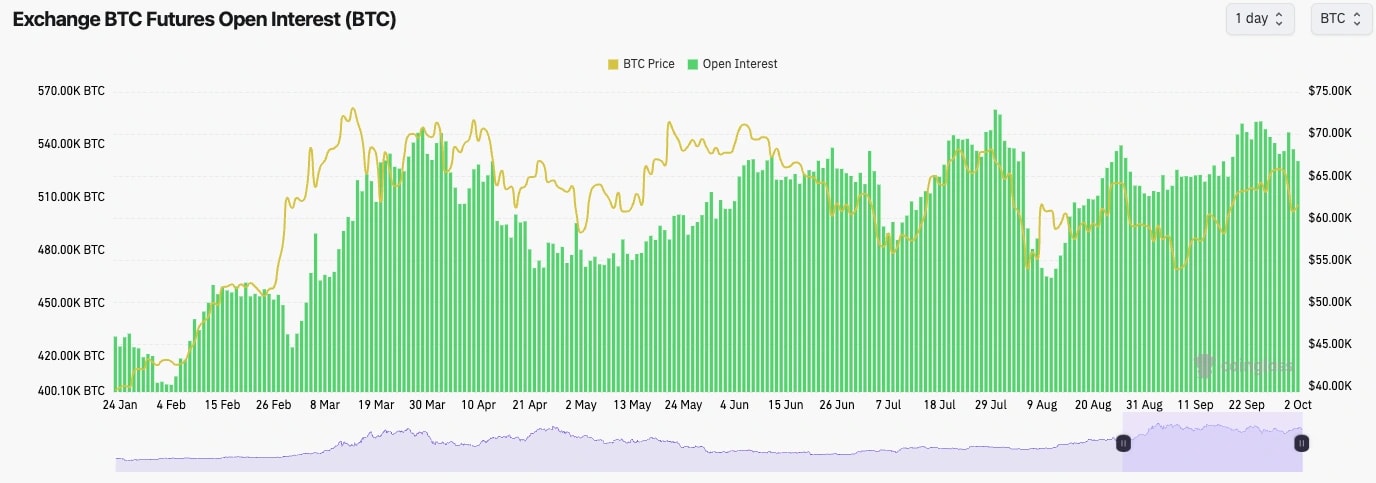

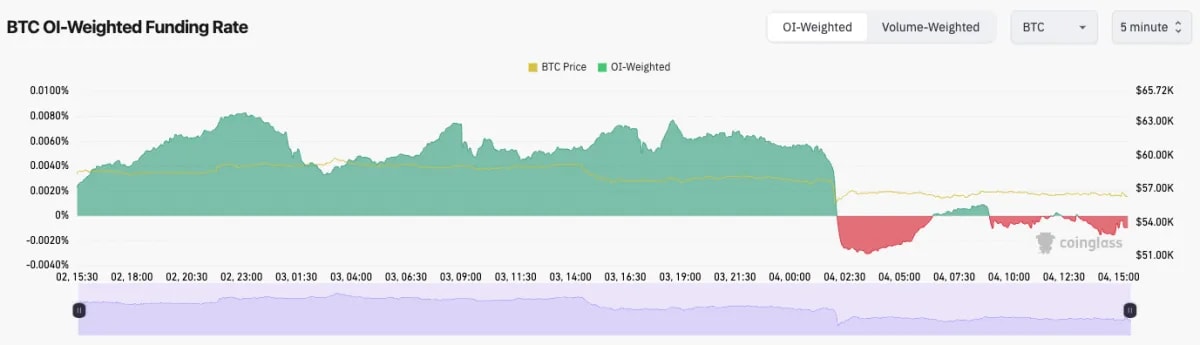

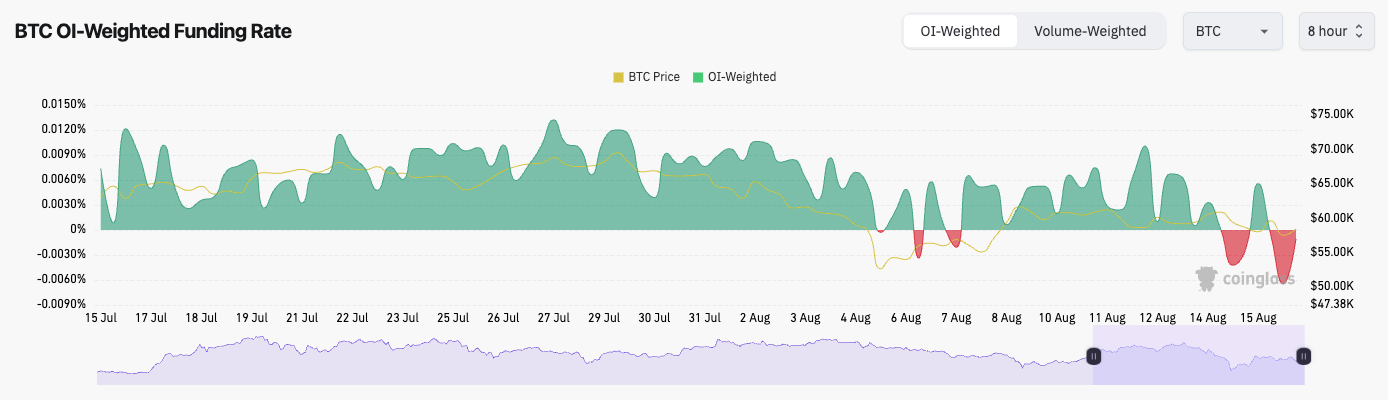

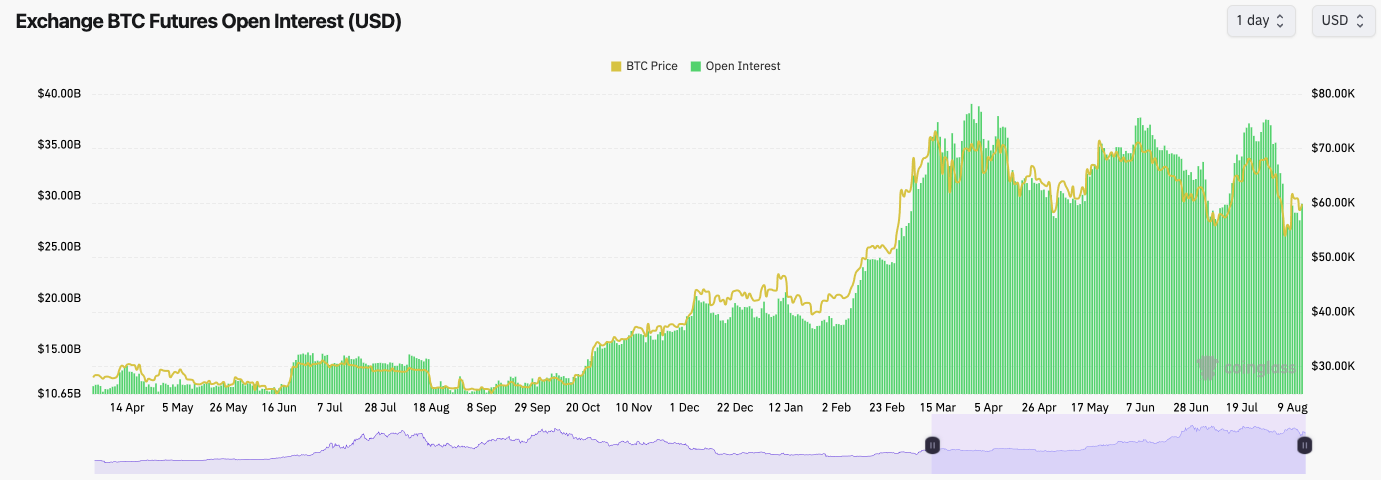

- This weekend's escalation between Iran and Israel saw markets pull back, with BTC's Open Interest pulling back. A healthy development.

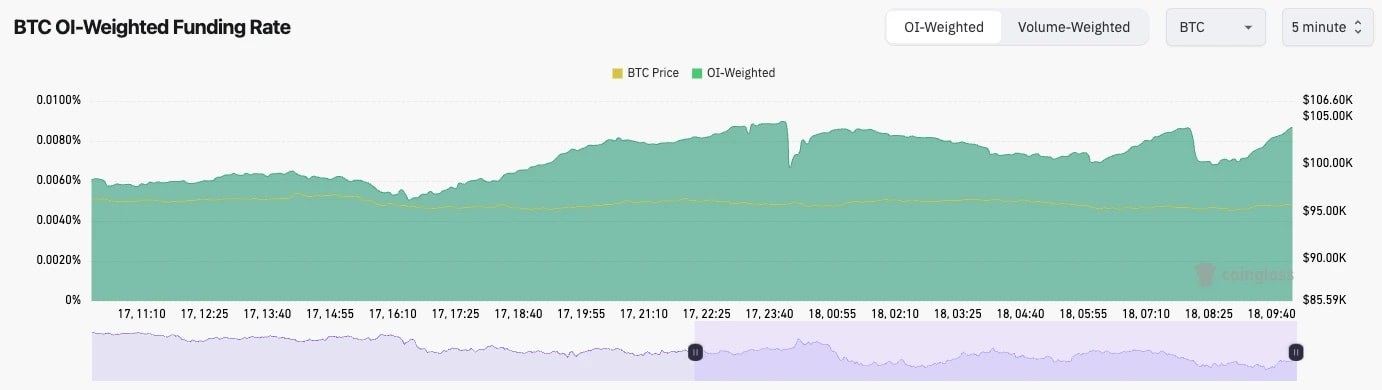

- Alongside this, Funding Rates are just about positive, meaning there is no froth from Longs here.

- Overall, this weekend's events have seen a flush in Open Interest, which now provides BTC with a healthier setup to now push higher.

Technical analysis

- Price dropped over the weekend into our main support area between $102.500 and $105,500. Price bounced at $102,600.

- Price has since recovered, and it is now battling at the main horizontal level of $107,000. Price will need to see a few Daily candle closures above this level for confirmation of continued upside.

- Beyond $107,000, the main horizontal resistance is at $110,500 and then the all-time high.

- To the downside, the main support range is between $102,500 and $105,500. We expect to see this area continue to hold as strong support.

- The RSI has pulled back to middle territory, with it now breaching above its moving average.

- Next Support: $102,500

- Next Resistance: $110,500

- Direction: Neutral/Bullish

- Upside Target: $112,000

- Downside Target: $102,500

Cryptonary's take

BTC has recovered well following the escalation this weekend between Iran and Israel, bouncing off the $102,500 horizontal support that we outlined in our last update. We're now looking for BTC to continue showing strength and to close convincingly above $107,000. This would then set up a move back to the highs at $110,500 over the coming days.A close above $107k would strengthen the case for BTC to retest its highs, though macro catalysts like Wednesday's FED decision and ETF flow trends will likely shape near-term direction.

Will BTC break $107k?

06 June 2025BTC is staging a bearish retest after a major breakdown. While Open Interest drops and shorts increase, all eyes are on the $95.7k–$98.9k support zone.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

