Ethereum (ETH) Price Prediction

Ethereum ($ETH) has been a game-changer in the crypto space, surging from just a few dollars to an all-time high of $4,878. Its volatility presents both opportunities and challenges, making price predictions crucial for investors.

We at Cryptonary provide you with the most accurate price prediction for all sorts of coins, including Ethereum. You can also request an on-demand ETH price prediction by joining our Discord Community.

Our Price Prediction Model

Unlike others, we don’t rely on automated methods because there’s a higher chance of getting a wrong prediction. There are many factors to consider when accurately predicting a cryptocurrency’s price.That’s why our team of Cryptonary analysts carefully research each cryptocurrency and give you a detailed price prediction using technical analysis to help you make the most profit. This prediction is based on a technical analysis of the coin rather than just general sentiment. We also offer various things like:

- Market Updates: Done a few times per week based on macro indicators.

- Market Directions: Provides details on current market conditions and patterns.

- On-Demand Analysis: Offer analysis of a coin according to your request.

With that said, here’s our Ethereum price prediction.

ETH stuck between $2,420–$2,720

16 June 2025Ethereum remains range-bound after a Middle East-driven selloff. Support held at $2,420, but with BTC leading sentiment, ETH’s next move may depend on broader momentum.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

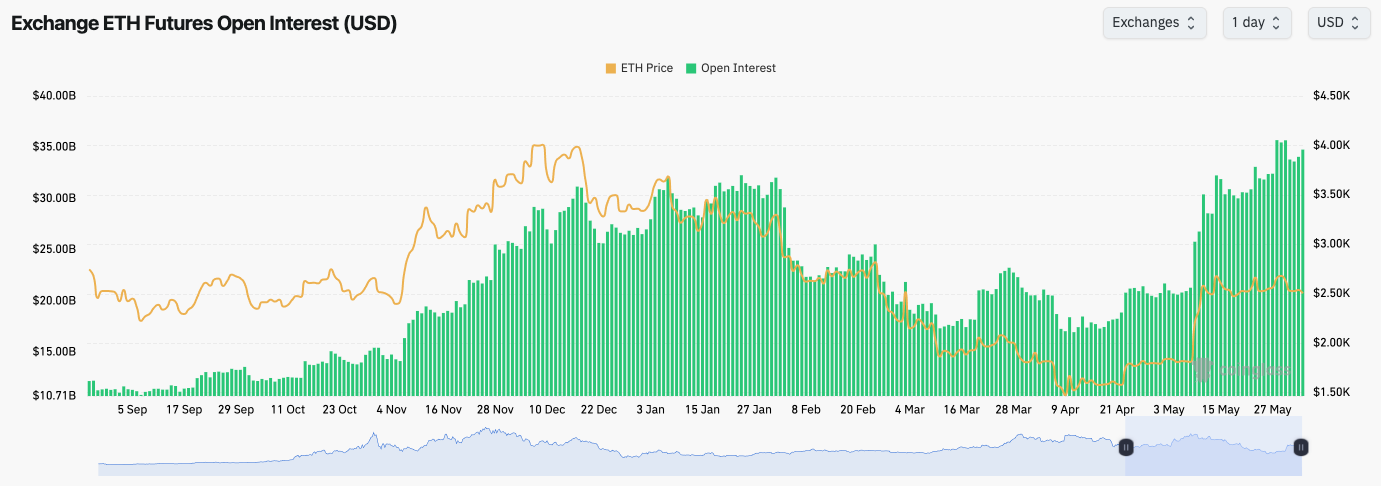

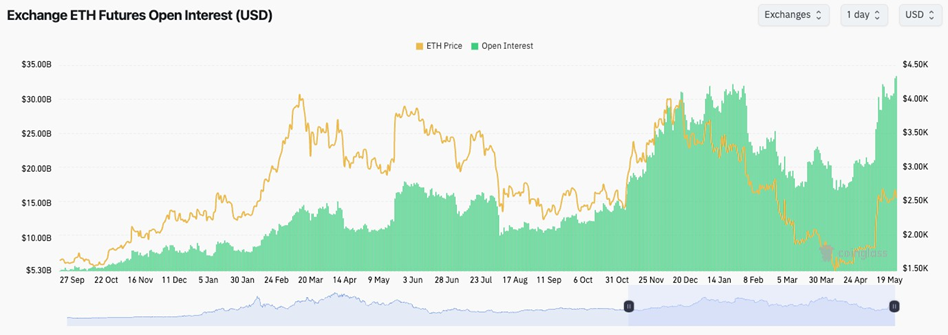

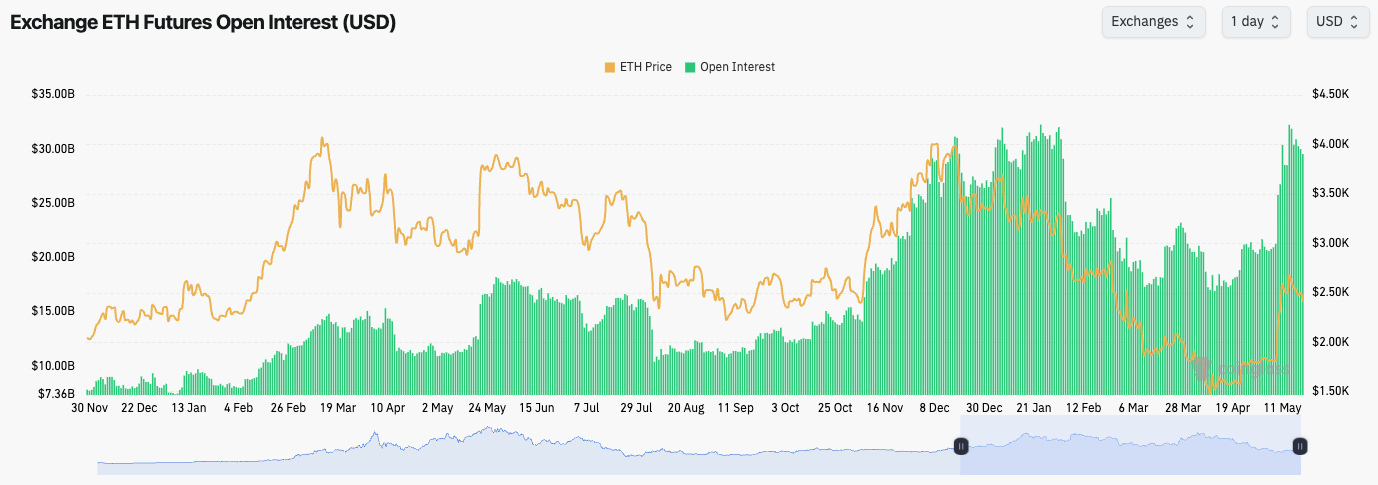

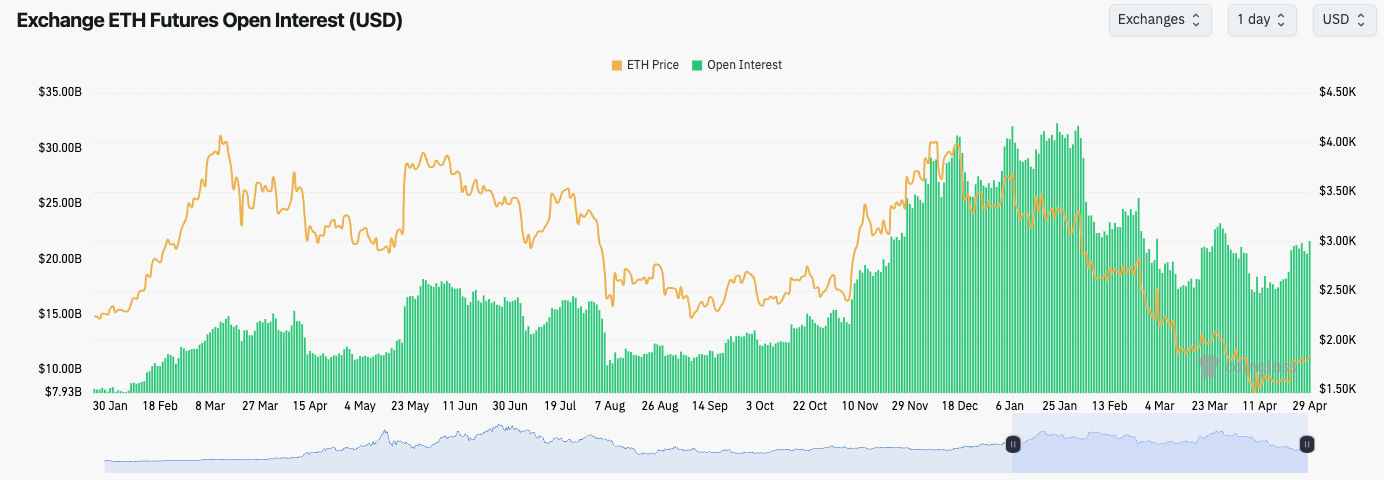

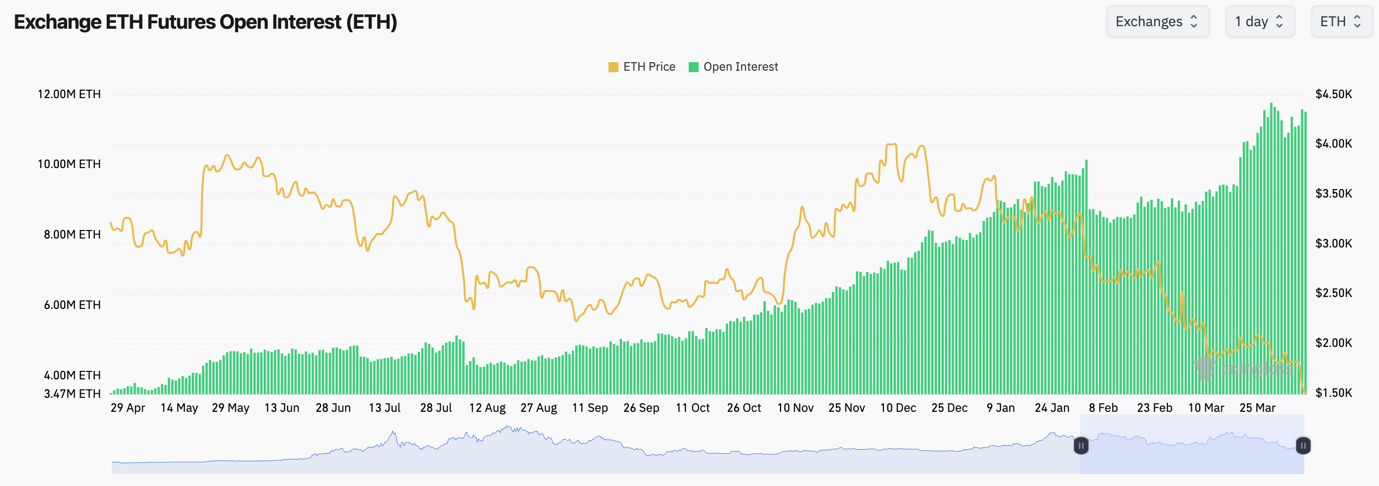

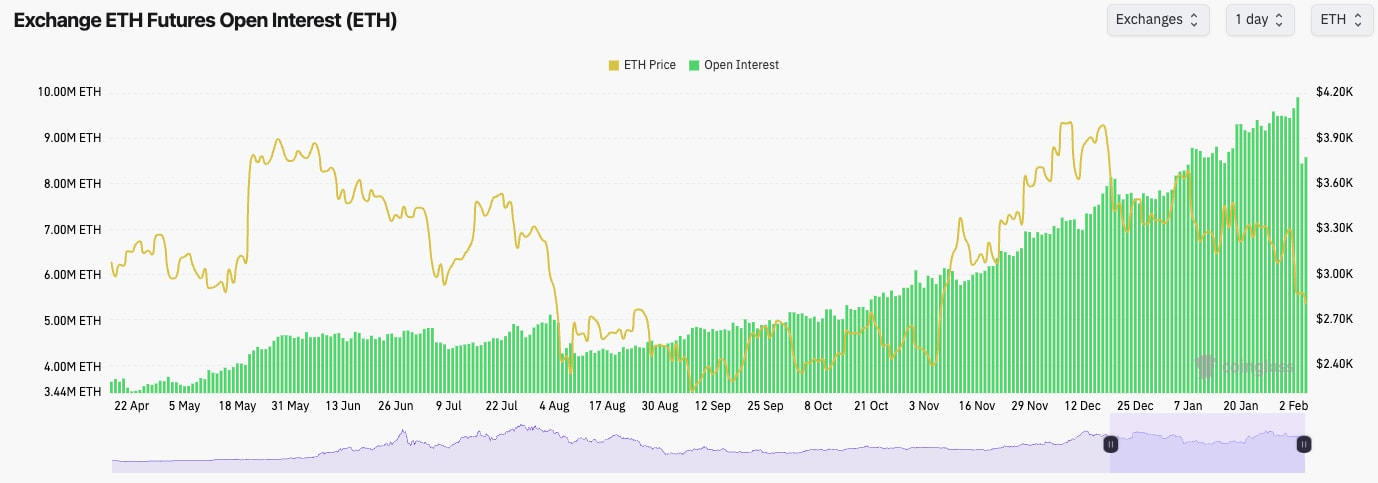

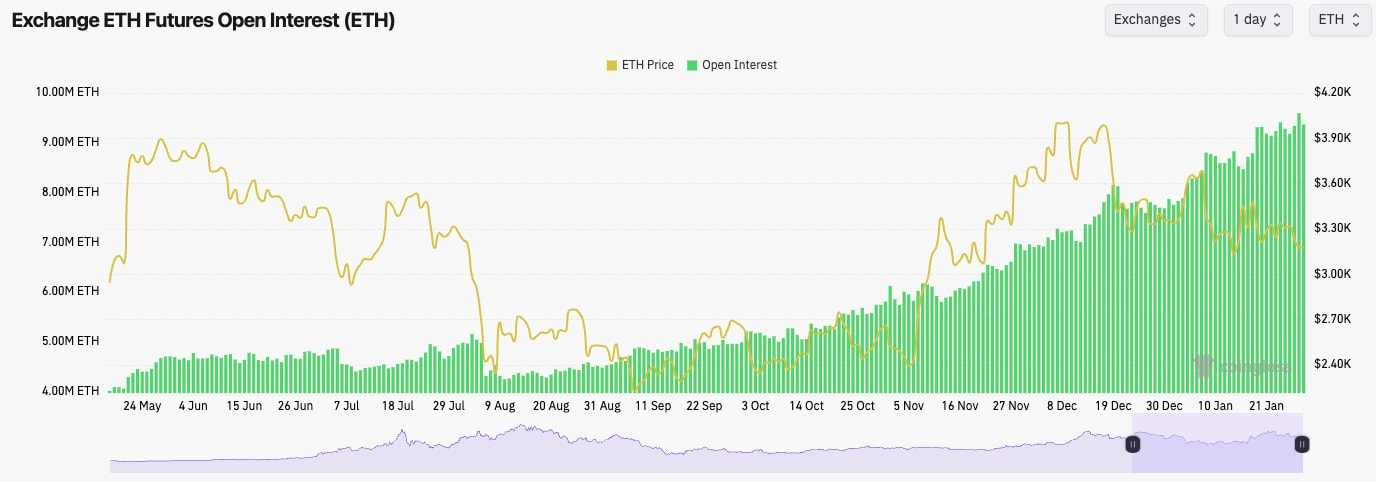

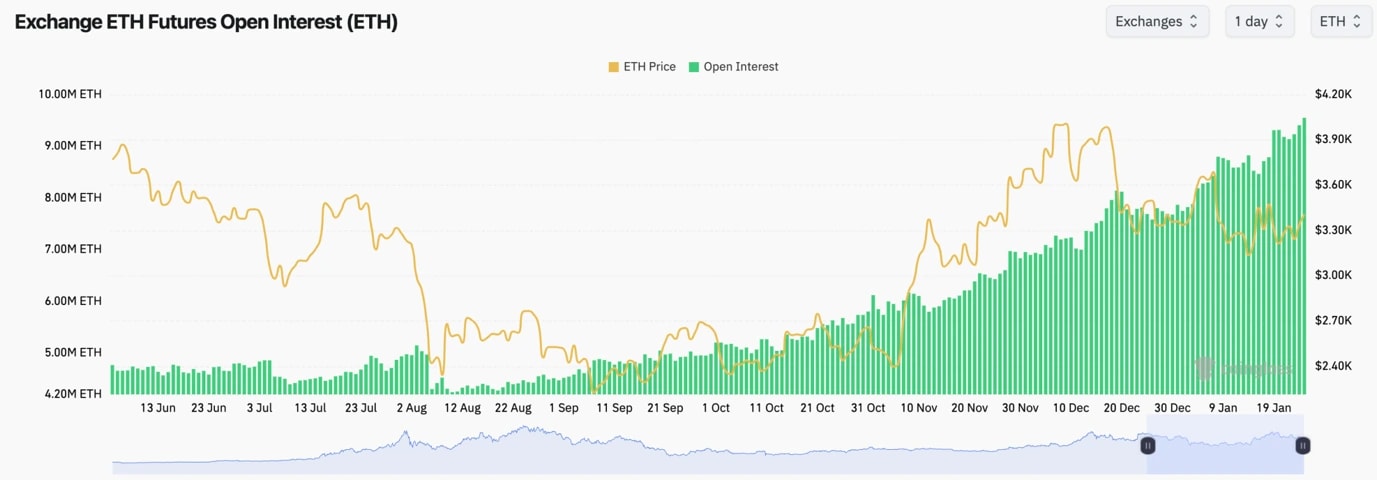

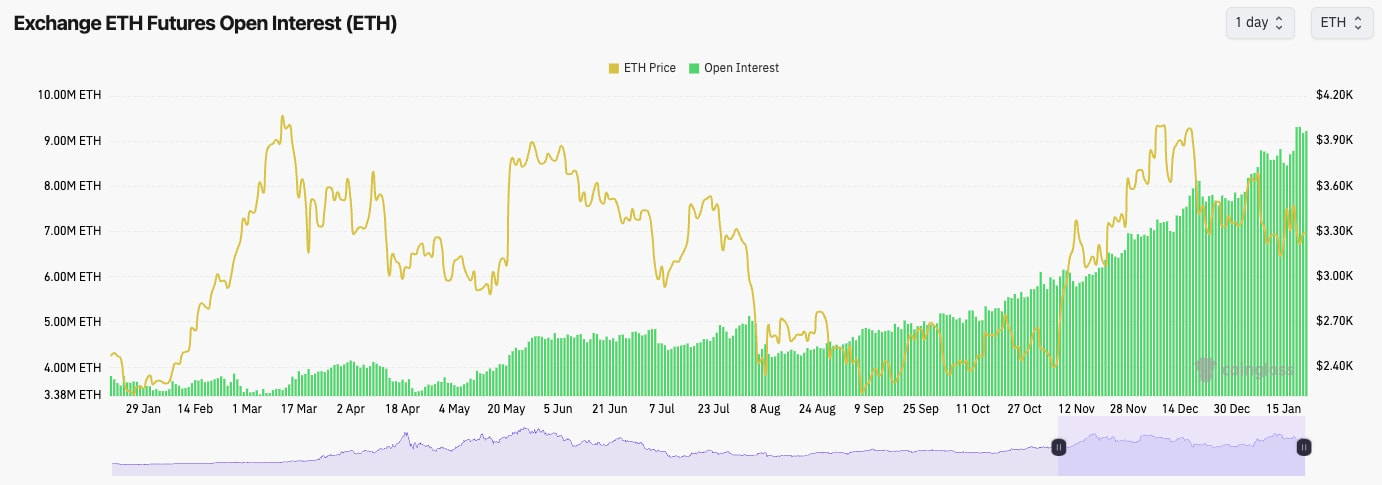

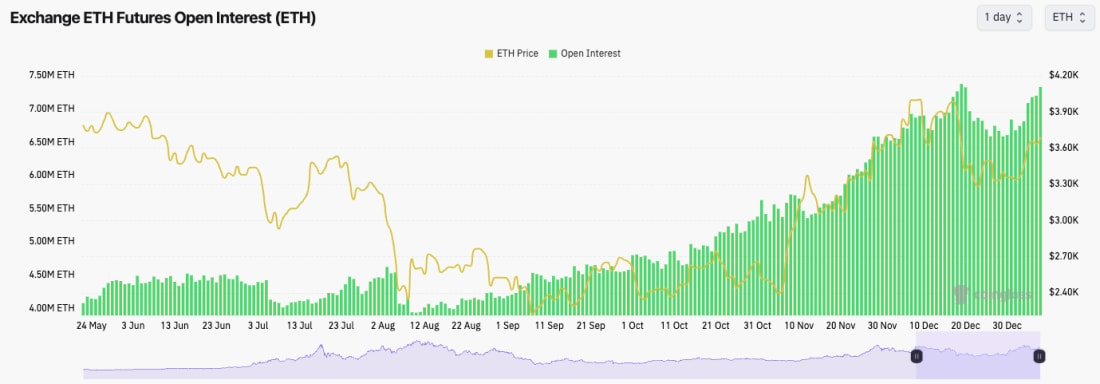

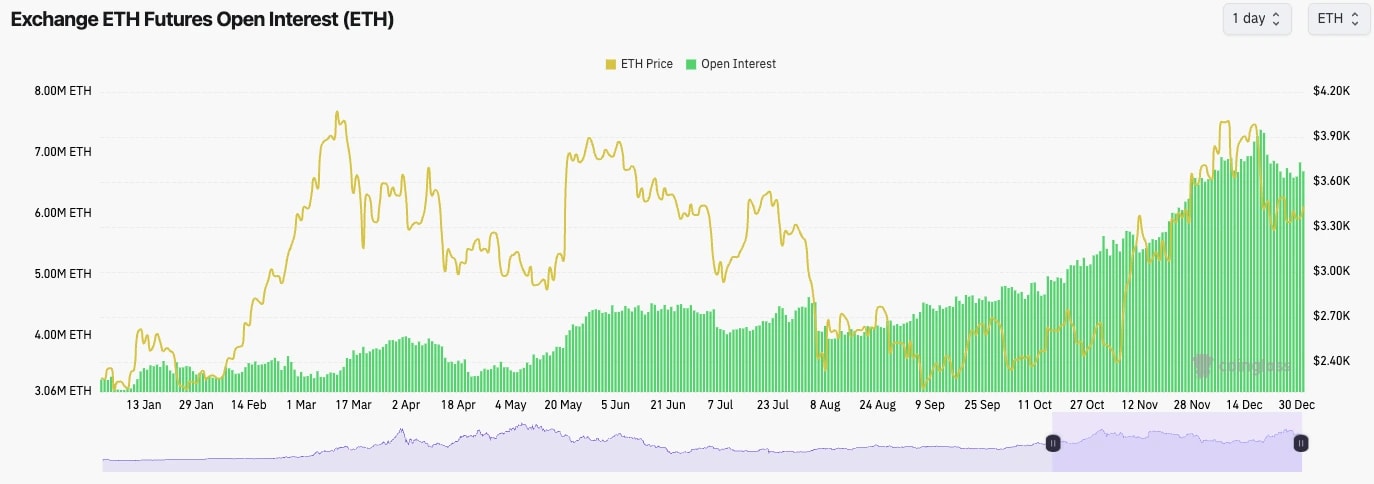

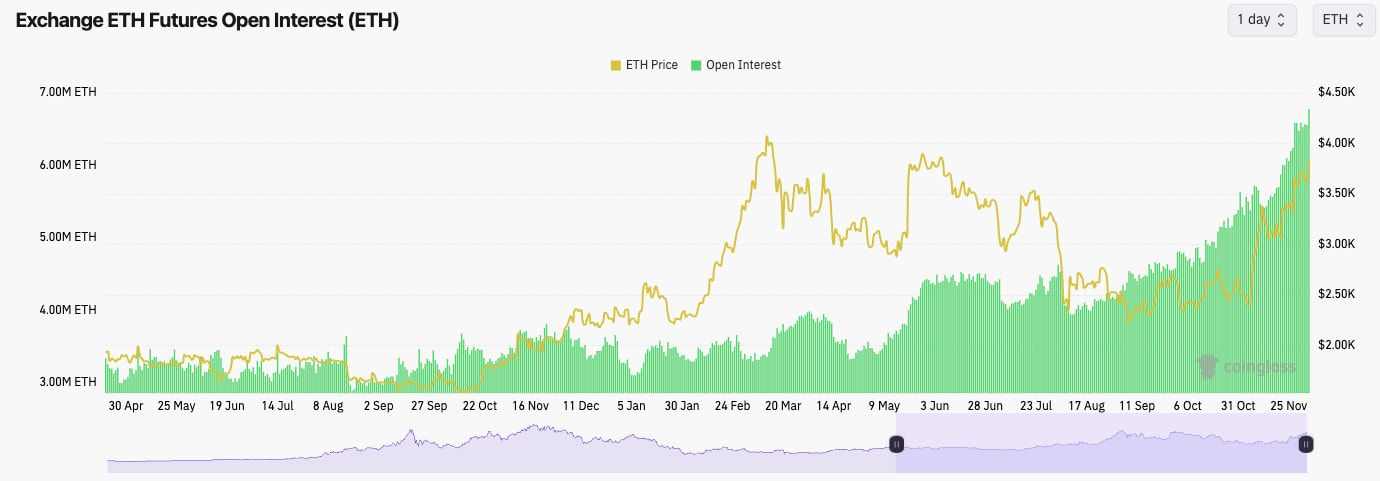

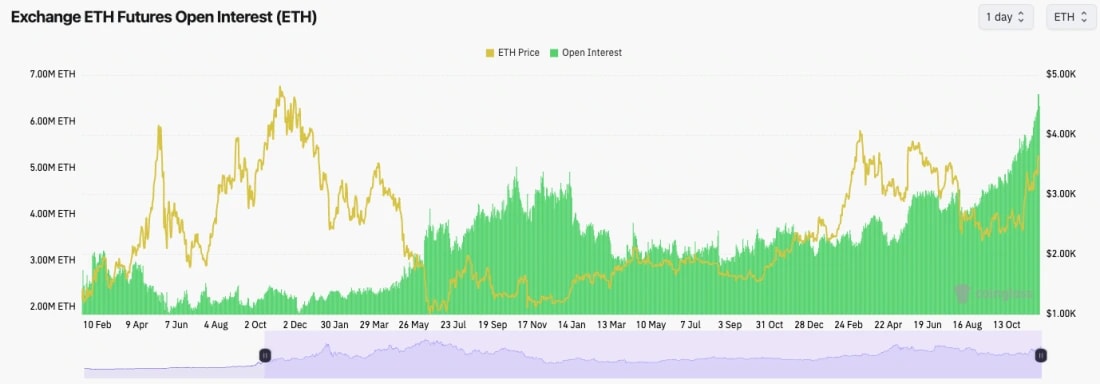

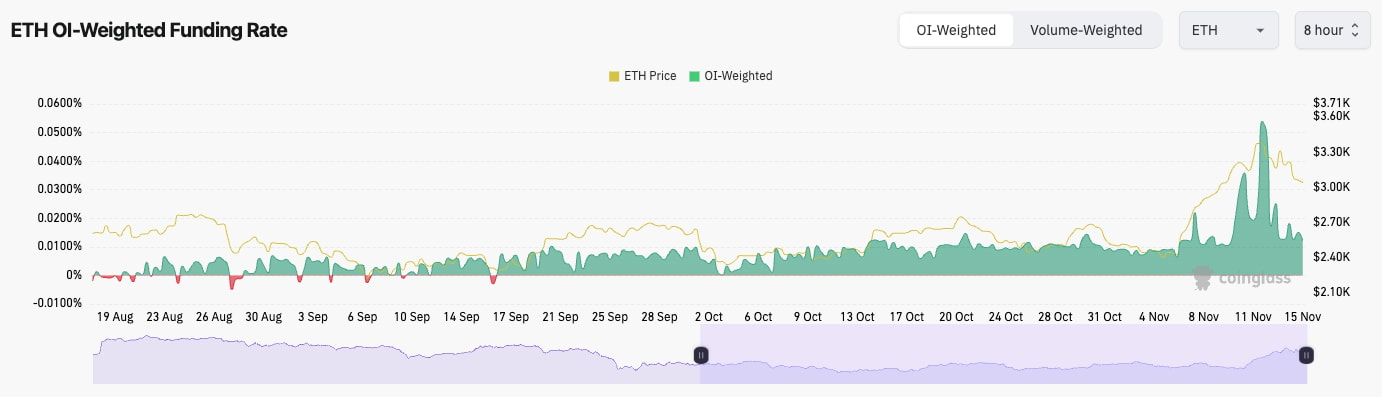

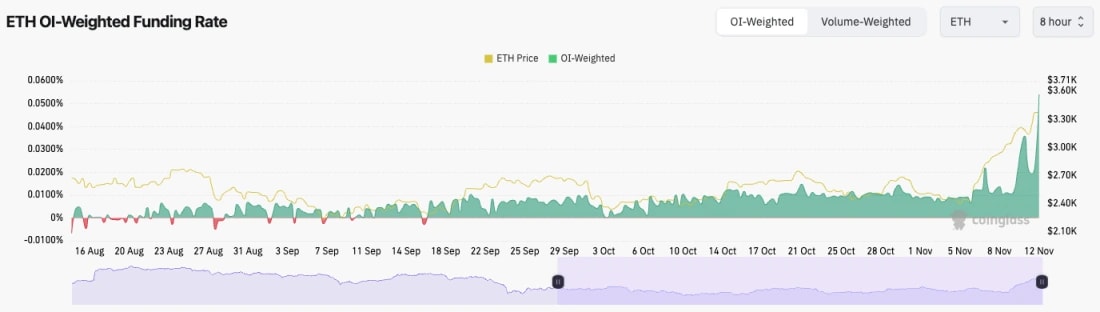

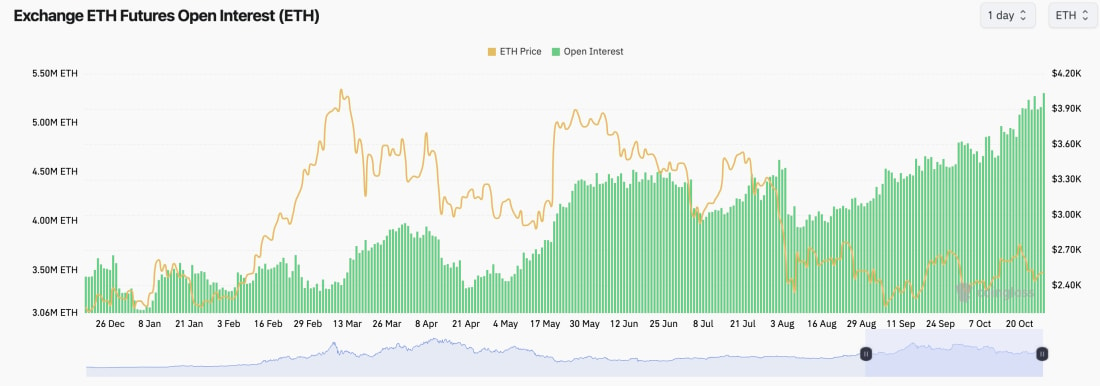

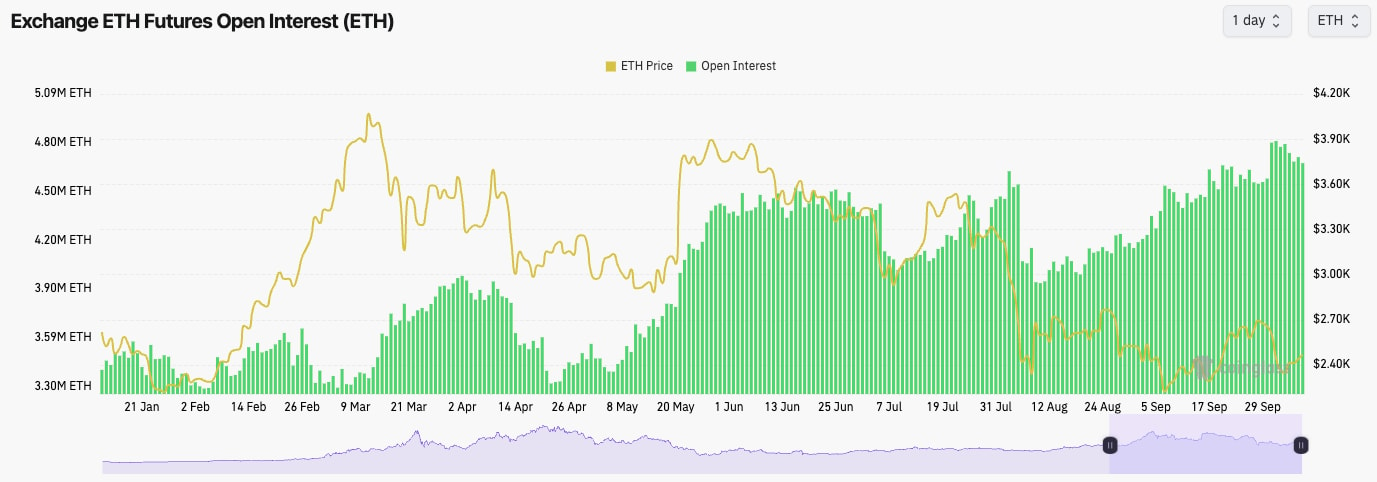

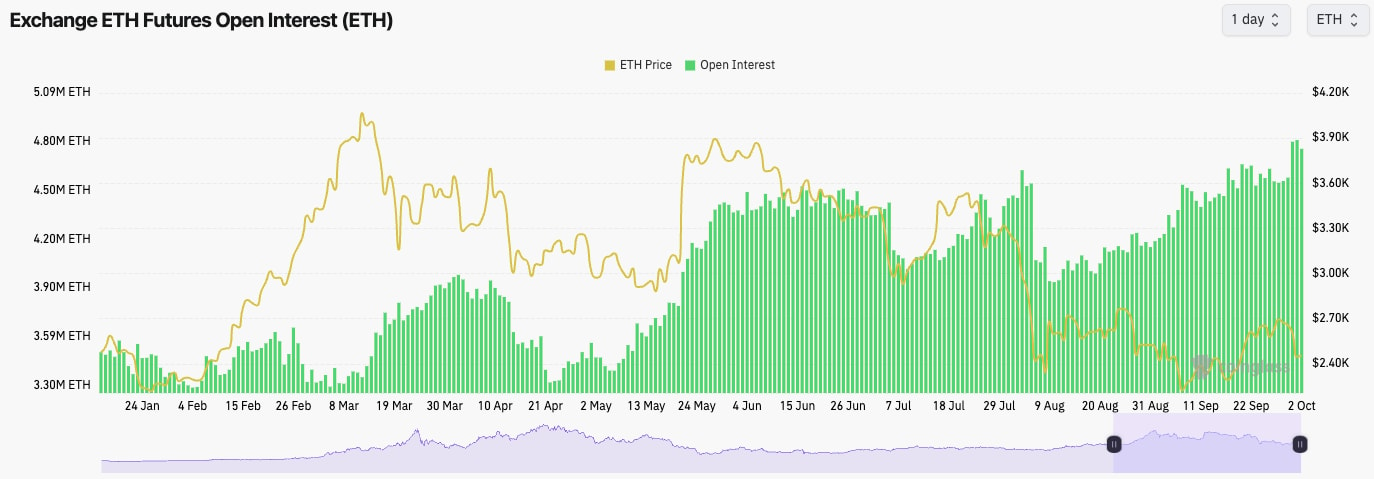

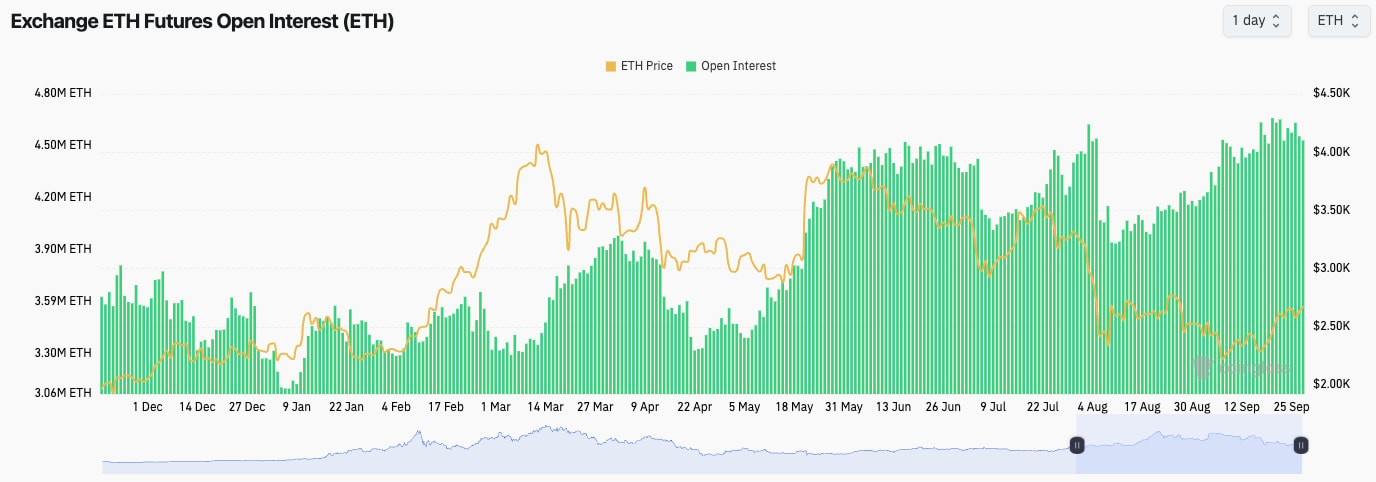

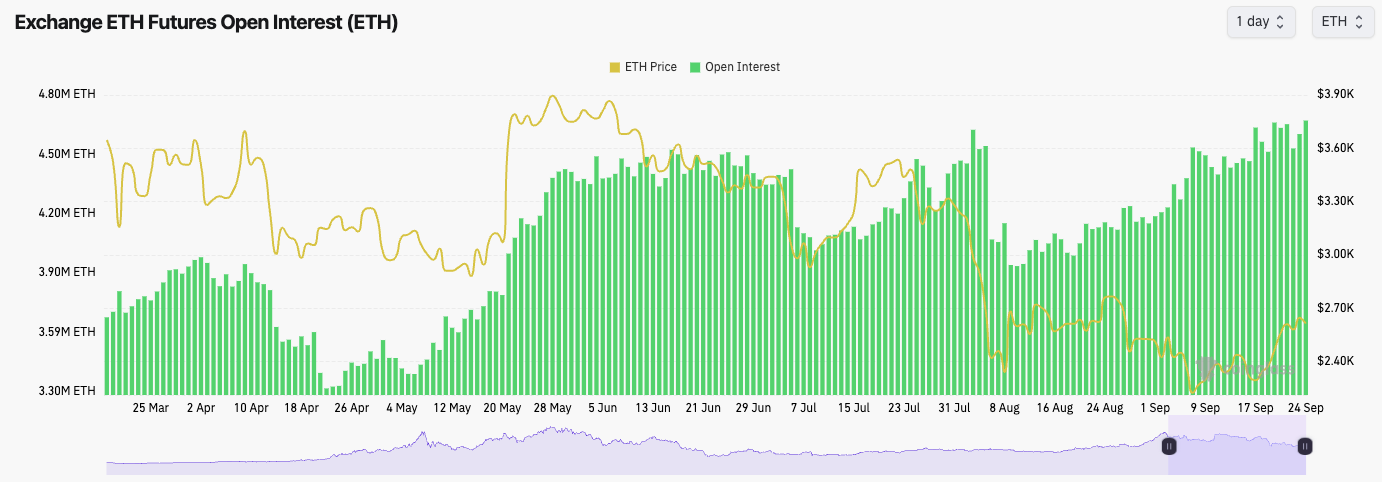

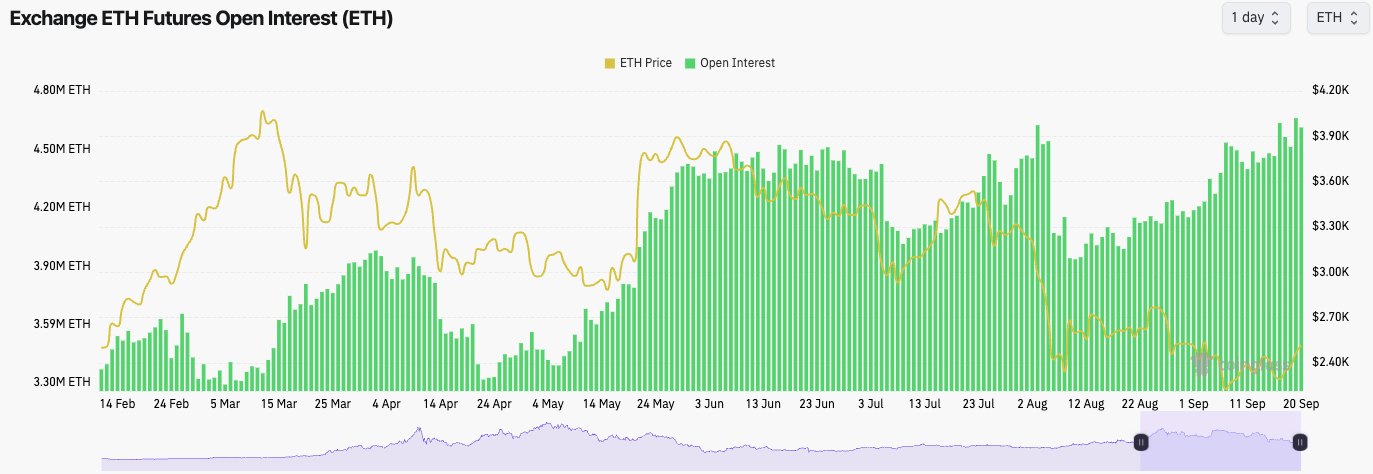

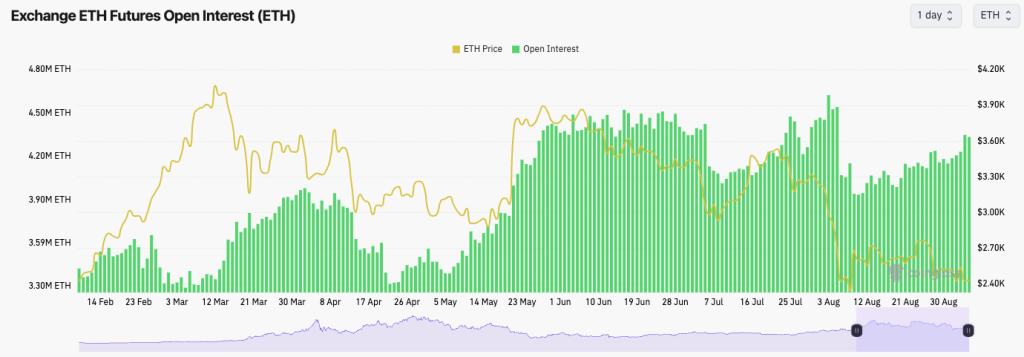

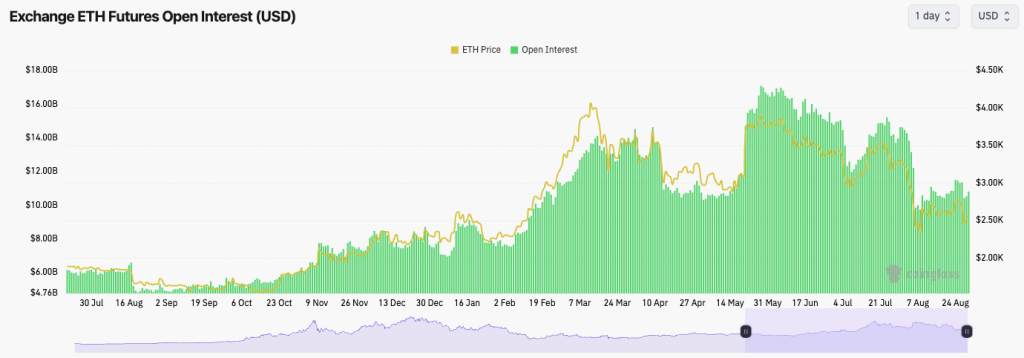

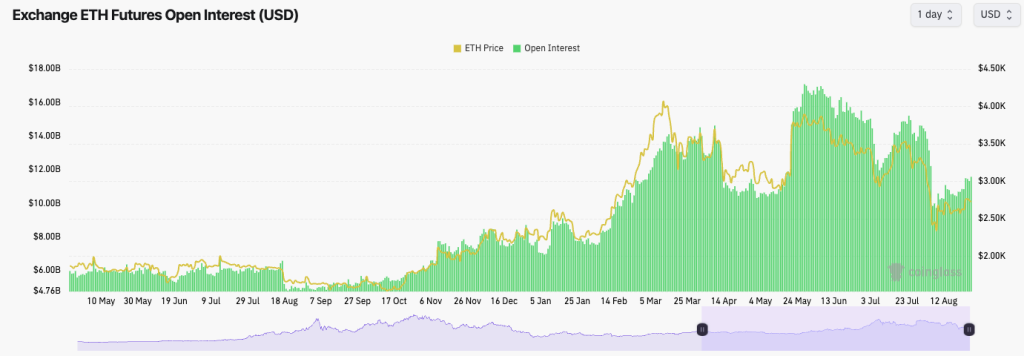

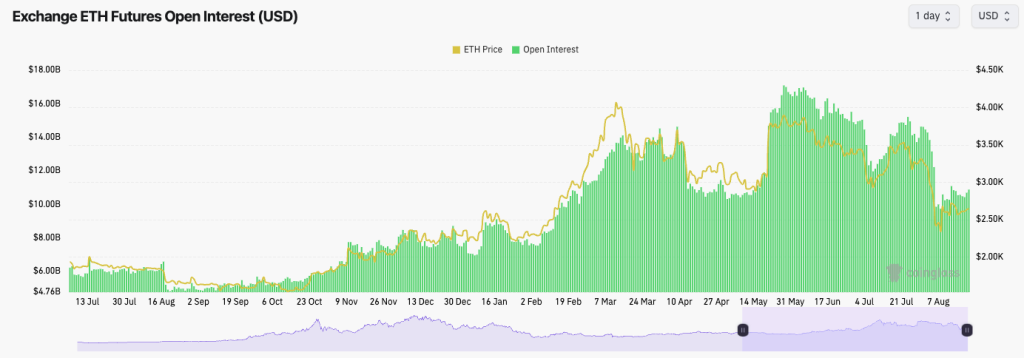

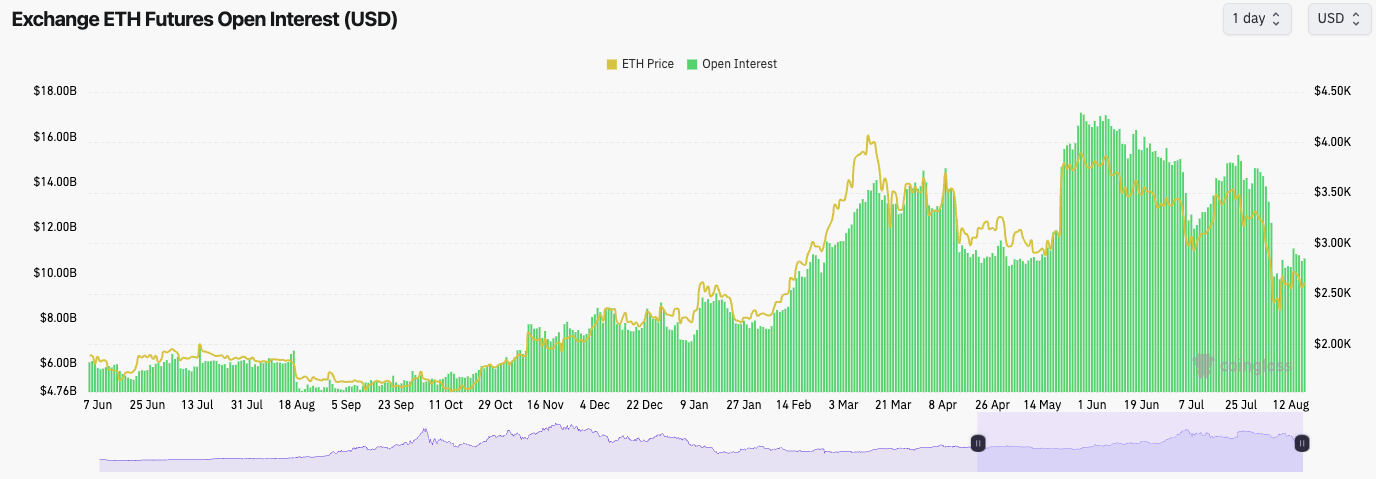

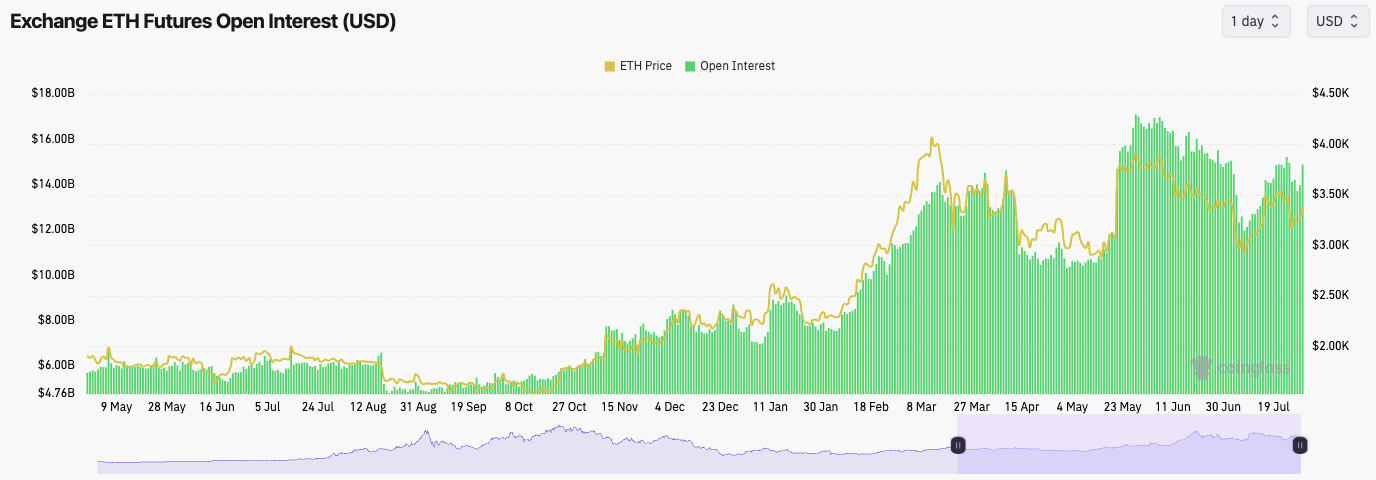

- ETH's Open Interest remains very elevated despite seeing a small flush out over the weekend on escalating tensions in the Middle East.