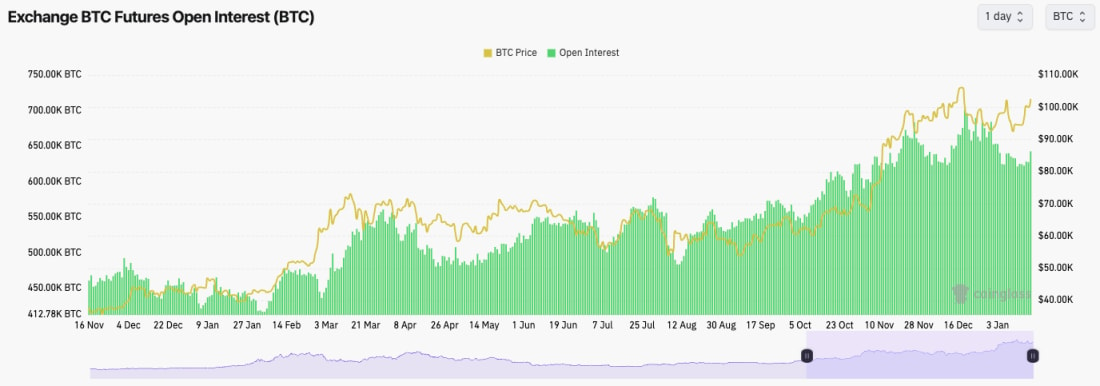

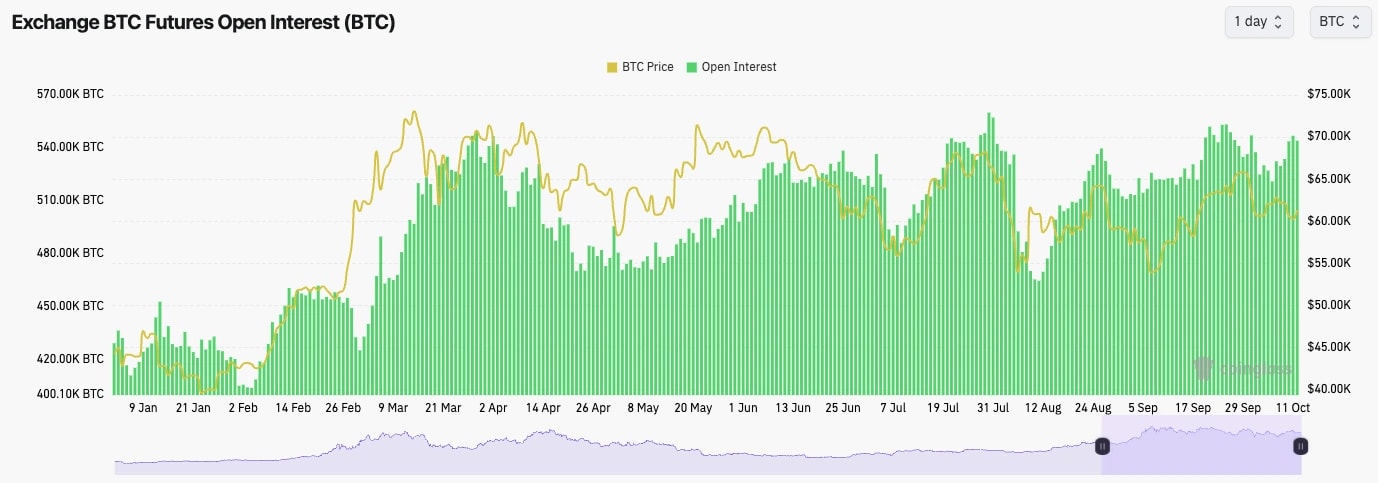

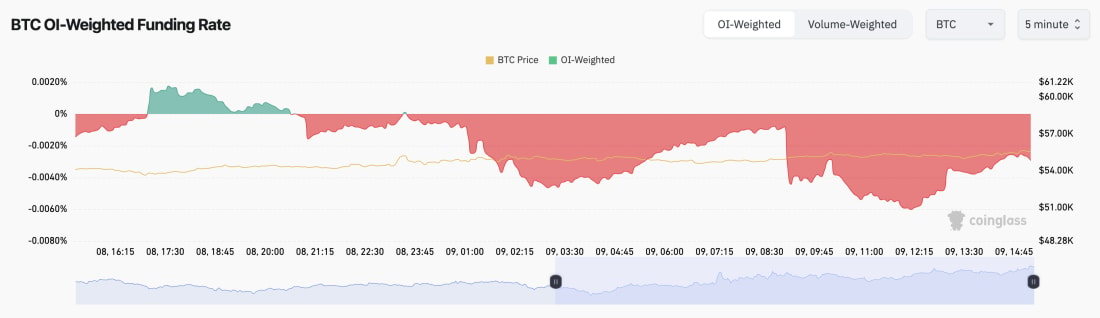

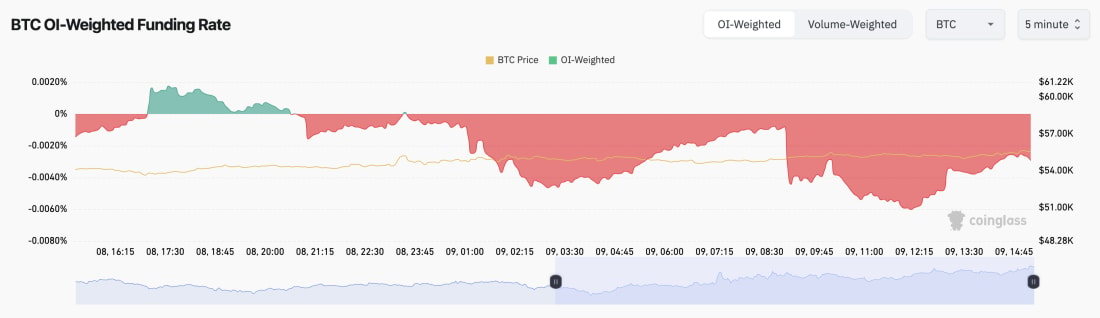

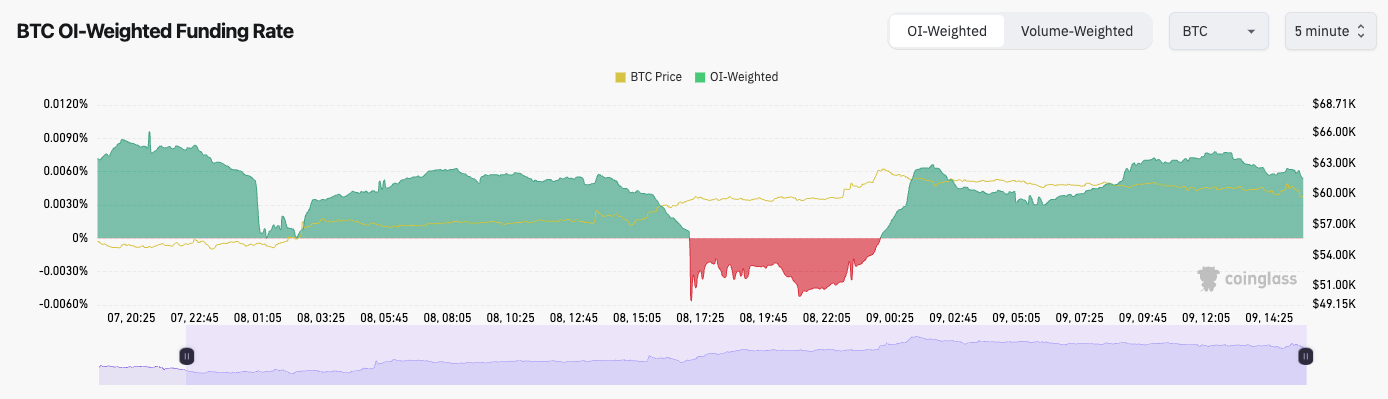

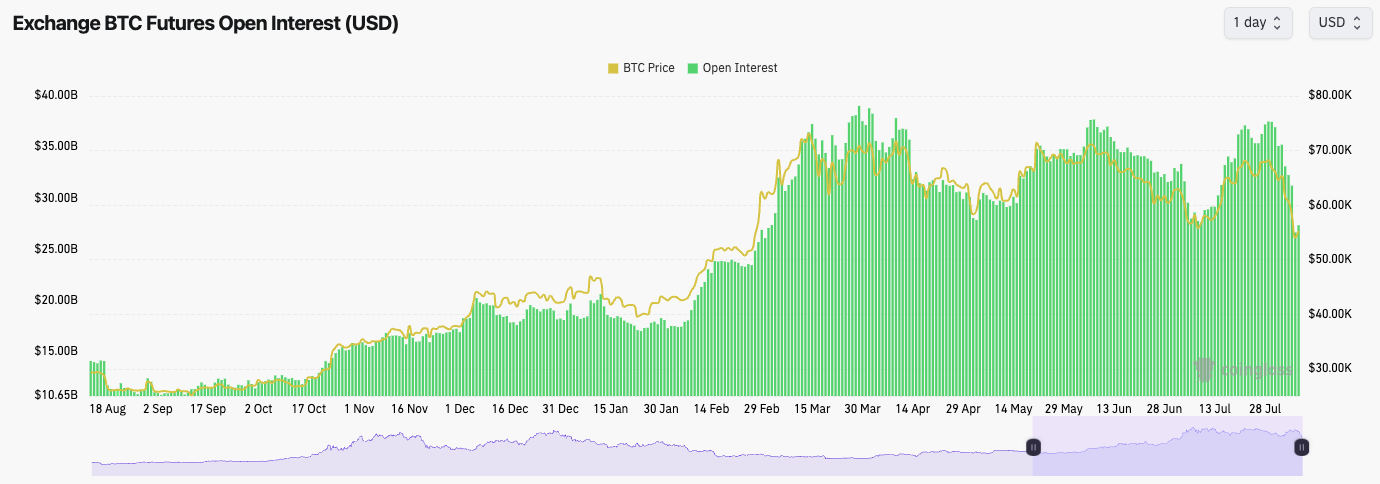

- BTC's Open Interest has pulled back on this price pullback, whilst the Funding Rate has turned negative. This suggests that late Longs have been flushed, and that Shorts have now chased the move down.

Technical analysis

- BTC formed a Head & Shoulders pattern which has seen a price breakdown as we expected it would.

- Price is now putting in a bearish retest, where price has moved back up to retest the underside of the resistance.

- The price range now (that might act as resistance) is between $102,500 and $105,000.

- Beyond that, the main horizontal resistance is at $107,000.

- The next zone of support (sub $100k) is at the Yellow Box we have identified. This is the range between $95,700 and $98,900.

- The RSI has pulled back from overbought territory and it's now back into middle territory.

- Next Support: $98,900

- Next Resistance: $106,900

- Direction: Bearish

- Upside Target: $106,900

- Downside Target: $95,700

Cryptonary's take

BTC looks to be putting in a bearish retest of the neckline of the Head & Shoulders pattern that it has recently broken down from. Our expectation is that price will continue to trend lower over the coming 1-2 weeks, and price will eventually fill the Yellow box between $95,700 and $98,900.We will assess at the time as to whether we repurchase BTC if it reaches the Yellow box zone. An invalidation of our thesis will be a breakout above $107k, although we're not expecting this to happen as the macro is still uncertain with the overall level of uncertainty and BTC ETF flows waning.

BTC tests major support amid pullback pressure

02 June 2025Bitcoin breaks below trendline support, while ETH holds firm within range. SOL weakens further, and HYPE shows signs of topping. Market structure is shifting fast.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

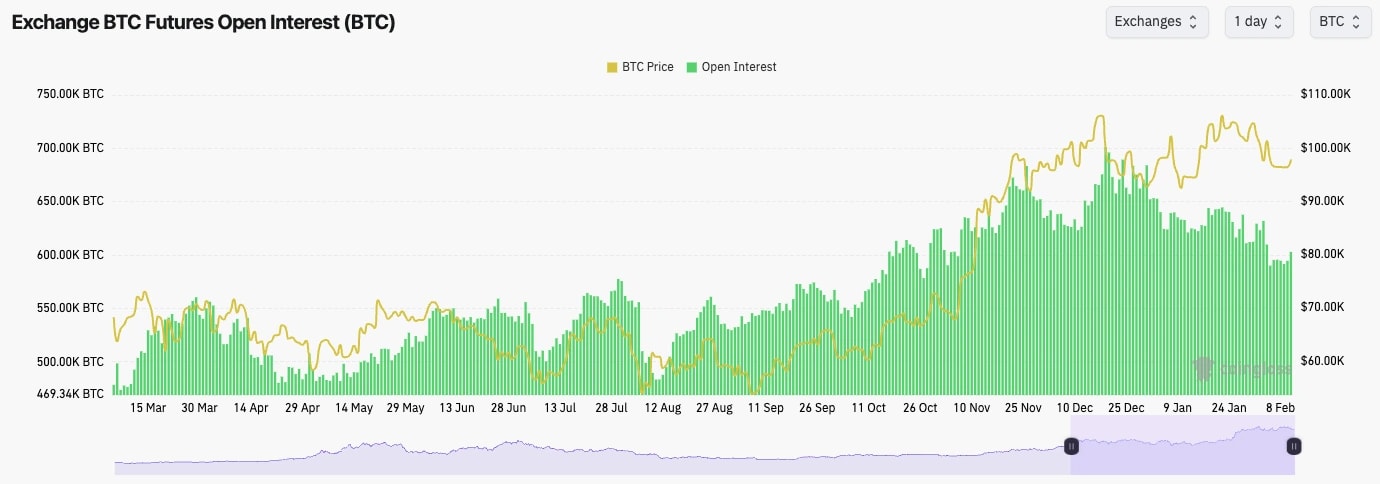

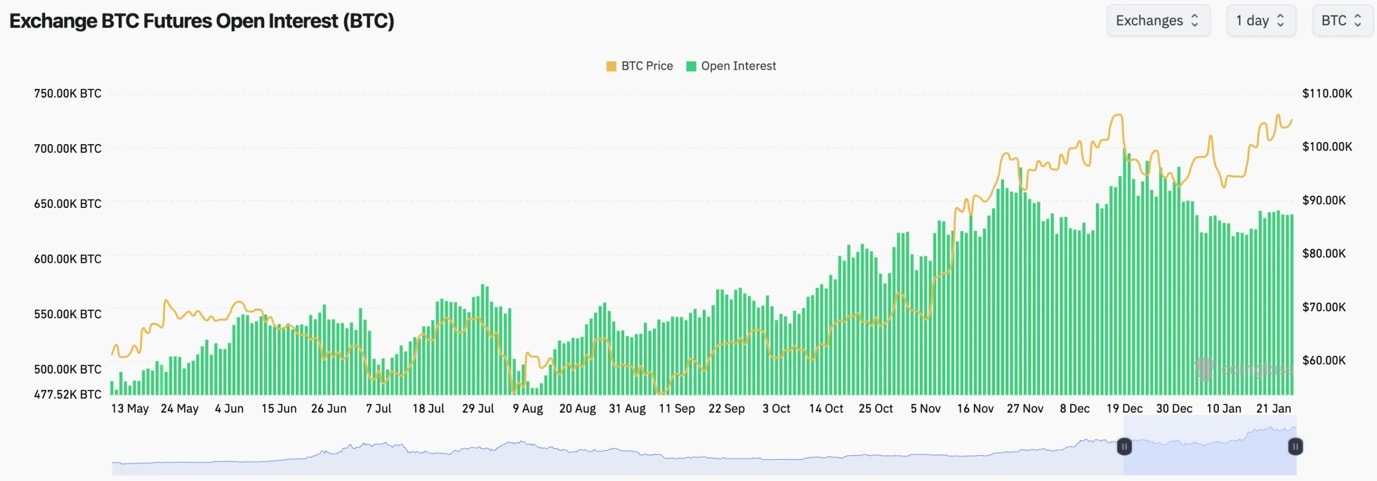

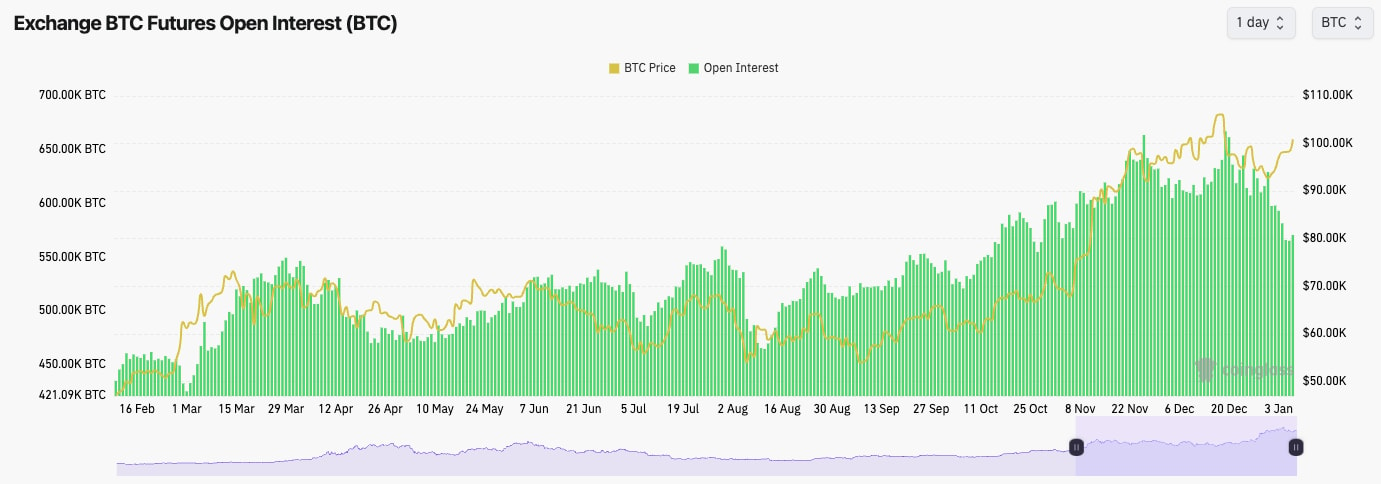

- Bitcoin's Open Interest has pulled back from its highs as the price has pulled back.

- BTC's Funding Rate was towards the 0.01% mark, but upon the OI pullback, the Funding Rate has moved closer to 0.00%.

- This is a relatively healthy setup from a mechanics perspective, with no signs of froth or excess.

Technical analysis

- Bitcoin has fallen out of its main uptrend line, with price also losing the horizontal level of $106,900.

- There is a support zone between $102,500 and $105,000. Price has so far found support in this zone.

- If price breaks below $102,500, then the next zone of support is likely to be between $95,700 and $98,900.

- To the upside, the key level for BTC to reclaim is $106,900, and then beyond that, it's the all-time high of $111,900.

- BTC does look to be forming a 'Head & Shoulders' pattern (which we have marked out on the chart). These formations have a bearish bias, with the likely breakdown target being at least $98,900.

- This price pullback has allowed the RSI to reset, pulling back to middle territory from having been close to overbought.

- Next Support: $102,500

- Next Resistance: $106,900

- Direction: Bearish

- Upside Target: $106,900

- Downside Target: $95,700

Cryptonary's take

BTC is at a critical juncture here. Price has broken below its main uptrend line and it's now below its first major line of support, whilst it's now forming a bearish candle formation. It's possible that $103k is the extent of the pullback however, our expectation is that there's much further to go here, with the first major pullback target area being between $95,700 and $98,900.For now, we're remaining patient as our expectation is that we'll see the price move lower in the coming 1-2 weeks, with the mid-90k's being that target area. At that time, we'll reassess the data to see if we'll begin re-accumulating BTC again in the mid-90k's.

Bitcoin holds key support, Eyes breakout again

27 May 2025Bitcoin is consolidating near all-time highs with rising open interest and balanced leverage, signaling a potential breakout and setting the stage for broader market opportunities.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Open Interest has increased to new highs, whilst the Funding Rate is positive but still contained. This suggests that a lot of leverage has been applied recently, but that it's evenly balanced between Longs and Shorts.

Technical analysis

- Bitcoin remains in its main uptrend after having broken out to new all-time highs.

- To the downside, the key zone of support is between $105,000 and $106,900. Price has remained above this zone, and used it as support several times already. This is the key level for price to hold.

- Below $105,000, the major horizontal support level is at $98,900.

- To the upside, the all-time high of $111,900 is the horizontal resistance. Beyond that, $120,000 is the next horizontal resistance.

- Over the last few days, BTC has been range-bound between $107,000 and $110,000. A period of consolidation is healthy during larger uptrend patterns.

- The RSI has pulled back from overbought territory, and a period of resetting this metric is positive. However, the RSI is now below its moving average, which is also overbought.

- Next Support: $106,900

- Next Resistance: $111,900

- Direction: Neutral/Bullish

- Upside Target: $120,000

- Downside Target: $98,900

Cryptonary's take

After breaking out to new all-time highs, BTC has remained range-bound at the highs, whilst the overall amount of leverage has increased, it is not yet in frothy territory.As all-time high breakouts go, this is a healthy breakout. This suggests that there could be more upside to be had in the near term following a small period of consolidation in the very short term. BTC's move continues to be supported by strong ETF flows and a weakening Dollar backdrop.

Our near-term price target for BTC is $120,000. This kind of BTC breakout will likely bring many more opportunities across the rest of the space, which we'll be on the lookout for and keen to take advantage of.