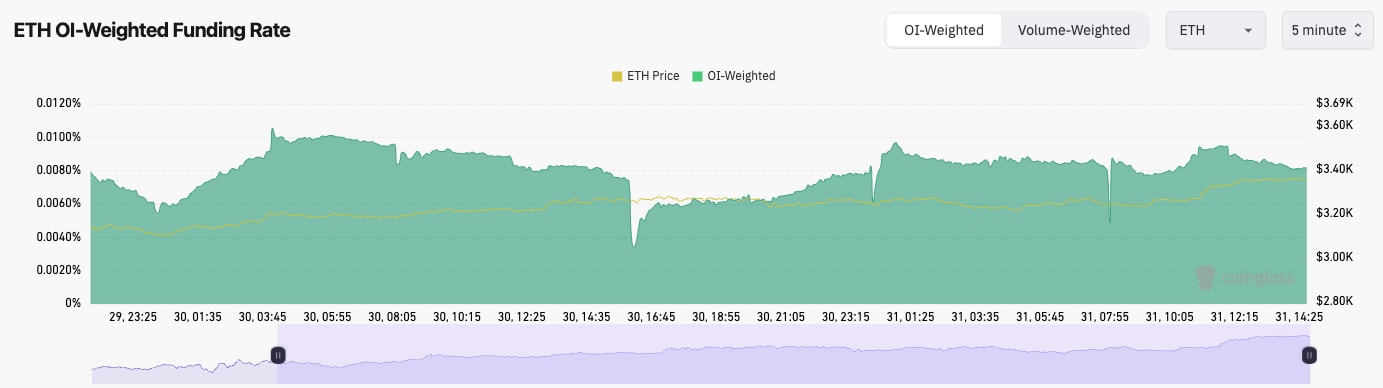

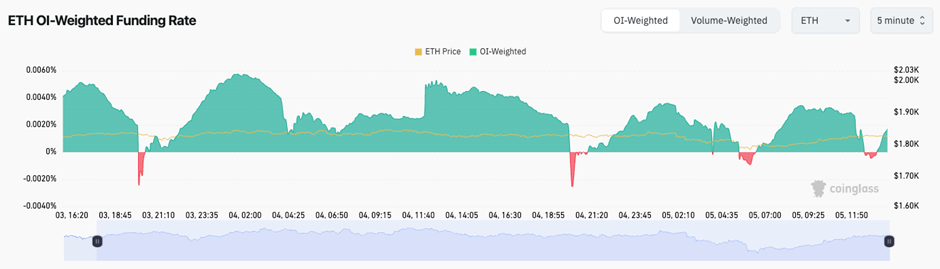

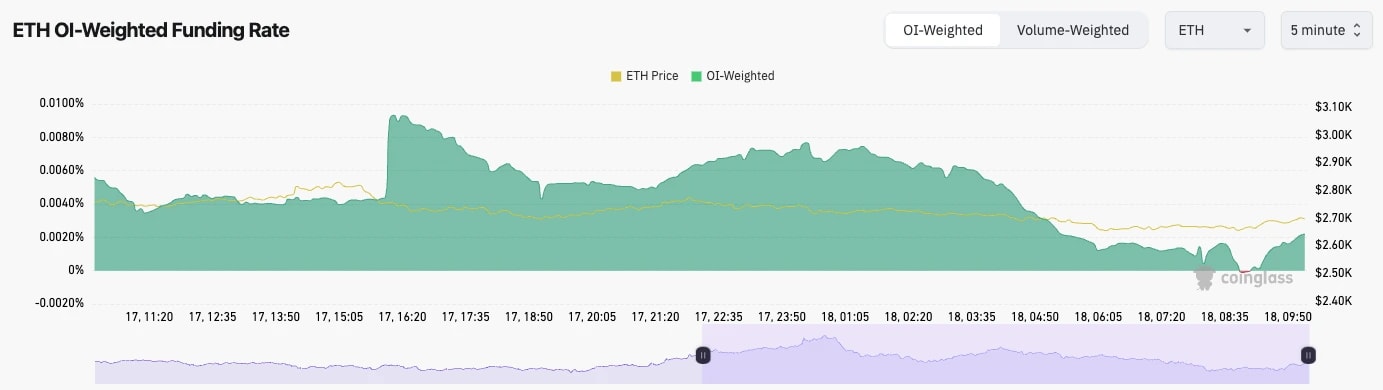

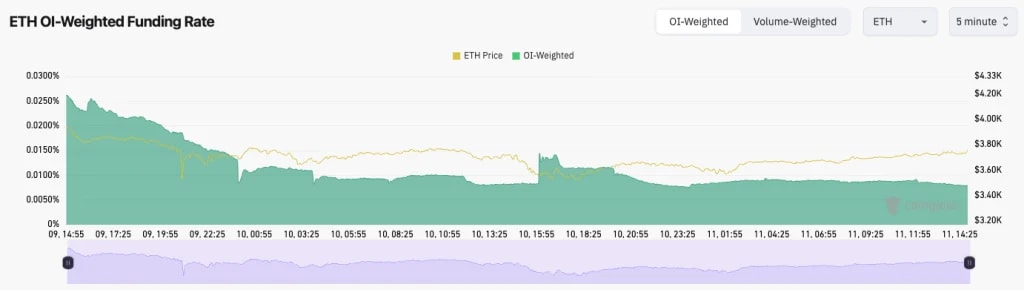

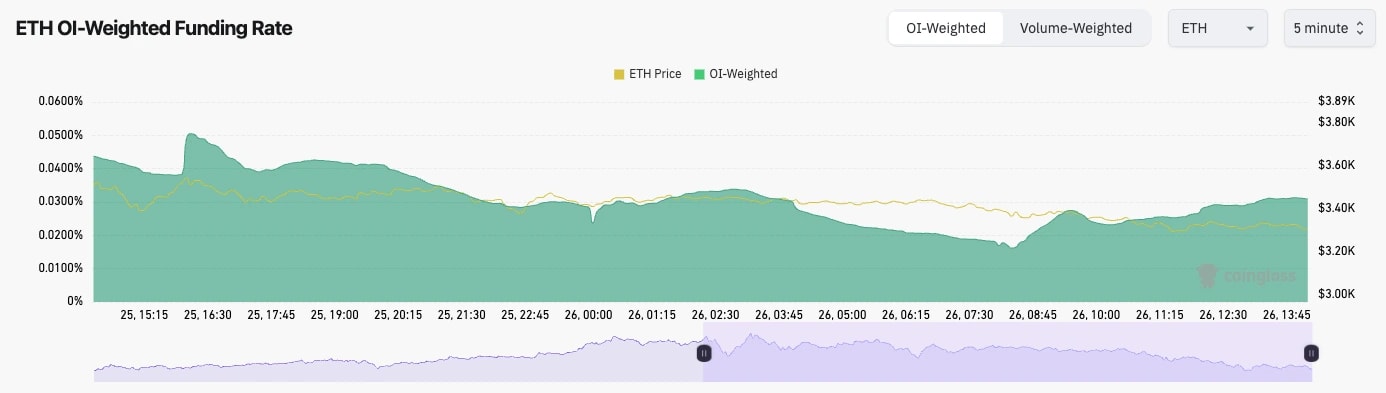

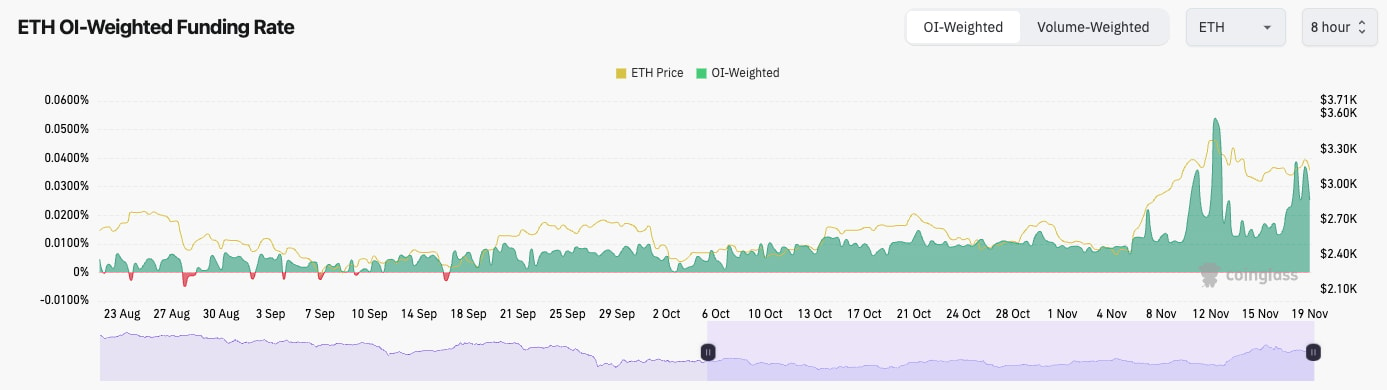

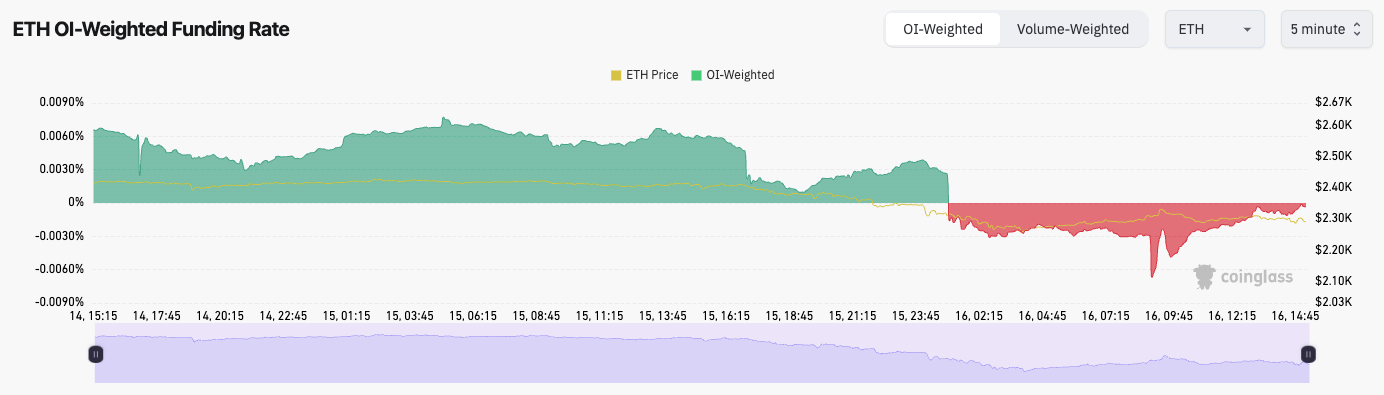

- ETH's Funding Rate remains positive and stable at 0.01%, indicating there is a healthy bias to be Long amongst traders.

Technical analysis

- War escalations in the Middle East resulted in ETH falling below its key horizontal level of $2,720, and the price returned to its old range of $2,420 to $2,720.

- Price has found support at $2,420, and it's now bounced back to the middle of the range.

- $2,420 is the main horizontal support, with $2,160 the major level below that. To the upside, the key horizontal level is $2,720.

- The RSI has meaningfully reset, and it has retested its downtrend line breakout as new support. However, it is below its moving average for now.

- Next Support: $2,420

- Next Resistance: $2,720

- Direction: Neutral

- Upside Target: $2,720

- Downside Target: $2,420

Cryptonary's take

ETH is essentially back into its range between $2,420 and $2,720, and to be honest, it's neither too bullish nor bearish here. A move higher (and a breakout) is likely now going to be led by other Majors (BTC or SOL), rather than being ETH-led like it was last week. For now, our expectation is that ETH will remain range-bound over the coming days/week, but the price may push into the resistance at $2,720. From there, we'll have to watch to see if price action is strong enough to break out.Ethereum caught in tight range with risks

06 June 2025ETH continues to consolidate between two major levels. While structure remains intact, traders are watching closely for a decisive breakout—or breakdown—driven by broader market stability.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

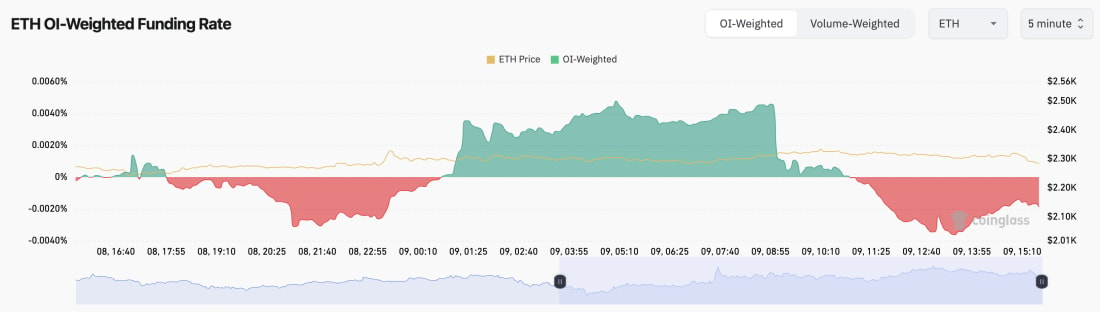

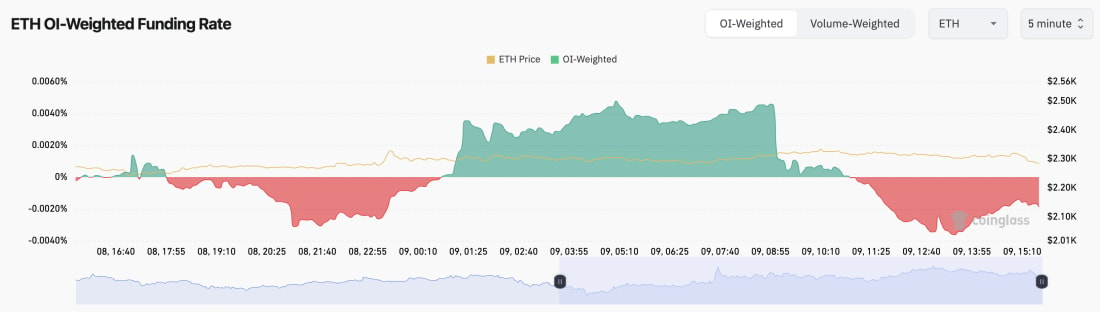

- ETH's Open Interest remains at phenomenally high levels whilst Funding Rates remain flat (0.00%).

- This suggests that there is a relatively even balance between Longs and Shorts.

Technical analysis

- ETH has initially rejected into the local resistance at $2,720, although price has found support at the main horizontal support of $2,420.

- ETH remains range bound between $2,420 and $2,720.

- If price breaks below $2,420, the next major horizontal support sits at $2,160.

- If price can move back towards the highs and breakout of $2,720, the next upside resistance level is $3,050.

- As price has consolidated between $2,420 and $2,720, this has given time for the RSI to reset and pullback to middle territory, being neither overbought nor oversold. This is healthy to see.

- Next Support: $2,420

- Next Resistance: $2,720

- Direction: Neutral/Bullish

- Upside Target: $2,720

- Downside Target: $2,160

Cryptonary's take

ETH's chart looks drastically better than the other Majors, as ETH has managed to hold its structure with the $2,420 horizontal support remaining intact. It's important that the $2,420 level continues to hold, and if the rest of the market can hold up at current levels, even for just a few days to a week, then ETH can potentially run back to $2,720 in this time. In terms of breaking out beyond that, we'd likely have to see the general market hold current levels.For now, we're not looking to trade ETH, although we may look to pick up longer-term Spot bags should ETH break down and retest the main horizontal support at $2,160.

ETH stability tested at $2,420 floor

02 June 2025ETH remains range-bound between $2,420 and $2,720 with high Open Interest. While BTC and SOL falter, ETH’s structure looks healthier—if $2,420 holds, bulls may get another shot.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest still remains incredibly high, and it's increased as price has remained range-bound.

- ETH's Funding Rate has pulled back from 0.01%, but it's still positive, which suggests that there is a relatively even balance between Longs and Shorts.

Technical analysis

- Price has broken into the upper bound of the range at the $2,720 horizontal resistance.

- Price has been range-bound over the last few weeks between the horizontal support at $2,420 and the horizontal resistance at $2,720.

- Price is now at the horizontal support (of $2,420) with the RSI having meaningfully reset back to neutral territory, which is healthy to see.

- If $2,720 can be broken to the upside, then $3,050 is the next major horizontal resistance.

- If $2,420 (the horizontal support) is lost, then $2,160 is the next level on the cards.

- Next Support: $2,420

- Next Resistance: $2,720

- Direction: Neutral

- Upside Target: $2,720

- Downside Target: $2,160

Cryptonary's take

We've had a monster rally across the board on all assets, so it wouldn't be bad to see a slight pullback or a period of consolidation, which is what we expect to see over the coming 1-2 weeks.BTC and SOL have both broken below their main uptrend lines, and they're balancing on key supports. ETH, on the other hand, is holding a key range, and granted it is at its main support of $2,420, but from a charting perspective, it does look better than the other Majors - if you're going to bet on upside. But as we said, we are expecting 1-2 weeks of pullback or chop, and therefore it might be hard for ETH to rally strongly in that environment. For now, we're watching the key level of $2,420 for ETH. We may consider longer-term Spot positions for ETH should it revisit $2,160.

Ethereum prepares for breakout as RSI resets

27 May 2025ETH has consolidated above a key support zone with increasing long interest and a resetting RSI, setting the stage for a possible breakout toward higher resistance levels.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest has increased to new highs whilst the Funding Rate is meaningfully positive. This suggests that most of the build-up in new OI is Longs.

Technical analysis

- Following its breakout, ETH has remained range-bound between $2,420 (the horizontal support) and $2,720 (the local resistance).

- ETH's RSI has reset during this period of consolidation above a key horizontal support ($2,420), and it now looks ready to breach back above $2,720 and target $3,050.

- If ETH can break out of $2,720, then $3,050 is the next horizontal resistance.

- To the downside, if ETH were to lose $2,420, then the next major horizontal support is $2,160.

- Next Support: $2,420

- Next Resistance: $2,720

- Direction: Bullish

- Upside Target: $3,050

- Downside Target: $2,160

Cryptonary's take

ETH has held and consolidated above a key technical level - the $2,420 horizontal support. During this period of consolidation, the RSI has also reset slightly, although it does remain below its moving average.Our expectation is that ETH's next major move will be a breakout to the upside, with a breakout of $2,720, seeing ETH potentially push onto $3,050. Our view would be invalidated with a breakdown below $2,420.

Ethereum faces pressure near $2,420 support

23 May 2025Ethereum’s sharp rally has stalled at $2,720 as momentum cools and RSI rolls over. Open interest remains elevated, hinting at heavy leverage. A drop to $2,160 remains possible if $2,420 breaks.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Funding Rate is positive but more muted than BTC and SOL's.

- ETH's Open Interest remains at very elevated levels, meaning that there is a large leverage buildup, although from Funding, we can tell that the positioning is relatively even.

Technical analysis

- ETH's price has fluctuated between the local horizontal resistance at $2,720 and the major horizontal support at $2,420.