BTC consolidates between critical support and highs

23 May 2025Bitcoin is testing fresh all-time highs, with open interest surging and RSI overheating. Consolidation between $105K and $112K could set up the next leg up. Stay patient as momentum builds.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

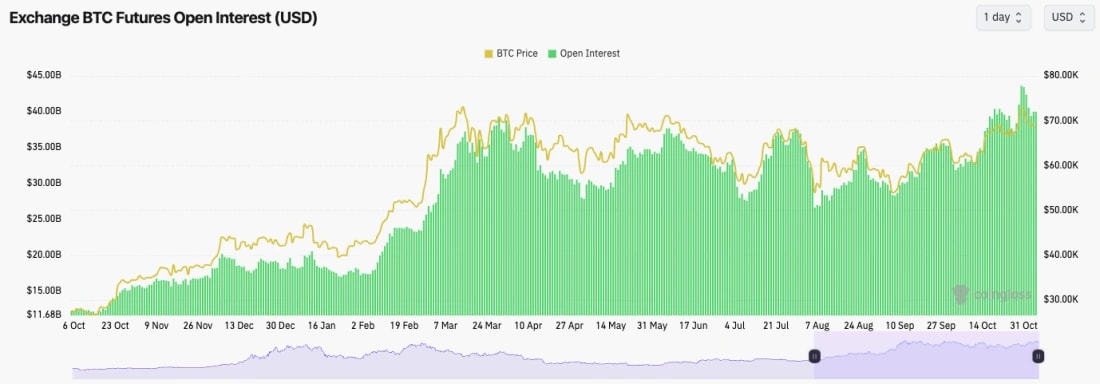

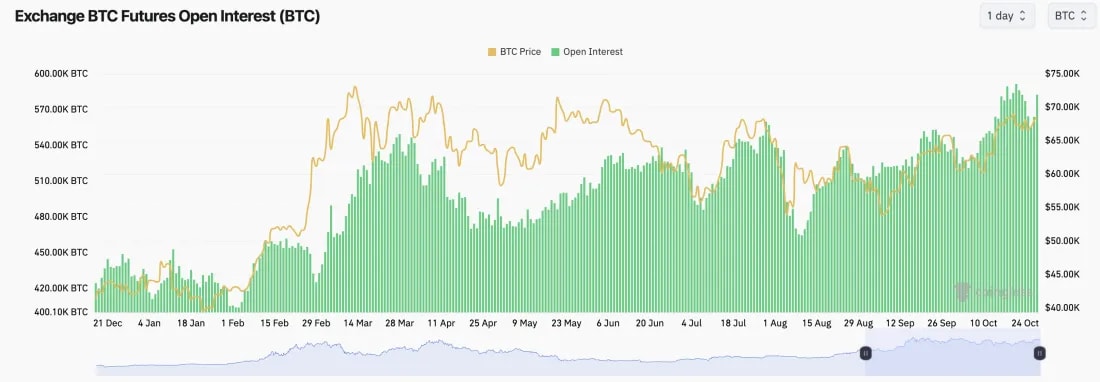

- BTC's Open Interest has soared to new highs, whilst Funding Rates have turned positive, although they're not in frothy territory.

Technical analysis

- BTC has broken out of its all-time highs and the key horizontal resistance of $106,700.

- Price has stalled at $112,000, with price now pulling back and retesting the $106,900 horizontal level, which is now new support.

- Should price break below the $106,900 horizontal support, the $105,000 support is just below. However, if we see a breakdown below $105k, the price will likely pull back to

- $95,700.

- In terms of upside, if the price can break back above the all-time highs of $111,900, then we expect the short-term price target to be $120,000.

- The RSI is just below overbought territory; however, its moving average is overbought, and it's the most overbought it's been since Trump won the election.

Cryptonary's take

BTC has broken out to new all-time highs, and it's possible that the price can continue moving up in the short term. However, our expectation here is that price consolidates between $105k and $112k for a small period (potentially a week). This would be healthy for the uptrend to continue, as it would allow the overbought indicators some time to reset. We would look to buy Spot BTC between $91,000 and $95,700, but in the meantime, we're not chasing price, and we're remaining patient.

- Next Support: $106,900

- Next Resistance: $112,000

- Direction: Neutral/Bullish

- Upside Target: $120,000

- Downside Target:$105,000

BTC setup screams danger — are you ready?

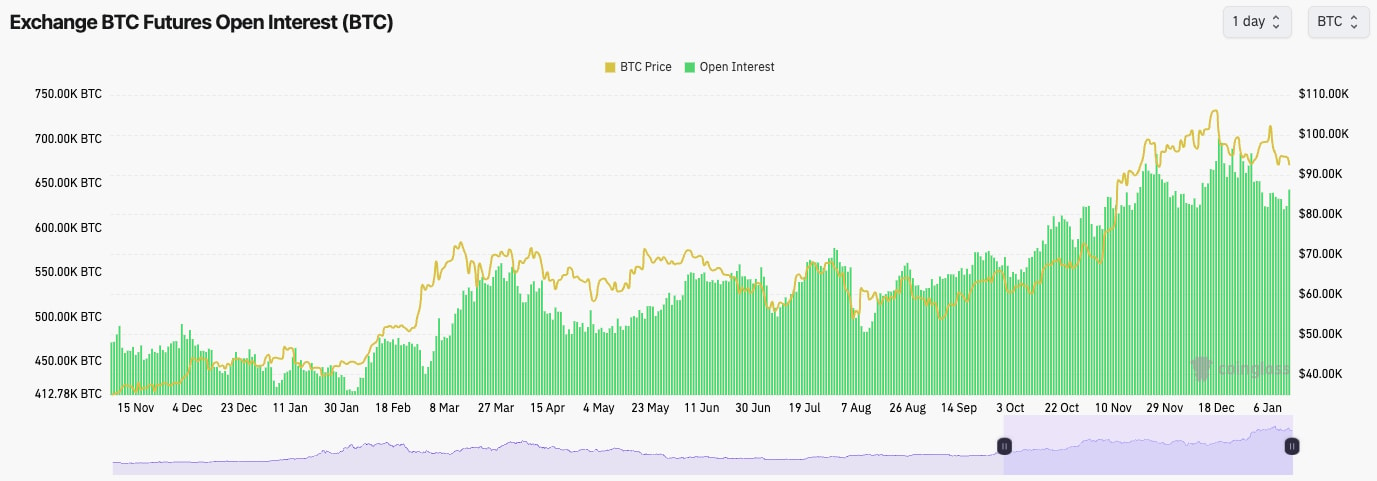

19 May 2025- BTC's OI spiked up over the last few days, and we saw this was mostly Longs, which were then flushed out on the Sunday evening pullback. OI remains high, but not as frothy as it was, whilst Funding Rates are relatively positive.

Technical analysis

- BTC was mostly range-bound between $102,000 and $105,000, when the price broke out higher on Sunday evening. However, price rejected into the main horizontal resistance at $106,900, which also converged with the underside of the uptrend line.

- The key horizontal resistance remains $106,900, and beyond that, the all-time high of $109,000.

- To the downside, $102,000 is the key horizontal support. A break beneath this level and price likely revisits the range between $93,000 and $95,000.

- If $102,000 is tested, then there is another local support at $98,900 that we should be aware of as well.

- As price moved up into $106,900, the RSI moved into overbought territory, whilst it also put in a bearish divergence (higher high in price, and a lower high on the oscillator).

- Next Support: $102,000

- Next Resistance: $106,900

- Direction: Bearish

- Upside Target: $106,900

- Downside Target: $93,000

Cryptonary's take

From a charting perspective, Bitcoin has held the highs well, but it is showing signs of the upside momentum stalling, and therefore, a more substantial pullback may be on the cards. This might be due to trade de-escalation now being priced in and there being a lack of more positive news to continue to help drive prices higher.In terms of a pullback, we expect a more substantial pullback to happen, however, it may be a slow grind down, rather than an 'elevator down' scenario. This, therefore, might take time (a few weeks). Our first area of interest is the $93,000 to $95,000 range.

If price moves down to this level, we will reassess at the time as to whether we begin scaling in with Spot buys. For now, we're staying patient and not chasing strength into resistance.

BTC price stalls near key resistance zone

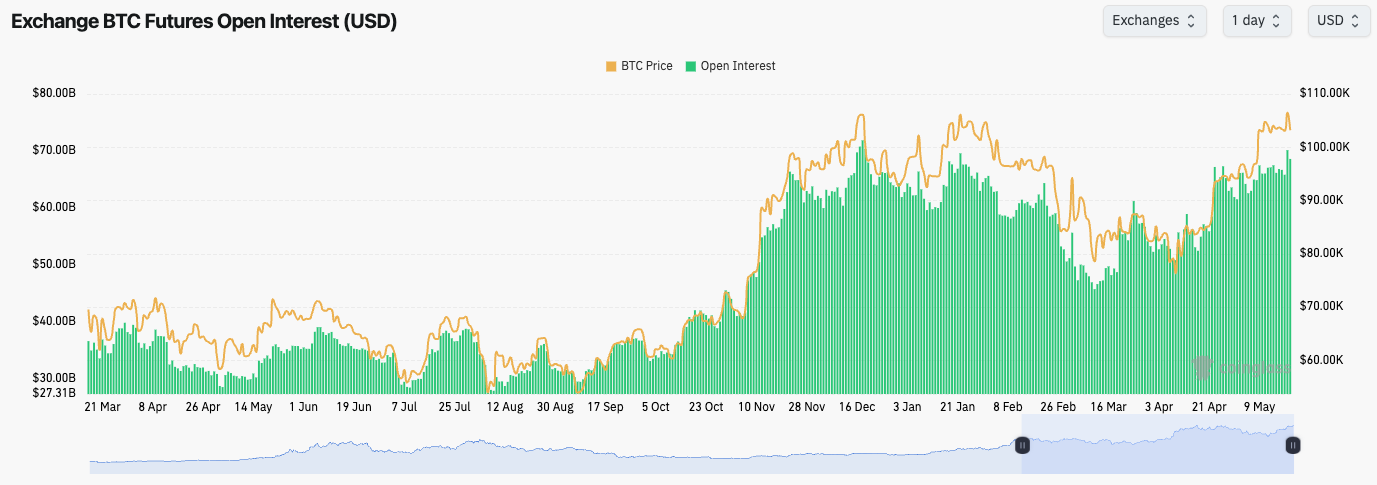

14 May 2025- BTC's Open Interest has moved back up to its highs in USD value, suggesting that more leverage has been on. However, Funding Rates have remained relatively neutral, meaning that there isn't a build-up of excessive Longs, but that it's a mix of both Longs and Shorts.

- Some of this Open Interest will likely have to be unwound, but it's hard to say if it'll be Longs or Shorts that might be squeezed.

Technical analysis

- BTC broke well above the horizontal level of $98,900, which may now become new support, or at least the first major support for price.

- Beneath $98,900, $93,000 to $95,700 should be a good zone of support, should the price fall back below $98,900.

- To the upside, the key levels are at $107,00 and then essentially the all-time high of $109,000.

- Price has begun to consolidate/stall slightly, with price now grinding into the main uptrend line. If price loses the uptrend and isn't quickly recovered, then it's very possible that we see a revisit of $93,000 to $95,700.

- The RSI is very overbought, and it's currently sitting on top of its moving average. For this metric to meaningfully reset, we'll need at a minimum a significant period of consolidation.

- Next Support: $98,900

- Next Resistance: $107,000

- Direction: Neutral/Bearish

- Upside Target: $107,000

- Downside Target: $93,000 to $95,700

Cryptonary's take

BTC has had a big move up and in a short period of time, fueled by Spot buying and Shorts being squeezed. Whilst it's possible that BTC continues pushing higher, we're not expecting this to be the outcome.We're not looking to chase prices currently, and we're expecting BTC to pull back from the $105k level back to 98900 As a minimum, however, this pullback might extend down to $93,000 to $95,700. If price pulls back to that level, we'll consider buying Spot BTC at that level with a view to holding it for at least 6 to 12 months.

Bearish divergences build as BTC stalls

05 May 2025BTC faces rejection below key resistance, with Open Interest high and funding neutral. A FED decision looms, potentially triggering a pullback as bearish signals begin to stack.

- On the price move up to $97,000, the negative Funding reset to neutral (a Short-squeeze), but the Open Interest remains relatively high in USD terms. This suggests that the build-up in Shorts has mostly been squeezed, but with OI still high, there's more room for this to potentially develop.

Technical analysis

- BTC has seemingly rejected through the $97,500 level, with price now below, but battling at the mid-level of the range at $95,700.

- If the price falls below the local low of $93,400, it will likely reach $90,000. This is a major psychological support that we're watching, and if lost, then $86,00 is on the cards.

- If price can recover $95,700, then it's possible we see a move higher to the major resistance level at $98,900. If this were to happen, we'd expect that to be a local top, and likely an area where we'd strongly consider a more sizeable Short.

- The RSI did briefly pop into overbought territory, but since it has pulled back, and it's now beneath its moving average. It's possible we see a move higher in price that then potentially puts in a bearish divergence (higher high in price and lower high on the oscillator) in overbought territory, and price can then pull back from there.

- Next Support: $91,700

- Next Resistance: $98,900

- Direction: Bearish

- Upside Target: $98,900

- Downside Target: $86,000

Cryptonary's take

We move into a pivotal week with a FED Meeting on Wednesday 7th, where we expect Powell to be somewhat hawkish and keep his optionality open. This might lead to a pullback in risk assets as rate cut bets are potentially pushed out to July, maybe even September.We're expecting BTC to have either put in a local top, or for a local top to be very close here. We're not looking to add to Spot bags at the current price, and we're expecting a pullback over the coming 2-6 weeks to take the price back to at least $86,000.

BTC faces crucial support levels amid pullback

29 April 2025BTC is currently navigating key support and resistance levels, with traders watching closely as price action approaches critical points. Let’s explore what’s next for Bitcoin as it battles potential pullbacks and upside targets.

- BTC's Open Interest has pulled back slightly, but it still remains relatively high.

- Price was driven up by Spot buying and Shorts being squeezed, although we've now seen this reset.

- Funding rates are fluctuating but mostly remain flat.

Technical analysis

- As we found out yesterday, price was driven higher by large Spot buyers (Saylor being a big one), and Shorts being squeezed.

- Price has now remained at the bottom of the mid-level of the range at $95,700. The major range we're looking at now is the $91,700 support and the $98,900 horizontal resistance.

- If the $91,700 support is lost, we'd expect $90,000 to be a potential support as it's a psychological level; however, if that's broken, then $86,000 would be the target.

- To the upside, if the price can climb above $95,700, then $98,900 is the upside target.

- The RSI is now just shy of being overbought, with a bearish divergence now also having formed (higher high in price, lower high on the oscillator).

- Next Support: $91,700

- Next Resistance: $95,700

- Direction: Bearish

- Upside Target: $98,900

- Downside Target: $86,000

Cryptonary's take

Price has climbed higher in a really strong manner, although we'd have preferred that this wasn't somewhat due to Saylor bidding. Price is now close to being overbought, whilst putting in a bearish divergence, whilst also butting up into the horizontal resistance of $95,700.It's possible that price goes higher here, with $98,900 the likely complete top (should price go higher), however, we remain cautious here and we're expecting a pull back over the coming week, with a larger pull back coming in the medium term.

Whether the price local tops around $95k or $98k is hard to say, but we do believe a local top is close as the macro environment doesn't support BTC clearing above $100k and heading to all-time highs currently.

Is Bitcoin's bullish breakout sustainable?