- If price loses the $2,420 level, then the next major support is at $2,160.

- To the upside, if $2,720 can be overcome, then $3,050 is the next major horizontal resistance.

- The RSI was in overbought territory, although it has now pulled back slightly. However, the moving average is in overbought territory, and it is now beginning to roll over.

Cryptonary's take

ETH has had a big and quick move up; however, momentum now looks as if it's stalling with the RSI rolling over and price being unable to break out above $2,720. If the price loses$2,420, then we'd expect a revisit of $2,160. If price revisits $2,160, we'll assess at the time if we add to ETH at those levels. It'll likely depend on how deep of a pullback BTC goes through in this same scenario. For now, though, we're remaining patient, and we're not looking to accumulate any ETH here as we're expecting the price to pull here over the coming 1-2 weeks.

- Next Support: $2,520

- Next Resistance: $2,720

- Direction: Neutral/Bearish

- Upside Target: $2,720

- Downside Target: $2160

ETH's bounce looks fake — $2.16K target?

19 May 2025- ETH's Funding Rate remains positive, but at a healthy level,

- ETH's Open Interest has increased dramatically on this price rebound. This is likely large players scaling into Shorts.

Technical analysis

- The positive development was ETH reclaiming back above $2,420, and the price began to use that level as horizontal support.

- However, price has since retested below that level, and it's now battling to maintain above it.

- To the downside, the two key horizontal levels are $2,420 (current level) and then $2,160.

- To the upside, the key horizontal level is $2,700.

- ETH's RSI moving average has moved well into overbought territory. It's possible we see a small move up of the RSI, and a rejection of its moving average. This likely results in the price moving into $2,160 over the coming weeks.

- Next Support: $2,420

- Next Resistance: $2,700

- Direction: Bearish

- Upside Target: $2,700

- Downside Target: $2,160

Cryptonary's take

This move higher in ETH was mostly due to Shorts being squeezed, hence it was such a violent move. However, we do see the most likely path for ETH over the coming weeks being a pullback to $2,160. At that level, we may begin DCA'ing into ETH, however, we will reassess at that price level (assuming we get it), and it's very possible that our DCA levels are lower than $2,160. For now, we're remaining patient and we're not looking to accumulate ETH, and probably not anytime soon.ETH pullback expected after rapid gains

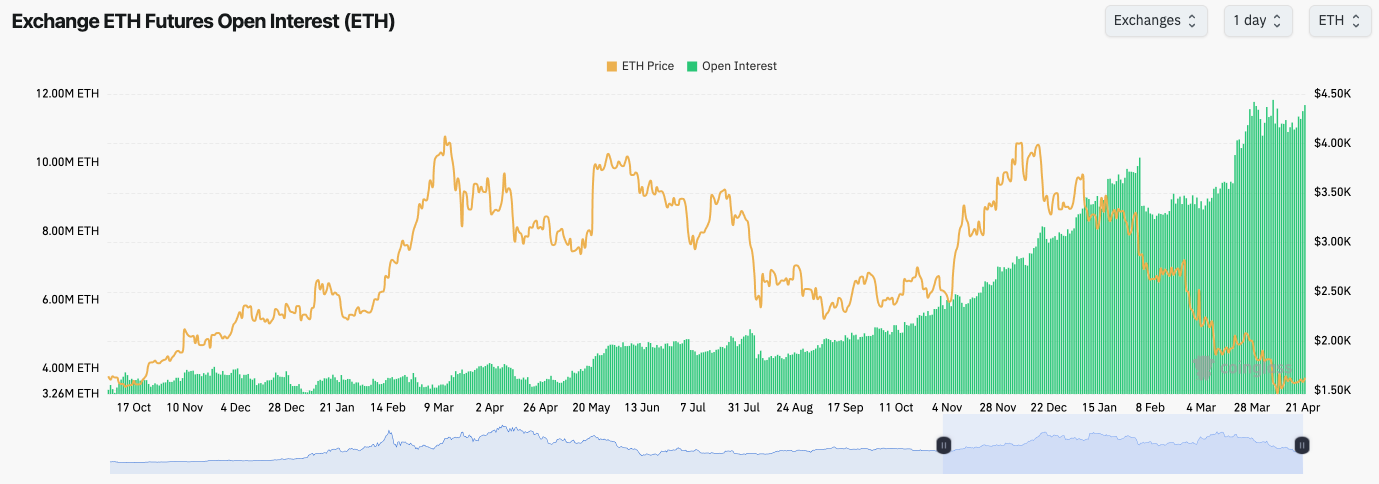

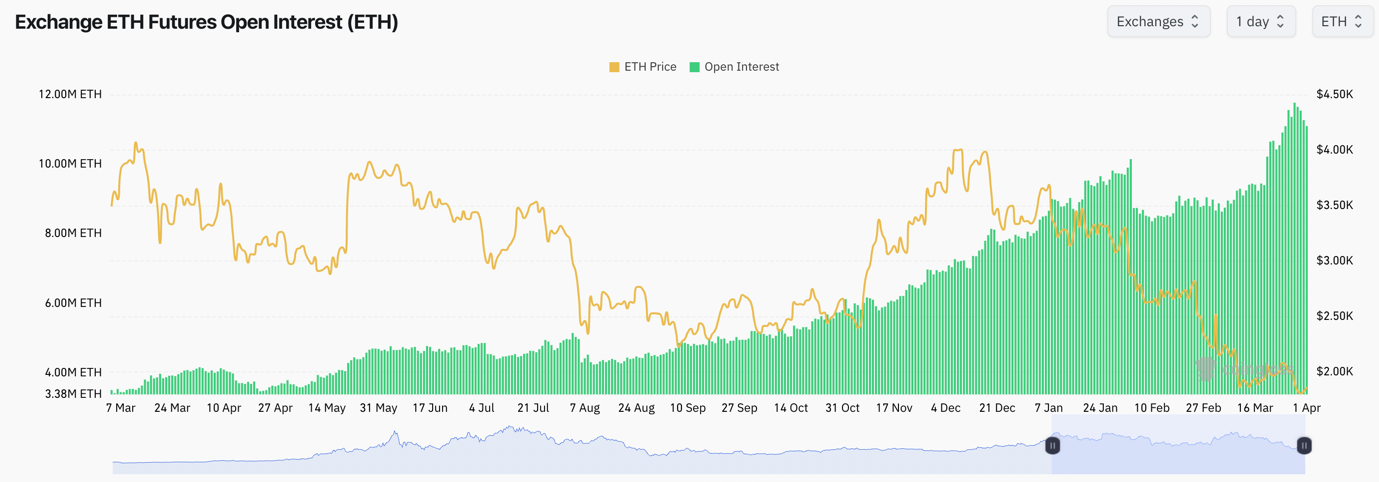

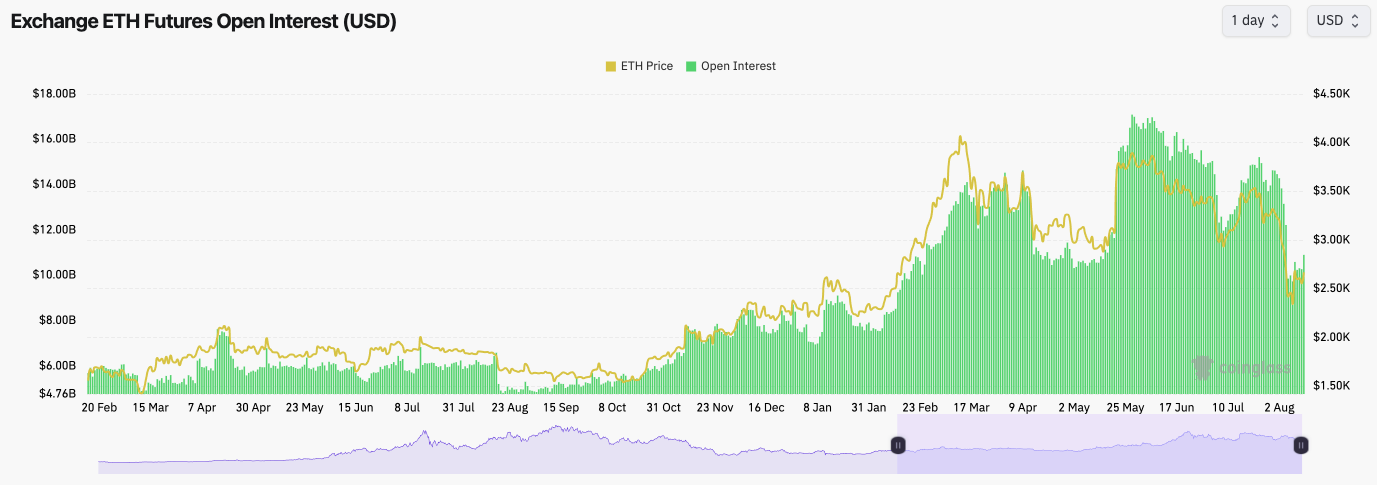

14 May 2025- ETH's Open Interest on a USD and number of coins basis has jumped up massively, whilst the Funding Rate is neutral (0.00%). This suggests that a large amount of leverage has now been applied, with it being relatively even between Longs and Shorts.

Technical analysis

- ETH broke up and recovered the $1,745 horizontal level. Price built support on top of it, and it has since exploded higher recovering some key levels.

- ETH broke above $2,160, and then also $2,420, these are the two key levels.

- ETH has since formed support on top of the $2,420 horizontal support. Ideally, it would be good to see this level hold, however, we expect $2,160 to $2,420 to be the key zone of support.

- To the upside, $2,730 is the local resistance, and $3,050 is the major horizontal resistance.

- The RSI is currently very overextended to the upside, with the moving average now at its highest level since March 2024.

- We also note on the RSI that a bearish divergence has been put in overbought territory

- Next Support: $2,420

- Next Resistance: $2,830

- Direction: Neutral

- Upside Target: $3,050

- Downside Target: $2,140

Cryptonary's take

This is a huge move up for ETH, where we've seen a significant driver of the move being the unwind of Shorts. The question here is, can this rally continue? Our expectation is that we're due for a pullback in the immediate term, which we expect can retest the $2,160 to $2,420 area. Although we prefer other plays (such as SOL and HYPE), we'd consider building Spot positions in ETH between $2,160 and $2,420, with a view to holding it for 6-12 months.ETH’s range tightens ahead of breakout

05 May 2025ETH maintains its breakout above $1,745, with bullish structure intact, though high Open Interest from cash-and-carry trades skews signals. A move to $2,160 is possible—if support holds.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Funding Rate has fluctuated, but it has mostly remained positive, whilst its Open Interest (by number of coins) remains very high. This suggests that there's a big demand for the 'cash-and-carry' trade. This distorts the data, meaning OI and Funding become less of a signal for ETH.

Technical analysis

- ETH has broken out of its main downtrend line, and it's holding above its horizontal level of $1,745. If price loses this level, then we'd expect a move back to $1,600.

- To the upside, the key horizontal resistances are at $2,000 and $2,160.

- The RSI is in middle territory, and it's now sitting on top of its moving average; this is a support level for ETH.

- Price has remained in a tight range between $1,745 and $1,850. We are expecting a breakout, and likely to the upside, assuming the general market doesn't dramatically sell off.

- Next Support: $1,745

- Next Resistance: $2,000

- Direction: Neutral/Bullish

- Upside Target: $2,160

- Downside Target: $1,530

Cryptonary's take

Overall, we're relatively sceptical on the market now as we are expecting a pullback over the coming days/weeks. However, ETH is the setup that looks best for a move higher, if that's directionally how you want to bet. If the market can hold up, then ETH can break out and move higher, potentially to $2,000. However, due to our bearish stance on the market currently, we're not looking to play ETH here.If ETH were to pull back to $1,530 to $1,600, it may be worth beginning to accumulate a very small bag for the long run, even if we do believe more in SOL and HYPE as outperformers over the coming 6-12 months.

ETH eyes $2,160 amid downtrend resistance

29 April 2025ETH's price is testing crucial support at $1,745, with bullish targets at $2,000 and $2,160. A break below $1,745 could send ETH towards $1,530. Market conditions remain pivotal for further gains.

- ETH's Open Interest has ticked up slightly, but the Funding Rate has also come down somewhat; however, they still remain slightly positive. This suggests that some Shorts have begun stepping in.

Technical analysis

- ETH has found support above the key horizontal level of $1,745, whilst price grinds along into the main downtrend line.

- If ETH can break out of its main downtrend line, the upside targets would be $2,000 and then $2,160.

- To the downside, the key level for ETH will be maintaining above the $1,745 horizontal support, but if that level does break, then $1,530 is the likely target area.

- The RSI is in middle territory, and nowhere near being overbought. This suggests that there can still be further upside for price.

- Next Support: $1,745

- Next Resistance: $2,000

- Direction: Bullish

- Upside Target: $2,160

- Downside Target: $1,530

Cryptonary's take

For us, it's difficult to bet on upside in this market when we have concerns over the macro environment over the coming months. However, if you are looking to bet on upside, ETH is the play, and it looks attractive to Long in comparison to other plays.If the general market can hold up (not meaningfully pull back), then ETH can break out and test $2,000 and then $2,160 in the short term.

ETH price struggles at $1,745 resistance

21 April 2025Ethereum’s price has been locked in a tight range, and traders are eyeing crucial levels for a potential breakout or pullback. Here's a look at what’s ahead for ETH.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest (by number of coins) remains at extremely elevated levels as traders continue to take advantage of the 'cash-and-carry' trade.

- Like the other Majors, ETH's Funding Rate has mostly been range-bound between slightly positive and slightly negative, indicating that there is no clear directional bias amongst traders.

Technical analysis

- ETH's price action remains range-bound between the support of $1,530 and the horizontal resistance of $1,680.

- Beyond $1,680, the major horizontal resistance lies at $1,745. If ETH can reclaim/flip this level, we'd take that as the signal for the bullish reversal.

- On the RSI, ETH has broken out of its main downtrend line, and it's above its moving average in middle territory. This could see an extension of the move higher, however, we do expect $1,745 to remain a strong resistance.

- We still expect a retest of the Green Buy Box between $1,230 and $1,530 over the medium term.

- Next Support: $1,530

- Next Resistance: $1,745

- Direction: Bearish

- Upside Target: $1,745

- Downside Target: $1,230

Cryptonary's take

ETH remains in a long-term downtrend, and we fully expect a retest of the lows, which would put price comfortably in the Green Buy Box between $1,230 and $1,530. We would look to accumulate ETH in this area with a long-term view to hold - it would likely be at least a 12-month hold.Whilst it's possible in the immediate term, ETH could see more upside (up to say $1,745 at best), we are, however, expecting more downside over the medium term; therefore, again, we remain patient. But with ETH, we're not looking for Shorts, as it's not at an attractive price point for Shorts despite the fact that we believe we'll see further downside in the medium term.

Ethereum forms bullish pennant near key level

14 April 2025ETH forms a tightening pennant, with bullish RSI and improving funding rates. But with resistance zones overhead, traders are watching closely for either breakout or rejection.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest still remains at very elevated levels as traders take advantage of the basis trade. From a zoomed-out perspective, ETH's OI is becoming less and less of a relevant tool when conducting our analysis.

- ETH's Funding Rate has fluctuated between negative and positive, but it now sits at more meaningfully positive levels. However, overall, this reflects indecision amongst traders.

Technical analysis

- ETH has found support between $1,400 and the $1,530 horizontal level, with price now forming a pennant pattern that looks to potentially be setting up to breakout to the upside.

- ETH is also squeezing into its main downtrend line. A breakout could set up a swift move to at least the next horizontal level at $1,745.

- To the upside, the main horizontal resistances are at $1,745 and $2,160. $2,000 is also a psychological level.

- To the downside, $1,400 to $1,530 remains the support zone.

- The RSI is above its moving average, and it has broken out of its downtrend line, whilst it's still in low middle territory, suggesting that there's further upside to be had.

- In terms of a bullish reversal signal, we'd be looking for a breakout of the local downtrend line and a reclaim of $1,745. We think this is possible in the short term.

- Next Support: $1,530

- Next Resistance: $1,745 (then $2,000)

- Direction: Bullish

- Upside Target: $2,000 (maybe $2,160)

- Downside Target: $1,530

Cryptonary's take

In the short-term, we expect ETH to see a breakout to the upside, which could see $1,745 retested as the minimum level, with $2,000 potentially being the first major stopping point. However, we do expect this to be a short-term relief rally, and for the $2,000 to $2,160 zone to be the stopping point (local top). We would then lean more bearish again, and expect the lows to be retested. That's where we'd look to fill longer-term Spot buys, between $1,230 and $1,530.ETH battles key support amid downtrend

11 April 2025ETH is fighting for a breakout at critical levels, with support around $1,230. As the market watches, will ETH reclaim its upward momentum, or continue its bearish trend?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest (by the number of coins) remains at highs. This is due to the coin's value going down substantially (reflected in higher OI by the number of ETH), but there is also still the appetite for funds to be taking advantage of the carry trade (Long Spot, Short Futures, and profit the Funding Rate).

- However, ETH's Funding Rate has recently flipped to being negative, as we can see below, suggesting there is more of an appetite amongst traders to be Short, but we might look to take the other side of this.

Technical analysis

- ETH has been in an aggressive downtrend now for 4 months, having reached extreme oversold levels, not seen since August 2024, and August 2023.

- Price is currently battling at the horizontal level of $1,530, whilst price is also squeezing into the local downtrend.

- The key level for price to reclaim to the upside is the $1,745 horizontal level. If this happens and the price can break out of the downtrend line, then $2,000 (psychological level) is the target.

- On Tuesday, the RSI went into extreme oversold levels. It has since bounced, and it's now pushing up against its downtrend line, whilst it's also got above its moving average.