21 April 2025Bitcoin’s recent breakout has sparked excitement, but the resistance ahead is fierce. In this analysis, we dive into the key levels BTC needs to overcome to shift direction.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

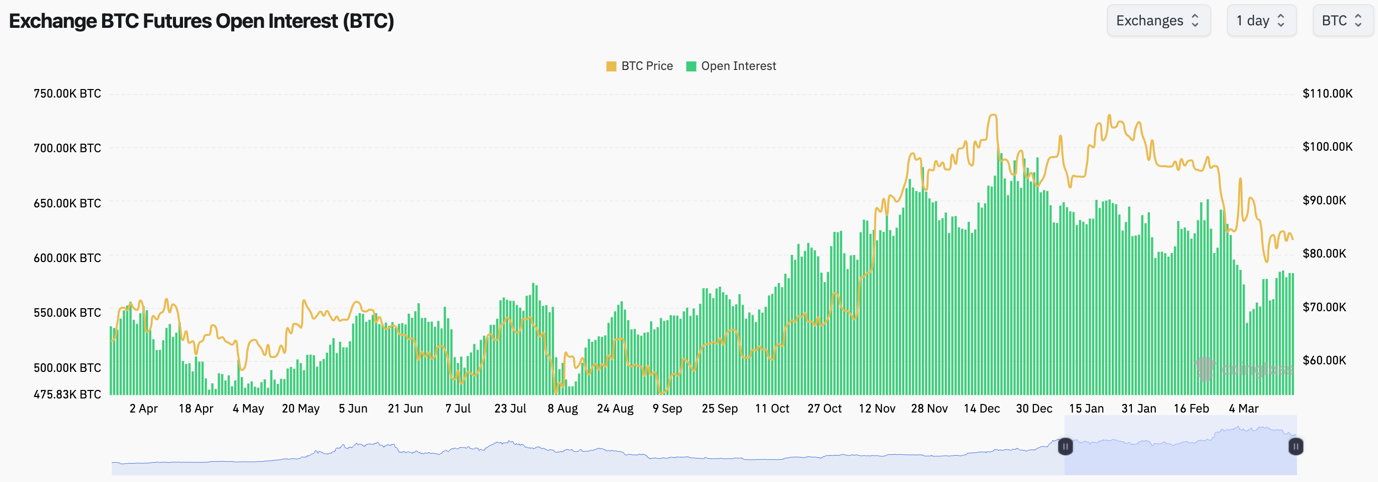

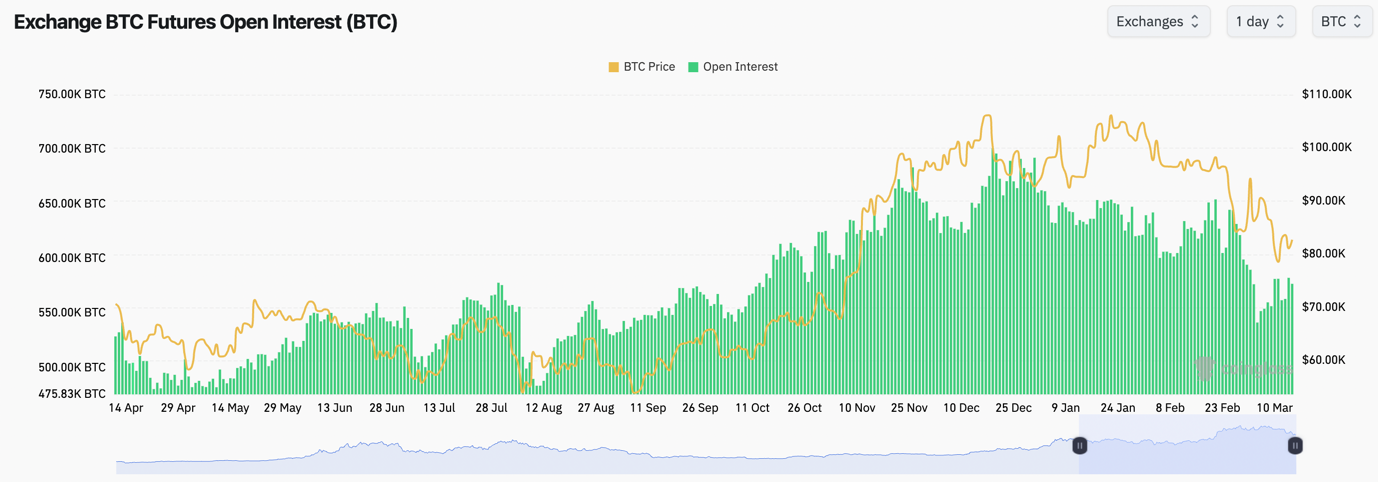

- BTC's Open Interest (by number of coins) has increased whilst Funding remains range-bound/fluctuating between slightly positive and negative. This move up in price has been driven by some leverage, but it's also been supported by a Spot bid.

Technical analysis

- BTC has broken out of its main downtrend line, and despite being in a tight range for a few days (between $83,500 and $85,500), price has now broken out to the upside.

- Price has now moved up to a local resistance zone between $87,500 and $88,500, however, the major horizontal resistance is at $91,700.

- If price reclaimed $91,700, that would indicate a bullish reversal, and we'd have to look to change our stance. However, we don't see price reclaiming this level anytime soon,

- On the downside, $82,000 is horizontal support, with the next major level in a zone between $74,800 and $78,500.

- The RSI had broken out of its downtrend line some time ago, and having also been sitting above its moving average, it has now broken upwards. It remains in middle territory, so it's possible this price move could extend into $88,500.

- Next Support: $82,000

- Next Resistance: $88,500

- Direction: Bearish

- Upside Target: $88,500

- Downside Target: $82,000

Cryptonary's take

Whilst price has positively broken out to the upside, we remain sceptical of the move. In fact, between $87,500 and $89,000, we will be looking to Short BTC, with the target being a minimum of a retest of $82,000. In the short term, we see upside as close to being done, and therefore we do expect price to pull back over the coming weeks, again with $82,000 as being the minimum target.In the medium term, we are still expecting a retest of the lows, and hence, for now, we remain patient. A price reclaim of $91,700, and we'd have to consider that we're wrong and we'd look to reassess our positioning.

Bitcoin faces $82K support before critical downturn

16 April 2025As the market braces for volatility, Bitcoin’s pullback and critical resistance levels across Ethereum and altcoins signal a shift in momentum. Let’s break down the key targets in play for major cryptos.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Technical analysis & market mechanics

- $86,000 is the first local resistance and where we begin building the short.

- $88,555 is secondary resistance to scale further into the position and add a layer to the short.

- $91,200 is the final resistance, and we reserve capital to complete the short.

- $82,000 is local support but weak; not a level too long.

- $78,000-$74,000 is the main target zone, where we expect the price to revisit.

- $70,000-$65,000 is the deeper downside objective if momentum accelerates.

- RSI sits around 50 - neutral, with room for price to push higher.

- Market structure remains bearish with lower highs forming.

- Funding rate at 0.0046% - flat; no long/short imbalance.

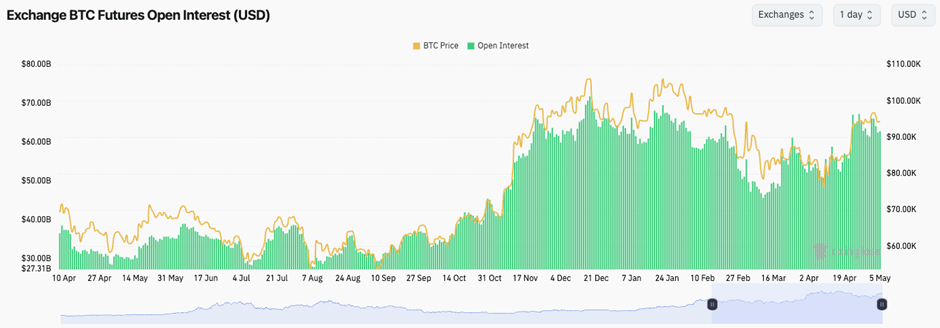

- Open interest consolidating between $53B-$56B - cautious but stable.

- Short liquidations stacked above $86,500 - adding to our thesis, we may push higher to take out those shorts before rolling

- Next Support: $82,000

- Next Resistance: $86,000

- Direction: Bullish

- Upside Target: $91,200

- Downside Target: $78,000

Cryptonary's take

We're shorting into the $ 86 K-$91 K region - a clear resistance block with stacked liquidity and fading momentum. Entries are staggered at $86K (core entry), $88,555 (scale-in), and $91,200 (final add). Stop-loss is placed above $93,000 to protect against invalidation. This setup aims to capitalise on a rollover as macro uncertainty around tariffs and economic policy weighs on risk assets.Targets are $ 74 K-$70 K, with potential extension to $ 65 K-$60 K if momentum breaks. The structure supports short exposure, clean levels, clear invalidation, and high reward-to-risk. We do expect a last push higher into these trading levels before we roll over.

Bitcoin stabilizes above trendline, eyes $88K

14 April 2025Bitcoin’s rally is gaining steam as it pushes above key levels, reclaiming trendline support and flipping sentiment. With funding turning positive and momentum building, all eyes are on where BTC heads next this week.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Open Interest (by number of coins), has moved up slightly, but not to alarming levels, which would suggest too much leverage has built up.

- BTC's Funding Rate has also returned to more positive territory, whereas last week, Funding was negative for significant periods, suggesting that traders were betting on further downside. But, we know when Funding is negative for too long, that likely suggests a reversal is imminent (upside for price).

Technical analysis

- Bitcoin is attempting to breakout of its downtrend line, and price is now building support on top of the downtrend line, to then potentially put in a move higher over this week.

- $82,000 is the local support, with $88,000 as the local resistance. However, in terms of resistance, it's more of a zone, and it's tricky to find clear levels here.

- In terms of the major horizontal resistance, the clear level is $91,700. A reclaim of this level would be the bullish reversal for then a retest of $100k and the all-time highs. However, in the short term, we don't expect $91,700 to be retested, let alone reclaimed.

- The RSI has cleanly broken out of its downtrend, and it's also above its moving average. It also still remains in the middle territory, suggesting that there may be some room to the upside here.

- Next Support: $82,000

- Next Resistance: $88,000

- Direction: Bullish/Neutral

- Upside Target: $88,000

- Downside Target: $78,000

Cryptonary's take

In the short-term, it's possible this move higher can continue, and if it does, we would expect the stopping zone to be between $88,000 and $89,000. If price were to push on to $90,000 to $91,700, we may even look for Shorts again in that range, as that might mean price has got too stretched to the upside in the short-term.We are still expecting this to just be a relief rally, and for the next few months to be choppy. Therefore, we'll look to take advantage of this choppiness, and we'll be looking to rebuild/re-add to long-term Spot bags, should prices retest the lows, and potentially make new lows. For BTC, that longer-term accumulation zone is between $63,400 and $75,500.

BTC could test $74,700 support

11 April 2025BTC is testing critical levels, with resistance holding strong and support just below. Will the market see a breakout or another pullback? Let’s take a closer look at the latest BTC movements.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Open Interest has remained slightly elevated over the last week or so, suggesting there is still some appetite for leverage exposure.

- Funding Rates are subdued and remain tight to 0.00%, with there being a slight negative skew currently, indicating that there is a small lean amongst traders to be Short.

Technical analysis

- Price moved down towards the top of the Green Buy Box, and price bounced from $74,700.

- Price then bounced into a new resistance zone that we have identified between $82,500 and $84,200. In our view, this is now the key level for price to reclaim.

- Price remains in its main downtrend, and we'll be closely watching for a breakout of this main downtrend line.

- In terms of downside, we expect $71,500 to $75,500 to be major support.

- The RSI broke out of its downtrend, and it's put in back-to-back bullish divergences (lower low in price, and higher low on the oscillator), whilst it's also above its moving average. We could see this reflected in helping prices go higher.

- Next Support: $74,700

- Next Resistance: $84,500

- Direction: Neutral/Bullish

- Upside Target: $87,000

- Downside Target: $74,700

Cryptonary's take

In the short term, price action is really hard to call here. If we had to call here, we could see the price pulling back slightly and then maybe moving up into the downtrend line and potentially pushing for a breakout. We've identified this with arrows on the chart.In terms of accumulating BTC, or playing this move, in all honesty, we're not too confident; it's extremely hard to call considering the whip-sawing price action we've been seeing lately as we constantly get the headline tennis playing out.

In the short term, we have low confidence. But, the game plan will be to accumulate in the Green Buy Box between $63,400 and $75,500, should we see retests, which we expect to see over the coming months.

BTC could drop another 10%

07 April 2025As the crypto market stabilizes, BTC faces key support at $71,500 while market sentiment remains cautious. Let’s explore the current price action and what could come next for BTC.

- BTC's Open Interest has spiked up slightly, but that's likely due to the price of the coins falling.

- Funding Rates are positive, but they're subdued.

- There is far less appetite than in previous months for traders to be heavily leveraged in trades.

Technical analysis

- BTC moved into our Short box, and it has rejected down to our target zone of $76k to $78k. Perfect move.

- The key battle for price came at the $81,500 to $82,000 level. When the price lost that level, it moved straight into the $78k level as we expected it might do.

- The new supports we're looking at are between $68,900 and $71,500, so again, another zone, rather than a specific price point.

- To the upside, the new horizontal resistance is now at $81,500 (the old horizontal support).

- In terms of resistance, we also have the main downtrend line. But, once price bottoms, we should see a grind sideways, and price will move into that main downtrend line, and that'll be what then potentially sets us up for a breakout.

- The RSI is once again close to approaching oversold territory.

- Next Support: $71,500

- Next Resistance: $81,500

- Direction: Neutral/Bearish

- Upside Target: $81,500

- Downside Target: $71,500

With the S&P and the Nasdaq down substantially, it's possible that a bottom for BTC isn't too far away. Now that doesn't mean we're looking for Longs here, but we would be very wary of Shorting BTC here, even if there is room for another 10% downside move. But, with the huge overextension to the downside in the S&P and the Nasdaq, a potential relief rally could be quite aggressive if it comes.

For now, we're patient and remaining on the sidelines. But, we're seeing many on the timeline getting really bear'd up here, and to us, that seems a bit too late to be doing that. The time for getting ultra bearish was months ago.

Whilst we think there's more downside to be had in the medium term, we're wary of a potential market bounce (just from very oversold levels). Therefore, we're not looking to Short BTC here, and we're starting to eye levels to buy.

For us, that's between $69,000 and $71,500 (assuming we get there). If we do, we'll begin to add lightly. This may come sooner than we expected, and that's due to Trump's aggressiveness.

What’s Next?

You’ve seen the analysis for BTC. The next trades — ETH, SOL, HYPE, and SPX6900 — are lining up now, with targets ranging from -20% to -45%. We’ve pinpointed the exact short zones, liquidation levels, and our strategy for execution.

BTC eyes $78,000 as next target

01 April 2025As the crypto market grapples with volatility, Bitcoin is testing key support levels while traders await direction. Let’s explore the latest technical analysis for BTC and what’s next in this unpredictable market.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

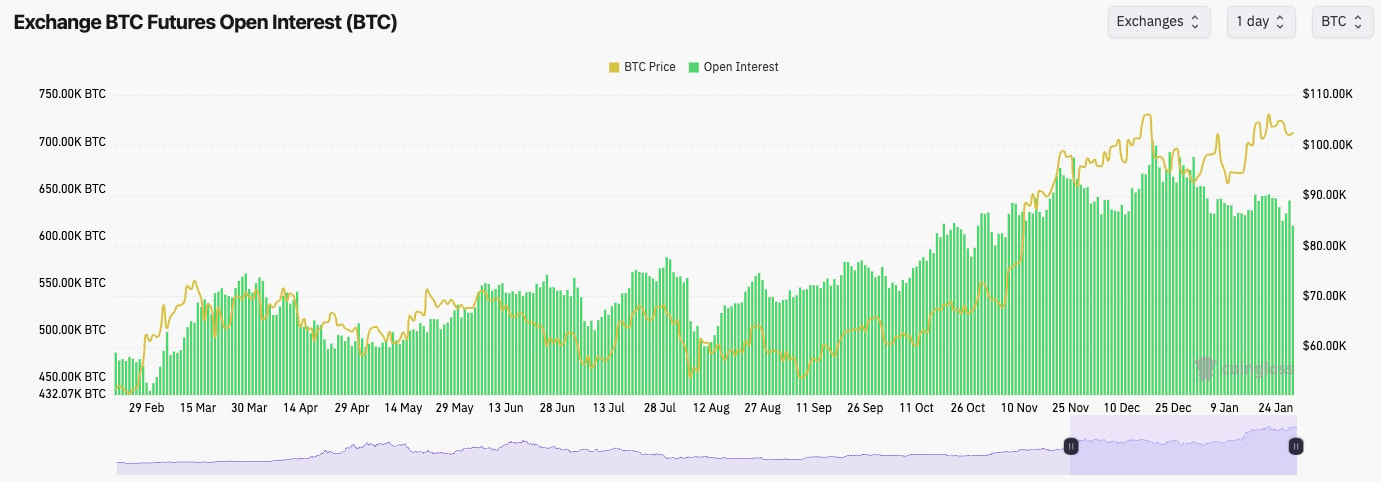

- BTC's Open Interest has pulled back a tad whilst Funding remains close to 0.00%, indicating that there isn't a huge appetite amongst traders to be placing heavy leverage bets.

Technical analysis

- Price rejected into the $87k to $88k region (our Short Box), and price has pulled back to $82k, which we have identified as a local support.

- $81,500 to $82,000 is the local support zone, and the price has bounced slightly from there over the last 24 hours.

- There is now a very local resistance at $84,500, with $87,200 as a more meaningful resistance. Beyond that, the key level is $91,700. But, we don't expect this level to be even tested anytime soon.

- Below $81,500 to $82,000 (the local support), the major support is likely the zone between $76,000 and $78,000.

- Interestingly, the RSI broke out of its downtrend, it pulled back to retest the downtrend as support, and it's now bouncing. However, it does remain below its moving average.

- Next Support: $81,500

- Next Resistance: $87,200

- Direction: Bearish

- Upside Target: $85,500

- Downside Target: $78,000

Cryptonary's take

Bitcoin is in a tighter range between $81,500 and $87,200, however, the levels on either side are also open. These would be $78,000 and $88,500. We don't, however, expect any major upside in the short-term, and in fact, we are quite confident that this price range will break, and the break will be to the downside.The market is on edge going into Trump's reciprocal tariff announcement tomorrow, and even if that comes in lighter than expected (we don't think it will), then any rally off the back of it we expect to be short-lived.

Ultimately, in the short or medium term, we do expect the price to break down and eventually retest that $76,000 to $78,000 level. We'll exercise patience in the meantime.

Bitcoin moves into key 'short box' zone

28 March 2025As market uncertainty looms, Bitcoin ($BTC) face critical price levels that could signal major moves. Let’s explore the latest trends and potential scenarios for BTC.

- BTC's funding rate has fluctuated between slightly positive and slightly negative, as we can see below. This indicates a lack of conviction amongst traders, who are flip-flopping between Longing and Shorting.

- BTC's Open Interest increased substantially from the lows, up approximately 20%. This was leverage traders chasing the price higher as it moved into the $87k to $88k area. Although this wasn't matched by strong Spot buying, hence we've seen the move higher be relatively weak and short-lived.

Technical analysis

- BTC has seemingly fallen into the 'Short Box' we identified between $86,300 to $91,700.

- Price rejected into the main downtrend line (red line).

- Price has now pulled back to the local support of $85,000, although the major horizontal support is at $78k.

- To the upside, $87,200 is a key local horizontal level for price to reclaim and hold above. If price can do this, then $91,000 to $91,700 is a potential target, and we'd reassess at that point. However, we don't see this happening in the short term.

- The RSI downtrend line has seen a breakout with the RSI now sitting on top of its moving average and in middle territory. This could help the $85,000 area be a local support.

- Next Support: $85,000

- Next Resistance: $88,500

- Direction: Bearish

- Upside Target: $88,500

- Downside Target: $82,000

Cryptonary's take

BTC has moved into our 'Short Box' that we had identified a number of weeks ago. We had to be patient in letting the price grind up to the box and to fill Short orders, which have now filled between $86,300 and $88,600.We are of the view that the recent move up has just been a small relief rally and not much more than that. We expect BTC to move down to retest $82k as a minimum target over the next week or two. However, we see the possibility of a retest of $78k as somewhat likely as well.

BTC targeting $78,000 support zone

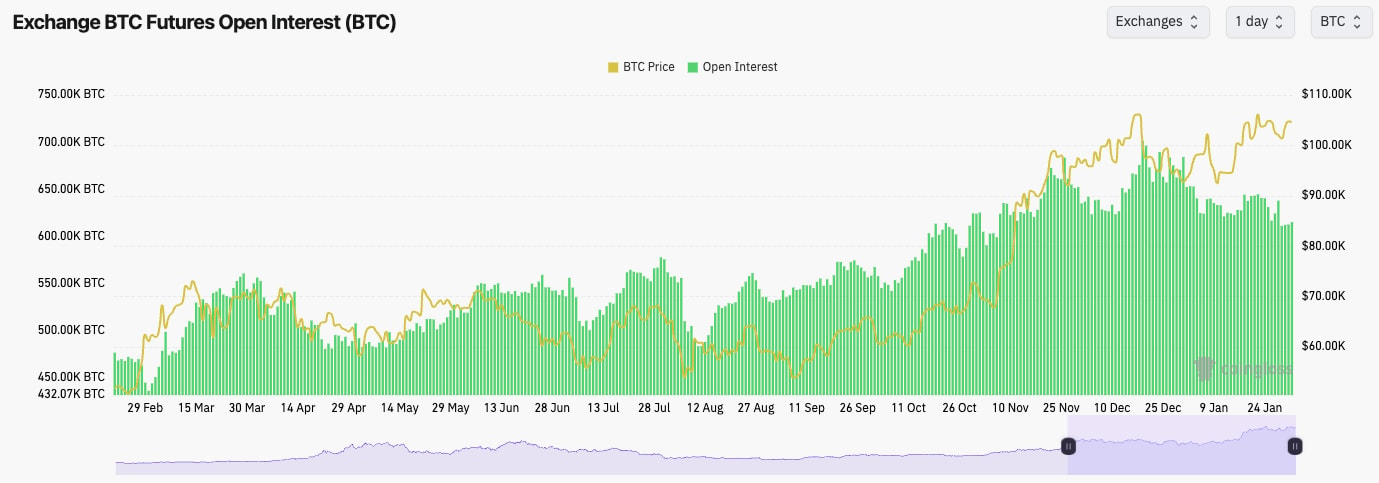

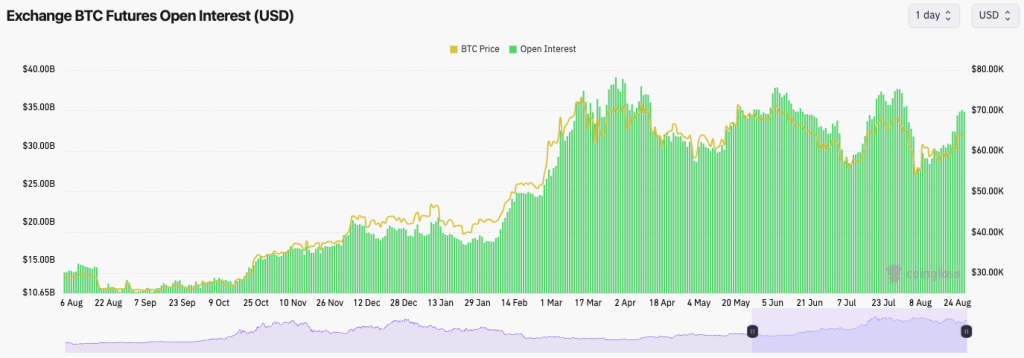

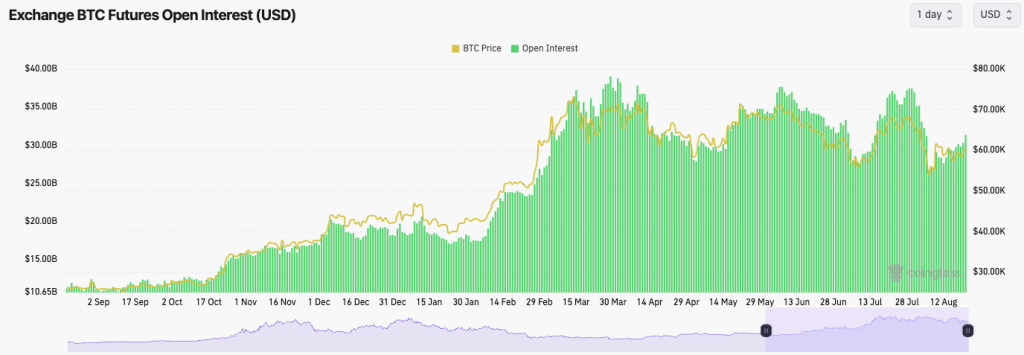

18 March 2025- BTC's Open Interest is up approximately 10% from the bottom, seen a few weeks ago. Although it still remains in a downtrend. This indicates that traders have less appetite to leverage trade BTC.

- Funding Rates are mostly flat, or fluctuating between slightly positive and negative. This suggests that there is indecision amongst traders.

Technical analysis:

- Bitcoin has moved up from the lows, as we expected, following the bullish divergence that is being formed (lower low in price, higher low on the oscillator).

- Price has now bounced into the $85,000 to $86,300 range which is a resistance zone, and also a lower high.

- The zone of major resistance, and where we'd strongly consider Shorts, is between $86,300 and $91,700.

- The RSI remains in a downtrend, although it's not in oversold territory, whilst it's also sat on top of its moving average and potentially looking for a breakout in the short-term.

- On the downside, major support remains between $77,000 and $78,000. A loss of this zone and price likely dips into $72,000, the old horizontal resistance, now potentially new support.

- Next Support: $78,000

- Next Resistance: $86,300

- Direction: Neutral

- Upside Target: $86,300 to $89,000

- Downside Target: $78,000

Cryptonary's take:

Bitcoin has moved off of the local lows, having put in the bullish divergence. Price has now slowly moved up, and likely helped by the bounce in TradFi Index (SPX and NDX). In the short term (coming days), we do think the price can continue this slow grind higher.However, we still expect we're in a multi-month downtrend, and therefore, if the price were to move into the $86,300 to $91,700 zone, we'd look to layer Short orders in that range for a move back to $ 70k over the coming 2-4 weeks.

BTC resistance at $86K looms

14 March 2025- BTC's Funding Rate is positive but muted, indicating that there's a small bias amongst traders to be Long.

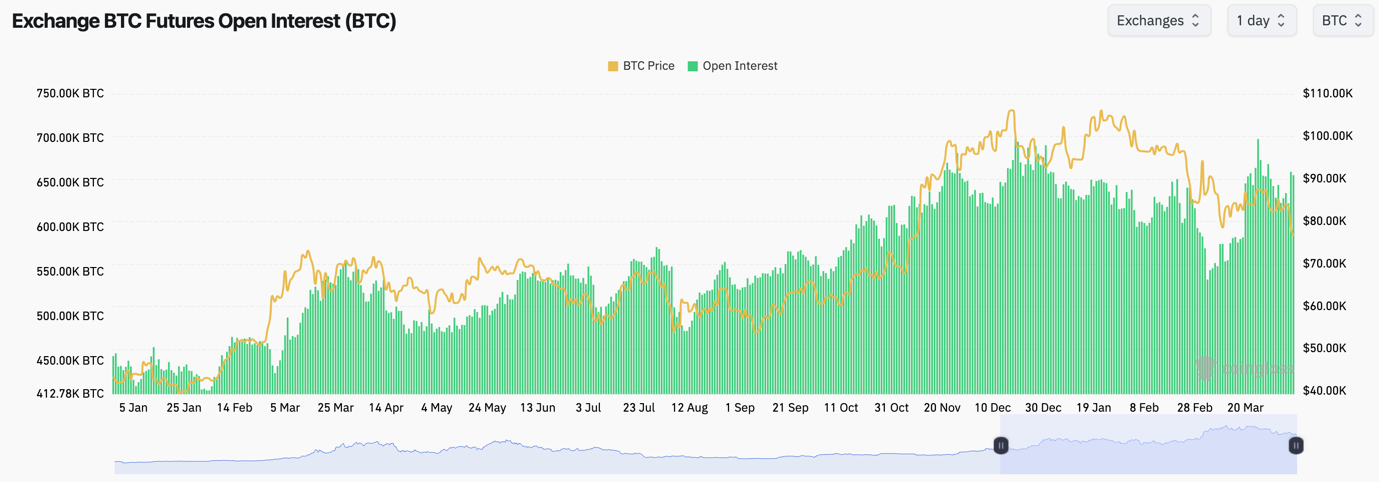

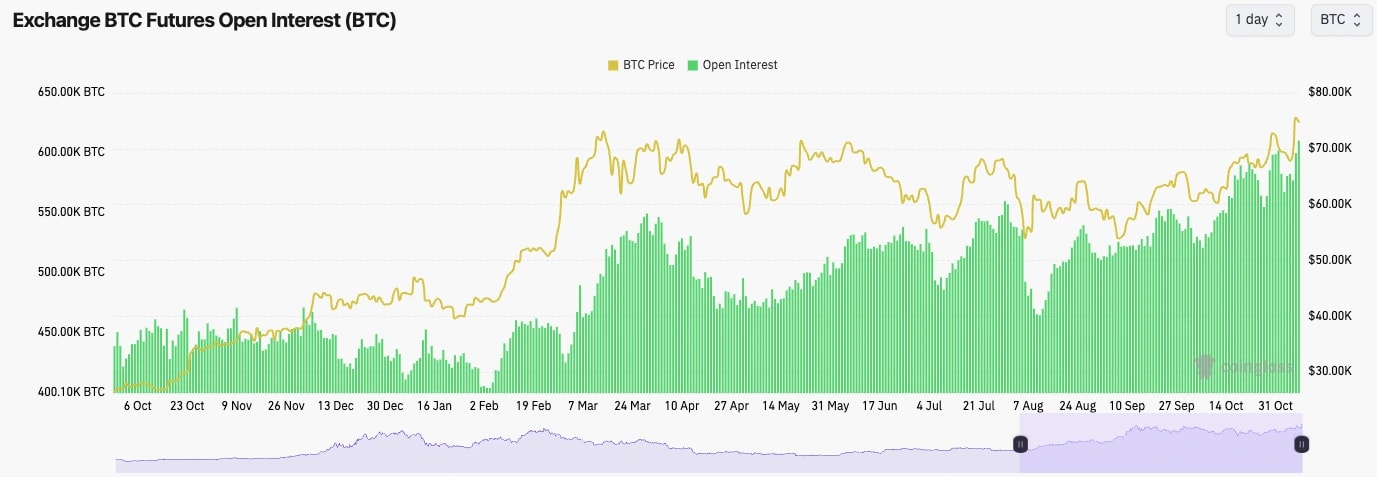

- BTC's Open Interest has been up off the bottom since March 3rd, but it's still in an overall downtrend, indicating that there's not the appetite for leverage that there was at the highs at the start of the year. OI was down from 700k BTC at the start of the year to 582k BTC. This is a meaningful reset.

Technical analysis

- BTC has found some support for now in the late $70k's.

- Price has also put in a lower low, whilst the RSI has put in a higher low, very close to overbought territory (bullish divergence). This could ignite a small relief rally if the TradFi Index can also bounce.

- There is a short-term resistance at $86,300, which price may likely struggle at. However, beyond that, the main resistance is $91,700. We don't expect the price to get near $91,700, let alone breach it in the short-term.

- The major support to the downside is $69,000 to $72,000. We expect this area to be bid quite heavily should BTC trade that low in the coming weeks.

- The RSI is off of oversold territory, and it's battling at its moving average. However, it remains in its major downtrend. We'd get more excited upon an eventual breakout of this downtrend. But, we're not expecting this anytime soon.

- Next Support: $78,000

- Next Resistance: $86,300

- Direction: Neutral/Bullish

- Upside Target: $86,300

- Downside Target: $73,900

Cryptonary's take

Bitcoin has held up relatively well over the last 4-5 days considering how poorly TradFi Index's (S&P and Nasdaq) have traded. However, we do expect that we're in a downtrend, with local rallies likely to put in lower highs and see rejections at local horizontal resistances, the next one is $86,300.If BTC were to get a small relief rally - just due to oversold conditions, it's due one - then we'd look for new shorts potentially between $86,000 and $88,000 (if BTC can get there).

However, we've felt that price has been due for a relief rally for some days now, and we haven't really seen one. Let's see how the price develops over the weekend whilst the TradFi Index isn't trading.

For now, we remain patient. We won't be Shorting lows, but on relief rallies, we'll be looking for Shorts. That current target zone is $86,300 to $88,000. Unless we're given that opportunity, we'll remain sitting on the sides and patient.

Bitcoin battles to hold $80K support

10 March 2025Bitcoin struggles to reclaim resistance as sentiment weakens, while funding rates signal reduced risk appetite. As BTC searches for support, will a relief bounce emerge or is more downside ahead? Let’s dive into the latest price action.