- In terms of accumulation levels for ETH, we see ETH as being close to a bottom. We'd be accumulating for the long-term (maybe smaller sizing against HYPE SOL etc), between $1,230 and $1,550.

- Next Support: $1,230

- Next Resistance: $1,745

- Direction: Neutral/Bullish

- Upside Target: $2,160

- Downside Target: $1,230

Cryptonary's take

As we said, ETH has been in an aggressive downtrend for 4 months now, and it's down 65% from its highs. With us potentially beginning to turn on the macro front, it might be wise to begin turning from a bearish to a more bullish bias and to be looking to pick up longer-term Spot bags. For that, we'll be eyeing the range between $1,230 and $1,550.In the short term, we think ETH might be good to attempt a breakout of its downtrend line here. However, the critical testing area will be $1,745, if ETH can reclaim that horizontal level, and then breakout of the downtrend line, $2,160 is the target.

ETH struggles at $1,530 support amid decline

07 April 2025As Ethereum battles crucial support levels, it joins BTC in a volatile market. Let's take a closer look at how ETH and other major assets like BTC are reacting to the current market conditions.

- ETH's Open Interest remains really high, however, this is due to the coin's price going down, hence OI by the number of coins goes up, as it becomes cheaper to leverage ETH.

- ETH's Funding Rate is fluctuating between slightly positive and slightly negative, suggesting that there's a lack of conviction and indecision amongst investors.

Technical analysis

- ETH moved down to the horizontal support of $1,745. But, price quickly broke down from that support ,and ETH is now fighting at the next horizontal level of $1,530.

- Below $1,530, the next major horizontal support is at $1,230. If ETH were to get there in the short/medium term, we might have to consider some light buys.

- On the RSI, ETH remained in its downtrend before breaking down more significantly. The RSI is now into deep oversold territory.

- To the upside, the $1,745 horizontal level will now be the new resistance. We wouldn't get bullish again until ETH reclaimed that level.

- ETH remains in both of its downtrend lines for now (dotted down-trending red lines).

- Next Support: $1,230

- Next Resistance: $1,745

- Direction: Neutral/Bearish

- Upside Target: $1,745

- Downside Target: $1,230

Cryptonary's take

ETH's price action has been really poor. It's essentially been straight down, with rallies being weak, and crucial support levels eventually being lost. Where this price decline stops is hard to say.Right now, price is very oversold, but with ETH really lacking in positive narratives, it's possible ETH can go lower. At some point, it'll reach a point where it starts to look attractive from a valuation point of view. $1,230 may be that level.

For now, we'll sit tight and see how this plays out, but we are getting closer to these buy levels, and it has happened quicker than we expected due to Trump's aggressiveness.

Ethereum targeting $2,100 resistance zone

01 April 2025Ethereum’s price is consolidating near crucial support levels while Bitcoin tests key resistance. As the market teeters, let’s explore the latest movements and see what lies ahead for ETH in these volatile conditions.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest remains close to all-time highs (by number of coins), whilst the Funding Rate remains slightly positive. Again, there isn't much signal in this currently other than the fact that the carry trade is still being had, whilst there isn't a huge appetite amongst leverage traders to be taking sizeable trades.

Technical analysis

- ETH rejected at $2,100 and price pulled back to the horizontal support of $1,745, as we expected it might.

- Price is now trying to bounce from this $1,745 horizontal support level. The RSI has also put in back-to-back bullish divergences (lower lows in price, with higher lows on the oscillator). This could help fuel a move higher.

- If the $1,745 horizontal support is broken to the downside, then the next major horizontal support is at $1,530. If $1,745 is broken, then expect $1,530 swiftly, although we do think $1,745 can hold in the short-term.

- To the upside, the horizontal resistances are $2,100 and $,2160, with the most significant at $2,420, although, to be frank, we don't expect this to be retested anytime soon.

- Next Support: $1,745

- Next Resistance: $2,100

- Direction: Neutral

- Upside Target: $2,100

- Downside Target: $1,530

Cryptonary's take

Despite the general picture for risk assets not being very positive currently, ETH is squeezing into a local downtrend line, having put in two back-to-back bullish divergences. If there is a general breakout in the market, then ETH does look like one of the plays that could get a good breakout.The issue with ETH recently has been its underperformance. So, even though this chart might look good for a breakout (if we're wrong on the macro and the market can break out) then ETH might rally but still underperform.

Whilst the structure looks constructive, we're not looking to chase strength in the current macro backdrop. We'd be more interested in Shorts if the price runs into key resistances, say at $2,420, but we don't expect this level to be retested anytime soon. For this reason, we just steer clear of ETH for now. The play recently was BTC into the Short box zone.

ETH faces bearish pressure at $1,950

28 March 2025Ethereum ($ETH) is testing key support levels, with bearish pressure continuing. Despite positive funding rates, price action remains weak, and a retest of lower levels is expected in the coming days.

- ETH's Open Interest continues to soar higher as traders/institutions take advantage of the 'cash-and-carry' trade - Buy Spot ETH, Short the Perps contract and profit from being paid the Funding Rate.

- ETH's Funding Rate has remained mostly positive, indicating traders have been more willing to be Long than Short.

Technical analysis

- ETH rejected to $2,100, which was where the bottom wicks lined up previously.

- We expected the major horizontal resistance of $2,160 not to be surpassed, and we presumed it would be tested, considering ETH was getting a relief rally after a really strong downtrend. However, it wasn't even retested.

- ETH is now seemingly breaking below the local support of $1,950.

- The major horizontal support for ETH is at $1,745. We expect this to be retested sometime over the next fortnight. We're not sure exactly when, but we do think it's inevitable.

- ETH's RSI broke out of its downtrend line, but it has swiftly rejected and fallen back into the trend, with it now also breaking below its moving average. Not great to see.

- Next Support: $1,745

- Next Resistance: $2,160

- Direction: Bearish

- Upside Target: $2,160

- Downside Target: $1,745

Cryptonary's take

ETH still looks very weak, and each time it gets to a key level to stage a test, it seems to fail, eg, it couldn't even retest $2,160 in this relief rally. We are expecting a retest of $1,745 in the coming week or two.If/when ETH gets there, we'll reassess, as it's possible another bullish divergence might form close to oversold territory, whilst ETH is moving into a major horizontal support. That might provide an opportunity for a Long. But let's see if our thesis plays out, and we'll reassess closer to the time.

ETH aims for $1,960 target

18 March 2025- ETH's Open Interest has continued its grind higher, likely due to participants taking advantage of the 'carry' trade.

- ETH's Funding Rate is slightly positive, but it might be being compressed due to the 'carry' trade, so the fact it remains positive suggests there's likely more of a slight bias here amongst traders to be Long, at this moment in time.

Technical analysis:

- Key note; the chart below is ETH on the 3D timeframe, so much more zoomed out. And we'll look at it from that perspective to get a better gauge as to how to play it, and to help us identify key levels.

- ETH is essentially just above its major support at $1,745, with $1,530 the next key level.

- We don't expect $1,530 will be lost/broken to the downside.

- On the upside, ETH's horizontal resistance is at $2,160, and we think this can be retested at a major relief rally.

- ETH's RSI is very oversold, the most oversold it's been since mid 2022, yes, that's pre-FTX collapse.

- Next Support: $1,745

- Next Resistance: $2,160

- Direction: Neutral

- Upside Target: $1,960

- Downside Target: $1,545

Cryptonary's take:

In the short term, we expect ETH will be range-bound between $1,745 and $1,960. We expect a breakdown into the $ 1,500 is possible, but that might be a good long-term buying area.Over the coming weeks, and maybe months, we expect the price to be range-bound and then to put in a more meaningful bounce on the other side of Trump/administration uncertainty. That might take 1-3 months. But we're expecting a sideways grind before a move higher.

So, something similar to summer 2022. We'd look to bid into the $1,500's to then sell ETH at $2,160. That's the play we'd be looking at for ETH over the coming weeks/months. But, we do see $1,500's as a good long-term buying opportunity to then sell ETH later in the year or in early to mid 2026.

ETH risks drop toward $1,530

14 March 2025- ETH's Open Interest (by number of coins) still remains very high. Since the early February flush out, ETH's OI has climbed back close to its all-time highs, now just 5% down from its highs. This shows that there is still strong demand for the carry trade in ETH (Long Spot, Short Futures, profit from the Funding Rate).

- ETH's Funding Rate is just about positive, and it has fluctuated between slightly positive and negative. This indicates that there's no clear bias or confidence among traders.

Technical analysis

- A really ugly chart that has been essentially down only now for some time.

- We commented at the beginning of the week that ETH had just broken below the $2,160 horizontal support level, and it was butting up into it, essentially as new resistance. It wasn't reclaimed, and ETH dropped drastically lower.

- Price then bounced perfectly off of the $1,745 horizontal support and has since formed a pennant pattern.

- ETH is now forming a bearish pennant which has a bias to break lower. The target of this would be a move back down to $1,745.

- Interestingly, ETH's RSI has put in two bullish divergences now (lower low in price, higher low on the oscillator). This may help the price to bounce.

- If ETH can bounce (our confidence is low), then $2,160 would be the likely top-level target. We wouldn't expect the price to breach above this level in the near term.

- To the downside, if $1,745 is lost, then $1,530 is the next horizontal support.

- Next Support: $1,745

- Next Resistance: $2,160

- Direction: Neutral/Bullish

- Upside Target: $2,160

- Downside Target: $1,530

Cryptonary's take

Despite ETH forming a bearish pennant, and if this were to break down, we think the price can retest $1,745 and bounce again from that level. However, our thinking is that ETH can potentially bounce here in the short term and potentially find a local resistance of $2,160.We're not sure we'd bet on this, because essentially it would be trading against the trend, but we can also appreciate that this is likely due a relief rally in the short-term.

ETH’s next support stands at $1,745

10 March 2025Ethereum continues to underperform, struggling below key resistance, while Bitcoin also faces downside risk. Market sentiment remains cautious—will relief rallies emerge, or is more weakness ahead? Let’s dive into the latest crypto trends and price action.

- ETH's Open Interest remains mostly unchanged as traders continue to take advantage of the basis trade. This doesn't give us much signal from a trading perspective.

- ETH's Funding Rate has fluctuated between 0.01% and -0.01% as traders have flip-flopped in their positioning. Although Funding is contained, so by, there is little appetite amongst traders to make big leveraged bets.

Technical analysis

- From a technical perspective, ETH doesn't look good here.

- ETH has just lost the vital horizontal support at $2,160, with the next major support at $1,750.

- Yesterday, the price broke below the $2,160 support. The price has since moved up to $2,160 and was rejected from that level. Old support now may have been turned into new resistance.

- The RSI has broken out of its downtrend line, and it remains close to overbought territory. This could have helped towards ETH bouncing, but whilst the rice remains beneath $2,160, it's not a good setup for Longs.

- If $2,160 can be reclaimed, then $2,420 is the next horizontal resistance level.

- Next Support: $1,745

- Next Resistance: $2,160

- Direction: Neutral/Bearish

- Upside Target: $2,420

- Downside Target: $1,745

Cryptonary's take

ETH has just been such an underperformer for a long time now. With ETH now seemingly having lost this $2,160 horizontal support level, it's hard to get bullish on ETH anytime soon. We're expecting a slow move down to $1,745 in the coming weeks. In the immediate term, ETH might just keep butting up to $2,160 and rejecting into that level.ETH battles key levels as sentiment fades

04 March 2025As ETH clings to key support and BTC faces its own pullback, market sentiment stays fragile. Traders watch critical levels closely across major cryptos, eyeing the next big move. Let’s break down what’s happening across the board.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

ETH:

- Like Bitcoin, ETH's Funding Rate remained relatively flat (even balance between Longs and Shorts) whilst the Open Interest remained level also.

- This suggests that the price increase was spot-driven.

Technical analysis

- ETH broke down to the last horizontal support at $2,160, and fortunately price was able to hold this level, and ETH bounced on yesterday's Trump tweet.

- Price is now battling at the $2,420 horizontal level. A reclaim of this and price can potentially be setup for a retest in to $2,600.

- The RSI has broken out of it's downtrend, and it's sat on top of it's moving average. This is perhaps the only positive element of the chart currently.

- The key supports are $2,160 and then if that's lost, $1,745.

- Next Support: $2,160

- Next Resistance: $2,420 (then $2,600)

- Direction: Bearish

- Upside Target: $2,600

- Downside Target: $1,745

Cryptonary's take:

Despite the positivity and the whip-saw to the upside in general sentiment following Trumps tweet yesterday, if we look at the ETH chart, it looks pretty poor here. It's possible in the short-term we see price just grind along and chop between $2,160 and $2,600 (more likely $2,420).And then in the upcoming month, potentially we see ETH break down to $1,745. We're not bullish on any timeframe on ETH here to be quite frank. Look at that chart and zoom out, it's hard to see where the bullish turn will come from as well. For now, we're sitting watching this and expecting more chop, and then a downside from there to say the $1,745 level.

$2,420 ETH support in focus

24 February 2025Ethereum faces rejection at $2,875 while funding rates remain mixed. With key support at $2,420, traders watch for either a breakout or further downside in the coming weeks.

- ETH's Open Interest has moved up from the lows very slightly, but it still remains well below the highs we saw before the flush out.

- ETH's Funding Rate has fluctuated between positive and negative, indicating that traders have flip-flopped between Longing and Shorting.

Technical analysis

- ETH has bounced from the $2,500 level and it's moved up to the local horizontal resistance of $2,875, where it has (for now) rejected, as we expected it to. $2,875 to $3,050 is the resistance zone. For now, we expect this resistance zone to hold.

- There is local support for ETH at $2,655, with the major support at $2,420.

- We're now also seeing the formation of a local uptrend line (yellow line). A break below this line could propel a larger move to the downside.

- The RSI has broken out of its main downtrend, it's moving higher and is using its moving average as support. This is one of the few elements of the TA.

- Next Support: $2,650 (then $2,420)

- Next Resistance: $2,875

- Direction: Bearish

- Upside Target: $2,875

- Downside Target: $2,420

Cryptonary's take

It's possible we see a positive outcome over the coming weeks, although we still favour the negative outcome (downside). The positive outcome would be price grinding into the main downtrend line and the horizontal resistance of $2,875, and then breaking out to the upside. The negative outcome is just a rejection into this converging resistance zone, and then the price makes new lows, likely at the $2,420 support.ETH RSI positive, Eyes $2,875 target

18 February 2025Ethereum ($ETH) remains range-bound, struggling to break above $2,875 while support at $2,500 holds. With resistance at $3,050, can ETH flip bullish, or is a drop to $2,420 next? Let’s analyze the latest price action.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest pulled back substantially on the price puke out in early February. Open Interest then bottomed off and has started rising again.

- ETH's Funding Rate isn't negative, but it is only just positive. This suggests that a fair portion of the open interest that has been recently added is in Shorts.

Technical analysis

- ETH has been range-bound at the new lows between $2,500 and $2,900.

- The horizontal resistance is at $2,875. We would need to see this level flipped and reclaimed in order to flip bullish again. However, just beyond this level, $3,050 is also a large resistance. So ETH has two big resistances within just a 10% move higher for price.

- Currently, there is local support at $2,700, but the main horizontal support is at $2,420.

- The RSI is the most positive aspect of ETH. It's broken out of its downtrend line, and it's also now nicely above its moving average.

- Next Support: $2,500

- Next Resistance: $2,875

- Direction: Neutral/Bearish

- Upside Target: $2,875

- Downside Target: $2,420

Cryptonary's take

It's hard to get bullish on ETH here. We're now just generally used to lacking performance, and then when you look at the chart, ETH is below two heavy horizontal resistances; $2,875 and $3,050.For now, we'd just remain patient with ETH, and whilst we still don't see the macro as majorly supportive, this would suggest to us that ETH can revisit the $2,420 area as a minimum in the coming weeks/months.