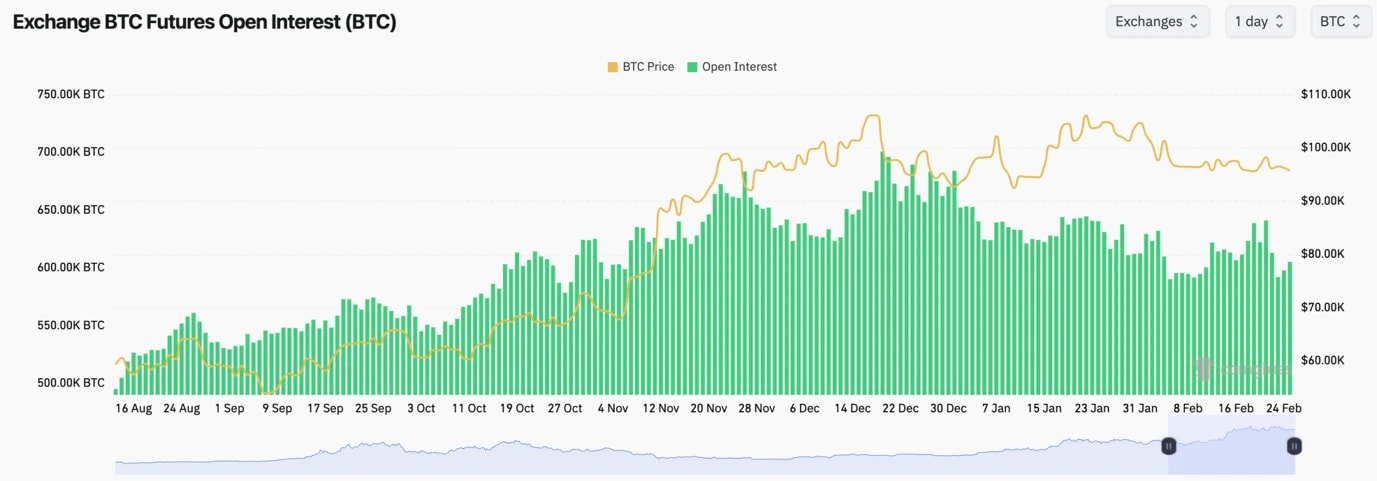

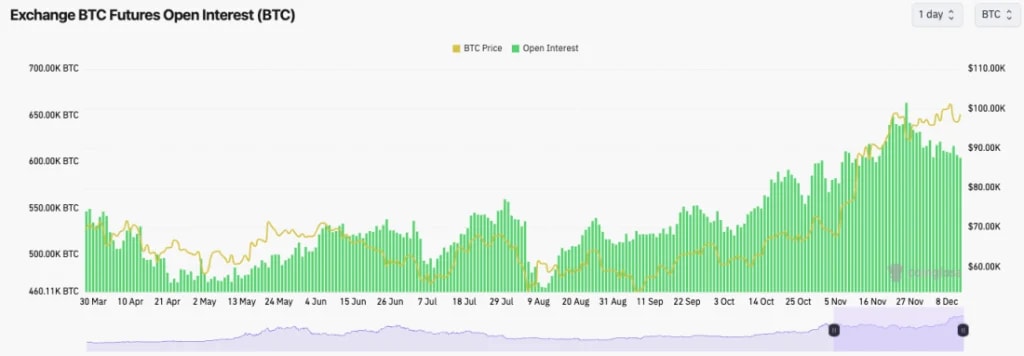

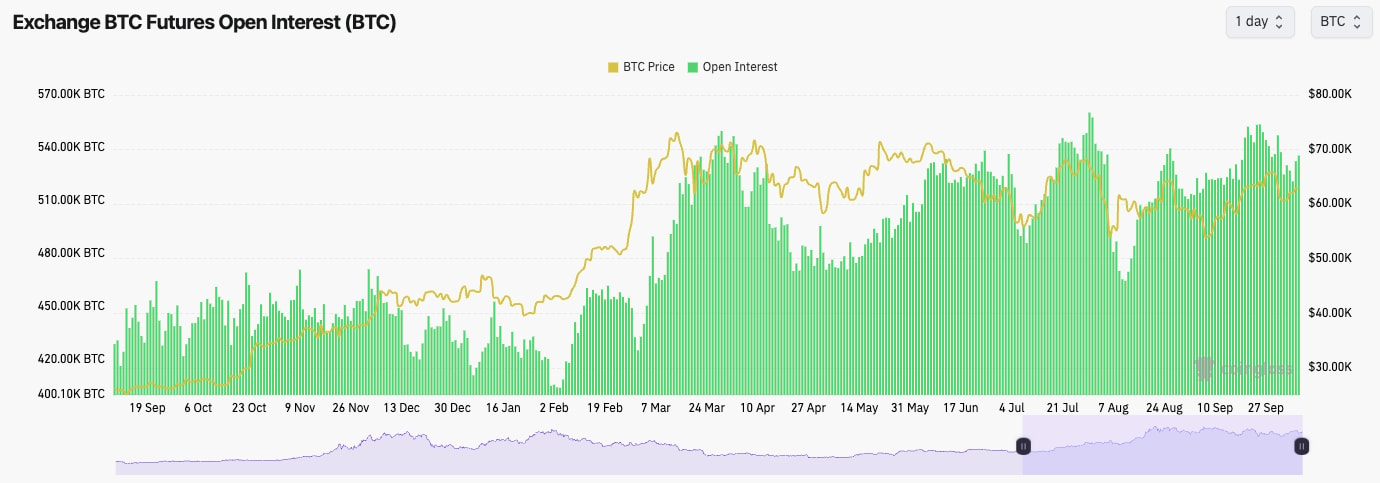

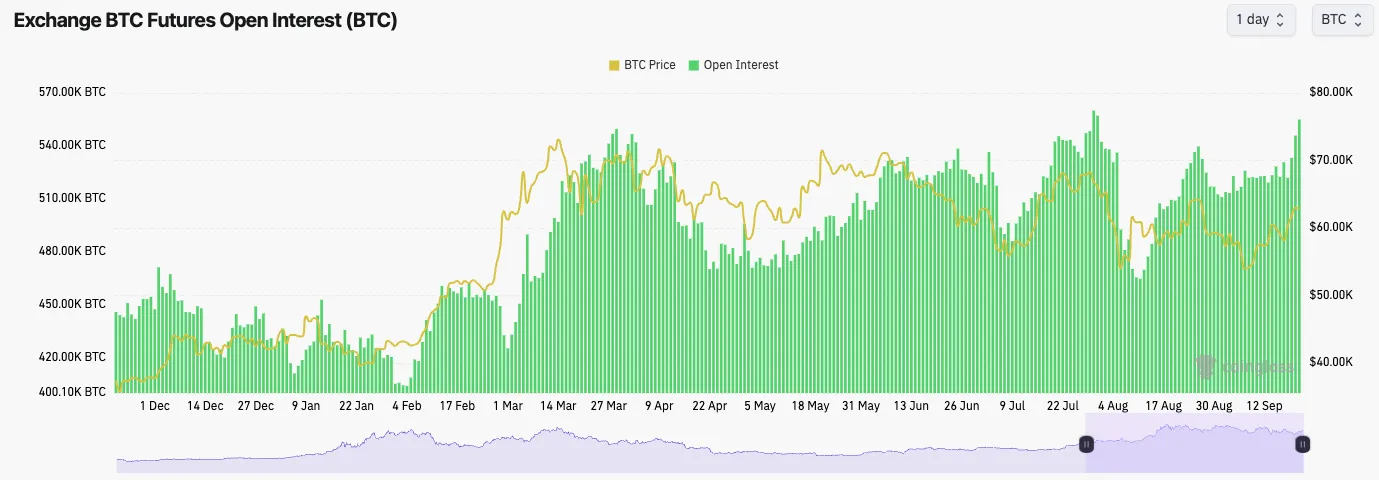

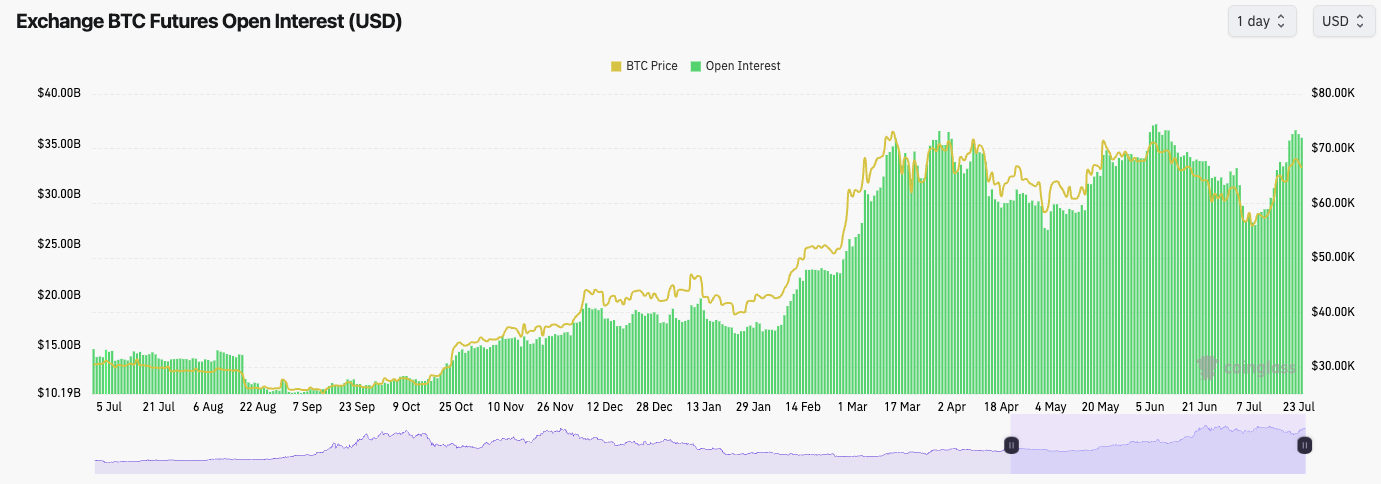

- Open Interest has pulled back substantially over the last 10 days. 10 days ago, OI was at 644k BTC. Following the full retrace of the move on March 3rd, OI came down to 541k BTC. This whip-sawed traders on both sides and this saw a lot of realised loss-taking.

- Funding Rates are now quite subdued, suggesting that there isn't the appetite to take large leverage bets at the moment.

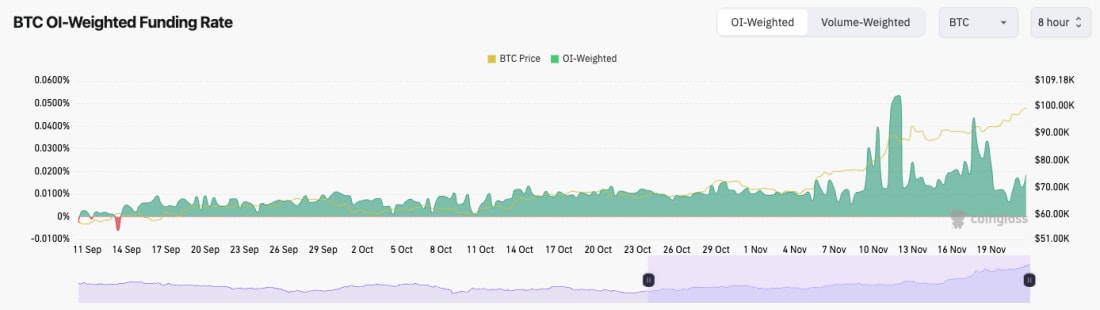

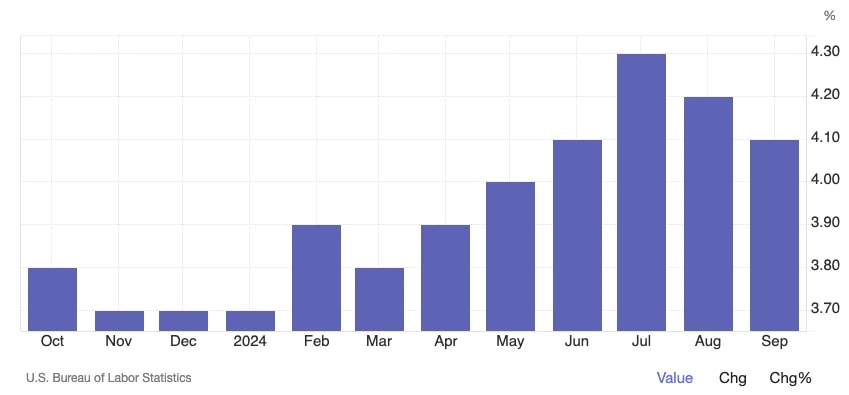

- In the below, we can see how subdued Funding Rates are today, in comparison back to November when the market was overheated post-Trump win.

Technical analysis

- On Thursday, BTC rejected into the horizontal resistance at $91,700, losing the price range that had been supporting BTC, and since then, the price has retraced $10,000.

- Zoomed out, the price remains in an overall downtrend, along with the RSI.

- The RSI has now put in a bullish divergence though (a lower low in price, and a higher low on the oscillator), whilst the RSI is now also creeping above its moving average. This may help to generate a small relief rally.

- So far, the rice has found support in the last $ 70k and the $80,000 level.

- It's hard to identify a clean local resistance at the moment, although if we had to suggest, we'd say it's the $86,000 to $87,000 zone that can be that next local resistance.

- The major overhead resistance is at $91,700. That's the level that'll need to be reclaimed in order to see a bullish reversal.

- Next Support: $80,000

- Next Resistance: $86,000

- Direction: Neutral

- Upside Target: $86,000

- Downside Target: $75,000

Cryptonary's take

We see on the timelines (Twitter etc) that sentiment is more bearish despite there still being the dip buyers out there. Price likely bottoms when the 'dip buyers' are no more. However, it is possible that we can get a small relief rally potentially in the immediate term just simply more as a slight mean reversion move.We're also looking at the S&P and the Nasdaq, both of which are close to oversold and are likely to see a small bounce in the short also. The tricky part to this is that it's hard to know if we go lower before a relief bounce.

Therefore, the way to play this is to look for Shorts into meaningful relief bounces. That's how we're looking to play the short term. We still expect over the coming weeks for BTC to move into the low $70k's at least.

Bitcoin faces critical support test after rally

3 March 2025Bitcoin’s recent surge has hit a wall, with resistance levels proving tough to break. Meanwhile, key support zones across major cryptos are under pressure. Can the market hold strong, or is there a deeper pullback ahead?

- BTC's Open Interest has continued its slight downtrend, this is in spite of the large move up yesterday in price.

- This suggests that yesterday's move up in price was a spot-driven move rather than a perps-driven one.

- Funding Rates have also remained relatively flat, with Shorts and Longs being mostly evenly balanced.

Technical analysis

- At the back end of last week, price moved in to the Yellow box, printed it's lowest oversold reading since August 2023, and price swiftly bounced.

- Price has now moved into the underside of the horizontal resistance at $95,700, and so far, it looks as if it's rejecting. Today's candle close will be an important assessment of this.

- BTC is now fighting at the major horizontal level of $91,700. This may become new support if price can hold. If price falls below it and remains below it (uses it as resistance), expect $80k again.

- The RSI has bounced out of extreme oversold territory, but remains in it's downtrend. It has now put in a hidden bearish divergence (higher high on the oscillator, lower high in price).

- Next Support: $91,700

- Next Resistance: $95,600

- Direction: Bearish

- Upside Target: $95,600 (maybe $98,900)

- Downside Target: $91,700 (then $87,000)

Cryptonary's take:

The move yesterday was really extreme, and you can get that kind of move when confidence/sentiment is on the floor. The good news is then overpriced as all those that have sold out rush to buy back in.For now, though, this move remains a move into high timeframe resistance, where there's a strong potential we can see a lower high put-in and price move lower in the coming month. The Crypto audience will now expect big announcements at the Summit this week. So, unless the move is ultra bullish (outright buying of coins) then expect it to be a 'sell the news event'.

The key level to watch in the short-term is $91,700. If that level is lost, and news out of the Summit isn't super bullish, then we expect lower prices. PS - the CME gap that was created is now down to $81k. It's common for gaps to be filled.

Bitcoin’s next move: $87K or $98K?

24 February 2025As Bitcoin hovers near key support, market sentiment remains fragile. With macro risks in play and resistance holding firm, traders prepare for potential downside. Let’s analyze the latest BTC trends and key levels shaping the market’s next move.

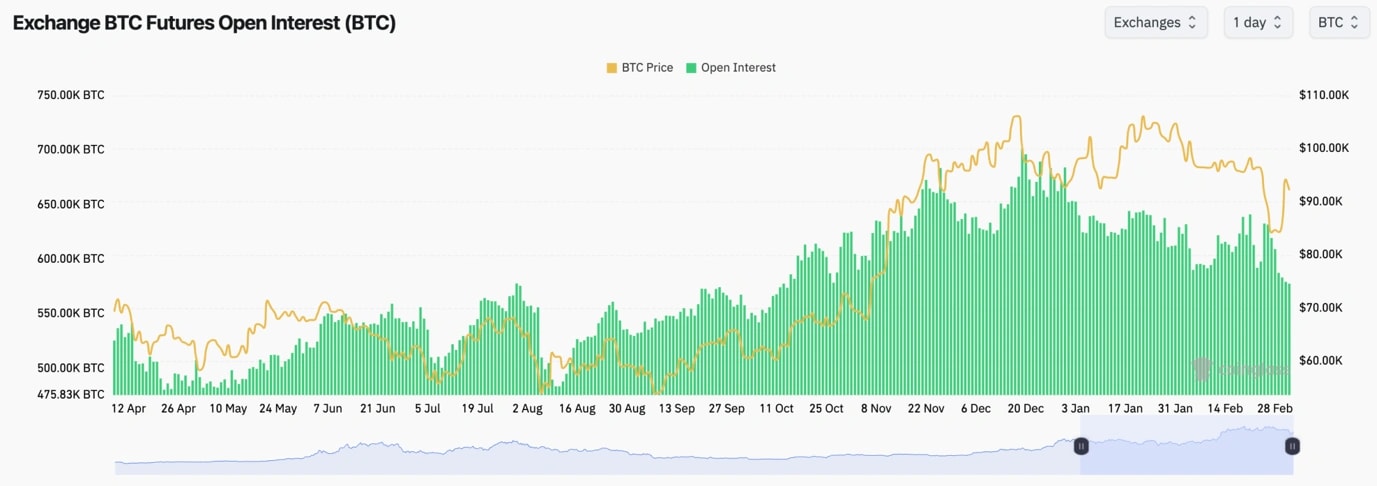

- We're still in a general downtrend for Open Interest, and it was interesting to see the OI pop higher into $99k before the price pulled back and OI came back down and into new lows.

- Interestingly, Funding Rates have mostly stayed positive, meaning Longs are still more dominant.

- This has been contrarian to the rest of the space where we've seen a lot of ALTS have negative Funding Rates.

Technical analysis

- Amazing really to see that Bitcoin has remained tight in its range.

- Bitcoin is still ranging between the major horizontal resistance of $98,900 and the horizontal support of $95,700.

- On Friday, the price tested the horizontal resistance and the local downtrend line, but the price was rejected and it's now back to the lows of the range. As we expected, the upside is capped.

- The RSI is still in a downtrend but remains in the middle territory and it's battling at its moving average.

- On the downside, if $95,700 breaks, $91,700 is the next level. We expect this level to be tested again at some point in the coming weeks.

- Next Support: $95,600 (then $91,700)

- Next Resistance: $98,900

- Direction: Bearish

- Upside Target: $98,900

- Downside Target: $87,000

Cryptonary's take

Whilst it's possible for Bitcoin that we still get these small pops higher, and granted the range lows have continued to hold, but we do expect them to break. In the coming weeks, we see a more material breakdown coming with $91,700 being the likely target, although the price may extend to the high/late $80k's - $87k to $91k say.We still lack catalysts in the short-term, whilst there are macro headwinds with Trump policies (companies are cautious until they see the effects of the policies). This can potentially set us up for more downside in the coming weeks. And for now, this is what we're expecting and positioning for. If the price retests north of $98k, Shorts can be considered.

Bitcoin to $80K or $100K next?

18 February 2025Bitcoin ($BTC) remains range-bound between $95,600 and $98,900, with key support at $91,700. The funding rate suggests indecision, but downside risks persist. A breakout is coming—will BTC move higher or break lower?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

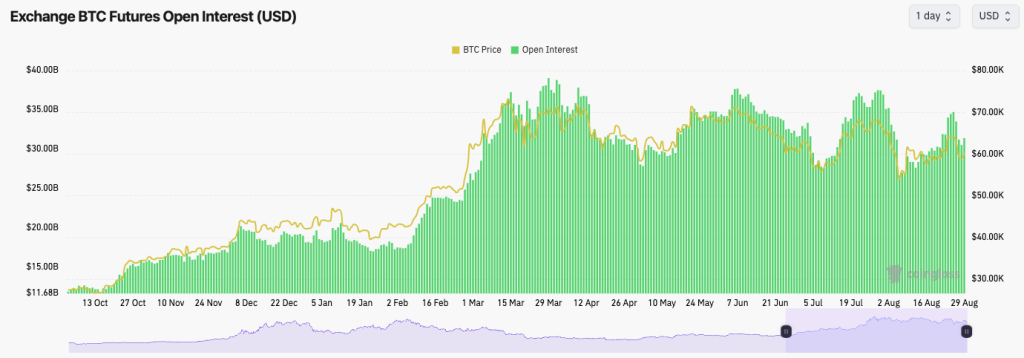

- Bitcoin's Open Interest has generally downtrended since mid-December, however, it has risen 6% from the lows in late January.

- The Funding Rate has remained positive and fluctuated between 0.004% and 0.01%. This suggests some indecision amongst traders, but still with a slight bias towards Longs.

- Overall, this is a more healthy leverage environment.

Technical analysis

- BTC has remained in a really tight range between its local support of $95,600 and its local resistance of $98,900.

- Beyond $98,900, the $100k level should act as a tricky psychological level, whilst the main horizontal resistance is at $106,900.

- To the downside, we expect $91,700 to act as key support as this also closely matches the short-term holder cost basis price ($92k).

- Sub $91,700, and the key levels are $87,100 and $80,300.

- The RSI is in relatively middle territory, so it has a downside if the price wants to go lower. The RSI is also beneath its moving average and finding that to be resistance currently.

- Next Support: $95,600

- Next Resistance: $98,900

- Direction: Bearish

- Upside Target: $98,900

- Downside Target: $91,700

Cryptonary's take

Bitcoin has been in this tight range now since early February. We are expecting a break at some point soon, and we're expecting this to be to the downside. For now, we remain risk-off, however, we will look to lightly add to our long-term BTC bags between $87k and $91k. Whilst we'll more aggressively add between $80k and $87k.Will BTC hold $95.7K support?

10 February 2025Bitcoin ($BTC) is attempting to reclaim $98.9K, but resistance remains strong. Alts and meme coins are struggling, and a key retest of $91K is possible. Will BTC break out or head lower?

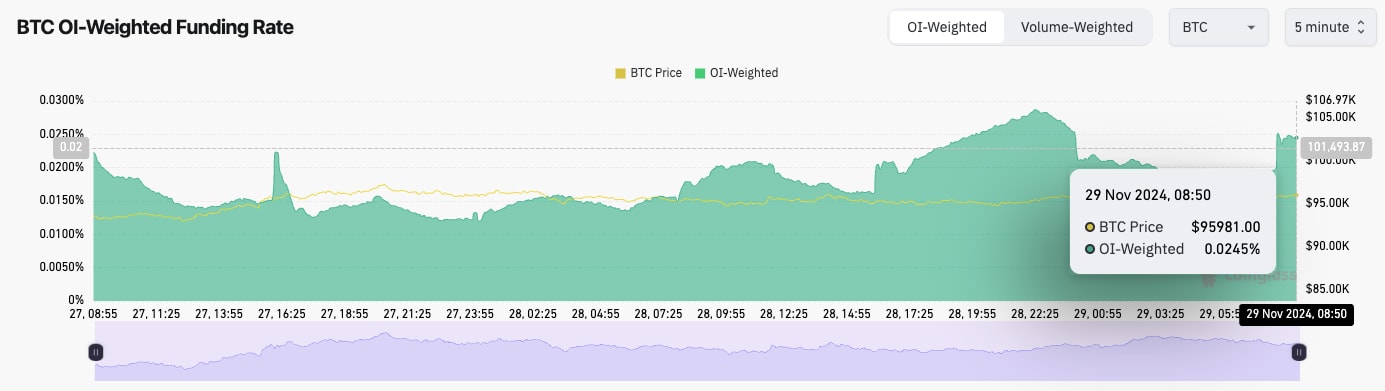

- BTC's Open Interest has kicked up from the lows, but only very slightly. Since the last week of December (OI highs), OI has reset by approximately 15%.

- BTC's Funding Rate has been fluctuating around neutral but it is gradually moving up to 0.01%.

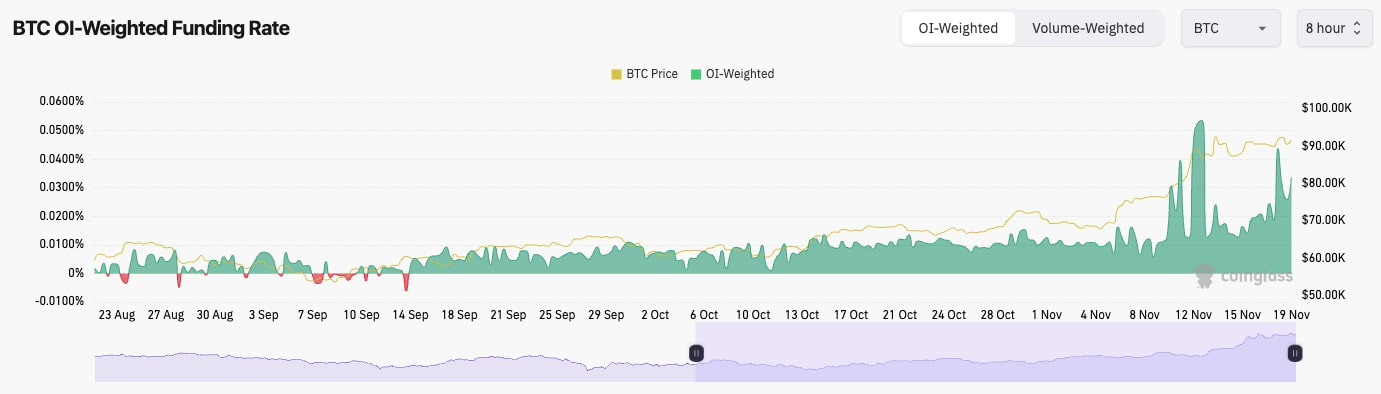

- Overall, this is a positive leverage environment and we have seen a flushing out of the froth that did exist towards the end of 2024.

Technical analysis

- BTC has found some support at the horizontal support of $95,700.

- Price is now attempting to put in a small bounce, with price moving into the horizontal resistance of $98,900.

- If $98,900 can be broken to the upside, then the next level of resistance to watch would be $101,500 to $102,300.

- The RSI is in the middle territory but it is now butting up into the underside of it's moving average.

- Next Support: $95600

- Next Resistance: $98,900 (then $102k)

- Direction: Neutral/Bullish

- Upside Target: $102,000

- Downside Target: $91,700

Cryptonary's take

It is still our expectation that BTC is in a downward trend to sideways chop for the upcoming weeks, and maybe months. We view the current move as a slight relief rally.This is less the case for BTC, but particularly the case for Alts and Memes. In order for us to consider changing our stance, we'd need to see a convincing break of $104k or to see a real rapid change in the macro, which we're currently not expecting. We still expect $87k to $91k to be retested in the coming weeks.

For the traders; if BTC reaches $102k to $104k, this may open the door for a trade opportunity. A Short. However, if the price reaches those levels, we'll reassess at the time also.

BTC eyes $102K but risks $91K retest

04 February 2025Bitcoin faces uncertainty after a 5% drop due to liquidations. BTC rejected $105K resistance, fell to $91.7K support, and now hovers near $99K. Traders remain cautious as funding rates fluctuate.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Open Interest has been downtrending since mid-December, and we've seen a further 5% decline over the last 48 hours due to the liquidation event on Sunday/Monday.

- Funding Rates have been choppy between slightly positive and slightly negative, indicating traders have been chopped up. We've seen Funding Rates go from negative to positive as the price has moved up (Shorts getting hit) and then the opposite on the way down (Longs being hit).

- Ultimately, there's indecision amongst traders in the current market, and we've seen the froth come out of the market over the last month.

Technical analysis

- BTC rejected from the $105k - $106k level (top of the range) as we expected.

- Price then collapsed below the horizontal supports of $98,900 and $95,700 on the Trump tariff news.

- Price found support at the major horizontal support at the bottom of the range at $91,700. This is a key area we have marked for the last few months.

- Price recovered nicely off the back of progress around deals with Canada and Mexico. It reclaimed $98,900, and the price is now using that horizontal level as new support.

- The RSI is in the middle territory, but it remains beneath its moving average.

- Next Support: $95,700

- Next Resistance: $102,000

- Direction: Bearish/Neutral

- Upside Target $102,000

- Downside Target: $91,700

Cryptonary's take

It's very positive that we've seen a capitulation event like we saw on Sunday/Monday, and BTC is at $99k and holding in the upper end of the major range (between $91k and $107k). In the short term, we wouldn't be surprised to see a return back to $102k. However, we are expecting more downside in the coming week or two, whether that be from $102k or from the current levels. We are expecting a retest of $95k, at least in the short term.BTC range-bound between $99K-$107K

31 January 2025Bitcoin remains in a tight range between $98,900 and $106,900, with a potential pullback in sight. Meanwhile, Alts are stabilizing, and some sectors are showing signs of strength. Let’s break down key levels and market trends.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

- We're seeing a lower BTC's Open Interest trend, which suggests there's less demand amongst traders to leverage it. This is positive but also expected when the market is in more choppy conditions.

- Funding Rates range from 0.00% to 0.01%, indicating there's an even balance between Longs and Shorts.

Technical analysis

- Next Support: $98,900

- Next Resistance: $106,900

- Direction: Bearish/Neutral

- Upside Target: $106,900

- Downside Target: $95,700

Cryptonary's take

Bitcoin currently ranges between $95,700 and $106,900. Whilst we're in this post-Trump inauguration period where too much good news was priced in (the market had overpriced against a realistic reality), it's possible now that we do see a pullback for BTC in the coming 1-2 weeks. It's possible BTC pulls back to $95,700 to say $98,900.We have highlighted this with a yellow arrow on the chart. We'll add two other things to this. Firstly, if BTC does pull back 5-10%, it doesn't necessarily mean Alts/memes will have another major pullback. Looking across the board, we feel most of the Alts/Memes have done the substantial portions of their pullbacks, but we also think they'll be range-bound for a while.

Secondly, in a range-bound market, it doesn't mean there won't be good pockets of outperformance. For example, $HYPE over the last 3-5 days has heavily outperformed.

Bitcoin stalls below $107,000 ahead of FOMC

28 January 2025Bitcoin remains range-bound between $98,900 support and $107,000 resistance, with traders awaiting a breakout. Institutional adoption strengthens BTC, but FOMC uncertainty keeps price action choppy. The market direction remains undecided.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Open Interest has continued its decline over the past few days, meaning that there's less of a leverage build-up.

- BTC's Funding Rate is at 0.01%, indicating there's an even balance between Longs and Shorts.

- Overall, this is a healthier leverage market, but that also doesn't mean that the rice has to go up because of it.

Technical analysis

- BTC rejected into the main horizontal resistance of $107,000. This was following the announcement of 'exploring a stockpile' and not a mention of a 'Strategic Bitcoin Reserve'.

- Price formed a bullish pennant but then broke down from that pennant off the back of the DeepSeek news yesterday.

- However, the price bounced strongly from the horizontal support of $98,900, and the downtrend line was used as support.

- Price is currently just choppy and range-bound between the horizontal support of $98,900 and the horizontal resistance of $107,000.

- The RSI is in the middle territory, and for now, the only negative here is that it's below its moving average. However, that isn't something we'd get too caught up with.

- Next Support: $98,900

- Next Resistance: $107,000

- Direction: Neutral

- Upside Target: $107,000

- Downside Target: $95,700

Cryptonary's take

Considering what Alts, Meme's, and TradFi markets have done over the last few days to a week, Bitcoin has held up really impressively. This is probably due to the fact there is this Institutional adoption happening, especially now that SAB21 has been overturned.But in the short-term, it's possible BTC price is still a tad ahead of its ski's post-Trump excitement. We're also going into an FOMC tomorrow, and the expectation is that Powell will continue in a hawkish tone.

Ultimately for now, we need to see BTC show us the direction, with either a breakout or a breakdown. There's an edge really in this choppy, range-bound price action, and in this situation, it's best to sit tight and let the market show you its hand first before you then act on that. We wouldn't be surprised if the price remained range-bound for more time as well.

$107K resistance challenges Bitcoin bulls

24 January 2025As Bitcoin ($BTC) clings to $100K support and tests $107K resistance, market participants await a decisive move. Let’s explore the latest analysis to uncover what’s next for BTC and the broader crypto market.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

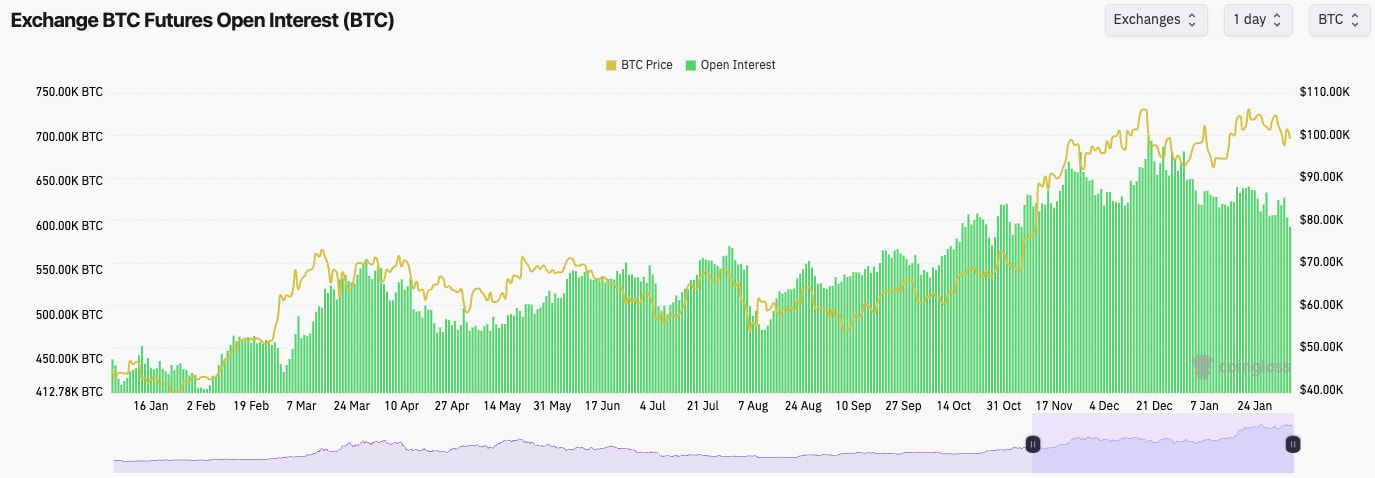

- BTC's Open Interest by number of coins has generally turned a tad lower over the last few days. We had a move-up in OI going into the inauguration, but that's tapered off slightly since.