ETH drops 16% in liquidation event

04 February 2025Ethereum’s open interest plunged 16% in a major liquidation event. ETH struggles to hold $2,600 support, while traders face market indecision with fluctuating funding rates and uncertain breakout potential.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

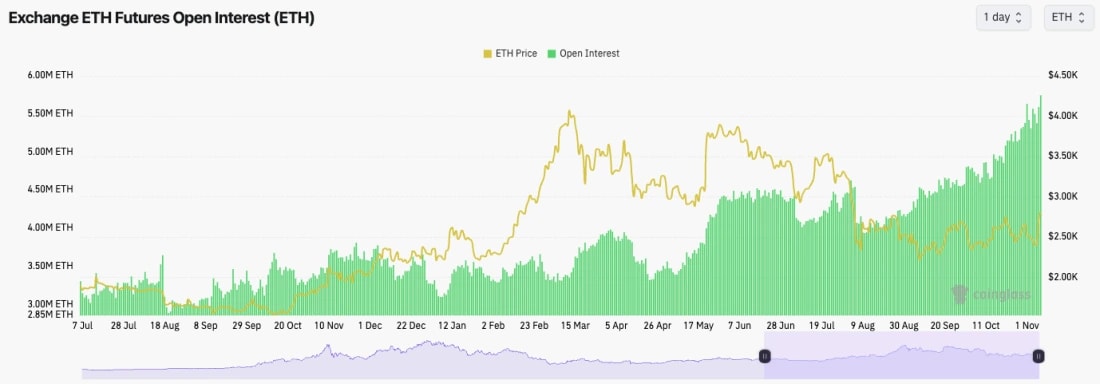

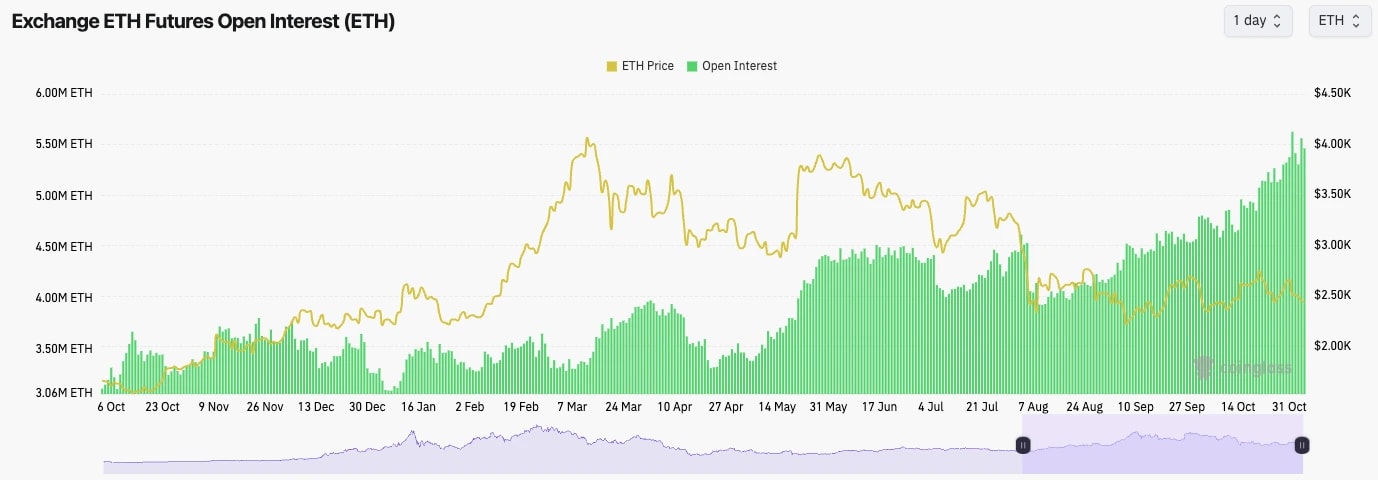

- ETH's Open Interest plummeted over the last 48 hours, showing that this was a large leverage washout event.

- ETH's Open Interest (by number of coins) fell by 16%.

- ETH's Funding Rate was very negative on Monday, but it has now returned to slightly positive. However, funding keeps flip-flopping between positive and negative, showing indecision among traders, who are most likely being chopped up.

Technical analysis

- ETH rejected into the horizontal resistance of $3,480. A failed breakout then sent the price to $3,280, which also couldn't hold.

- The capitulation event sent ETH well below the next horizontal support of $2,420, but the price has recovered and is now trying to stabilise around the Yellow Box - which has now been filled, as we called for.

- $2,600 is the next horizontal support, whilst $2,875 is the next horizontal resistance.

- ETH's RSI is close to being oversold, and it remains well below its moving average.

- Next Support: $2,600

- Next Resistance: $3,050

- Direction: Bearish/Neutral

- Upside Target $3,050

- Downside Target: $2,400

Cryptonary's take

We'd expect the price to take some time to establish a new range here, likely between $2,600 and $3,050. Whilst the price remains in the downtrend, we'd expect it to be range-bound, and therefore, we're not expecting any major breakouts anytime soon. If the price were to revisit the $2,300's, that might be worth a bounce play. But, other than that, we're not too interested in ETH at this moment in terms of trading opportunities.ETH eyes $3,700 after breakout

31 January 2025Ethereum is testing key levels at $3,280 and $3,480, struggling to break out. Meanwhile, Bitcoin holds its range, and the market remains uncertain. Will ETH rally or retest $3,050 first? Let’s break down the key price action.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

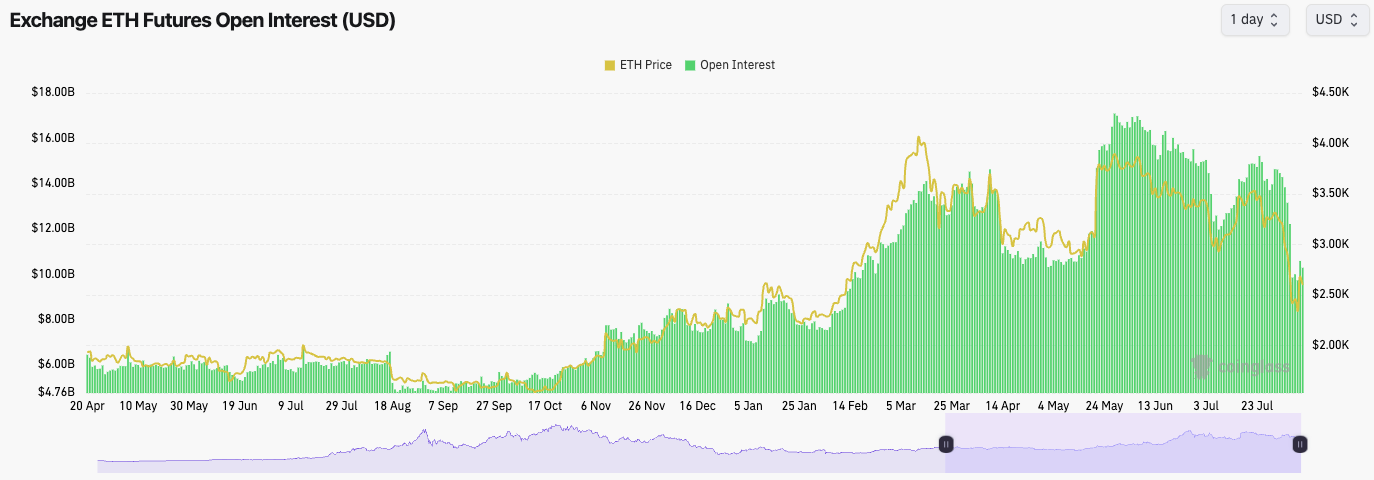

Technical analysis

- ETH is interesting here. The price bounced off the main horizontal support of $3,050.

- Price is now attempting a break above the horizontal level of $3,280 whilst it's also looking to break out of the main downtrend line.

- The key for a major breakout here will be for the price to break the main horizontal resistance at $3,480.

- If the price can break out at $3,480 (we're sceptical in the short-term), then $3,700 is the target.

- The RSI is also attempting a breakout above the downtrend line and the moving average. We really need to see this move stick to potentially see a more substantial upside.

- Next Support: $3,280

- Next Resistance: $3,480

- Direction: Neutral

- Upside Target: $3,700

- Downside Target: $3,050

Cryptonary's take

ETH is at a really key level here as it is trying to break out. A breakout of the downtrend line and $3,480 horizontal resistance is a big ask, so we are sceptical. But this is what's needed to get that breakout.If the price were to break out, it would be a huge sign-off strength, and this may actually lead to other plays/sectors also having more substantial rebounds. Unfortunately, we're not expecting a substantial breakout in the short term, and we're still thinking that ETH can revisit $3,050 before it touches the Yellow Box. But we're expecting $3,050 as a minimum retest again.

ETH breaks below $3,280 – What’s next?

28 January 2025Ethereum remains stuck in a tight range, failing to break above $3,280 resistance while holding $3,050 support. With high open interest and a balanced funding rate, will ETH finally see a breakout? Let’s analyze the market action.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest is still sky-high due to the cash-and-carry trade. It's becoming somewhat pointless to look at ETH's OI because of this.

- ETH's Funding Rate is at 0.008%, suggesting there's an even mix of Longs and Shorts.

Technical analysis

- ETH has broken down from its main horizontal resistance of $3,480 and is also rejected at the main downtrend line.

- Price has then broken below the next horizontal level of $3,280, but we are seeing the $3,050 hold as support for now.

- The RSI is in middle territory, but it's in a downtrend and also below its moving average.

- The key breakout will be a move above $3,480 and a break above the downtrend line.

- Next Support: $3,050

- Next Resistance: $3,280 (then $3,480)

- Direction: Neutral/Bearish

- Upside Target: $3,280

- Downside Target: $2,900

Cryptonary's take

ETH has been pretty boring here, and there isn't a mega-development beyond our last update. However, the new information we have is that ETH hasn't broken out of its downtrend line, and it's now also below the horizontal level of $3,280 - last time, it was butting up to $3,480 (the key breakout level).It's possible ETH can move back up to $3,400 - $3,500; however, we wouldn't be surprised if the Yellow box is eventually filled in the coming weeks. Again, this is another that we'll wait on for it to show us direction.

ETH targets $3,700 after $3,480 break

24 January 2025Ethereum ($ETH) is at a critical point, holding $3,280 support while testing $3,480 resistance. Will ETH break out toward $3,700, or face a potential rollover? Let’s dive into the latest market analysis

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's funding rate is 0.01%, which indicates an even mix between longs and shorts.

- The Open Interest for ETH remains really high, and alongside that, we've seen Spot purchases not be as strong.

Technical analysis

- ETH is beginning to look more interesting here from a TA perspective.

- We have ETH, having been able to hold the lows/the supports at $3,150, and the price has now reclaimed $3,280 and is pushing onto the main horizontal resistance of $3,480.

- The $3,480 horizontal resistance also converges with the main downtrend line. If the price can break out of these converging resistance areas, then the price will likely swiftly move up to $3,700.

- ETH's RSI is now also battling at its uptrend line and looking for a breakout.

- Next Support: $3,280

- Next Resistance: $3,480

- Direction: Neutral

- Upside Target: 3,700

- Downside Target: $3,050

Cryptonary's take

Key decision time here for ETH. It's managed to hold the lows and move higher, with it now really testing the main resistance levels (the horizontal resistance at $3,480 and the main downtrend line). We need to see ETH get some follow-through here. Otherwise, confidence may be lost again, and we might see a price rollover and retest of $3,050.The key decision for ETH is here. If it can be helped/pushed by the rest of the market, then that's great, as that's what it may need.

Ethereum finds support at $3,140

21 January 2025Ethereum battles $3,480 resistance as its RSI trends downward, while BTC shows signs of strength. Will key catalysts push the market toward a breakout? Let’s explore the latest trends and opportunities.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest just continues to soar. This is likely TradFi taking advantage of the 'cash-and-carry' trade alongside protocols/mechanisms like Ethena.

- Funding is at 0.01%, so there is an even balance between Longs and Shorts.

- The signals aren't that clear or decisive here.

Technical analysis

- ETH remains range-bound between the major horizontal resistance of $3,480 and the local support of $3,140 (this is a new level).

- There are also other key horizontal levels to monitor: $3,050 and $3,280.

- ETH remains in its main downtrend, and to see a major bull reversal, we'll need to see the price breakout of the downtrend and also the horizontal resistance of $3,480.

- The RSI is also in a downtrend, and it hasn't yet broken out, whilst it's currently battling to remain above its moving average.

- Next Support: $3,140

- Next Resistance: $3,480

- Direction: Neutral

- Upside Target: $3,700

- Downside Target: $3,050

Cryptonary's take

Like BTC, ETH doesn't really look either here or there. Although arguably, BTC has shown some strength, whereas ETH has just held its level, it seems to be losing a bit of momentum. This week remains a tricky week to navigate, with the market just essentially waiting on Executive Orders from Trump.If there is a sell-off, and we think this is still possible for ETH to achieve, then $3,050 is likely the minimum target. But, if Trump issues very pro-Crypto executive orders, then this could see ETH get the breakout that it really needs.

ETH targets $3,700 upside soon

17 January 2025ETH struggles to break $3,480 resistance despite strong RSI. BTC's rally drives optimism. Trump’s policies next week could shape crypto momentum.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- The Open Interest in ETH didn't even pull back. There's a huge amount of OI on ETH currently. This may be due to new market mechanisms/protocols such as Ethena.

- The Funding Rate is also back to 0.01%, indicating a balance between bulls and bears (Longs and Shorts).

Technical analysis

- ETH wicked into the $2,900's and was close to filling the Yellow box. However, it got a strong bounce, and the price rebounded swiftly into the main horizontal resistance at $3,480.

- Price is now range-bound between the horizontal support of $3,280 and the horizontal resistance of $3,480.

- ETH remains in a downtrend, and for this to bull reverse, it'll need a breakout of the $3,480 and the main downtrend line.

- The RSI is looking better/good here, and it's now resting on top of its moving average. Being in the middle territory, this has room to go higher here.

- A break below $3,200 - $3,280, and ETH likely pulls back to $3,050.

- Next Support: $3,280

- Next Resistance: $3,480

- Direction: Bullish

- Upside Target: $3,700

- Downside Target: $3,050

Cryptonary's take

Unlike BTC, ETH hasn't broken out of its downtrend currently. For the full bull reversal, we'll need to see ETH break out of the downtrend and reclaim comfortably back above $3,480. However, similar to BTC, a lot of the short-term forecasts rely on Trump next week.If it's better than what the market expects, then the price can break out; if not, then a sell-down. It's hard here; it depends on what Trump does next week. If Trump delivers, then I'd expect to see ETH break out. If the opposite is true, then the $3,200's can be tested.

Yellow buy box: $2,660-$2,875 range

13 January 2025ETH struggles below $3,280 resistance, with RSI nearing oversold levels. Key supports include $3,050 and the Yellow Buy Box ($2,660-$2,875) for potential recovery.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH Open Interest is frightening. It just keeps soaring higher.

- ETH's Funding Rate is at 0.005%, which again shows a balance between Longs and Shorts.

Technical analysis

- ETH had a nasty rejection on Jan 7th, which was the jobs data, and it lost the key horizontal level of $3,280 just days later, breaking down from the bearish pennant.

- On the upside, the key level for ETH to reclaim is $3,480, although the price is 15% away from there currently.

- ETH has now moved down into the local horizontal level of $3,050, where we have initially seen some bids come in, and the price is holding up for now. Beneath $3,050, the next horizontal level is at $2,875, with the Yellow Buy Box going down to $2,660.

- The RSI has moved down drastically and now just sits above oversold territory, although there aren't any bullish divergences yet.

- Next Support: $3,050

- Next Resistance: $3,280

- Direction: Bearish

- Upside Target: $3,280

- Downside Target: $2,660 - $2,875

Cryptonary's take

ETH has pulled back substantially, but it is close to approaching the Yellow Buy box, whilst the RSI is also close to being overbought. What we'd like to see is a price to pull back to the Yellow Buy box and remain range-bound for a period. In this period, we'd like to see 1 or 2 bullish divergences (lower low in price, higher low on the oscillator) build up. That would be the indication for us to potentially Buy/Long.We wouldn't be surprised to see ETH either range here in a tight area for a few days or break lower. We're expecting an upside at some point, but not in the immediate term. We have the inflation data on Wednesday, and a hot print could be what sends ETH into the Yellow Buy box. Let's see.

Ethereum moves toward $4,000 resistance zone

06 January 2025Ethereum ($ETH) surges above $3,480 resistance, targeting $3,970 and $4,000 as leverage resets. RSI confirms bullish momentum with room for further upside.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- It's really interesting to see that ETH's OI (by number of coins) is back to its highs. This shows that a lot of leverage has been put into ETH recently.

- ETH's Funding Rate is flat at 0.01%, meaning that the increased Open Interest is a relatively even mix of Longs and Shorts.

- This leverage setup is likely TradFi players taking advantage of the basis trade - Long the ETH ETF, Short the Futures, and take the Funding Rate as the arbitrage risk-free.

Technical analysis

- Exactly what we were expecting and looking for: a clean break above the range resistance at $3,480.

- $3,700 is a local resistance, but it might just be a short-term stopping point before ETH ends up heading higher to $4,000 again.

- If there is a more meaningful pullback (we're not expecting one), then $3,480 is likely to be old resistance now flipped into new support.

- The RSI has broken above its moving average, and at 58, it's still a long way from even being close to overbought. More upside likely.

- Next Support: $3,480

- Next Resistance: $3,970

- Direction: Bullish

- Upside Target: $3,970

- Downside Target: $3,480

Cryptonary's take

Again, it was a really nice and clean move higher than we perfectly called in our last Market Direction. ETH is now in this higher range between $3,480 and $3,700. There's likely more upside to be had even if the price sits still for a few days first, but we are expecting a retest of $3,970 in the coming 7-10 days. All conditions look good here for it; let's see if we get it.Ethereum moves toward $4,000 resistance zone

31 December 2024Ethereum ($ETH) holds $3,280 support while aiming for $3,700. A 10% OI pullback has reset leverage, creating an opportunity for fresh momentum in the coming days.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest is also down approximately 10% from its highs, although it has started moving higher again in the past few days. Perhaps traders are looking to get exposure to ETH going into the New Year.

- The Funding Rate for ETH is at 0.01%, indicating a healthy dynamic between Longs and Shorts. Funding isn't skewed in either direction for now.

Technical analysis

- Overall, it is a really interesting chart with prices respecting key levels.

- The price was rejected on the underside of the uptrend line, and the horizontal resistance was at $3,967.

- Price has since pulled back to the low $ 3,00,0, and it has been mostly range-bound between the horizontal support of $3,280 and the horizontal resistance of $3,480.

- A break out of $3,500 likely sends the price swiftly back to $3,700.

- The RSI is in the middle territory at 47, but it is breaking above its moving average. This could see price follow through a push up to $3,700 in the immediate term.

- Next Support: $3,280

- Next Resistance: $3,480

- Direction: Neutral (Bullish)

- Upside Target: $3,700

- Downside Target: $3,280

Cryptonary's take

ETH looks good here for a short-term stab higher, potentially testing into $3,700. For this, we're looking for a breakout of $3,480 to $3,500, which we think we'll get/see in the coming days.ETH struggles near $4,000 resistance

16 December 2024ETH climbs after reclaiming key support at $3,480, while BTC holds strong and SOL eyes a potential breakout. Let’s analyze what’s next for Ethereum.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest (by number of coins) continues to grind to a new all-time high. However, this may be due to large funds/institutions taking advantage of the 'cash-and-carry' trade (buy the ETF, short the futures, profit off the Funding Rate).

- ETH's Funding Rate remains at the healthy level of 0.01%. This is positive to see.

Technical analysis

- ETH did break below its uptrend line, but the price bounced perfectly from the $3,480 horizontal support.

- Price is now battling to recover the uptrend line, and it is putting up a good fight so far.

- Price is now butting into the main horizontal resistance between $3,950 and $4,000.

- If ETH were to break above $4,000 convincingly, we'd expect $4,500 to be swiftly achieved.

- There is now local support for ETH between $3,700 and $3,800.

- The RSI has meaningfully reset and not near overbought territory. This may allow the price of the room to run higher.

- Next Support: $3,700

- Next Resistance: $4,500

- Direction: Bullish

- Upside Target: $4,500

- Downside Target: $3,700

Cryptonary's take

ETH is in a really interesting spot here. It's possible that the converging resistances (beneath the uptrend and the horizontal resistance) can keep the price below $4,000 for more days. However, we expect ETH to break out more imminently. And when it does, we expect $4,500 to be achieved quickly. Any pullbacks to $3,700 - $3,800 should be bought for a move up to $4,500.ETH consolidates below $4,000 range

11 December 2024ETH consolidates below $4,000 after a clean bounce off $3,480 support. With RSI normalizing and resistance firm, what’s next for Ethereum?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest still remains high and hasn't seen as much of a flush out.

- ETH's Funding Rate has pulled back substantially from 0.03% to just 0.01% in the last 48 hours. So we've seen some flush out of excess Longs.

Technical analysis

- Really clean price action.

- Price was in a really clean uptrend and rejected at the main horizontal resistance at $4,000.

- The price then broke below the main uptrend line and swiftly revisited the main horizontal support at $3,480, where the price bounced perfectly.

- Price is now out of the main uptrend, so therefore, the underside of the uptrend line and the horizontal resistance of $4,000 will act as strong resistance.

- The RSI has also pulled back to 58, which is close to middle territory and nowhere near being overbought.

- Next Support: $3,480

- Next Resistance: $4,000

- Direction: Neutral/Bullish

- Upside Target: $4,000 (then $4,500)

- Downside Target: $3,480

Cryptonary's take

ETH is now out of its main uptrend, so it's possible we will see a further period of consolidation below $4,000. The bullish reversal will come upon a breakout of $4,000, so that's what we'd be waiting for. We expect this might take another week or so, and ETH might require patience here. For now, we continue to hold ETH, and we're not looking to make any changes.ETH holds key support at $3,700

06 December 2024Ethereum ($ETH) saw a 10% Open Interest drop and funding reset, holding key support at $3,700. Bulls eye $4,000 resistance, with $4,500 as the next upside target.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- Like BTC, the rest of the market also moved lower; however, generally speaking, the rest of the market saw less of a meaningful flush out.

- ETH's Open Interest on Binance moved down from 1.67m ETH to 1.51m ETH, so an approximate 10% flush out in Open Interest for ETH.

- The Funding Rate had moved up substantially, and it came down from 0.065% to 0.024%.

- So, some Longs were flushed out. However, there still remains a relatively high level of Open Interest.

Technical analysis

- The TA hasn't changed much from our last update, so we'll keep this section lighter.

- Price has remained in an uptrend, and for now, the price has initially rejected the major horizontal resistance and psychological level of $4,000.

- To the downside, the $3,480 to $3,700 zone should act as major support.

- The RSI is very close to overbought territory. It's close that there is further upside, but we wouldn't be surprised to see the price linger under $4,000 for a week or so, and that might help reset the RSI slightly.

- Next Support: $3,480 - $3,700

- Next Resistance: $4,000

- Direction: Neutral/Bullish

- Upside Target: $4,000 (then $4,500)

- Downside Target: $3,480

Cryptonary's take

Whilst it's possible that ETH does just break beyond $4,000, we do still expect that $4k is a resistance, at least for a few more days, potentially up to the next week. However, beyond that, we do expect a stronger break out that eventually sees ETH move to $4,500 within the coming weeks.For now, we continue to hold Spot bags. A retest of $3,500, and we'd consider adding to these Spot bags for a short-term swing trade.

ETH RSI signals $4,000 resistance

04 December 2024Ethereum’s ($ETH) rally pushes near $4,000, with strong open interest and elevated funding rates. As RSI enters overbought territory, $3,700 emerges as a key support for potential pullbacks. Will ETH break through psychological resistance?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest is on an absolute rip, on both the USD terms and the by the number of ETH. This is likely due to increased 'cash-and-carry' trades and more large players entering the ALT market following Trump's win.

- ETH's Funding Rate has also increased to 0.03%. Again, this is relatively elevated; however, we're not greatly concerned about it in the immediate term.

Technical analysis

- It was just a really clean move up to nearly $4,000, which we have called for perfectly over the last few weeks.

- Price has managed to find support and held key horizontal levels before moving higher. First, it was $3,000, then $3,280, then $3,480, and now it's a straight move to $4k.

- To the downside, we'd expect $3,550 to $3,700 to be a strong support zone for ETH.

- For now, ETH is moving in a nice uptrend, and it's possible that, at an approach of $4,000, there might be significant psychological resistance for ETH.

- The RSI is also grinding higher into overbought territory. If ETH approaches $4,000 and struggles to have a smooth break out above that level, we might see a short-term overbought pullback.

- Next Support: $3,700

- Next Resistance: $4,000

- Direction: Bullish

- Upside Target: $4,000

- Downside Target: $3,480

Cryptonary's take

ETH is one we've got really spot on over the last few weeks, having perfectly called for the move up from the lows around $2,300 to $2,500. ETH is now approaching the short-term target of $4,000. While it's possible we will see a major break out of that level, it's also possible that we will see ETH stall in the short term at the $4,000 mark. If that then generates a small pullback, a retest of $3,700 might be a good place for a new entry.ETH targets $4,000 this week

29 November 2024Ethereum ($ETH) consolidates between $3,480 support and $4,000 resistance. Record-high open interest and bullish momentum point to further gains despite bearish divergence on oscillators.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest remains at record highs, while the Funding Rate is also elevated, but it is not excessively high.

- The reason why ETH's Open Interest is likely so high is likely due to large players taking advantage of the 'cash-and-carry' trade. Buy the ETF and Short ETH Spot, and profit from being paid the Funding Rate.

Technical analysis

- Really nice move that, overall, we've called relatively perfectly.

- ETH managed to consolidate between $3,280 and $3,480 before now breaking above $3,480 and pushing into $3,600. $4,000 likely soon.

- In terms of support, we expect $3,480 to be local support, with $3,280 as a stronger support.

- On the upside, we think the main resistance is at $4,000. It's a psychological level as well as a prior resistance level.

- One thing to note here is that ETH has put in a bearish divergence (a higher high in price and a lower high on the oscillator). However, it's not in overbought territory, so that's not as bad.

- Next Support: $3,480

- Next Resistance: $4,000

- Direction: Bullish

- Upside Target: $4,000

- Downside Target: $3,280

Cryptonary's take

ETH's narrative has improved substantially, and price action has been positive for once.Therefore, we do expect ETH to just grind up to $4,000 in the coming week.

If we get this, we'd expect $3,480 to then become a more major support. Overall, we're positive on ETH here, as we pretty much have been since its lows in the low $ 2,000s.

ETH trades 25% off all-time highs

26 November 2024ETH remains resilient above $3,280 as BTC retraces. With institutional interest growing, RSI cooling, and key levels in play, the stage is set for a potential breakout. Let’s explore the latest action across the crypto market.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- Like BTC, ETH's Open Interest remain very high. An element of this may be institutional players taking advantage of the carry trade, longing the ETF, shortening the futures, and profiting from the funding rate.

- ETH's Funding Rate also remains high at the 0.03% level, although it has been higher, and this isn't very extreme here, all things considered.

- ETH looks less vulnerable to a flush-out in comparison to BTC, even though it is still somewhat overheated here.

Technical analysis

- Much more positive price action from ETH here, with it being able to hold above the $3,280 horizontal support.

- For now, in the short term, the $3,480 horizontal level remains the major resistance.

- A break above $3,480 and ETH likely moves on to $4,000.

- If $3,280 is lost to the downside, then it's possible that ETH pulls back as much as $3,000, although there is a fair amount of support between $3,000 and $3,280.

- The RSI was overbought but has recently approached back into overbought territory, with it now resetting to 61. This is positive to see it's not overbought.

- Next Support: $3,280

- Next Resistance: $3,480

- Direction: Neutral/Bullish

- Upside Target: $4,000

- Downside Target: $3,050

Cryptonary's take

This is the first time ETH has performed relatively well, even with the rest of the market seeing a more significant pullback. Institutions may be looking at ETH here and saying, "It's 25% off its all-time highs, whilst BTC is 50% above its old all-time highs; there is some divergence here".This may then attract institutional money into ETH here as it's beginning to look more attractive in relation to BTC, despite ETH still somewhat lacking the narrative.

We'd like to see ETH continue to find support above $3,280. If it does this, we'll grow in confidence that a $3,480 break out is on the cards.

We're holding Spot ETH and are not looking to sell it here. Overall, we think ETH looks relatively positive here, especially if BTC can avoid a larger pullback to the $87k area, let's say.

Ethereum’s next target: $3,480 resistance

22 November 2024Ethereum’s open interest hits all-time highs as it consolidates near $3,280. Can ETH break resistance at $3,480 and target $4,000 next?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest is still at all-time highs, having really kicked up higher over the last week. It's likely we'll see a shakeout at some point. However, this may last for more days/weeks.

- The Funding Rate has also increased back to its recent highs. This indicates that positioning is net Longs here, meaning Longs are potentially vulnerable to a flush-out.

Technical analysis

- ETH looks really interesting here.

- ETH looks to be potentially forming a double top into the $3,400 area just shy of our $3,480 horizontal resistance.

- ETH did manage to find support locally at $3,050 and into $3,000, as we thought might be the case, with $3,00 being a psychological level.

- ETH is currently sitting on top of local support at $3,280. If ETH can hold support at $3,280, this improves the setup and enables ETH to possibly run to $4,000 upon a breakout of $3,480.

- If ETH were to lose the $3,000 level, then we'd expect the major support of $2,875 to hold.

- ETH's RSI has pulled back from overbought territory, and it also has printed any bearish divergences (unlike BTC).

- Next Support: $3,000

- Next Resistance: $3,480

- Direction: Neutral

- Upside Target: $4,000

- Downside Target: $2,875

Cryptonary's take

ETH is currently in an interesting spot between a key range of $3,000 to $3,480. We'd expect, with the bullish market we have, that ETH can reach $4,000 again in the coming weeks/months. We'd be buyers on dips, although we would remain underweight ETH against SOL, and we still favour being significantly overweight SOL. We expect ETH to move up with the rest of the market, but we still don't feel that it'll outperform other assets (SOL especially).ETH at $3,480 or $2,875?

19 November 2024Ethereum’s pullback to $3,000 raises questions as funding rates climb and leverage markets overheat. Meanwhile, BTC holds highs. Let’s break down ETH’s bear flag setup and key levels ahead.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest remains at very high levels.

- The funding rate has also increased more meaningfully.

- The leverage market as a whole is quite overheated here, and therefore, a flush out to the downside may be on the cards.

Technical analysis

- Since rejecting the $3,400 level, ETH has pulled back to the psychological level of $3,000, but it has managed to bounce from there.

- However, ETH is now forming a bear flag, which would have a breakdown target of somewhere between $2,875 and $3,000. It's possible that the $3,000 psychological level can be held as support if there is a breakdown for price.

- The RSI has pulled back meaningfully from overbought conditions, and it's now back to a more middle territory of 58. This is a healthy reset.

- To the upside, the key levels for the price to reclaim are $3,280 and then $3,480. A break above $3,480 and ETH will likely swiftly move on to $4,000.

Cryptonary's take

Other than BTC, most of the market is seeing a slight pullback here, including ETH. Whilst ETH is set up bearishly in the immediate term, we're still very bullish in the medium and long term. Therefore, if ETH does move down to $3,000, this may be a good level to add buys, particularly if there is a move into the $2,875 area.Bearish to neutral in the immediate term. Bullish beyond that.

ETH testing $3,000 support zone

15 November 2024Ethereum ($ETH) consolidates after hitting resistance near $3,280-$3,480, with support at $2,875. RSI and funding rates reset, setting the stage for its next potential move.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Open Interest remains extremely high and at all-time highs in USD value and by the number of ETH.

- Like BTC, ETH's Funding Rate has also pulled back to more sensible and therefore healthy levels. This is positive.

Technical analysis

- Even though ETH's move was also mostly straight up, we're referring back to the Daily timeframe for the ETH chart.

- ETH moved into the range between two key levels: $3,280 and $3,480. ETH couldn't sustain in this higher range and has since pulled back.

- It's possible that the psychological level of $3,000 acts as local support for ETH. However, the major support for ETH is at $2,875.

- ETH was very overbought, but via pulling back, the RSI has reset more meaningfully, and it's back in the middle territory and finding support on its moving average. This is better and needed.

- On the upside, it's likely that $3,280 to $3,480 will be more significant resistance for ETH to overcome.

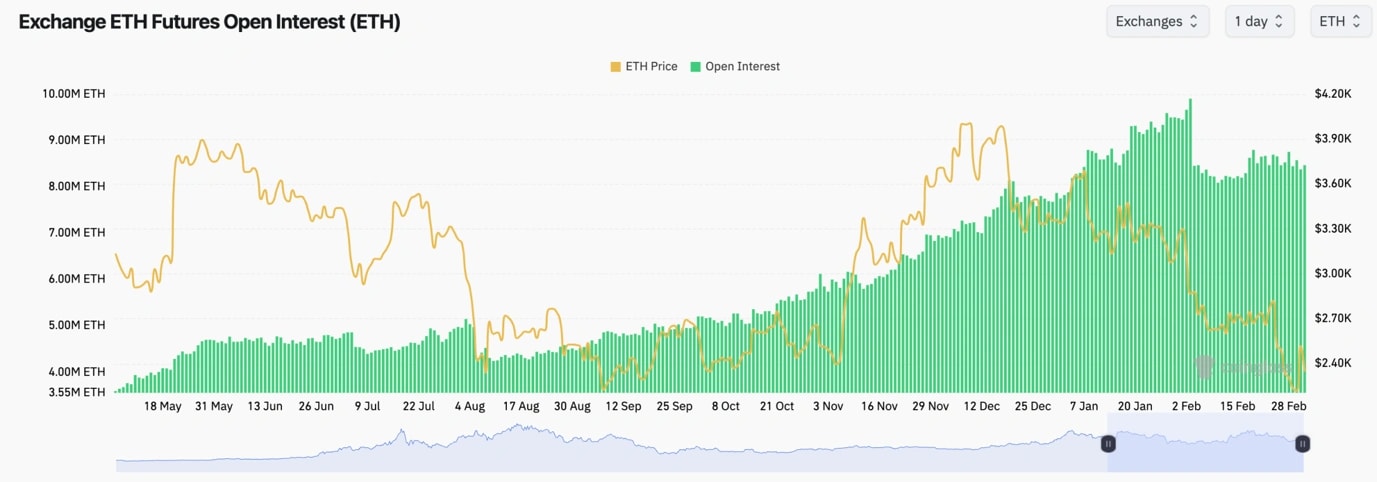

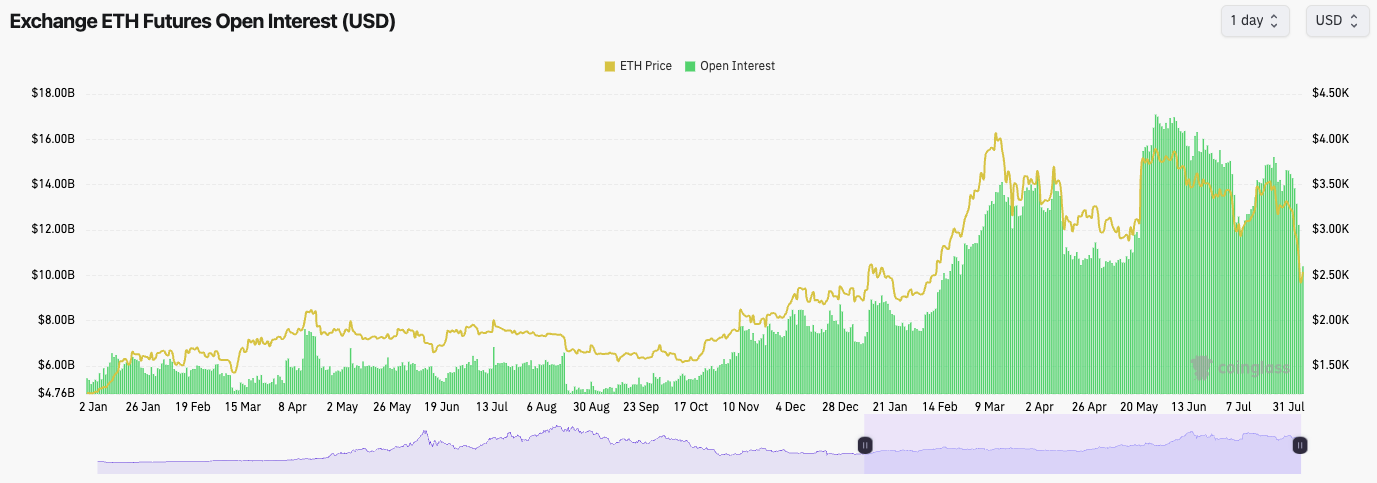

- Next Support: $3,000