- The Funding Rate is at 0.004%, indicating there is an even balance between Longs and Shorts currently.

Technical analysis

- Price has broken out of the downtrend line and is now range-bound between the horizontal support of $98,900 (and the psychological level of $100,000) and the horizontal resistance of approximately $107,000.

- We've also had a breakout of the downtrend line on the RSI, but that has also become range-bound whilst also putting in a bearish divergence (higher high in price, lower high on the oscillator). Although, it isn't in or close to overbought territory.

- The key support zone is between $98,900 and $100,000.

- $107k to $108k is the breakout zone to watch out for.

- Next Support: $100,000

- Next Resistance: $107,000

- Direction: Neutral

- Upside Target: $107,000

- Downside Target: $98,900

Cryptonary's take

It's been very tricky trading BTC this week with the market feeling weak at times, but also knowing that any positive pro-Crypto Executive Order could be dropped by Trump at any moment.We've seen a price rally on positive news, but it has had a decreasing effect as the week has gone on. The market had also pulled back when the news was released, and it essentially wasn't the Strategic Bitcoin Reserve. However, each time, the price has seemingly comfortably held the lows of $100k - $101k and bounced relatively swiftly.

Ultimately, this range will probably resolve itself soon. The market at times has felt weak, and the rallies into positive news have faded, which feels like a sign of exhaustion. But, on the other hand, the price comfortably held the lows when it pulled back.

BTC is very evenly balanced here, and direction is really difficult to call. We'd expect that when there is a breakout or a breakdown, it'll likely be a relatively big move in that direction. But calling the directions is super hard here.

Bitcoin eyes $108K resistance breakout

21 January 2025As BTC defends its $98.9k support, the crypto market looks to Bitcoin for direction. With key resistance at $108k, all eyes are on the next move in this dynamic landscape.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

- BTC's Open Interest has crept up slightly, but it still remains quite a way from the highs we saw in mid-December.

- The Funding Rate is at 0.01%. So it's flat, with an even balance between Longs and Shorts.

- This is a more healthy leverage environment. There aren't signs of froth, but there also remains good activity.

Technical analysis

- BTC has broken out of the downtrend line, and the price has rejected roughly into the prior price all-time highs.

- But, when the price pulled back to retest key levels, it bounced nicely off of the horizontal support of $98,900, the old horizontal resistance. Price has also used the psychological level of $100k as support.

- The major resistance to the price being cleared above is $108k.

- The local resistance is at $105k

- If the price were to break down below $98,900, there are quite a few supports in the $ 90k range. The first being at $95,700 and then $91,500.

- BTC has broken out of its downtrend on the RSI, and it has come back, retested it, and moved higher. Alongside this, it's also above its moving average. Positive.

- Next Support: $100,000

- Next Resistance: $108,000

- Direction: Neutral/Bullish

- Upside Target: $108,000 (then $112k)

- Downside Target: $98,900

Cryptonary's take

BTC looks very positive here, and considering Trump didn't mention it, now that we have seen any pro-Crypto Executive Orders (as of yet), BTC has done very well to hold up at the $103k area. For now, let BTC show you its next move, either a breakout of the highs or a breakdown. The rest of the market feels a tad flat, and BTC, holding at the price it's at, seems to be what's holding the rest of the market up for now.My (Tom) personal feeling is that I'm just not sure here. I feel like BTC can come down a bit, almost a sell the news now, and we're not sure where the next major catalyst is. But at the same time, we're expecting a positive year, and in the short term, Trump can issue an Executive Order, and everything turns around. Tricky spot here. Best off just being passive and seeing how this week and price action unfolds.

I'm not scared/worried here, so let's definitely clarify that. I'd just rather get some clarity before making my mind up on positioning. But overall, BTC has held up well, considering no Executive Orders have come (yet).

Next BTC resistance: $108,000

17 January 2025Bitcoin rallies past $102,600 resistance with spot-driven momentum, fueled by pro-crypto sentiment and easing inflation. Other assets like ETH, SOL, and POPCAT are holding critical levels.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Funding Rate has returned to 0.01%, indicating an even balance between Longs and Shorts.

- BTC's Open Interest has kicked up slightly from the lows in the last 24 hours, but not in any meaningful way. This indicates that the recent rally is more Spot-driven than leverage-driven. This is positive for the bulls.

Technical analysis

- BTC wicked into the $90k's and has bounced aggressively, breaking through a number of key horizontal resistances @ $95,700 and then $98,900.

- Price is now breaching the prior local high of $102,600.

- What's also positive is that the price has seemingly broken out of the local downtrend line. We need to see how today's Daily candle closes, but so far, it looks good.

- The RSI is also breaking out of the downtrend line and coming from a middle territory, still with some way to go before it becomes overbought.

- On the RSI though, we do have to be careful of any potential hidden bearish divergences (lower price highs, higher highs on the oscillator). We'll monitor this.

- Next Support: $102,000

- Next Resistance: $108,000

- Direction: Bullish

- Upside Target: $108,000

- Downside Target: $102,000

Cryptonary's take

Overall, it's a really solid move. Mostly, this has been driven by hype/positivity around Trump issuing pro-crypto Executive Orders on day 1. It's also been driven by the positive inflation print (less inflation than what the market expected) we saw on Wednesday, plus some dovish FED speak from Waller (granted, he's about as dovish as they get, so take it with a pinch of salt).It's possible the rally will continue into Monday, despite the price being at a local resistance of $102,600, but it has smashed through the other resistances so far. In my opinion (Tom's), Trump will likely have to over-deliver next week for this rally to really continue into a multi-week/multi-month rally into new price highs.

However, if Trump drops a load of overly positive (more than what the market currently expects) pro-Crypto Executive Orders, then it's possible we will see $108k early next week.

Ultimately, I think a lot of next month will depend on what Trump does next week. If he heavily over-delivers, that is what would invalidate my thesis for lower. However, the weaker inflation print on Wednesday has also helped me invalidate my prior thesis.

BTC's $91,500 support critical now

13 January 2024Bitcoin’s struggle between $91,500 and $95,700 has traders bracing for volatility. With shorts increasing and RSI weakening, will BTC test the $80k range next?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Funding Rate is at 0.005%, indicating there is some Short interest here.

- BTC's Open Interest is up 4% from the lows but still remains 10% off the highs. The recent 4% increase is likely more dominated by Shorts. However, it is not so dominant that the funding rate has gone negative.

- Positioning is still relatively even overall here.

Technical analysis

- Bitcoin is currently playing between the key range of $91,500 (support) and $95,700 (resistance).

- Beyond $95,700, the main horizontal resistance is $98,900.

- There is a zone of support below $91,500, with that extending down towards $90,000.

- If $90k is lost, it's possible that the price dips into the low $ 80k in the short term.

- The RSI is at 41, so it's a middle-ish territory, but it probably still has room to go down further, particularly as it is below its moving average and remains in a downtrend.

- Next Support: $91,500

- Next Resistance: $95,700

- Direction: Bearish

- Upside Target: $95,700

- Downside Target: $87,000

Cryptonary's take

So far today, the price has held the lows (in the $ 90k range) and actually responded positively. However, we'll need a strong amount of bidding to push BTC into the resistance of $95,700 and then beyond that. Whilst BTC remains between $91,500 and $95,700, we remain with the view that it's more likely we'll see a breakdown and for BTC to head into the $80k's in the short-term.A breakout above $95,700 would invalidate this. Today, we have the S&P and Nasdaq gaping down, so we might see a bid there as they close the gap, which could give BTC a bid. However, we expect them to reject after the gap has been filled, and that would also likely result in BTC going lower with them. We expect BTC to head into the low $ 80k in the short term (next 1- 2 weeks). No, we don't believe the inauguration is a buy-the-news event.

Bitcoin breaks $101K, heading toward $108K

6 January 2025Bitcoin ($BTC) gains momentum with a bullish setup, targeting $108k after breaking $98,900 support. Healthy consolidation signals further upside with strong ETF inflows and technical strength.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Open Interest is down to 570k BTC from the local high of 667k BTC. This approximate 15% drawdown in OI is good and healthy to see. It means that excess leverage has been flushed, and BTC sits at $101k... super strong.

- Funding Rates are also at normal levels of 0.01%; again, excess leverage has been flushed, which is good to see.

- Overall, this is a healthy setup from a leverage perspective.

Technical analysis

- BTC found support at $91,500, and it has broken out of the local downtrend line, sending prices higher.

- We've had a move higher into the local horizontal resistance at $98,900, and on the US open today, we've had a convincing break above. We'll now be looking for today's candle closure to be in this kind of area ($101k; anything north of $100k is good).

- Beyond $98,900, the main horizontal resistance is between $101,700 and $102,500. A break above this level, and you'd expect a swift retest of $108k.

- If we get a strong close today, we'll be looking at $98,900 to become new horizontal support.

- The RSI is above its moving average, and now it's retesting its downtrend line. A breakout from here is what likely pushes us to $108k again.

- The RSI is also not too close to being overbought yet. Room to go higher here.

- Next Support: $98,900

- Next Resistance: $102,500

- Direction: Bullish

- Upside Target: $108,000

- Downside Target: $95,500

Cryptonary's take

Overall, it was a really nice and clean move so far, exactly what we wanted to see going into the first few trading days of 2025 when the big boys have come back to their desks. Today, the US open drove prices higher, which again is a positive sign. We'll be looking to see strong ETF inflows today. In the short term, we expect BTC to continue to move up here. It's possible that $108k will be retested again in the coming 5-10 days.BTC eyes $98,900 target soon

31 December 2024Bitcoin ($BTC) holds $91k support while targeting $98,900 resistance. Healthy open interest pullback and spot demand drive positive momentum despite thin order books.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- Open Interest has pulled back from 660k coins to 606k coins over the last two weeks. An approximate 10% pullback in OI is healthy.

- Funding Rates remain flat at 0.01%, indicating that there isn't excessive gambling in the futures market, as would be reflected in very high Funding Rates.

Technical analysis

- Bitcoin has been in a local downtrend since mid-December, and its price is at an all-time high.

- So far, the price has found support in the high $91k's which was a prior all-time high resistance back in early November.

- We expect the low $ 90k to hold as support in the short term. But, if the price were to break lower, we'd expect $88k to be a major support.

- To the upside, BTC is moving into a local horizontal resistance at $95,700, although the price is currently attempting to push through.

- Beyond $95,700, there is the local downtrend line and the more major horizontal resistance of $98,900 that price would need to break through.

- The RSI is in the middle territory, although it is butting up against its moving average.

- Next Support: $91,000

- Next Resistance: $98,900

- Direction: Neutral (Bullish)

- Upside Target: $98,900

- Downside Target: $91,000

Cryptonary's take

What's important to note is that between Christmas and just after New Year, the order books are quite thin, so the price can move in a volatile fashion. Currently, there is an underlying Spot bid (today) which is driving the price higher, which is good to see.Bitcoin has looked really strong throughout the past month despite us seeing weakness in other sectors. Whilst it's possible that price remains range-bound between $91k and $96k, we are actually leaning more towards Bitcoin breaking out to the upside in the coming days.

This would have a potential target of $98,900, and we'd reassess price action around there once/if the move we're predicting happens.

BTC breakout could target $120K

16 December 2024Bitcoin’s fresh all-time highs face resistance, while SOL and WIF test key support levels. With markets awaiting FED signals, let’s explore the latest price moves and what's next.

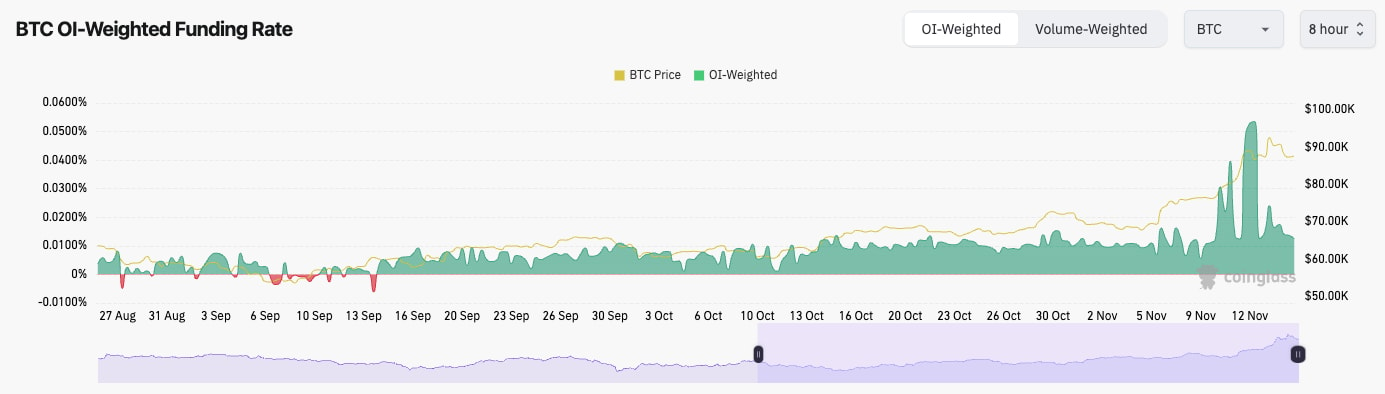

- BTC's Open Interest (by the number of coins) has increased again as the price has hit a new all-time high. However, OI still remains slightly below the highs prior to the leverage flush out.

- The Funding Rate has also remained positive but flat at just 0.01%.

- Overall, this is a positive setup from the mechanic's viewpoint, with BTC moving into all-time highs.

Technical analysis

- TA-wise, the BTC chart is quite awkward-looking here, with not many clear levels.

- BTC popped higher last night into a new price all-time high, but it has pulled back slightly today.

- Over the last two weeks, BTC has hammered out the $99,000 level as a new horizontal level, so we are now looking at that as a new horizontal support.

- The major zone of support is between $87,100 and $91,500; however, we're not confident that BTC will revisit those levels again. If it did revisit, we'd be buyers in that area.

- To the upside, yesterday's all-time high of $106,500 is the new horizontal resistance, and then you're looking at psychological levels, e.g., $100k, $120k, etc.

- The RSI is no longer overbought, but we have formed a bearish divergence again (a higher high in price and a lower high on the oscillator).

- Next Support: $98,950

- Next Resistance: $106,500

- Direction: Bullish/Neutral

- Upside Target: $115k (by Christmas)

- Downside Target: $95,700

Cryptonary's take

Overall, BTC does feel really strong with any meaningful dip being swiftly and aggressively bought up, and that's price action you have to pay attention to. Since breaking above $100k, BTC has had a number of pullbacks, and this has now formed a number of strong support areas, which we see as important for BTC to end up pushing up even further.In the immediate term, we're unsure of BTC's direction. We appreciate that BTC has been very strong, and we expect it to continue in this way. However, this week's price action might be determined by the FED Press Conference on Wednesday, although we are expecting a dovish Powell, who we think could reassure the markets on a further rate-cutting path in 2025.

BTC eyes $104,000 resistance soon

11 December 2024As BTC recovers from a major leverage flush and tests key support at $94,100, all eyes are on the FED meeting. Could this consolidation fuel the next breakout? Let’s explore BTC’s latest price action and outlook.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

- BTC's Open Interest has pulled back by 10% over the last week. This reset was needed.

- Funding rates have also returned to normalised levels (around 0.01%), having been at extremely elevated levels a week or so ago.

Technical analysis

- Quite messy price action and technical analysis here, to be honest.

- We had the deleveraging event for BTC last week, and since then, the price has recovered, having tried a run back to the highs but ultimately rejected.

- Locally, we now see $94,100 to $95,700 as a new local support zone.

- The main horizontal resistance remains at an all-time high at $104,000. However, there is now also a local resistance at $101,500.

- The last week of price action has seen the RSI meaningfully reset, and it is now not very close to overbought territory.

- Next Support: $200

- Next Resistance: $250 - $260

- Direction: Neutral

- Upside Target: $300 (then $330)

- Downside Target: $200

Cryptonary's take